Gold and Silver Massacre to Continue?

Commodities / Gold and Silver 2021 Aug 12, 2021 - 03:03 PM GMTBy: Monica_Kingsley

Again, today’s report will be way shorter than usual, and focus only on select charts so as to drive position details of all the five publications.

Let‘s move right into the charts (all courtesy of www.stockcharts.com).

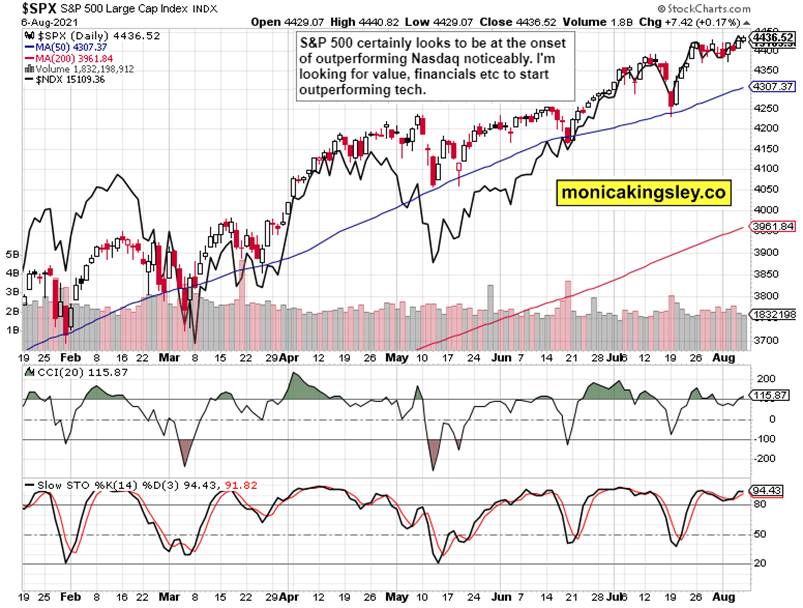

S&P 500 and Nasdaq Outlook

The tightly tracking each other indices – S&P 500 and Nasdaq – are likely to part ways to a degree soon. As Treasury yields made a double bottom, look for more tech to give way to cyclicals as they come back. Inflation, reopening trades and interest-rate sensitive spreads (e.g. financials over utilities) should start doing better.

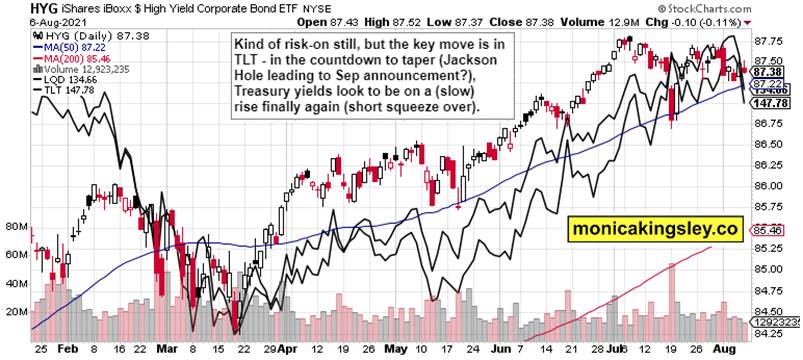

Credit Markets

- High yield corporate bonds resilience is a good sign, and credit spreads likely to start widening again would confirm the continued albeit questioned economic expansion. Not hiccup-free but still continuing – unless the Fed tightens prematurely and too much. The market isn‘t worried about that though at the moment.

Gold, Silver and Miners

Grim price action in the metals, and more be yet to come (looking at overnight price action, in all likehood we‘re done with shakeouts) – gold and silver usually do better once the waiting for taper is over. The Bernanke experience is the right one to compare taper prospects to, but the Fed will have a much harder time mopping up the excess liquidity than it did in 2018 – commercial bank credit creation isn‘t still there to make up for lost central bank purchases. Gold is getting inordinarily scared even as inflation isn‘t showing signs of retreating and real rates remain deeply negative – only inflation expectations have been jawboned. As neither miners to gold ratio nor TIPS signal panic, the only question is when the metals would stabilize and whether a fresh washout would occur or not. My view is that we‘re way closer to the pain‘s end than to its June beginning.

