Facing down our investment fears, Courage comes from a strategy you can genuinely believe in

Commodities / Gold and Silver 2021 Sep 02, 2021 - 05:54 PM GMT“Gold shone with the placid certainty of received tradition. Honored through the ages, the standard of wealth, the original money, the safe haven. The value of gold was axiomatic. This view depends on a concept of gold as unchanging and unchanged—nature’s hard asset.” – Matthew Hart, Vanity Fair magazine

Facing down our investment fears

Courage comes from a strategy you can genuinely believe in

“As markets shake off their summer slumbers,” writes London-based analyst Bill Blain, “what should we be worrying about? Lots..! From real vs transitory inflation arguments, the long-term economic consequences of Covid, the future for Central Banking unable to unravel its Gordian knot of monetary experimentation, and the prospects for rising political instability in the US and Europe.”

Facing down your investment fears can only come from a strategy you can genuinely believe in. One of the great quotes on gold ownership came many years ago from Richard Russell, the now-deceased editor of the Dow Theory Letters. “I still sleep better at night,” he wrote, “knowing that I hold some gold. If or when everything else falls apart, gold will still be unquestioned wealth.” It is not a complicated strategy, but it is an effective one.

Though rarely discussed, gold ownership has as much to do with personal philosophy and how we wish to conduct our lives as it does finance and economics. In many ways, it is a rational portfolio decision that suits the times, but it is also a lifestyle decision that provides some peace of mind no matter what happens with the pandemic, the mania on Wall Street, or the political maneuvering in Washington D.C.

Palantir buys $50.7 million in gold bars to hedge black swan events

The prospect of sleeping better at night played largely in Palantir Technologies’ $50.7 million purchase of gold last month – 28,000 troy ounces in 100-ounce bars. In a move that surprised Wall Street, the Denver-based firm founded by Peter Thiel and Alex Karp said it purchased the gold as a hedge against “a future with more black swan events.” It is interesting to note in the context of black swan events that among Palantir’s many data-based products, it offers the AI-ready Gotham operating system – a program, according to its website, that surfaces “insights from complex data for global defense agencies, the intelligence community, disaster relief organizations, and beyond.”

“Risk,” says US Global Investors’ Frank Holmes in a piece posted at Seeking Alpha, “is precisely the reason why Palantir Technologies decided to make an investment in gold. … [N]amed for the all-seeing crystal balls in Lord of the Rings – [Palantir] is also allowing customers to pay for its software in gold.” Holmes also cites a National Inflation Association subscriber note that the company’s decision “is only the beginning of what will soon be many major corporations diversifying their U.S. dollar cash into gold.”

In a detailed article posted at ETF Trends on the Palantir acquisition, Jared Dillian recommends a way of viewing gold we have advocated since the publication of the first edition of The ABCs of Gold Investing in 1996. “As gold investors (I hold a bunch),” he suggests, “maybe we should stop thinking about gold as a trade or an investment and start thinking about it as an insurance policy.”

‘Hello, Mr. Gold Bullion, have you noticed what they’re saying and doing?’

The retrospectives on the Nixon shock continue to pour in even now as we end August – the month fifty years ago when the Nixon administration severed the link between the dollar and gold and ushered in the fiat money era in which we are still immersed. The repertoire, though, would not be complete without a few words from James Grant – one of the great critics and chief chroniclers of the era through his highly recommended newsletter, Interest Rate Observer. The following are excerpts from an interview of Grant published by Sprott, the Canadian gold firm, in mid-August. Grant ends the exchange hosted by the firm’s Ed Coyne with an admission: “I think I spilled my entire bits of wisdom here on the counter!” We want to thank Sprott for permission to quote the interview at length. The full exchange is available at the previously highlighted link.

James Grant –

“It’s immensely frustrating, right? Because where you see heterodoxy posing as the gospel truth, we see heresy wrapped up as sound policy. And you keep on saying, ‘Hello, Mr. Gold Bullion, have you noticed what they’re saying and doing? Have you noticed that the Fed’s balance sheet doubled during the pandemic? Have you noticed that the Fed is talking about nurturing a rate of inflation higher than its target in the midst of evidence accelerating inflation? Have you noticed any of this?’ We address this new thing called gold bullion and gold bullion keeps on slumbering …

“Gold has a way of disappointing its most devoted adherents. In 2008-09 it broke people’s hearts and went down. ‘This is a crisis!’ Gold is an ancient medium that appears in the periodic table. I didn’t invent it. Some people think I invented it! It appears in the periodic table, it’s an old thing and it takes its sweet time, right. It has a kind of a geological time set, that’s its clock: geological. Over the sweep of a reasonable investment horizon, it protects against the depredations of the stewards of our currencies. That’s what its purpose is. And that’s what it mainly does. Over the course of fiscal quarters and even some years, it will disappoint, but over the course of a reasonable investment, long-term horizon, it will spare you the punishment that our central bankers so willfully are meting out.

