Gold Prices Investors beat Central Banks and Jewelry, as having the most Impact

Commodities / Gold and Silver 2021 Jun 18, 2021 - 06:49 PM GMTBy: Richard_Mills

Gold had a remarkable 2020, gaining 22% for the calendar year on a “perfect storm” of factors, namely:

- Torrid safe haven demand driven by fear of the coronavirus and its economic fallout;

- Record-low sovereign bond yields, with many countries’ bonds actually offering negative returns. There is a strong correlation between the gold price and low yields, particularly the benchmark US 10-year Treasury note yield which plummeted at the start of the pandemic and bumped along under 1% for the rest of the year. Since gold does not offer a yield, it draws money from bonds and other income-yielding assets, when interest rates/ bond yields are low;

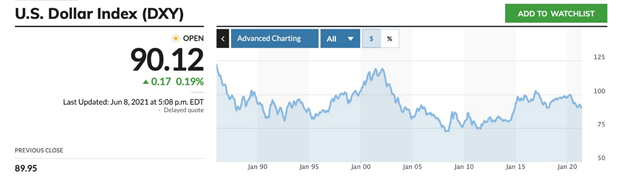

- And a low US dollar. There is an inverse relationship between the gold price and the dollar. The US Dollar Index (DXY) crashed from 98.36 in March 2020, as investors sought US dollars as a safe haven, to around 90 for the rest of the year, as it became clear to investors that the US economy was in trouble, its government having badly mismanaged the pandemic which led, and still leads, the world in the number of cases and deaths.

However when vaccines were announced near the end of last year and Donald Trump lost the US presidential election to Joe Biden, who promised to take swift action to curb the pandemic, gold starting losing favor.

Attention turned from bad economic news to the impending recovery, with China the poster child, as demand for commodities like copper and iron ore, needed to feed its resurgent manufacturing sector, soared.

Gold was sideswiped by fear of inflation, the result of trillions worth of pandemic-related relief spending by the US government (and others) and a big increase to the Fed’s balance sheet as it continued its monthly purchases of bonds and mortgage-backed securities (“QE”), thereby running up the money supply.

Investors priced in the likelihood of the US Federal Reserve raising interest rates to cool the economy. The result was a climb in bond yields, and a gold sell-off, as investors dumped bonds and moved funds into riskier assets, like stocks, and longer-term yields rose to keep bond investors from selling.

The World Gold Council goes into detail re what happened to gold in Q1 2021. Among its key observations:

- The gold price fell 10% in Q1.

- First-quarter gold demand of 815.7 tonnes was on par with the fourth quarter of 2020 but down 23% compared to the first quarter of 2020;

- Bar and coin investment grew 36% year on year, buoyed by bargain-hunting and inflation expectations.

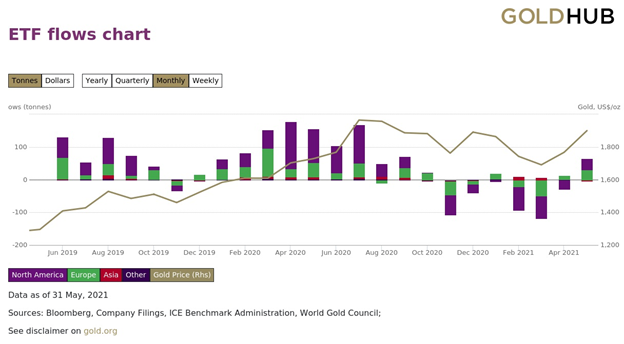

- Growth in consumer gold demand was offset by strong outflows from gold ETFs, 177.9 tonnes in Q1, as higher interest rates (bond yields) and a lower gold price weighed on investor sentiment.

- Despite the last bullet point, central banks kept buying gold, with global official reserves growing by 95.5 tonnes, 23% lower year on year but 20% higher than Q4 2020.

Come Q2, however, the rise in commodity prices including foodstuffs, base metals and silver, along with covid-related supply chain disruptions in a number of industries, added to the inflation narrative, from which gold has benefited. That seems counterintuitive to gold being damaged by rising bond yields, due to fear of inflation, but gold is also an inflation hedge. The precious metal has proven over the years that historically, gold holds its value compared to fiat currencies, which gradually lose their purchasing power due to inflation. When inflation rears its ugly head, investors often turn to bullion.

One manifestation of gold’s second-quarter rebound is the resurgence of gold ETFs. According to the World Gold Council, global gold exchange-traded funds added 61.3 tonnes in May, reversing three straight months of outflows.

