Gold’s Inflation Utility

Commodities / Gold and Silver 2021 Jun 10, 2021 - 11:32 AM GMTBy: Gary_Tanashian

Gold is okay, but not yet unique

There are times when gold is an okay inflation hedge, while under-performing the likes of industrial metals, oil/energy, materials, etc. During those times, if you’re doggedly precious metals focused you should consider silver, which, as a hybrid precious metal/industrial commodity, has more pro-cyclical inflation utility than gold.

But as I have argued for much of the last year, if the inflated situation is working toward cyclical progress (as it is currently) then there is a world full of trades and investments out there to choose from, many of which are trouncing gold (which, as I have belabored for the better part of 2 decades now, is not about price but instead, value) in the inflated price casino.

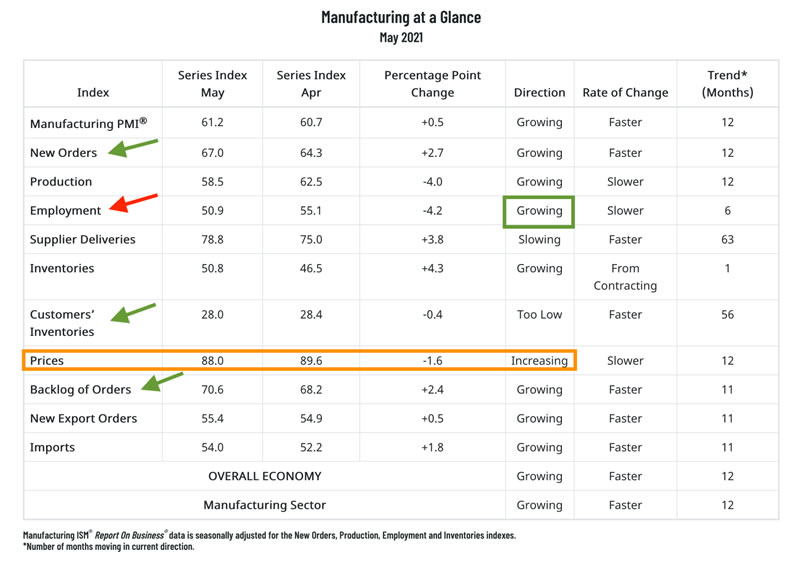

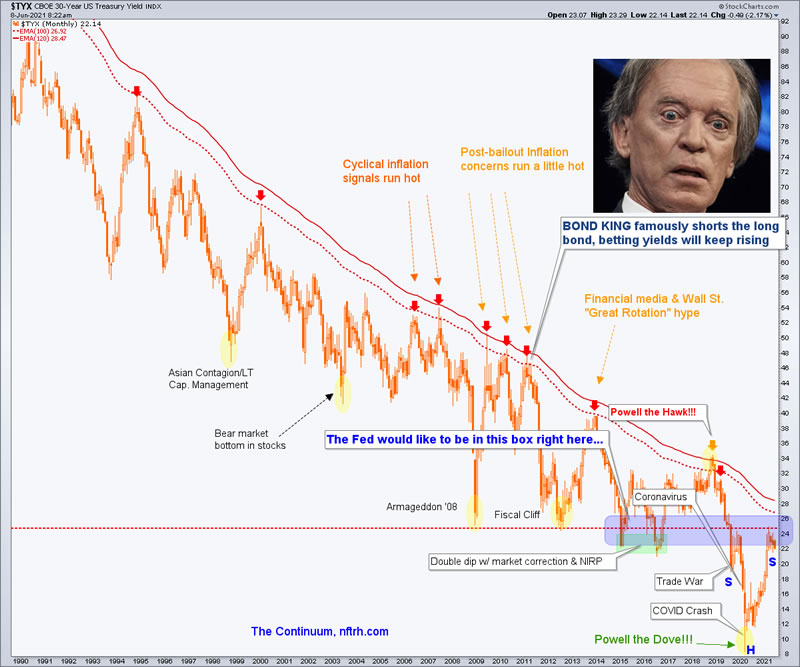

The latest ISM Report on Business shows one negative among the important areas as employment declined. Now, before we get too excited about that gold-positive reading let’s also realize that manufacturing employment is still growing, new orders are briskly increasing, backlogs are up and customer inventories are down. In short, manufacturing continues to boom.

But being inflation-fueled, the economic recovery also has a ‘prices’ problem… and a materials/supplies problem (unless you’re one of the 2 or 3 people out there with a deep desire to own Acetone. There are potential Stagflationary elements to this situation, which would come forward if the economy starts to struggle due to inflation and the economic pressures it is building.

Gold is a monetary metal (says Captain Obvious) and as such, its utility is more monetary. In some cases this monetary aspect works against it, as in mid-2020 when the inflationary bull market in equities, commodities and the inflated/reflated economy were getting off the ground (after gold had provided another of its important utilities, capital preservation during the COVID-induced deflation scare).

