Gold: Crisis or Opportunity?

Commodities / Gold and Silver 2021 Mar 08, 2021 - 11:57 AM GMTBy: The_Gold_Report

Peter Krauth, editor of Gold Resource Investor, delves into gold's recent price movements and discusses whether now is a good time to buy gold and gold stocks.

People…relax. It's a correction.

If you're a serious gold investor, then I sympathize.

If you're freaking out, then this is not for you. If you're anxious, then you need to check your premises.

After all, what's changed since gold reached a new all-time nominal high over $2,000 last August?

Actually, most of the fundamental drivers that support gold have simply gotten more entrenched. And that ultimately means much, much higher gold prices over the next few years.

So, the current rout becomes a matter of perspective. After all, we've set a lot of records lately…in a bad way. Unless you think record levels of debt, record low interest rates, record high stock valuations, and record levels of money supply will hurt gold prices, then relax.

In the meantime, it's helpful to just try and better understand what's pressuring gold. That way we can decide if its weakness is transitory, or structural.

Odds are you know where this is going. But let's work through it anyways, you know, for fun.

Rising Yields, Deficits and Debts

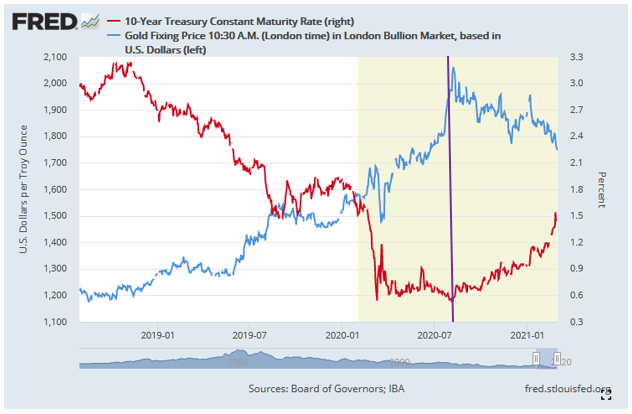

My take on what's been pressuring gold for the last few months boils down to one main factor, the rise in long-term yields.

Bond yields have been on a path higher since early August. It's no coincidence that gold started to correct at virtually the same time. Gold pays no dividends. And investors have become attracted to higher bond yields as stocks have gotten even more pricey.

Intertwined with that is the rising U.S. dollar. As the rise in yields accelerated when we entered 2021, foreigners likely began converting their currencies to dollars to buy U.S. bonds. That has prompted a rally in the U.S. dollar index which could have a bit higher to go before peaking.

Judging by the RSI and MACD momentum indicators, the Ten-Year Treasury Index is looking overbought. And the 1.5% ten-year yield level, which acted as support several times in late 2019, may now become resistance.

Meanwhile, U.S. deficits are screaming higher. As explained in Crescat Capital's February Research Letter, there's an impending $1.9 trillion "rescue" package. In addition, Biden is aiming for a "recovery" package. While still in discussions, it may reach as much as $3 trillion. The total could reach $4.9 trillion, as compared to last year's $3.1 trillion. And last year major foreign holders of US debt bought a measly 5.2% of all treasuries issued.

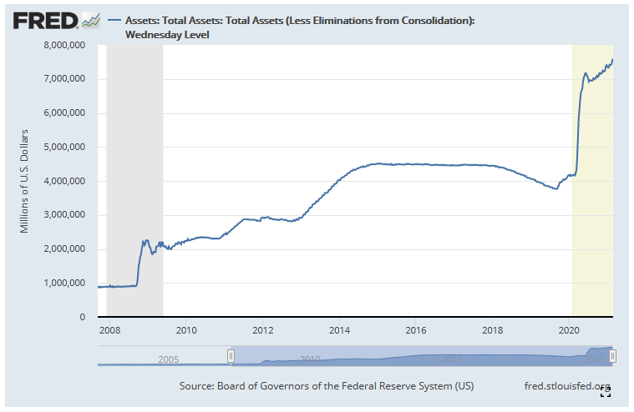

That leaves the Fed as a buyer of last resort, naturally. Let's look at what that's meant for more than the past decade.