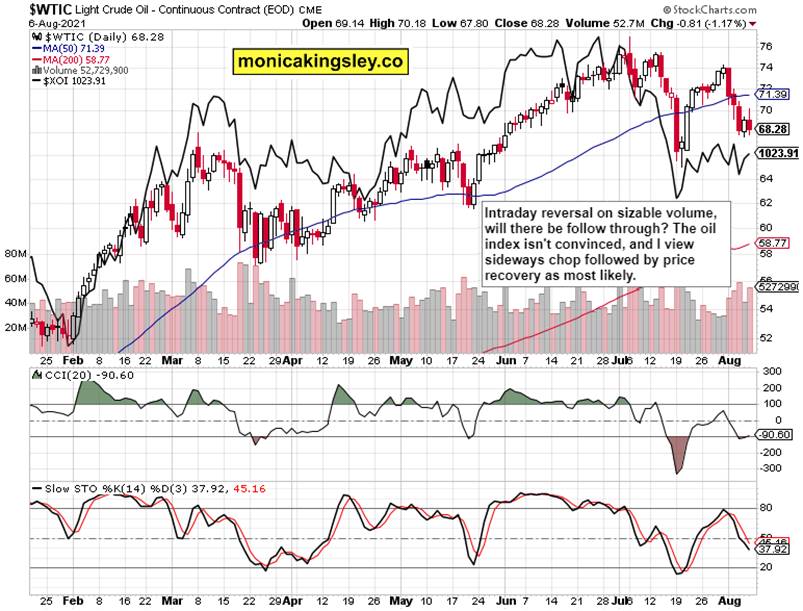

Crude Oil

Oil staged another reversal, and it was intraday to the downside. How credible is that? Again trading within the $60-$80 range, I‘m of the opinion that prices are interesting to the buyers here, as black gold got caught in the taper fears selloff just as gold with silver or copper did. Oil demand may be also coming under pressure through all the restrictions even though APT doesn‘t signal its sharply rising odds (yet).

Copper

Copper retreated from promising upswing, but its indicators are slowly turning positive. While it has mirrored the yields compression (signs of weakening growth / growth worries), it looks ready to gradually come back to life and play catch up with the commodity index.

Bitcoin and Ethereum

Resolute downswing rejection of Sunday‘s retracement in both Ethereum and Bitcoin – the bulls are on the march still. Cryptos have turned the corner very evidently indeed. With so much bearish sentiment out there, the dips might be short-lasting and shallow.

Summary

In place of summary today, please see the above chart descriptions for my take.

Thank you for having read today‘s free analysis, which is available in full here at my homesite. There, you can subscribe to the free Monica‘s Insider Club , which features real-time trade calls and intraday updates for all the five publications: Stock Trading Signals, Gold Trading Signals, Oil Trading Signals, Copper Trading Signals and Bitcoin Trading Signals.

Thank you,

Monica Kingsley

Stock Trading Signals

Gold Trading Signals

www.monicakingsley.co

mk@monicakingsley.co

* * * * *

All essays, research and information represent analyses and opinions of Monica Kingsley that are based on available and latest data. Despite careful research and best efforts, it may prove wrong and be subject to change with or without notice. Monica Kingsley does not guarantee the accuracy or thoroughness of the data or information reported. Her content serves educational purposes and should not be relied upon as advice or construed as providing recommendations of any kind. Futures, stocks and options are financial instruments not suitable for every investor. Please be advised that you invest at your own risk. Monica Kingsley is not a Registered Securities Advisor. By reading her writings, you agree that she will not be held responsible or liable for any decisions you make. Investing, trading and speculating in financial markets may involve high risk of loss. Monica Kingsley may have a short or long position in any securities, including those mentioned in her writings, and may make additional purchases and/or sales of those securities without notice.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.