“We believe this to be largely a function of investment demand increasing with the price strength of gold, along with renewed inflation concerns in the market, a weaker dollar and lower real yields,” the Gold Council states.

Gold’s steady rise in 2020, its rapid fall in the first quarter of 2021, and its strong push higher in the second quarter, are shown in the chart below, depicting a V-shaped recovery.

Starting the year at $1,898/oz, spot gold has been on a wild ride, slumping as low as $1,700 on March 1, to its current $1,892.50, at time of writing, for a tidy three-month gain of 11.3%.

Not bad for a global economy supposedly in the updraft of a vaccine-led recovery.

That got me thinking, what is the most important factor driving the gold price? Not a re-hash of all the gold price antecedents that have been well covered by this newsletter writer, but which one stands out? And why? That is the topic of this article, as we take a deep dive into gold demand.

Our analytical tool is a very interesting chart by the World Gold Council, entitled, rather blandly, ‘Supply and demand statistics’. With the help of this chart and a little interpretation by yours truly, we come up with some fascinating conclusions.

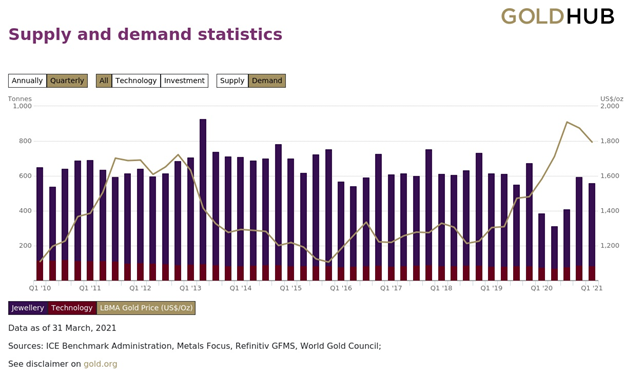

First, notice the 11-year horizon, starting in the first quarter of 2010 and ending in Q1 2021. The WGC breaks gold demand into four categories: jewelry, technology, investment, and central banks.

In Figure 1 below graphing all four demand drivers with the LBMA gold price, the yellow line, we see that the bars correspond fairly closely to the gold price, in that gold will often move higher at the same time as, or just after, a rising bar, or group of bars. For example between Q1 2010 and Q3 2011, gold demand rises steadily, from under 1,000 tonnes to just over 1,250t, as gold climbs from about $1,200 an ounce to $1,700. The inverse occurs when gold falls from $1,700 in Q1 2013 to below $1,200 in Q4 2015, corresponding with demand dropping by 100 tonnes during that same period, from roughly 1,300t to 1,200t.

The second observation to be gleaned from this graph, is the “cup and handle” pattern the gold price appears to have formed over the past eight years. The cup is the shallow curve, going from the “upside-down V” at Q1 2013, to Q3 2020, and the handle just beginning to form is the sharp downturn, seen as another upside-down V, at Q3 2020, stopping at Q2 2021. In technical stock analysis, the cup and handle is considered a bullish signal, with the right-hand side of the pattern typically experiencing lower trading volume.

What we really want to know though, is how these factors, like central bank buying, investment and jewelry demand, are influencing the gold price. We can find the answer more easily by isolating the variables.

Figure 2 below shows jewelry and technology, such as gold used in the manufacture of electronic and medical devices. Throughout the analysis period, both demand drivers fluctuate somewhat, but not a lot. Technology demand, the brown part at the bottom of each bar, stays at roughly 100 tonnes. Jewelry fabrication is more variable but most years it totals about 700 tonnes.

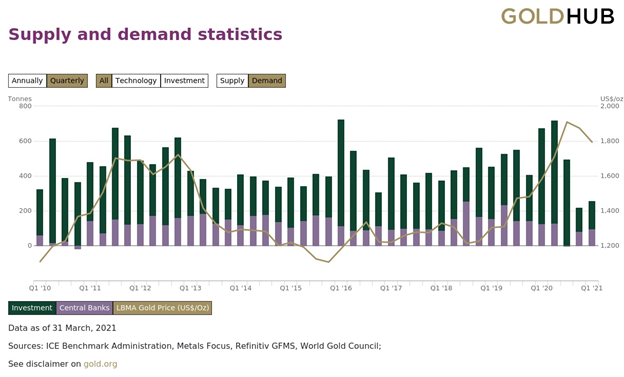

Next we look at the other two demand drivers, central bank buying and investment, shown as purple and green bars, respectively. Starting at the far left of the chart, in the first quarter of 2010 the gold price is $1,109/oz, investment demand is 228 tonnes and central bank demand is 59t. The next quarter, investment spikes to 599 tonnes and the gold price adds $90, but central bank buying is just 14t. Gold went up even though central bank demand dropped, and investment demand more than doubled. We are beginning to see the start of a trend.

