What Stock Market Lessons Can We Learn From Yoda - The Jedi Master?

Stock-Markets / Stock Market 2021 Mar 14, 2021 - 05:32 PM GMTBy: Avi_Gilburt

Over the last 9 years since we opened Elliottwavetrader, I have had the privilege of training thousands of investors, traders and money managers regarding how to appropriately view the stock market from an honest and objective standpoint. And, during that time, I have just about seen it all when it comes to the wide array of perspectives with which people approach the market.

So, in this article, I am going to tap into some of the brilliance presented in the teachings of the Jedi Master - Yoda, and will apply it to my experience in training thousands of investors, traders and money managers. I will also be bolstering these lessons with what our members have actually said about these truths regarding the market.

YODA: “Ready are you? What know you of ready? For eight hundred years have I trained Jedi. My own counsel will I keep on who is to be trained. A Jedi must have the deepest commitment, the most serious mind.”

While I have not trained traders for 800 years as has Yoda, I have certainly trained thousands. And, during that time, I have tried to force investors to be honest with themselves, and have said many times that the Elliott Wave analysis that we teach will not be for everyone. It is a difficult methodology, and requires a rigorous application of the methodology. Most people simply do not have the patience to learn it in its true depth. And, that is why many of you may see truly poor Elliott Wave analysis being presented elsewhere. Too many want an easily applicable methodology or cut corners when it comes to a true Elliott Wave application.

But, if you have the “deepest commitment, and the most serious mind,” it will transform your view of markets, and your profitability.

“This service is tough to get to understand, especially for people like me: not good in number-thinking. The rewards however are likewise. These are HUGE. Most certainly in comparison with some other services I have been using.”

This brings us to our next golden advice from Yoda:

YODA: “Patience you must have my young Padawan.”

Learning Elliott Wave analysis requires patience. And, even after you learn the methodology, and learn how to accurately apply the methodology, it takes a great deal of patience to allow the market to provide you with a set up that deserves for you to allocate your hard-earned money.

There is an old saying that the best traders are only in the market 30-40% of the time. The reason is that they patiently wait for the market to provide them with their “fat pitch.” When the market is uncertain, then you should bide your time and not burn your money. But, when the market provides you with the appropriate low-risk high-reward set up, that is the time you allocate your money to that opportunity.

As one of our members have noted:

“Avi also has an uncanny ability to hold two different perspectives simultaneously in his market analysis, and he knows how to wait patiently until the market tells him which one it is doing, rather than trying to guess at market moves prematurely.”

YODA: “You will find only what you bring in.”

I have often said that there are very few analysts that have earned my respect. Moreover, there are even less Elliott Wave analysts that have truly earned my respect. Unfortunately, most of those that claim they are applying Elliott Wave analysis are doing nothing more than what I call “wave slapping.” I have written about this in a blog post several years ago, and you can read it here: Stock Picks, Stock Market Investing.

Basically, “wave slapping” is when an analyst places numbers and letters on a chart based either upon the “look” of the chart, or to support their prior bias about market direction. Since I would classify most analysis presented as Elliott Wave analysis as such, resultingly, most analysis is rarely correct more than 50% of the time. And, this lends to the argument that so many have about Elliott Wave being too subjective in nature.

So, when investors follow this type of “analysis” and see how often it is wrong, they make the assumption that Elliott Wave really does not work, and are turned off.

Therefore, I have always urged those learning from me that they need to put in the time and effort to understanding the depths of what we are attempting to teach. Those that have taken me up on this challenge have reaped rewards greater than they have ever expected. In fact, these are just some of the many responses we have recently received from our members:

“I know I fought this.. but damn it works . . . My accounts are killing it.. returns I did not think possible.”

“The TMPW crew is awesome. Having been trading for 12 years, I've read a lot of professional and institutional analysis. However, none have come close to the accuracy / scenario analysis of Avi and the team at TMPW. Their calls and identification of key levels is simply amazing. However, be prepared to do your own homework, as Elliott Wave Theory is very complex. This is NOT a service for people that just want buy/sell calls with stop/limit orders.”

YODA: “To be Jedi is to face the truth, and choose. . . Many of the truths that we cling to depend on our point of view.”

