Crimex Silver: Murder Most Foul

Commodities / Gold and Silver 2021 Oct 12, 2021 - 02:45 PM GMTBy: The_Gold_Report

Precious metals expert Michael Ballanger decries last week's manipulations in the silver market. Anyone schooled in the Canadian educational system in the 1960s is by default familiar with William Shakespeare’s famous play Hamlet about a Danish prince that seeks revenge upon his uncle who was believed to have murdered his father to seize the Danish throne. As students forced to utilize a learning method called “rote,” we had to memorize literally the entire scene where the ghost of the murdered king utters those immortal words “Murder most foul.” Claimed to be the “most-filmed” of all literary works, Hamlet was also the genesis of Bob Dylan’s 17-minute-long ballad whose topic was JFK’s assassination in Dallas in November 1963, an event virtually every baby-boomer remembers vividly.

"Last Wednesday, traders watched an aberration, a deformity in the principles of “best price possible.”

They should also add September 29, 2021, to the list of notable murders because the victim this time was the integrity of the Comex trading arena (or “theater” in honor of Willie Shakespeare). To an even greater degree, it marked the final death of any respect or reverence for the Commodity Futures Trading Commission (CTFC) because between the Crimex “exchange” and the CFTC, the rare remaining believers in free-market capitalism were led to slaughter by a mob of hedge funds that decided to take full and blatant advantage of the lack of regulatory oversight in order to pad their bonus pools the second-to-last trading day of the third quarter of 2021.

That the notional value of the traded paper was several times the annual amount of silver produced by the mining industry in any given year is irrelevant; it is the total and complete abandonment of the rule of law regarding position limits, not to mention the total inattention to the tried-and-true trading rule of “best price possible.” When buyer meets seller in any market, the buyer always seeks the best (lowest) price while the seller seeks his/her best (highest) price, and it is this relationship between buyer and seller that allows for full, true, and plain price discovery.

This practice was put into effect to prevent unfair manipulation of all markets unless, of course, it is applied to the precious metals markets where gold and silver are the arch enemies of the sovereign paper-hangers (fiat currency and credit generators) and they are not in the interest of the national security of governments spanning across the globe.

"When [the bullion bank traders] get gold and silver in the crosshairs, they are merciless with nothing standing in their path, be that opposing buyers or indifferent regulators."

Last Wednesday, traders watched an aberration, a deformity in the principles of “best price possible” because those already short the silver market were allowed to execute gargantuan sell orders for one purpose and one purpose alone—to ensure price was marked lower going into the end of the quarter. By doing so, they sweetened their profit and loss statements thus ensuring a greatly improved standing in the performance rankings and, in case you missed it, the securing of an enhanced bonus payout thanks to that beautifully executed raid that also happened to not only crush holders of silver futures, triggering massive margin calls that afternoon and the following morning, but it also pounded a nail into the coffin of Millennial and Gen-Exer interest in the #SilverSqueeze and Wall Street Silver social media movements.

As I have written about for literally decades, you cannot mess with the bullion banks because if you try, they simply draw upon their Fed/Treasury-backed credit lines to cap price, and if the competition gets too fierce, they can alter margin requirements at the stroke of a pen. Finally, if you think for a moment that the Department of Justice will protect investors from collusion, fraud, and manipulation, think twice because it is the case against JP Morgan that resulted in over US$436 million in fines related to metal market manipulation that smacks one in the chops. The shenanigans continue unchallenged and underregulated to this very day.

As I have opined in the past, I have grown to have immense respect for the absolute perfection of execution carried out by the bullion bank traders; when they get gold and silver in the crosshairs, they are merciless with nothing standing in their path, be that opposing buyers or indifferent regulators.

However, because it was an “event-driven” takedown where capturing quarter-end profits was the obvious objective, I took the other side of the trade late Wednesday by wading into the iShares Silver Trust ETF (SLV:US) (that everybody hates) under US$20, (equivalent to US$21.55 for December silver) for a number of reasons but the main one was that every blogger and newsletter guru was looking at the double bottom just above US$22 and the island gap at $18 and assumed that technical analysis would prove foolproof. What they forgot is that breakdowns of support and resistance levels work in all markets around the globe except the gold and silver markets. In gold and silver, you buy “breakdowns” and you sell “breakouts” and the reason that you make this a rule of thumb is really quite simple. Technical analysis does not work in markets that are totally and completely rigged. (I learned that in 1979.)

