US Close to Hitting the Debt Ceiling: Gold Doesn’t Care

Commodities / Gold and Silver 2021 Oct 03, 2021 - 10:07 PM GMTBy: Arkadiusz_Sieron

Another fiscal year, another governmental fight to raise the debt limit. A failure spells a crisis, but gold turns a blind eye and continues its fall.

Another fiscal year, another governmental fight to raise the debt limit. A failure spells a crisis, but gold turns a blind eye and continues its fall.

So, America has a new tradition! The government shutdown is coming. A new fiscal year starts tomorrow, and if Congress fails to agree on a budget by the end of today, the government will shut down.

What does it mean for the US economy? According to Treasury Secretary Janet Yellen, the failure to lift the debt ceiling could be a catastrophe:

If the debt ceiling is not raised, there would be a financial crisis, a calamity. It would undermine confidence in the dollar as a reserve currency (…) It would be a wound of enormous proportions (…) It is imperative that Congress swiftly addresses the debt limit. If it does not, America would default for the first time in history. The full faith and credit of the United States would be impaired, and our country would likely face a financial crisis and economic recession.

She also clarified in a separate letter sent to Congress that the Treasury could run out of money by October 18, 2021:

We now estimate that Treasury is likely to exhaust its extraordinary measures if Congress has not acted to raise or suspend the debt limit by October 18. At that point, we expect Treasury would be left with very limited resources that would be depleted quickly. It is uncertain whether we could continue to meet all the nation’s commitments after that date.

Her rhetoric was rather gloomy. As a result, the risk aversion softened, while stock prices dropped. So, gold prices had to increase, right? Well, not exactly. As the chart below shows, the price of the yellow metal continued its downward trend that accelerated in September, partially caused by more hawkish expectations for the tapering timeline and future path of the federal funds rate.

So, what is happening in the gold market? I would point out three crucial factors right now. First, the US dollar has appreciated recently. Yes, despite worries about the debt ceiling, the greenback has strengthened. It shows that there is simply no alternative. Another issue is that people have seen this movie before, and they know how it ends. At some point, Congress will pass a new debt limit and return to its spending spree.

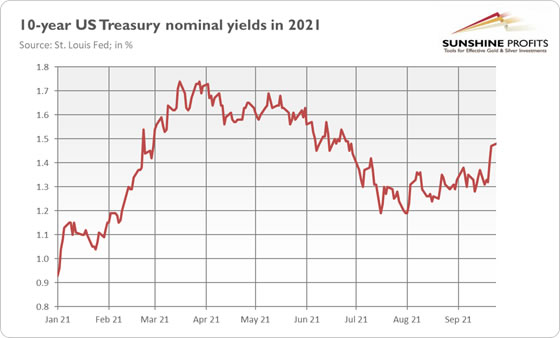

Second, the bond yields have increased. For example, the nominal yields on 10-year Treasuries jumped from about 1.3% last week to almost 1.5% on Monday (September 27, 2021), as the chart below shows. The recent dot-plot revealed that the FOMC members want to raise the federal funds rate earlier than previously thought, which has been transmitted into the yield curve, creating downward pressure on gold. Higher interest rates imply higher opportunity costs of holding bullion.

Third, the market sentiment still seems to be negative toward gold. It’s partially justified by the macroeconomic environment — namely, the rapid recovery from the pandemic recession. As the global economy is improving, the central banks are about to tighten their monetary policy.

Implications for Gold

What does it all imply for the gold market? Well, the environment of strengthening dollar and rising bond yields is negative for the yellow metal. Higher interests make bonds more attractive relative to gold. The worries about the debt ceiling will likely be short-lived and won’t provide gold with a needed lifeline. The current downward trend in gold shows that the market simply doesn’t care about the government shutdown. The only hope is an inflationary crisis, but (so far) worries about inflation have been entailing higher interest rates rather than strong demand for gold as an inflation hedge.

Thank you.

If you enjoyed the above analysis and would you like to know more about the gold ETFs and their impact on gold price, we invite you to read the April Market Overview report. If you're interested in the detailed price analysis and price projections with targets, we invite you to sign up for our Gold & Silver Trading Alerts . If you're not ready to subscribe at this time, we invite you to sign up for our gold newsletter and stay up-to-date with our latest free articles. It's free and you can unsubscribe anytime.

Arkadiusz Sieron

Sunshine Profits‘ Market Overview Editor

Disclaimer

All essays, research and information found above represent analyses and opinions of Przemyslaw Radomski, CFA and Sunshine Profits' associates only. As such, it may prove wrong and be a subject to change without notice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are believed to be accurate, Przemyslaw Radomski, CFA and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. Radomski is not a Registered Securities Advisor. By reading Przemyslaw Radomski's, CFA reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Przemyslaw Radomski, CFA, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

Arkadiusz Sieron Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.