Gold Predictive Modeling Suggests A New Rally Targeting $2300+, But When Will it Start?

Commodities / Gold and Silver 2021 Mar 08, 2021 - 12:02 PM GMTBy: Chris_Vermeulen

One of our readers’ favorite tools is the Adaptive Dynamic Learning (ADL) predictive modeling system. This tool maps out technical and price patterns into an array of similar setups using historical data, then applies that data to current and future price bars. Using the ADL predictive Modeling tool, we can see into the future based on historical technical analysis that maps statistically relevant price activity and shows us the highest probability outcomes.

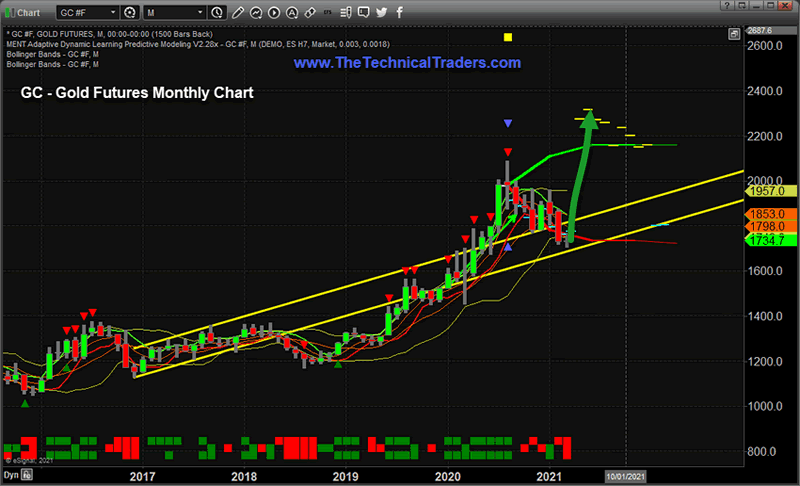

Monthly ADL Gold Predictions

In this research article, we’re going to focus on Gold and how current price action suggests a bottom is likely near the $1720 level. The YELLOW price channels on this Monthly Gold chart highlight exactly where we believe support is located for Gold. If this $1700 price level is breached to the downside, then the previous lows, near $1400, are the next support level for Gold.

Our ADL predictive modeling system suggests the $1720 support level will hold, prompting a new rally to levels above $2200 within 30 to 60+ days. The ADL system predicts an aggressive move in Gold near May or June 2021. The move higher may happen earlier than the ADL Monthly predictions indicate. There is a chance that a move back above $1850 starts the move higher before the end of March or April 2021 – propelling Gold toward the $2300+ peak. The actual peak level predicted by the ADL predictive modeling system is $2315.

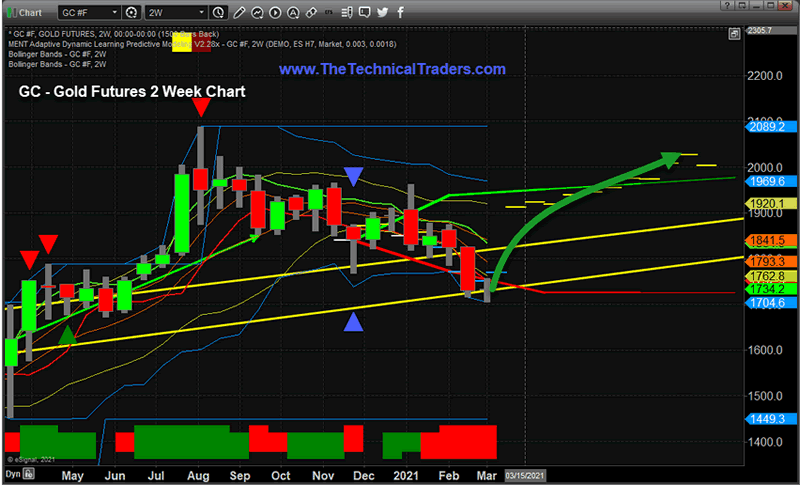

2-Week ADL Predicts Gold May Start To Rally near Mid-March

This 2-Week Gold Chart highlights a similar ADL price prediction. What we find interesting about this ADL outcome is the similar price predictions originating from vastly different origination points. The Monthly ADL prediction originates from a date of August 1, 2020 – the peak price bar. This 2-Week ADL prediction originates from a date of November 23, 2020 – the intermediate low DOJI bar before the recent continue downward trend targeting the YELLOW price channel.

Be sure to sign up for our free market trend analysis and signals now so you don’t miss our next special report!

The similarities between these two unique ADL predictions suggest that Gold may attempt to find support fairly quickly near the $1700 to $1720 level, then attempt to move above $1795~1825 as an early stage rebound off the lower YELLOW price channel. The 2-Week ADL price prediction suggests that Gold will quickly attempt to move higher, before or near March 20th, targeting levels above $1900. Then, as you can see from the YELLOW DASH LINES on this chart, Gold will attempt to move moderately higher over the next 2 to 3+ months targeting levels above $2030.

If these ADL price predictions are accurate and Gold does find a solid bottom near $1700, then we would want to watch for an upward price trend to start to setup near March 15th or so, attempting to push Gold prices above $1850 to $1900. If that happens, then the next phase of the ADL price predictions would become even more relevant. That means the upward price trend would attempt to target the $2050 level, then the $2300 level before June or July 2021.

