Gold Breakout Confirmed... Almost

Commodities / Gold and Silver 2021 Nov 11, 2021 - 03:39 PM GMTBy: MoneyMetals

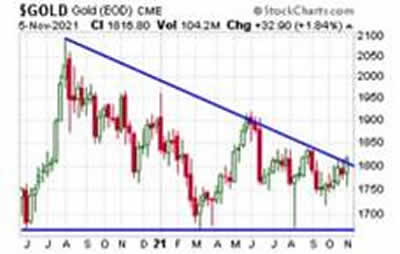

Gold finished solidly above the $1,800/oz level on Friday, marking the yellow metal’s best weekly close since late August. More importantly, gold may be breaking out of a larger consolidation pattern that has been in force since prices peaked in August of last year.

Prices edged above the descending triangle line – although perhaps not convincingly so.

If the breakout is real, then we should see a follow-through advance this week to confirm it.

Interpreting chart patterns is more of an art than a science. Any given technical setup, whether bullish or bearish in appearance, can fail.

Traders who lack conviction in the underlying fundamental case for gold will bail out of their positions the moment they read something bearish into the price action. They may get lucky with some trades, but they likely will never realize the massive gains that come from holding through the duration of a major bull market.

That requires conviction.

That requires conviction.

Fortunately, the fundamental reasons to invest in precious metals at this time – with stagflation likely looming in 2022 and beyond – are compelling.

Loose monetary policy and rising inflation bode well for hard assets in general.

Gold and silver in particular are uniquely well-situated to benefit from a potential currency crisis.

Gold and silver are forms of hard money. No other commodity or collectible serves that unique function.

That’s important to keep in mind when investing not just for inflation, but also for the potential of a severe downturn in the economy or loss of confidence in the U.S. dollar.

Most investments related to hard assets, including base metals, energy, and real estate, are economically sensitive – meaning they tend to get pulled down when the economy and stock market head south.

Gold shows virtually no correlation with the business cycle and can sometimes move in the opposite direction of conventional asset markets.

It has underperformed stocks as well as many other types of hard assets year to date. Frustrating though that may be for gold bulls, the divergence isn’t anything for long-term holders to worry about.

It represents an opportunity to switch out of assets that have appreciated substantially and into precious metals which are relatively undervalued.

The pendulum of investor sentiment will inevitably, eventually, swing away from the stock market and its sky-high valuations. It will in time swing toward safe havens, toward hard assets, and ultimately toward hard money.

Stefan Gleason is President of Money Metals Exchange, the national precious metals company named 2015 "Dealer of the Year" in the United States by an independent global ratings group. A graduate of the University of Florida, Gleason is a seasoned business leader, investor, political strategist, and grassroots activist. Gleason has frequently appeared on national television networks such as CNN, FoxNews, and CNBC, and his writings have appeared in hundreds of publications such as the Wall Street Journal, Detroit News, Washington Times, and National Review.

© 2021 Stefan Gleason - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.