With everything else dollar-denominated trading at record highs, I choose to own those assets that are not trading at or near all-time highs. Silver is currently at roughly 40% of its 1980 and 2011 highs; gold is trading at 84.6% of its 2020 high. The two metals that have served as stores of value for thousands of years are both down year-to-date while the Goldman Sachs Commodity Index is outperforming them both by more than sixfold. Notwithstanding the illogic of it, the manner in which the bullion banks have been allowed to sit on price advances whenever they choose is “most foul, strange, and unnatural.” (Thanks, Willie.)

Regardless of what these behemoths have been allowed to perpetrate, gold and silver valuations relative to all other assets including equities are compelling from both recent and historical perspectives. The numbers do not lie.

I once had the utmost faith in the ability of markets to be predictive in that, when left alone, stock prices are excellent barometers of future corporate performance. The old adage held that if equities swooned into a bear market, economic recession was within six months of materializing. The problem today lies in the constant and relentless interference that muddles outcomes and impairs the predictive function of finance. In its place is this warped view of the future where stocks are a tool to be used to manage consumer behavior by way of the asymmetrical wealth effect. People feel better about spending when markets are rising and because of the manner in which the Fed “dodged the bullet” at the terminus of the 2007–2008 Great Financial Crisis Bailout, there arose a glaring enrichment of the investor class through massive monetary stimulus and tax cuts, which has over the past decade not only rescued the collateral held against loans by corporations and consumers, it has widened the gap between those “in the club” and those “not in the club” (with apologies to the late, great George Carlin).

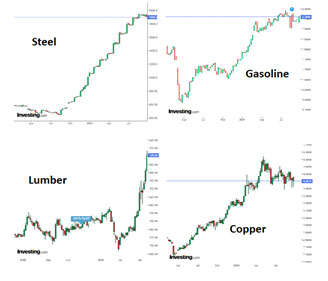

This brings me right back to the gold miners. I get asked countless questions about the lackluster performances of the NYSE Arca Gold BUGS Index (HUI) and VanEck Gold Miners ETF (GDX)/VanEck Junior Gold Miners ETF (GDXJ) combo on a daily basis and to drill down into those greatly improved balance sheets is one thing but it is now the forward guidance regarding the input costs that is causing concern for gold and silver producers. It seems like only yesterday that Pierre Lassonde was podcasting the light fantastic about low input costs versus a strong gold price that would bring the generalist fund managers “over the golden wall.” Even Warren Buffett did the unthinkable and took a big position in Barrick last year (only to dump it a few months later). Today, I am sad to say, is a different cup of tea than the one being offered a year ago. With oil at USD $80/barrel, this major input cost is chewing away at those “sexy margins” of last summer. Now, the good news is that all of those feasibility studies that gave unanimous go-aheads with 30-40-50% projected internal rates of returns based on lower inputs have to be

reworked and I can tell you that most of them are going back to the drawing board. What this means is that all the new supply that was racing to production has to also be removed from the equation so given that global demand for gold and silver remains elevated for all of the reasons about which I drone on and on every week (ad nauseum ad tedium), the price variable has got only one direction to move. Mind you, a lot of people are still solidly in the deflation camp so the debate will rage on until the inflation numbers finally and resolutely put to rest any notion that all of this stimulus money sloshing around the world will fail to thwart the deflationary wave.

As far as the juniors go, the uranium space remains strong and copper deals are hanging in. One of my favorite positions is a new name called Allied Copper Corp. (CPR:TSX; CPRRF:OTCQB), which has at the helm ex-Fluor Corp. trouble-shooter Warner Uhl as chairman and a mandate to add pounds (as in copper) quickly and efficiently with emphasis on friendly jurisdictions like the U.S. southwest. From what I hear, there is a cavalcade of news about to flow once it receives IIROC approval for the RTO associated with a Nevada-based copper-gold porphyry acquisition back in May. It is expected that a resumption of trading in this name is “imminent” but with IIROC, it is unwise to make any assumptions because you just never know what they know and when they knew it.