Between Q2 2010 and Q3 2011, the gold price increased by $500, investment demand grew to 528t, and central bank buying was 148t. From Q3 2011 to Q4 2012, gold bases at around $1,700, investment demand falls a bit, and central bank buying is stable at about 150t.

Now see the gold price plummet from $1,772 in Q4 2012 to $1,106 in Q4 2015 (where the gold price forms a “V” under the chart’s X-axis) We would expect to see investment demand crater during this period, and it does, dropping from 462t to 234t. Central bank demand during the same time frame fluctuates but is fairly steady, about 150t to 175t.

Now see investment demand spike in the first quarter of 2016, to 614t, as the gold price rises to $1,183. The next two quarters investors added a respective 459t and 345t, as the gold price jumps to $1,335.

The next leg up for gold starts in the second half of 2018. From $1,226 in Q4 2018 to Q3 2020, the gold price adds $683, as investment demand soars, moving from 395t to 493t during the same period. Note that in Q3 2020, despite gold hitting its highest point since 2011, there was NO central bank buying; in fact CBs were selling, resulting in a net loss of 2.9t.

At the far right of the chart, where the “handle” mentioned above is forming, we see the gold price fall to $1,794 in the first quarter of 2021. As expected, investment demand drops to just 161t.

The pattern over the past 11 years is absolutely clear: investors, not central banks, drive significant changes in the price of gold. The other two World Gold Council demand drivers — jewelry and technology — are relatively static, meaning they have far less influence on the gold price than investment demand.

Figure 2: Gold demand — jewelry and technology. Source: World Gold Council

Figure 3: Gold demand — central bank buying and investment. Source: World Gold Council

Investopedia notes, the demand for gold, the amount of gold in the central bank reserves, the value of the U.S. dollar, and the desire to hold gold as a hedge against inflation and currency devaluation, all help drive the price of the precious metal.

True enough. But this analysis has shown that the variable most likely to be behind large price changes is investment demand.

Survey data backs this up.

The evidence suggests that gold, the granddaddy of precious metals, is a popular choice among mainstream investors, in terms of bars or coins, gold jewelry or gold ETFs.

According to the World Gold Council, gold is the third most consistently bought investment (46%), behind savings accounts (78%) and life insurance (56%).

The research also showed that two-thirds of retail investors believe that gold is a good safeguard against inflation and currency fluctuations, and 61% trust gold more than fiat (paper) currencies.

The WGC’s ‘Gold market retail insights’ page compiles a huge data set from 18,000 people recently interviewed around the world about their thoughts on gold as an investment.

Among the key findings:

- 44% bought gold to manage risk, 31% purchased bullion on the advice of a financial advisor or friend, and 29% bought gold because it was low or on an upward trend.

- Gold investors are loyal to their investment, more so than investors in other asset classes; 69% of people who bought gold in the past, would buy it again, whether as jewelry, bars/ coins or ETFs.

- The gold market has large growth potential — 38% of those surveyed had never bought gold before but were open to doing so in future.

- However, among retail investors, lack of trust is considered a barrier in making a gold investment, with 28% worried about buying fake gold, 21% concerned about the purity and 14% not trusting the businesses that are selling gold.

We know from the preceding analysis who has bought gold over the past decade (mostly investors and central banks), but we don’t know why they’re buying. Why, for example, did the gold price shoot up between the first quarter of 2010 and the third quarter of 2011? What was driving investment demand?

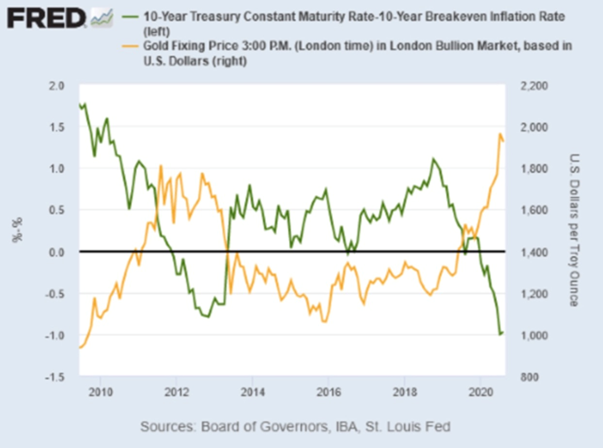

Well we know from a previous article that real interest rates are a reliable predictor of gold price movements.