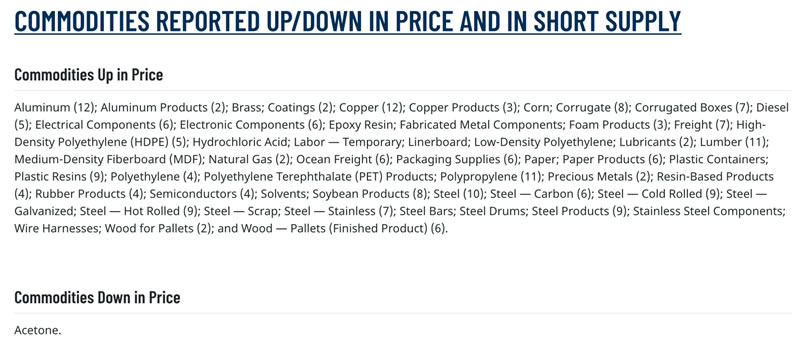

In some cases gold can keep up a decent pace during inflation, as today with Treasury yields (10yr is currently 1.5%)…

…not keeping up with officially recorded inflation in the economy (source: Tradingeconomics.com).

It is no surprise whatsoever that the gold price has rallied since March while long-term yields have consolidated downward since that very same time period.

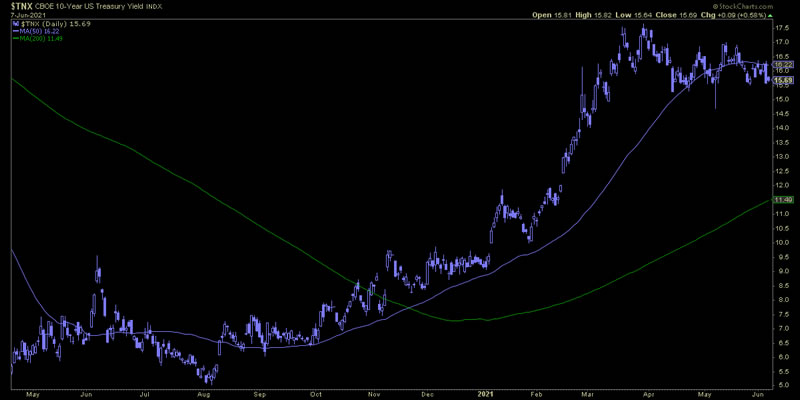

So at this time, a period of slightly easing inflation concerns, gold has a green light to at least participate in the reflationary party, and so too the gold miners. The Continuum’s (monthly chart of the 30yr Treasury yield) right side shoulder, which is in progress as we (NFTRH) have fully anticipated, represents that easing of inflation concerns.

But for the gold sector to continue playing along there will need to be negatives coming into play for the economy. That is as yet unlikely to be in the form of deflation, which by many of our indicators is still a long way off. But if the economic pressures brought on by the inflation to date (as represented in the ISM data and so many other economic readings and anecdotal cost/supply problems we regular citizens witness every day) start to wear away at economic activity, then gold’s utility during such times may well continue to come front and center.

A caution on the miners, however. They are labor intensive businesses and they are subject to the same cost/supply/human resources dynamics as many other businesses. So for gold miners to prosper fundamentally, gold would need to start out-performing cyclical resources currently in short supply. The current and slight easing of inflationary pressure of late has given gold a little bounce in relation to the cyclicals, but the larger trends are still with pro-cyclical, pro-inflationary forces.

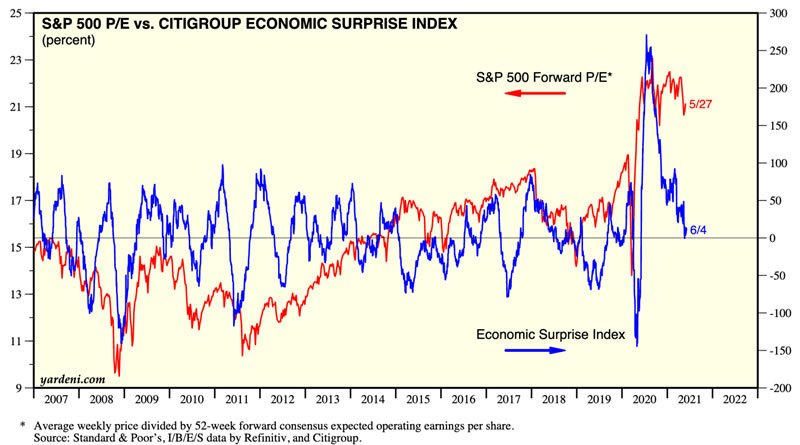

As one example of a hint at the negative signaling needed for gold to gain eminence on the macro, the Citi Economic Surprise Index (source: yardeni.com) shows an extreme pullback to what can be considered par for the economic course. But Wall Street analysts are sticking out like a sore thumb with forward P/E projections.

Bottom Line

Deflation is a long way off. What’s more, the recent cooling of inflation gives the Fed and government some wiggle room with which to continue the inflation. If/when that happens and yields resume upward (at least to the Continuum’s EMA 100 & EMA 120 limiters) Stagflationary forces will need to intensify in order to fundamentally justify investments in gold* and gold stocks as anything unique or special in the macro backdrop. As a side note, both Gold and HUI are poised bullish on their big picture technicals.

* Qualification: a long-term investment in gold is something different, an investment in monetary value with no care whatsoever about the shorter-term goings on in the inflated casino.

For “best of breed” top down analysis of all major markets, subscribe to NFTRH Premium, which includes an in-depth weekly market report, detailed interim market updates and NFTRH+ dynamic updates and chart/trade setup ideas. You can also keep up to date with actionable public content at NFTRH.com by using the email form on the right sidebar. Follow via Twitter ;@NFTRHgt.

By Gary Tanashian

© 2021 Copyright Gary Tanashian - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Gary Tanashian Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.