The Great American Housing Boom Has Begun

Housing-Market / US Housing Aug 07, 2020 - 02:58 PM GMTBy: Stephen_McBride

What if I told you that US housing is one of the best money-making opportunities today? You’d probably think I’m crazy. After all, how can anyone think housing is a good bet right now… especially in the middle of a global pandemic?

Well, today I’m going to show you the facts. You’ll see exactly why I’ve never been more excited about US housing. You’ll see why the coronavirus hasn’t even dented this market. And you’ll find out the best way to play this boom for maximum profits.

The Residential Housing Market Is Worth $35 Trillion

And it’s absolutely BOOMING. This past month, new home sales surged 55%—their biggest gain since 2005. The number of Americans looking to refinance their mortgages jumped 111%. And Quicken Loans—the US’s largest mortgage broker—just had its best quarter in its 35-year history.

In the first six months of 2020, Quicken funded a record $120 billion in home loans. It broke the record for its best lending year ever with six months to go.

And get this: last month, the average home sale price spiked 6%. This marks 100 straight months of gains, according to the National Association of Realtors (NAR).

You’d expect these stellar growth numbers from a tiny disruptor having its “breakout moment.” Yet, we’re talking about America’s biggest industry!

There’s A Big “Squeeze” Happening In US Housing

Take first-time homebuyer Brett-Ashlee Ward for example. She put in offers for nine homes over the past three weeks in Oklahoma City.

She was beaten out by higher offers every time. Ward wasn’t lowballing. She offered above the listing prices and didn't ask the sellers to cover the closing costs.

But bidding wars are fast becoming the rule, not the exception in US housing. Data from internet realtor Redfin (RDFN) shows more than half of buyers who purchased a home in the past three months were forced into a bidding war.

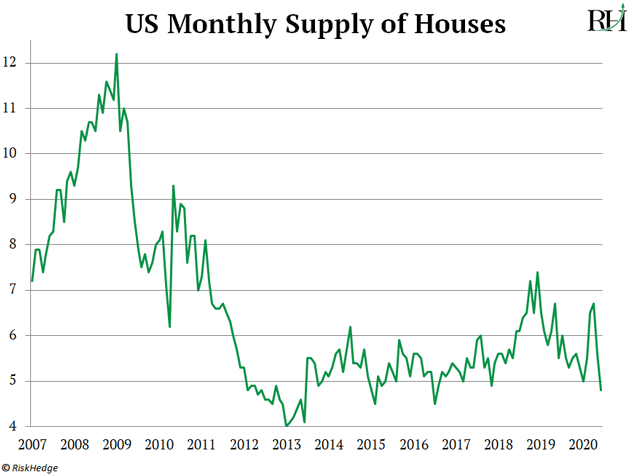

This won’t come as a surprise to longtime RiskHedge readers. As housing expert Barry Habib told me last year, “There is a chronic undersupply of homes in America.” In fact, it would take less than five months to sell every existing home on the market, as you can see here:

Scarred by the housing bust, homebuilders have been sitting on their hands for the past decade. Census Bureau data shows an average of 1.5 million homes were built each year since 1959. Yet over the past decade, just 900,000 homes have been built per year.

We have a serious housing shortage in America today. Millions of homeowners chose not to list their homes during the peak of the coronavirus… which has only “shrunk” supply further.

A Flood Of Homebuyers Is Rushing Into The Market

Today’s young adults, as you probably know, are called “millennials.” They’re the biggest generation in US history—bigger even than baby boomers. They’re famous for living in their parents’ basements, delaying marriage, and earning less money than their parents did.

But as I wrote last year, millennials aren’t kids anymore. This year, the average millennial turns 32. And guess what the median age of a first time homebuyer in the US is? 31!

According to NAR, four in ten homebuyers was a millennial in 2019. And recent data from Realtor.com found millennials’ share of mortgages surpassed 50% in the spring.

The first wave of young homebuyers are bursting into the market. But every year for the next decade, tens of millions of millennials will hit home-buying age.

In other words, a whole generation of homebuyers will soon flood the market. At a time when there is a massive shortage of homes in America!

Remember, the most important driver of home prices is supply and demand. Today, supply is tight. And with record numbers of house hunters entering the market, it all but guarantees the housing boom has YEARS left to run.

I’m “Pounding the Table” On Homebuilder Stocks

The cure for America’s housing woes is simple: Homebuilders MUST build more houses. As I mentioned, builders have been very cautious over the past decade. But now they’re finally ramping up.

Before lockdowns, new home “starts” jumped to their highest level since 2006! The number of building permits granted shot up to their highest level since March 2007. Coronavirus has been little more than a blip on the radar for homebuilders. Housing starts surged 17% in June as states began reopening.

And here’s the kicker: the shortage of available homes is allowing homebuilders to charge a premium. According to a CNBC survey, almost six in ten builders recently bumped prices up.

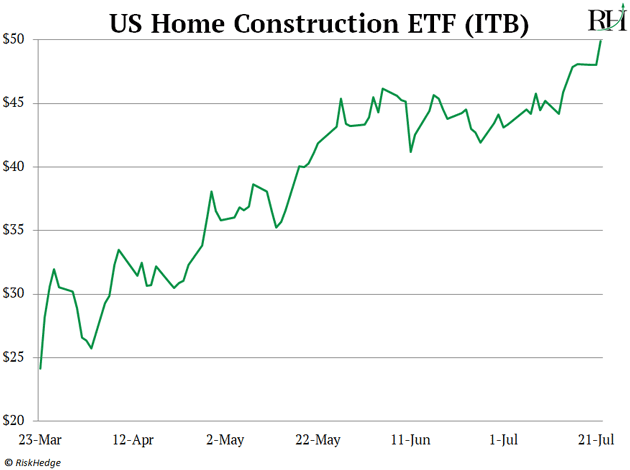

The bottom line is homebuilders are set to make boatloads of money in 2020, 2021, and beyond. Builders dived along with the market in March. But now they’re ripping higher and are about to break out to new all-time highs.

Check out the performance of homebuilder’s fund ITB. It’s up 100% in just four months!

In short, this setup is handing us a slam-dunk profit opportunity. It’s time to pull the trigger on homebuilders as the US housing boom roars on.

The Great Disruptors: 3 Breakthrough Stocks Set to Double Your Money"

Get my latest report where I reveal my three favorite stocks that will hand you 100% gains as they disrupt whole industries. Get your free copy here.

By Stephen McBride

© 2020 Copyright Stephen McBride - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.