The demand for gold moves inversely to interest rates — the higher the rate of interest, the lower the demand for gold, the lower the rate of interest the higher the demand for gold.

The reason for this is simple, when real interest rates (interest rate minus inflation) are low, at, or below zero, cash and bonds fall out of favor because the real return is lower than inflation. If you are earning 1.6% on your money from a government bond, but inflation is running 2.7%, the real rate you are earning is negative 1.1% — an investor is actually losing purchasing power. Gold is the most proven investment to offer a return greater than inflation, by its rising price, or at least not a loss of purchasing power.

Historically, we can see the inverse relationship between negative real interest rates and gold, by charting the gold price and the 10-year Treasury’s yield after inflation.

In the FRED chart below, notice that the gold price between 2013 and 2020 never gets above $1,400, corresponding to the period when the real yield on the 10-year is between about 0% and 1%. However, when real yields “go negative,” as they did around 2011-13, and in 2020, gold prices jumped.

Last year’s 22% increase in the gold price was due to pandemic fears, combined with a low US dollar and plunging Treasury yields, causing real yields to go negative even though inflation stayed below 2%.

The US dollar is often cited as a gold price influencer, however the correlation is not that strong, as a historical DXY chart versus our World Gold Council 10-year demand chart shows.

For example, gold’s steep ascent from Q1 2010 to Q3 2011 does correspond, roughly, to a drop in the dollar, from 86.13 in May 2010 to 74.60 in July 2011. However, between Q3 2018 and Q3 2020, when gold went from $1,213 to $1,909, the US dollar index actually grew, from 94.74 in July 2018 to 102.82 in March, 2020. The dollar did slide quite a bit throughout the rest of last year, corresponding to gold’s record run past $2,000, with DXY falling as low as 89.83 at the end of 2020.

Source: MarketWatch

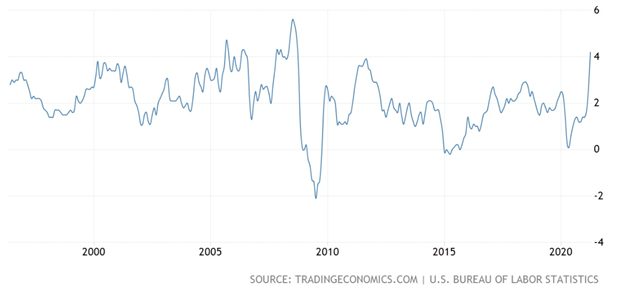

How about inflation as an underlying factor of investment demand hiking the gold price? Gold’s one-year run in late 2010 should correspond to a bump in the consumer price index. What we see is inflation falling sharply in 2008-09, corresponding to the financial crisis, then turning back up at the end of 2009 and into 2010. Between Q1 2010 and Q3 2011, inflation does rise 1 percentage point, from 2.63% to 3.63%, but it’s not enough to be a significant price driver. The next big gold spike, Q3 2018 to Q3 2020, does not correlate at all with inflation, which drops from 2.95% in July 2018, to an 11-year low of 0.12% in May 2020, before climbing steeply to its current 4.16%, the result of pandemic-related government spending and Fed money-printing.

US inflation over the past 25 years

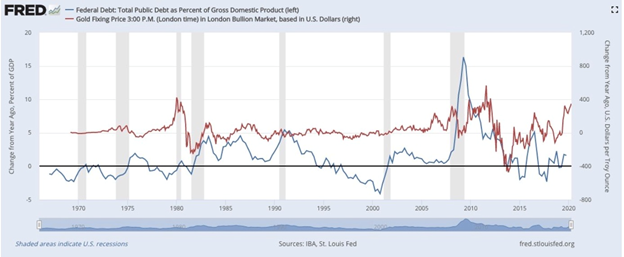

Apart from telling us which countries are good and bad credit risks, the debt to GDP ratio can also help in predicting the price of gold.

The chart below, by the Federal Reserve Bank of St. Louis, compares total US public debt as a percentage of GDP, to the London Bullion Market gold fixing price.

