Gold Price Back Below $1,800!

Commodities / Gold and Silver 2021 Sep 10, 2021 - 06:55 PM GMTBy: Arkadiusz_Sieron

Gold Price Back Below $1,800!

Easy come, easy go. The yellow metal rallied on Friday just to plunge on Tuesday. What’s your next move, Mr. Gold?

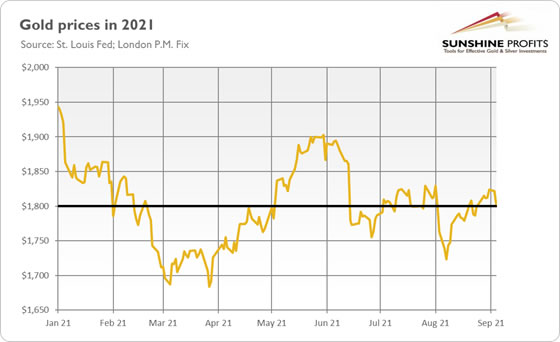

Ugh, the recent rally in gold prices was really short-lived. As the chart below shows, the price of gold increased after the publication of disappointing nonfarm payrolls on Friday. However, it declined as soon as on Tuesday, and on Wednesday it slid below $1,800.

I have to admit that I expected a more bullish performance. To be clear: I was far from opening champagne. For instance, I pointed out that the tapering of quantitative easing remained on the horizon, and I expressed some worries that gold’s rally was rather moderate despite the big disappointment of job gains:

Another caveat is that gold failed to rally above $1,835 despite softened expectations of the future path of the federal funds rate

However, I thought that the likely postponement of the Fed’s tightening cycle in the face of weak employment data would allow gold to catch its breath for a while. Well, it did, but only for a few days.

The quick reversal is clearly bearish for gold. Sure, without disappointing job numbers, the yellow metal could perform even worse. However, the inability to maintain gains indicates gold’s inherent weakness in the current environment.

Of course, the recent decline in gold prices was at least partially caused by new developments in the financial markets, namely: the strengthening in the US dollar and the rise in the bond yields. So, one could say that earlier bullish news was simply outweighed by later bearish factors.

However, please note that the US dollar strengthened and the interest rates rose amid an increase in risk aversion. The fact that gold, which is considered to be a safe-haven asset, drops when investors become more risk-averse, is really frustrating.

What’s more, some analysts pointed out that the dollar strength and higher yields were not enough to account for the plunge in gold prices – so, it seems that the momentum is simply negative and gold wants trade lower, no matter the fundamentals.

Indeed, neither the negative real interest rates, nor curbed dollar, nor high inflation were able to get gold to rise decisively this year. Nor the recent weak nonfarm payrolls that lifted the expectations of a more dovish Fed and the postponement of normalization of the monetary policy.

Implications for Gold

What does it all mean for the yellow metal? Well, the recent volatility in the gold market reminds us that in fundamental analyses it’s smart not to draw too far-reaching conclusions from the immediate price reactions and to look beyond the hustle and bustle of the trading pits. It also confirms that I was right, writing in the recent Fundamental Gold Report that “a long quiet summer has ended, and a more windy fall has started”.

Now, I have to point out that fundamental factors turned out in recent days to be more positive for the gold market than a few weeks ago. The announcement of the Fed’s tapering will be likely postponed from September to November 2021. Indeed, yesterday’s remarks of the New York Fed President John Williams at St. Lawrence University suggest that the FOMC may continue its wait-and-see approach this month and taper later in 2021:

There has also been very good progress toward maximum employment, but I will want to see more improvement before I am ready to declare the test of substantial further progress being met. Assuming the economy continues to improve as I anticipate, it could be appropriate to start reducing the pace of asset purchases this year.

Meanwhile, the economic activity has slowed down, partially because of the spread of the Delta variant of the coronavirus. For example, the recent edition of the Beige Book says that:

Economic growth downshifted slightly to a moderate pace in early July through August (…) The deceleration in economic activity was largely attributable to a pullback in dining out, travel, and tourism in most Districts, reflecting safety concerns due to the rise of the Delta variant, and, in a few cases, international travel restrictions.

Given that inflation remains high, the slowdown in economic growth will push the economy into stagflation, which should be a positive macroeconomic environment for gold.

Having said that, more bullish fundamentals without positive momentum could not be enough. As I’ve written earlier, gold has recently shrugged all the bullish factors off – it’s focused now on the economic normalization after the pandemic recession and the upcoming Fed’s tightening cycle. So, it seems to me that gold needs more than the postponement of tapering (think about next economic crises, the decline in economic confidence, or the abandonment of monetary policy normalization) to rally decisively. Until this happens, it is likely to continue its struggle.

Thank you.

If you enjoyed the above analysis and would you like to know more about the gold ETFs and their impact on gold price, we invite you to read the April Market Overview report. If you're interested in the detailed price analysis and price projections with targets, we invite you to sign up for our Gold & Silver Trading Alerts . If you're not ready to subscribe at this time, we invite you to sign up for our gold newsletter and stay up-to-date with our latest free articles. It's free and you can unsubscribe anytime.

Arkadiusz Sieron

Sunshine Profits‘ Market Overview Editor

Disclaimer

All essays, research and information found above represent analyses and opinions of Przemyslaw Radomski, CFA and Sunshine Profits' associates only. As such, it may prove wrong and be a subject to change without notice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are believed to be accurate, Przemyslaw Radomski, CFA and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. Radomski is not a Registered Securities Advisor. By reading Przemyslaw Radomski's, CFA reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Przemyslaw Radomski, CFA, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

Arkadiusz Sieron Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.