Another quote that I truly love that conveys this sentiment about “truth” was written by Ben Franklin:

“Geese are but Geese tho’ we may think ‘em Swans; and Truth will be Truth tho’ it sometimes prove mortifying and distasteful.”

We are amazing creatures in that we often have such a hard time accepting the truth. We often wear blinders, which causes us to so often lose money in the markets. And, with those blinders, we often rationalize why the truth is really a falsehood.

This brings me to yet another quote from Ben Franklin: “So convenient a thing is it is to be a reasonable creature, since it enables one to find or to make a reason for everything one has a mind to do.”

And, that is even assuming we understand where to look for the truth in the market. What you have to accept is that price is truth. If price is going opposite of your expectations, you must face the fact that what you previously held as a truth may indeed be a falsehood.

So, rather than resign yourself to losses, you must force yourself to search for the truth rather than fighting price. When I hear people claiming “the market is simply not trading based upon fundamentals at this time,” and then follow it up with “it's not a loss until I sell,” well, you have clearly shown your inability to take off your blinders and have resigned yourself to losing money.

At this point, you must force yourself to open your eyes, and attempt to search for the truth in the market, which is supported by price action.

“When I first saw Avi's work I was skeptical. His approach requires members to release themselves of their own bias and take on an objective view of markets, trends and sentiment. As a new member I took too much of my own bias to the table and as a result did not make the most of his service. The result? Lost money. Now I've had the time to better understand the methodology and analysis, and remove my own bias. The result? Making money. So my advice for potential members is to commit to learning, and try not to assume your own bias are correct about markets, and how they function. If you do that, you'll make lots of money. Avi approaches his analysis and service with intellectual honesty and integrity. A true professional.”

YODA: "Only a Sith deals in absolutes"

There is nothing that is absolute when it comes to financial markets. Since the financial market is a non-linear environment, one must learn to approach the market from a perspective of probabilities rather than a perspective of absolutes. And, this is why one must utilize an objective analysis methodology when approaching the market.

While I see many comments in my public articles from those who cannot accept my if/then approach to market analysis, that is one of the greatest strengths of Elliott Wave analysis.

Consider a general's perspective when he goes to battle. He has his primary battle plan, and he also has a contingency plan. Therefore, we maintain a primary expectation about the market. And, should the market breach a level pre-determined through our objective analysis, then we quickly adjust to our alternative plan which was set out before we even entered our position. Is there any reason one should not approach the stock market environment in this manner?

Unfortunately, most investors have bought into a story, and continue to hold their position without any objective standard to know if they are right or wrong. This often leads to the wrong perspective taken by most investors in this situation: "It's not a loss unless I sell."

This now brings me to what is likely my favorite quote from Yoda:

We all come to the market with our personal biases. We follow the news media, whether being presented in print or on the air waves, and they attempt to provide “reasonable” explanations for a market move after the fact. Moreover, how often has it happened to you that you have fallen in love with a story about a stock, only to see that stock move in the exact opposite direction of your expectations? Furthermore, how often have you seen markets begin a precipitous drop after good news has been reported, or rally strongly after bad news has been reported?