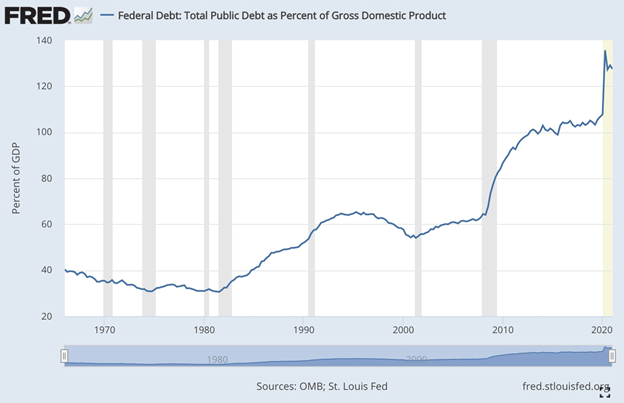

The next chart is simply the debt to GDP ratio, over the same period.

We see a positive, though fairly weak, correlation between gold (the red line in the first chart) and the US debt to GDP ratio (the blue line) from 1970 until 2008.

But the really big move occurred during the financial crisis of 2008-09.

Faced with a crisis in the banking system caused by excessive lending and a severe depreciation in the US subprime mortgage market, many central banks around the world turned to an unconventional monetary policy that came to be known as quantitative easing.

During the rounds of QE conducted by the US Federal Reserve, starting in 2008, the Fed increased the money supply by $4 trillion. But there was also a massive fiscal stimulus package launched to get the economy moving again.

We see the debt to GDP ratio in the second chart jump from 62% in 2007 to 83% in 2009, 90% in 2010, and it has kept climbing ever since.

This trend is fairly clear: as the debt to GDP ratio rises, either because of a drop in GDP due to a recession, or a jump in government borrowing that piles up debt, or both, the gold price reacts.

Conclusion

All of the above-mentioned factors — real interest rates, the US dollar, inflation and the debt to GDP ratio — are important in understanding gold price behaviour.

However, by now we hope you have come to the same conclusion that we have, ie., that the best indicator of gold price movement is investment demand. While there are a number of different components to gold demand, ie., jewelry, technology, central banks and investment, it is the latter that really drives gold prices. Investment comes in the form of physical gold, ie., bars and coins, and ETF buying.

According to the World Gold Council, during the first quarter of 2021, growth in retail demand (a 36% increase in bars and coins) was offset by strong ETF outflows, as investors sold shares in ETFs, likely worried about future gold price weakness and higher interest rates, due to inflation concerns.

The correlation between investment demand and the gold price in Q1 is clear: spot gold dropped 10%, alongside about a 300-tonne drop in investment demand compared to Q3 2020.

We won’t know what Q2 demand looks like until the next WGC quarterly report comes out, but we expect investment demand to be stronger than Q1, correlating with the higher gold price, which has risen from $1,738 on March 31, to the current $1,891. We already know that gold ETFs added 61.3 tonnes in May, reversing three straight months of net outflows, raising global assets under management (AUM) to 3,628 tonnes, only 7% shy of the October 2020 tonnage high of 3,908t.

Our research shows that most retail investors, who are the main drivers of gold’s price, trust gold more than fiat (paper) currencies to preserve their purchasing power. When debt soars, when real interest rates go negative, when cash becomes trash, gold shines brightest.

The upshot? Getting granular with gold investment demand data is an excellent way of understanding past, present and future gold price movements.

By Richard (Rick) Mills

If you're interested in learning more about the junior resource and bio-med sectors please come and visit us at www.aheadoftheherd.com Site membership is free. No credit card or personal information is asked for.

Richard is host of Aheadoftheherd.com and invests in the junior resource sector. His articles have been published on over 400 websites, including: Wall Street Journal, Market Oracle, USAToday, National Post, Stockhouse, Lewrockwell, Pinnacledigest, Uranium Miner, Beforeitsnews, SeekingAlpha, MontrealGazette, Casey Research, 24hgold, Vancouver Sun, CBSnews, SilverBearCafe, Infomine, Huffington Post, Mineweb, 321Gold, Kitco, Gold-Eagle, The Gold/Energy Reports, Calgary Herald, Resource Investor, Mining.com, Forbes, FNArena, Uraniumseek, Financial Sense, Goldseek, Dallasnews, Vantagewire, Resourceclips and the Association of Mining Analysts.

Copyright © 2021 Richard (Rick) Mills - All Rights Reserved

Legal Notice / Disclaimer: This document is not and should not be construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment. Richard Mills has based this document on information obtained from sources he believes to be reliable but which has not been independently verified; Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness. Expressions of opinion are those of Richard Mills only and are subject to change without notice. Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission. Furthermore, I, Richard Mills, assume no liability for any direct or indirect loss or damage or, in particular, for lost profit, which you may incur as a result of the use and existence of the information provided within this Report.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.