Our ADL predictive modeling system accurately called the rally in gold in 2019 and has delivered some incredible predictive analysis over the past few months. You can read some of our earlier ADL predictions here:

- November 22, 2020: ADAPTING DYNAMIC LEARNING SHOWS POSSIBLE UPSIDE PRICE RALLY IN GOLD & SILVER

- August 4, 2020: REVISITING OUR SILVER AND GOLD PREDICTIONS – GET READY FOR HIGHER PRICES

- March 28, 2019: PRECIOUS METALS SETUP FINAL BUYING OPPORTUNITY

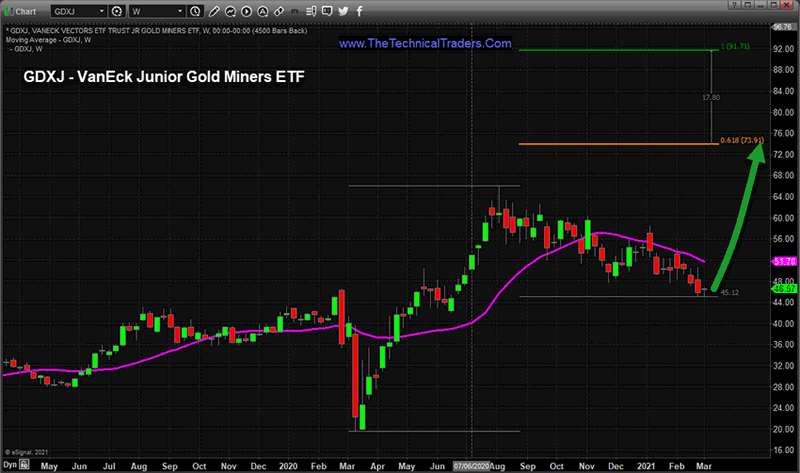

Miner ETFs May See Big Gains

In terms of sector ETF trends, a stronger upside move in Gold would likely prompt Miner ETFs to also move dramatically higher over the next 30 to 60+ days. This GDXJ Weekly chart highlights a Fibonacci 100% measured move higher which suggests the $73.91 and $91.71 levels could become our next upside targets.

Additionally, one has to consider the process that would likely prompt Gold to move higher throughout this span of time. A continued commodity rally could prompt some of this move to happen, but fear would also have to be factored into this move if Gold were to rally above $2300 as the ADL system predicts. Any renewed fear would likely come from global financial or credit market concerns or be related to hyper-inflation concerns. We’ll have to see how things progress throughout the rest of 2021 to really get a better feel for what may be driving this upward price trend.

We suggest traders pay very close attention to what happens in Gold over the next 2 to 4+ weeks. If our ADL predictions are accurate, we could see some really big moves in the global markets, various sectors and metals/miners very quickly. If the markets start to roll over and volatility rises, we can benefit from it with our Options Trading Signals which we use non-direction trades to sell premiums. This allows options traders to profit from volatility and not worry about which way the market moves.

Don’t miss the opportunities in the broad market sectors in 2021, which will be an incredible year for traders of the BAN strategy. You can sign up now for my FREE webinar that teaches you how to find, enter, and profit from only those sectors that have the most strength and momentum. Staying ahead of sector trends is going to be key to success in volatile markets.

For those who believe in the power of trading on relative strength, market cycles, and momentum but don’t have the time to do the research every day then my BAN Trader Pro newsletter service does all the work for you with daily market reports, research, and trade alerts. More frequent or experienced traders have been killing it trading options, ETFs, and stocks using my BAN Hotlist ranking the hottest ETFs, which is updated daily for my premium subscribers.

Happy trading!

Chris Vermeulen

www.TheTechnicalTraders.com

Chris Vermeulen has been involved in the markets since 1997 and is the founder of Technical Traders Ltd. He is an internationally recognized technical analyst, trader, and is the author of the book: 7 Steps to Win With Logic

Through years of research, trading and helping individual traders around the world. He learned that many traders have great trading ideas, but they lack one thing, they struggle to execute trades in a systematic way for consistent results. Chris helps educate traders with a three-hour video course that can change your trading results for the better.

His mission is to help his clients boost their trading performance while reducing market exposure and portfolio volatility.

He is a regular speaker on HoweStreet.com, and the FinancialSurvivorNetwork radio shows. Chris was also featured on the cover of AmalgaTrader Magazine, and contributes articles to several leading financial hubs like MarketOracle.co.uk

Disclaimer: Nothing in this report should be construed as a solicitation to buy or sell any securities mentioned. Technical Traders Ltd., its owners and the author of this report are not registered broker-dealers or financial advisors. Before investing in any securities, you should consult with your financial advisor and a registered broker-dealer. Never make an investment based solely on what you read in an online or printed report, including this report, especially if the investment involves a small, thinly-traded company that isn’t well known. Technical Traders Ltd. and the author of this report has been paid by Cardiff Energy Corp. In addition, the author owns shares of Cardiff Energy Corp. and would also benefit from volume and price appreciation of its stock. The information provided here within should not be construed as a financial analysis but rather as an advertisement. The author’s views and opinions regarding the companies featured in reports are his own views and are based on information that he has researched independently and has received, which the author assumes to be reliable. Technical Traders Ltd. and the author of this report do not guarantee the accuracy, completeness, or usefulness of any content of this report, nor its fitness for any particular purpose. Lastly, the author does not guarantee that any of the companies mentioned in the reports will perform as expected, and any comparisons made to other companies may not be valid or come into effect.

Chris Vermeulen Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.