Inflation Soars, Powell Remains Unmoved. What about Gold?

Commodities / Gold and Silver 2021 Jul 16, 2021 - 01:18 PM GMTBy: Arkadiusz_Sieron

The CPI surged 5.4% in June, but Powell still sees inflation as transitory. For now, gold has risen under the dovish Fed’s wing amid higher inflation.

The CPI surged 5.4% in June, but Powell still sees inflation as transitory. For now, gold has risen under the dovish Fed’s wing amid higher inflation.

Did you think that 5% was high inflation? Or that inflation has already peaked? Wrong! Inflation rose even further in June, although it was already elevated in May. Indeed, the consumer price index surged 0.9% in the last month, following a 0.6% jump in May. It was the largest one-month change since June 2008, during the Great Recession.

Importantly, the Core Price Index, which excludes food and energy, also rose 0.9%(after a 0.7% increase in the previous month). It shows that inflation is accelerating not only because of higher energy prices but also due to more structural, underlying trends.

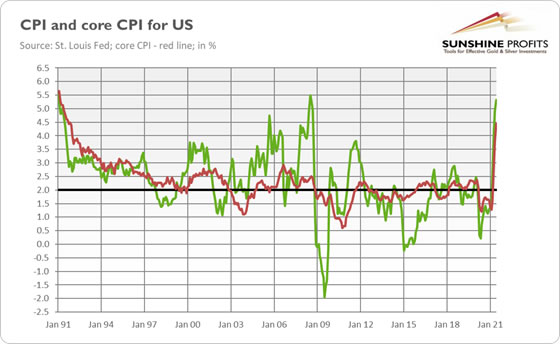

On an annual basis, the inflationary outlook is even scarier. The CPI soared 5.4% in June, following a 5% jump in May. It was the largest annual change since August 2008, just before the bankruptcy of the Lehman Brothers and the outbreak of the global financial crisis. As the chart below shows, the inflation annual rate has been trending up every month since the beginning of 2021. So, how much “temporality” can be found here?

However, the real shocker is that the core CPI surged 4.5%, the largest 12-month increase since November 1991 (see the chart above)! Ups, Houston, we have a problem, an inflationary problem! Or at least a surprise, as June inflation numbers came significantly above expectations.

Furthermore, high inflation could persist later this year, or it could even accelerate further – this is at least what the producer prices suggest. The PPI for final demand increased 1.0% last month after rising 0.8% in May. On an annual basis, it surged 7.3%, following a 6.6% rise in May. It was the largest gain since November 2010. Additionally, rising producer prices could translate (with some lag) into rising consumer prices.

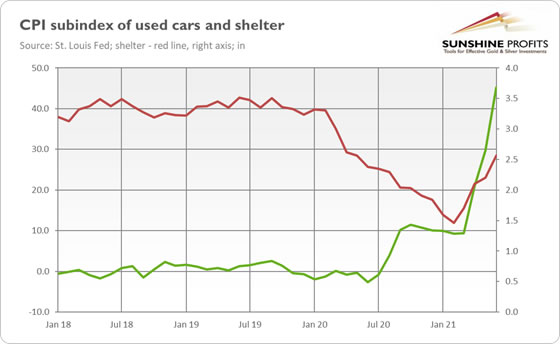

Of course, inflationary pressure may soften later this year. After all, the index for used cars and trucks soared 10.5% in June (MoM) and 45.2% (YoY), as the chart below shows, accounting for more than one-third of the surge. However, inflation is already more persistent than expected, and it could remain elevated for longer than believed.

In other words, although the surge in inflation is partially caused by the supply bottlenecks and the recovery from the pandemic, it has also structural origins that are not entirely linked to the epidemic. You can think about the increase in the broad money supply and easy fiscal policy with stimulus much larger than the output gap. As one can see in the chart above, the index for shelter – the biggest component of the CPI, not hit directly by the pandemic – has also been increasing recently.

Implications for Gold

What does the acceleration in inflation mean for the gold market? On the one hand, higher inflation should increase the demand for gold as an inflation hedge. It could also decrease the real interest rates and weaken the US dollar, also supporting the yellow metal. But on the other hand, higher inflation could translate into expectations of more hawkish Fed and higher interest rates, which could negatively affect gold.

Luckily for gold bulls, it seems that the acceleration in inflation won’t change the Fed’s course. Powell downplayed the inflation threat in his yesterday’s testimony to Congress. He continued seeing higher inflation as transitory and said that conditions to trigger a policy shift are “still a ways off.”

As a consequence, the price of gold increased yesterday to above $1,820, temporarily reaching $1,830. It’s not surprising, as an unmoved Fed amid higher inflation is a fundamentally positive factor for the yellow metal.

However, the upward move was very modest given the circumstances, which isn’t particularly encouraging. Investors seem to still believe that inflation is just transitory, and it won’t be a problem for the economy. But the Fed’s tightening cycle will come sooner or later (think about Bank of Canada or Reserve Bank of New Zealand which have already tightened their monetary policies), possibly with some hawkish twists later this year, so gold bulls should remain cautious.

Thank you.

If you enjoyed the above analysis and would you like to know more about the gold ETFs and their impact on gold price, we invite you to read the April Market Overview report. If you're interested in the detailed price analysis and price projections with targets, we invite you to sign up for our Gold & Silver Trading Alerts . If you're not ready to subscribe at this time, we invite you to sign up for our gold newsletter and stay up-to-date with our latest free articles. It's free and you can unsubscribe anytime.

Arkadiusz Sieron

Sunshine Profits‘ Market Overview Editor

Disclaimer

All essays, research and information found above represent analyses and opinions of Przemyslaw Radomski, CFA and Sunshine Profits' associates only. As such, it may prove wrong and be a subject to change without notice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are believed to be accurate, Przemyslaw Radomski, CFA and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. Radomski is not a Registered Securities Advisor. By reading Przemyslaw Radomski's, CFA reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Przemyslaw Radomski, CFA, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

Arkadiusz Sieron Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.