[Y]ou really have to take these things in with a great grain of salt and just say, all right, what I have here in gold, and very cheap gold equities, by the way, what I have here is an investment in monetary disorder, not a protection against it. We have it (monetary disorder) already. Monetary disorder is in fact the monetary system. It is an inherently disorderly system. In gold, you have an investment in that you do well, the more disorderly it becomes and especially well when the world recognizes the essential chaos of our monetary institutions.”

Don’t be fooled by the Fed’s taper talk

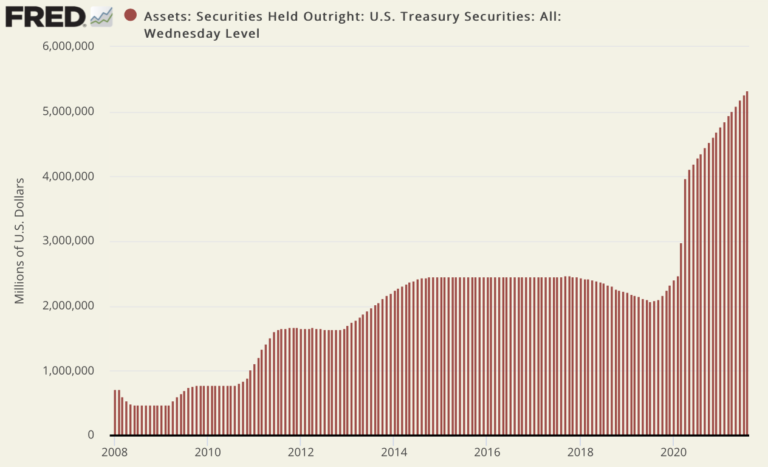

Sources: St. Louis Federal Reserve [FRED], Board of Governors Federal Reserve System (US)

“Some commentators suggest that long-term rates might rise due to less Fed purchases of government bonds,” writes Brendan Brown in an analysis posted at the Mises Institute website. “This is implausible, given that the prices of these are determined by supply and demand related to the stock of bonds outstanding. The Fed will still be a huge holder of this stock, hence continuing to weigh down on the so-called term premium.”

Under the functioning fait accompli, as long as the federal government’s enormous borrowing needs exceed market demand, the Fed fills the gaps with its own purchases of U.S. Treasuries. The Wall Street Journal recently reported that the Fed has purchased 74.6% of the federal debt issued since the pandemic began. Under what circumstances, the logical observer might ask, would any of that change? Brown, a hedge fund manager, ends by raising the specter of Afghanistan: “History will judge,” he says, “whether the advice on monetary matters which the Biden administration is seeking and acting on is any better or worse than on Afghanistan.”

The looming stagflationary debt crisis

Columbia University’s Nouriel Roubini, or Dr. Doom as he is known on Wall Street, sees symptoms of an economic breakdown already in motion wherever he looks. He goes so far in this analysis as to say that in the end, we will get a melding of the 2008 debt crisis and the 1970s stagflation – pretty much a banana republic-style breakdown. “In April,” he writes in a detailed analysis posted at Project Syndicate, “I warned that today’s extremely loose monetary and fiscal policies, when combined with a number of negative supply shocks, could result in 1970s-style stagflation (high inflation alongside a recession). In fact, the risk today is even bigger than it was then…At some point, this boom will culminate in a Minsky moment (a sudden loss of confidence), and tighter monetary policies will trigger a bust and crash.”

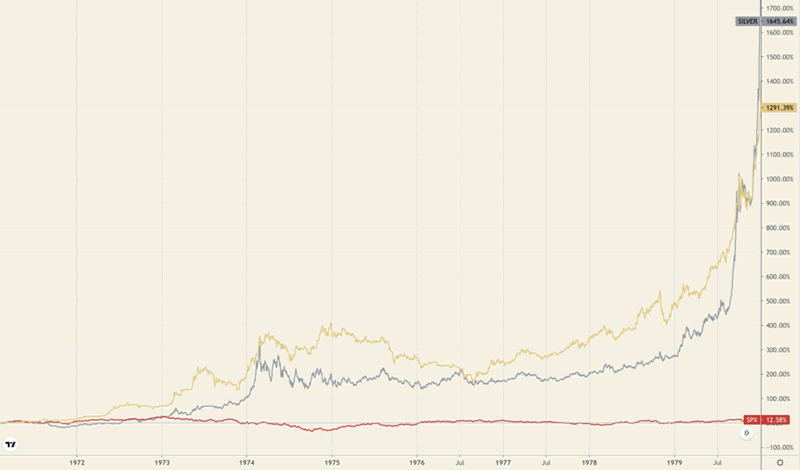

Chart courtesy of TradingView.com • • • Click to enlarge

So what would a stagflationary crisis mean for gold? “Well, slower economic growth and higher inflation,” says economist Arkadiusz Sieron in an Investing.com article, “due to the spread of the Delta variant are good news for gold. It brings us closer to a stagflationary environment, which should be welcomed by the yellow metal. Although gold doesn’t always protect against inflation, it served as a good inflation hedge during the 1970s, so we could reasonably expect similar performance during the potential 2020s stagflation.”

