Silver Expectations Given GameStop Price Action and the Reddit Revolution

Commodities / Gold and Silver 2021 Feb 02, 2021 - 04:25 PM GMTBy: Chris_Vermeulen

Near the end of 2020, my research team identified trends, pullbacks, and overall upward/downward trends in US major markets as well as those for Gold and Silver. It is time we revisited these early 2021 predictions in relation to what is happening in the markets currently. You can revisit our original publication entitled What To Expect in 2021 Part II – Gold, Silver, and SPY.

At the time we made these predictions, we were unaware of the global phenomenon, the Reddit #wallstreetbets movement, that was taking place. Our expectations are based on our advanced predictive modeling system and what it sees as the highest probability outcome for price. The recent news that this Reddit group has targeted a number of symbols (GME, AMC, BB, amongst others), as well as SILVER, may change the dynamics/liquidity of the markets very quickly.

What we are witnessing is the incredible strength of the retail trader when they act in a “pack-form”. The retail traders of the world, using a social media platform, have found new strength as the global markets continue to struggle with COVID-19 and institutional weakness. In a way, these retail traders are focusing on an institutionally authorized “exploit”, like a game exploit, where short-sellers have been permitted to overrun many smaller traders and companies over the past decade or so – ever since the “Uptick Rule” was removed.

This has created an environment where excessive risks were allowed by many institutions as short sellers were able to enter short positions far in excess of the floating shares available. With extreme leverage in place, these positions were ticking time-bombs waiting to explode. And then along comes the Reddit group – hungry, happy, and en mass. They identify this structural weakness, which was legally allowed to happen, and begin their “autist wave” of buying these heavily shorted symbols.

Be sure to sign up for my FREE webinar that will teach you how to find and trade my BEST ASSET NOW strategy on your own!

Gamestop became a “shot across the bow” for these hedge funds and has sent a liquidity ripple across the global markets. Is the financial system at risk because of excessive leverage, derivatives, and institutional manipulation? What would it take to completely disrupt these hedge funds and what are the consequences of these short-squeeze runs? Is this issue bigger than many people expect? Could it turn into a “liquidity trap”?

These are all questions that are certainly going to be answered over the next 6+ months and no one really has a true understanding of how the “deleveraging process” will take place. If push comes to shove and institutional shorts are forced into excessive losses, then we may see a bigger corrective trend setup in 2021 as a result of this capital/liquidity trap that has sprung.

Now, before we continue to review some of our 2021 expectations, let’s review a couple of important charts…

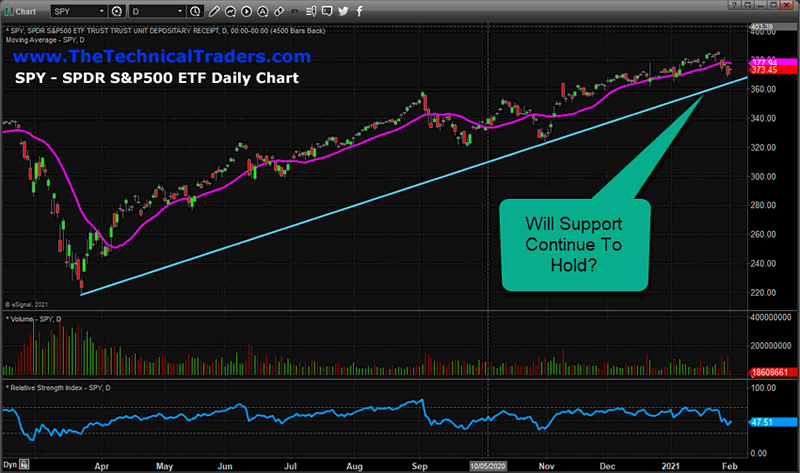

SPY Must Hold Above Support

The following Daily SPY chart highlights the major support channel originating from the March 2020 lows. If this channel is breached, we may begin a deeper downside trend that could align with a volatility/liquidity trap event. Losses generated by these excessive, leveraged, short positions will prompt firms to pull profits from other symbols/sectors. This wave of volatility may be just starting.