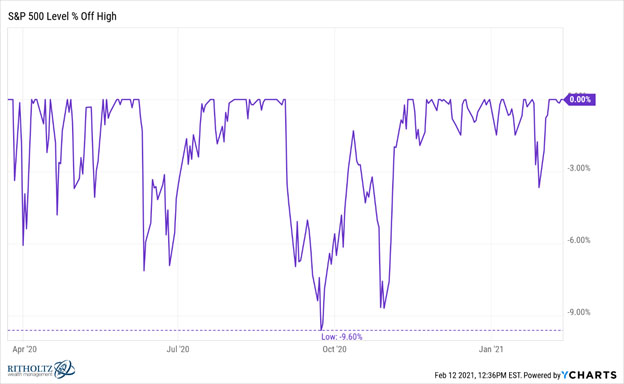

Most of the junior developers in the GGMA portfolio have not avoided the pressure of weaker markets and diminished animal spirits but as most investors out there (and not just precious metals players) are terrified of a major crash (like March 2020) in the broad markets, I am looking to add to the well-funded juniors in anticipation of a year-end rally. I am also holding hedges (volatility and a few puts) on the outside chance that the S&P actually does have a greater-than-10%, correction which has not been seen since before the COVID Crash in March 2020. In fact, the best the bears could scare up was a 9.6% pullback a year ago and that does not even meet the criterion for a “correction.”

So, we now have four weeks in which to get out of the historically dangerous month of October and if you judge risk based upon sentiment, odds favor sideways, zig-zag action as opposed to anything drastic. Having said that, look at the graphic posted above (courtesy of Ritholtz Wealth Management). If I had more time and space, I would show you a graphic from Yarmeni Advisors that illustrates the random frequency of corrections going back to the 1950s, and it has only been since the Secretary of the Treasury Hank Paulson begged Congress for a bailout that the term “free lunch” moved from the bread lines of the 1930s to the Tiki bars of Lower Manhattan.

Despite all of this insanity, investors must accumulate that which is “cheap” relative to that which is “dear,” a practice that has been deemed as outdated at best and stupid at worst, which is always the prevailing attitude just before valuations experience mean reversion therapy causing bodies to fly off rooftops, marriages to end, and grossly inflated egos to be seen suddenly, in the ocean, at low tide, without suitable attire, and in obviously what was very cold water.

One last point — Fido has finally returned to the sanctity and solitude of my office. Being devoid of any form of outside interference or deviant motive, he knows that my mood swings are dependent upon my trader’s mental state and when I went through the blatant absurdity of last Wednesday, he scampered through an open window then bolted for the safety of the room he dug under the tool shed. I tried to assuage him but he would have none of it until I offered him some beef jerky at which point this immense and very elegant female Great Dane squeezed her way out of the tiny tool shed entrance and devoured the bribe I had just offered to the cowering Rottweiler. At that point, I quicky realized that behind every action, there is an equal and opposite reaction and that my concern for Fido had nothing to do with his departure from the office. Fido had plans and I was not in them. I was being played.

God bless him…

Follow Michael Ballanger on Twitter @MiningJunkie. He is the Editor and Publisher of The GGM Advisory Service and can be contacted at miningjunkie216@outlook.com for subscription information.

Originally trained during the inflationary 1970s, Michael Ballanger is a graduate of Saint Louis University where he earned a Bachelor of Science in finance and a Bachelor of Art in marketing before completing post-graduate work at the Wharton School of Finance. With more than 30 years of experience as a junior mining and exploration specialist, as well as a solid background in corporate finance, Ballanger's adherence to the concept of "Hard Assets" allows him to focus the practice on selecting opportunities in the global resource sector with emphasis on the precious metals exploration and development sector. Ballanger takes great pleasure in visiting mineral properties around the globe in the never-ending hunt for early-stage opportunities.

Disclosure: 1) Statements and opinions expressed are the opinions of Michael Ballanger and not of Streetwise Reports or its officers. Michael Ballanger is wholly responsible for the validity of the statements. Streetwise Reports was not involved in any aspect of the article preparation. Michael Ballanger was not paid by Streetwise Reports LLC for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. 2) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports. 3) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article until three business days after the publication of the interview or article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases.

Charts provided by the author.

Michael Ballanger Disclaimer: This letter makes no guarantee or warranty on the accuracy or completeness of the data provided. Nothing contained herein is intended or shall be deemed to be investment advice, implied or otherwise. This letter represents my views and replicates trades that I am making but nothing more than that. Always consult your registered advisor to assist you with your investments. I accept no liability for any loss arising from the use of the data contained on this letter. Options and junior mining stocks contain a high level of risk that may result in the loss of part or all invested capital and therefore are suitable for experienced and professional investors and traders only. One should be familiar with the risks involved in junior mining and options trading and we recommend consulting a financial adviser if you feel you do not understand the risks involved.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.