Sieron offers the same historical analogy we have since burgeoning stagflation became a general concern over the past several weeks: Gold performed well during the last stagflation in the 1970s. Stocks, we will add, were a non-starter finishing the decade about where they started.

The folly of ruling out a collapse

“A remarkable feature of extended bull markets,” writes John Hussman (Hussman Funds), is that investors come to believe – even in the face of extreme valuations – that the world has changed in ways that make steep market losses and extended periods of poor returns impossible. Among all the bubbles in history, including the 1929 bubble, the late-1960’s Go-Go bubble, the early 1970’s Nifty-Fifty mania, the late-1990’s tech bubble, and the 2007 mortgage bubble that preceded the global financial crisis, none has so thoroughly nurtured the illusion that extended losses are impossible than the bubble we find ourselves in today.”

Hussman, in short, sees the present stock market valuation as an extreme that makes all others pale by comparison. He contemplates “a far more interesting trip ahead than many investors seem to have in mind” – one, in our view, that cries to be hedged even as the lemmings mount their charge. (By the way, the image Hussman has chosen to accompany this lengthy missive is worth the visit alone.)

King World News’ Eric King once called Richard Russell – who regaled us with his wisdom in the Dow Theory Letter for nearly half a century – “the greatest financial writer in history.” We can only guess what Russell would have had to say about the current state of affairs, but the quote to follow from a KWN interview in 2016 provides a clue.

“Bear markets are sneaky beasts,” he said, “and they like to do their damage as secretly and as unobtrusively as possible. I hate to say it but somewhere ahead, the bears going to get it all together and the innocent little stream is going to turn into a waterfall. What can you do about it? Stay out of the market? Protect yourself by remaining in pure wealth, gold. For thousands of years, silver and gold have been treated as pure wealth. As the standard measures of wealth (stocks and bonds) have deteriorated, veteran investors have forgone profits and moved their assets into pure wealth.”

So it is that appropriately we end this month’s newsletter where we began – with a quote from Richard Russell and thoughts of sleeping better at night.

Final Thought

Ubiquity, complexity, and sandpiles

For a long while, John Mauldin (Mauldin Economics) has been one of the more thoughtful big picture analysts – someone whose work we read regularly. In a recent reflection posted at the GoldSeek website, he begins with a section on a Brookhaven National Laboratories study of sandpiles. Researchers attempted to ascertain at which point, and to what degree, the last grain of sand falling on the pile causes disequilibrium and the collapse of the pile. It found that the impact of the last grain of sand varied. It “might trigger only a few tumblings or it might instead set off a cataclysmic chain reaction involving millions.”

“We cannot accurately predict when the avalanche will happen,” Mauldin concludes. “You can miss out on all sorts of opportunities because you see lots of fingers of instability and ignore the base of stability. And then you can lose it all at once because you ignored the fingers of instability. You need your portfolios to both participate and protect. Don’t blindly buy index funds and assume they will recover as they did in the past. This next avalanche is going to change the nature of recoveries as other market forces and new technologies change what makes an investment succeed. I cannot stress that enough. Don’t get caught in a buy-and-hold, traditional 60/40 portfolio. Don’t walk away from it. Run away.”

So why would the story of the last grain of sand hitting the pile before it begins to dissemble be important? “The peculiar and exceptionally unstable organization of the critical state,” says Mark Buchanan, who wrote a book on catastrophes of all kinds (and referenced by Mauldin), “does indeed seem to be ubiquitous in our world. Researchers in the past few years have found its mathematical fingerprints in the workings of all the upheavals I’ve mentioned so far [earthquakes, eco-disasters, market crashes], as well as in the spreading of epidemics, the flaring of traffic jams, the patterns by which instructions trickle down from managers to workers in the office, and in many other things.” There comes a breaking point a which time the result is uncontrollable.

Up-to-the-minute gold market news, opinion, and analysis as it happens. If you appreciate NEWS & VIEWS, you might also take an interest in our Daily Top Gold News and Opinion page.

By Michael J. Kosares

Michael J. Kosares , founder and president

USAGOLD - Centennial Precious Metals, Denver

Michael J. Kosares is the founder of USAGOLD and the author of "The ABCs of Gold Investing - How To Protect and Build Your Wealth With Gold." He has over forty years experience in the physical gold business. He is also the editor of Review & Outlook, the firm's newsletter which is offered free of charge and specializes in issues and opinion of importance to owners of gold coins and bullion. If you would like to register for an e-mail alert when the next issue is published, please visit this link.

Disclaimer: Opinions expressed in commentary e do not constitute an offer to buy or sell, or the solicitation of an offer to buy or sell any precious metals product, nor should they be viewed in any way as investment advice or advice to buy, sell or hold. Centennial Precious Metals, Inc. recommends the purchase of physical precious metals for asset preservation purposes, not speculation. Utilization of these opinions for speculative purposes is neither suggested nor advised. Commentary is strictly for educational purposes, and as such USAGOLD - Centennial Precious Metals does not warrant or guarantee the accuracy, timeliness or completeness of the information found here.

Michael J. Kosares Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.