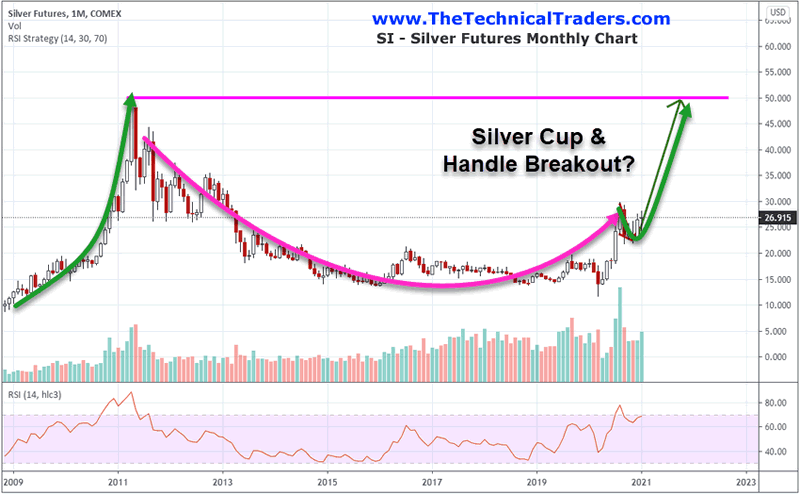

Silver Targets $55 Or Higher

Silver has recently been targeted by the Reddit group as one of the most heavily shorted precious metals on the planet. Currently, silver has rallied above $30 in early trading on Monday, February 1, but has come down closer to the opening (which gapped significantly). If Silver rallies above $35 and continues to trend, $50 to $55 is the next target level. After that level is reached, we move into uncharted territory (above $55) and the sky’s the limit for Silver and Gold.

revisiting our 2021 Expectations

Now, onto our 2021 Expectations and how this new dynamic of volatility and liquidity may change things. If the increased volatility and liquidity issue persists beyond February 2021, we would expect the global markets to begin to immediately reflect a transition away from excessive risks and leverage. This would take place by off-loading positions in at-risk and in-profit trades throughout the world to position portfolios in a means to mitigate 3x+ std deviation risks. This deleveraging process may prompt a huge upside move in precious metals because any global deleveraging event, if it aligns with a moderate price correction event, may push institutions to urgently address leverage issues. This urgency, in combination with the retail trader revolt, may prompt an excessive liquidity trap in certain sectors/symbols – almost like a “flash-rally” event.

Overall, we believe the global markets will settle back into our expected 2021 ranges – although Gold and Silver may rally far beyond our upside 2021 expectations if the Reddit group continue to push Silver higher like they did with Gamestop. So, at this point, be prepared for massive volatility ranges and continued upside price trends in Gold and Silver while the markets address these global institutional and leverage issues.

What this means for traders is that we should expect to see some really big trends through almost all of 2021. Most importantly, we will end up with more rational price trends and a potentially reduced leverage environment for many sectors and symbols. This should prompt various market sectors to initiate or resume trends as capital is put to work in sectors that have a stronger growth potential over the next few years.

2021 is going to be full of these types of trends and setups. Quite literally, hundreds of these setups and trades will be generated over the next 3 to 6 months using my BAN strategy. You can learn how to find and trade the hottest sectors yourself with no proprietary indicators or algorithms just by taking my FREE one-hour BAN tutorial.

For those who believe in the power of relative strength, market cycles, and momentum but don’t have the time to do the research every day then my BAN Trader Pro newsletter service does all the work for you. In addition to trade alerts that can be entered into at the end of the day or the following morning, subscribers also receive a 7-10 minute video every morning that walks you through the charts of all the major asset classes. For traders that want more trading than our 20-25 alerts per year, we provide our BAN Trader Pro subscribers with our BAN Hotlist of ETFs that is updated each day.

Happy Trading!

Chris Vermeulen

www.TheTechnicalTraders.com

Chris Vermeulen has been involved in the markets since 1997 and is the founder of Technical Traders Ltd. He is an internationally recognized technical analyst, trader, and is the author of the book: 7 Steps to Win With Logic

Through years of research, trading and helping individual traders around the world. He learned that many traders have great trading ideas, but they lack one thing, they struggle to execute trades in a systematic way for consistent results. Chris helps educate traders with a three-hour video course that can change your trading results for the better.

His mission is to help his clients boost their trading performance while reducing market exposure and portfolio volatility.

He is a regular speaker on HoweStreet.com, and the FinancialSurvivorNetwork radio shows. Chris was also featured on the cover of AmalgaTrader Magazine, and contributes articles to several leading financial hubs like MarketOracle.co.uk

Disclaimer: Nothing in this report should be construed as a solicitation to buy or sell any securities mentioned. Technical Traders Ltd., its owners and the author of this report are not registered broker-dealers or financial advisors. Before investing in any securities, you should consult with your financial advisor and a registered broker-dealer. Never make an investment based solely on what you read in an online or printed report, including this report, especially if the investment involves a small, thinly-traded company that isn’t well known. Technical Traders Ltd. and the author of this report has been paid by Cardiff Energy Corp. In addition, the author owns shares of Cardiff Energy Corp. and would also benefit from volume and price appreciation of its stock. The information provided here within should not be construed as a financial analysis but rather as an advertisement. The author’s views and opinions regarding the companies featured in reports are his own views and are based on information that he has researched independently and has received, which the author assumes to be reliable. Technical Traders Ltd. and the author of this report do not guarantee the accuracy, completeness, or usefulness of any content of this report, nor its fitness for any particular purpose. Lastly, the author does not guarantee that any of the companies mentioned in the reports will perform as expected, and any comparisons made to other companies may not be valid or come into effect.

Chris Vermeulen Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.