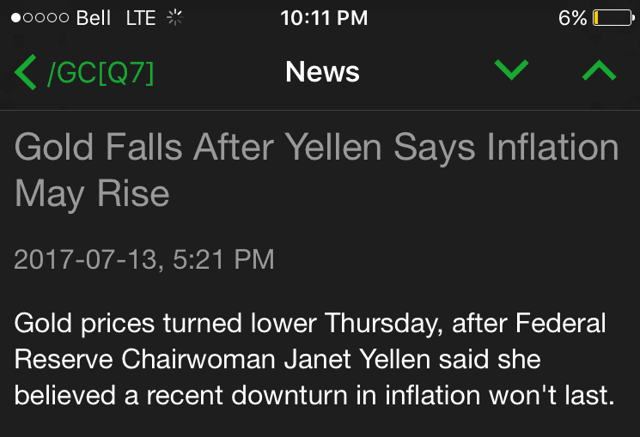

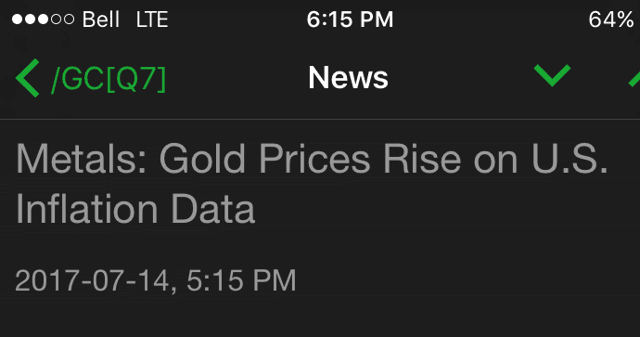

In fact, I have personally witnessed back-to-back days where an asset has moved in the exact opposite direction after the exact same type of news has been reported in these back-to-back days:

For those that may not know my background, allow me to explain the qualifications with which I initially approached the markets. I graduated college with a dual major in both economics and accounting. I went on to pass all 4 parts of the CPA exam in one sitting, something which only 2% of those taking the exam are able to achieve. I then went on to complete law school in two and a half years, and graduated ***** laude and in the top 5% of my class. I then went on to NYU for a masters of law in taxation. I became a partner and National Director at a major national firm at a very young age, where I worked to organize very large transactions. So, when I tell you that I understand the fundamentals of economics, business, and balance sheets, you can believe me.

Yet, when I approached investing in the market with all this background of understanding businesses, economics and balance sheets, I was no better than the average investor, and sometimes even worse. It was not until I learned more about the psychology of the market that I began to learn how to maintain on the correct side of the market the great majority of the time. In effect, I had to ignore everything I learned about economics, businesses and balance sheets, and predominantly focus upon investor psychology in order to make more sense of market action.

And, many of my money manager clients and individual investors with similar backgrounds have noted the same:

“I was following Avi for quite a while but it took me a couple of years to join The Market Pinball Wizard. Now with a few weeks in I must say that I regret I was passively watching Avi's team and not getting on board. After my almost 20 years in the industry, a charter to prove that "I know stuff" and a few bruises after a couple of global and local crises, I can tell I finally found what I was looking for - heavily devoted professionals with their own style, ideas and willingness to share those and teach others though without arrogance or unnecessary aggressiveness. TMPW will suit both professional like myself to get new knowledge, view on the markets, behavioral moments, psychology and other hugely useful tips. For the newcomers this service will be a great guide that will save them from many mistakes we all do and save a lot of money and nerves.”

“Quick note of thank you to Avi and the crew this year . . . absolute masterful job of keeping people invested in equities globally and importantly getting the rotations right as well . . .I run a fund and this sight has been as important as all the proprietary work that we do.”

“Joining EWT, and using it to be a better portfolio manager has been the smartest thing I’ve ever done in my 30-year career. Not only is it another great tool in my toolbox, it has become the single most important tool.”

So, while you have “feelings” of what the market may or may not do for the rest of 2021, or beyond, you must make sure that it aligns with price. If price is moving opposite of your “feelings,” or that which you read or hear about the market, well, it's time to ignore all that you feel, hear or read, and make every effort to align yourself with price.

In my humble opinion, the US stock market has higher to go in 2021, with my next target being the 4300SPX region, as long as we hold the 3500-3675SPX support region. And, once we reach that target, we can raise our supports, and begin to look towards my next higher target in the 4600-4900SPX region thereafter.

If you “feel” that my expectations are wrong, what objective analysis are you using to determine if you are wrong? I know I have price points and market structure as the objective guidelines which direct my perspective about the market. If you do not, you must ask yourself “why not?” and then exert every effort to gain an objective understanding of the truths inherent within our market, as long as they align with price.

I want to thank each of you for reading my perspective on Yoda’s wise advice and how it is appropriately applicable to how you should approach the stock market. I hope it was eye opening and has pushed you to be a better trader, investor or money manager.

Avi Gilburt is a widely followed Elliott Wave analyst and founder of ElliottWaveTrader.net, a live trading room featuring his analysis on the S&P 500, precious metals, oil & USD, plus a team of analysts covering a range of other markets. He recently founded FATRADER.com, a live forum featuring some of the top fundamental analysts online today to showcase research and elevate discussion for traders & investors interested in fundamental rather than technical analysis.

© 2021 Copyright Avi Gilburt - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.