One big standout, for me, from this chart is how short lived and relatively shallow any asset reductions were. The most obvious takeaway, naturally, is the sheer amount of growth in assets. Over the 12 short years from 2008 to 2020, assets have blasted from $1 trillion to $7 trillion.

Now lets' step back for a little golden perspective.

Gold's and Gold Stocks' Big Picture

If we look at a 20-year gold chart, the recent correction takes on a different context.

Consider that gold's big upleg from late 2018 until its 2020 peak took it from $1,175 to $2,070. That's a 76% gain in just two years. And it certainly justifies its current correction.

Looking at a 2-year chart suggests gold's correction may be nearly done.

Last April to June there was a confluence of trading in the current range around $1700–$1,750. And the RSI and MACD indicators suggest gold is at or very near oversold levels.

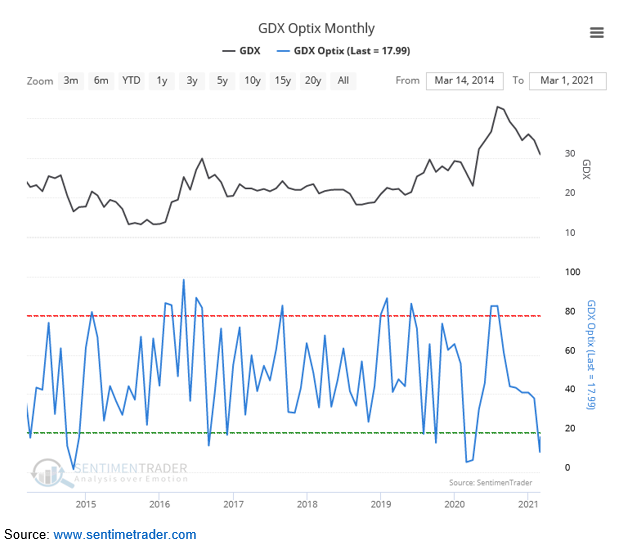

From price and sentiment perspectives, gold stocks also look like they're near their nadir.

The bottom for GDX could well sit near the $30 level. The RSI suggests a little more work needs to be done.

And from a contrarian sentiment perspective gold stocks have only been this hated, and therefore attractive, twice in the past decade.

In the Gold Resource Investor newsletter, I provide my outlook on which gold stocks offer the best prospects as this bull market progresses. I recently added two companies to the portfolio that I believe have exceptional potential to outperform their peers in the next 12 months.

So, the bottom line is that gold at $1,700 is not a reason to freak out. Instead, it needs to been seen for the opportunity that it is. In all likeliness, after eight months of correcting by nearly 18%, we are at or near a bottom.

It's time for you to decide. Is the current gold price a crisis or an opportunity?

Logic would dictate the latter.

Peter Krauth is a former portfolio adviser and a 20-year veteran of the resource market, with special expertise in energy, metals and mining stocks. He has been editor of a widely circulated resource newsletter, and contributed numerous articles to Kitco.com, BNN Bloomberg and the Financial Post. Krauth holds a Master of Business Administration from McGill University and is headquartered in resource-rich Canada.

Disclosure: 1) Peter Krauth: I, or members of my immediate household or family, own shares of the following companies mentioned in this article: None. I personally am, or members of my immediate household or family are, paid by the following companies mentioned in this article: None. My company has a financial relationship with the following companies mentioned in this article: None. I determined which companies would be included in this article based on my research and understanding of the sector. 2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: None. Click here for important disclosures about sponsor fees. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security. 3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy. 4) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports. 5) From time to time, Streetwise Reports and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article until three business days after the publication of the interview or article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.