US Housing Market Collapse Second Phase Pending

Housing-Market / US Housing Jul 20, 2020 - 12:19 PM GMTBy: Chris_Vermeulen

In this second part of our research into what we believe is the US pending real estate collapse, we’ll explore more data supporting our expectations. In the first part of this article, we highlighted the Case-Shiller data showing home price levels had already exceeded 2006-07 levels and how earning levels have collapsed after the COVID-19 virus event. Our research team believes thee extremely high price levels, combined with the uncertainty of future earnings, unemployment, layoffs, and other economic contractions will result in a late 2020 or early 2021 shift in the residential real estate market.

We already know that commercial real estate has experienced one of the worst declines in decades. Delinquencies have skyrocketed and thousands of US businesses have entered bankruptcies. Main street and consumer services sectors will likely continue to feel the pain related to the post-COVID-19 economy for many months still. The question before all investors should be “how will the price levels reflect the changes in earning and economic data throughout this transition?”

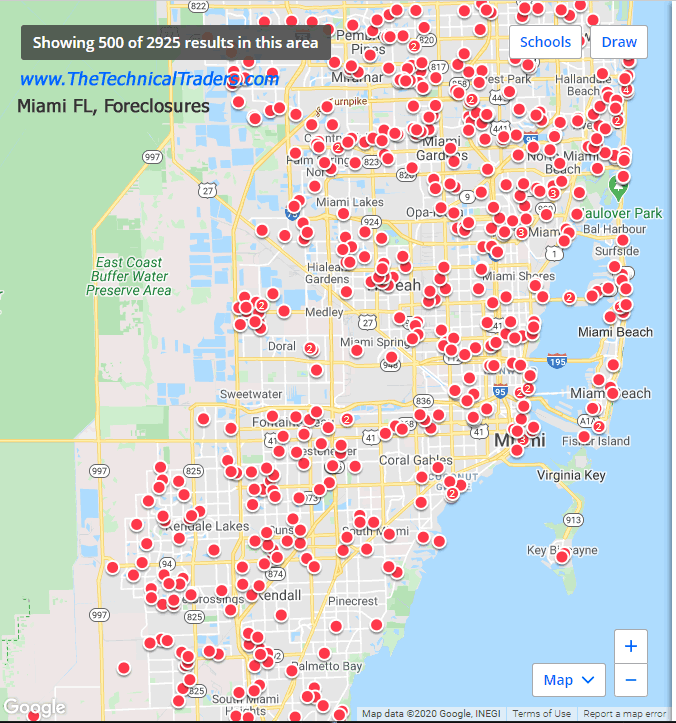

Our research team believes the contraction in earnings for the consumers as well as the extended unemployment levels will present a very real potential for future foreclosures and delinquencies in the residential real estate market. We believe this process will begin to become noticeable approximately 6+ months after the COVID-19 shutdowns started – sometime near August or September 2020. Once the destruction of earning levels properly reflects into the economic cycles and banks tighten lending opportunities, the scale of capable buyers will shrink at a time when home inventories may begin to skyrocket – very similar to the 2008-09 credit crisis.

Ever since the lower interest rates pushed mortgage levels below 3%, residential home sales have been booming. This is likely because people in cities are wanting to move out of the city and into the suburbs for a healthier and less compacted lifestyle. Additionally, many of these more rural areas present better home price levels and more value for people selling urban real estate.

Another aspect of this boom in rural home sales is that people wanted to escape the trap of the city and move to locations where they have more room and more ability to “live off the property instead of living off the supermarket or local outlets. This process of urban escape could take many months or possibly years for qualified sellers to relocate out into the more rural areas. The point being that urban real estate values may dramatically decline as a result of the mass exodus from the cities that are currently taking place.

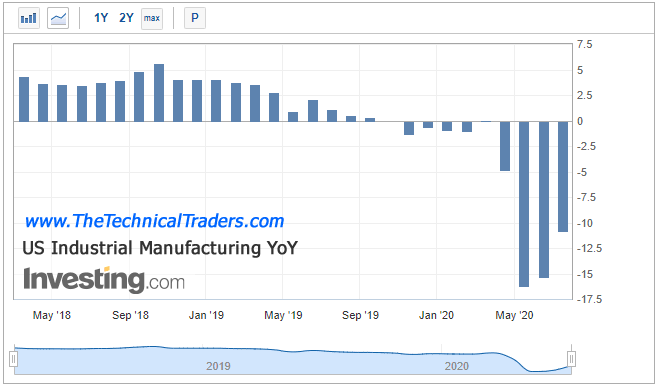

US manufacturing continues to decline year over year which indicates that manufacturing jobs and output is far from recovering. If we attempt to read between the lines, it suggests that one of the most important aspects of any economic recovery is still showing -10% year over year contraction. This suggests a longer recovery process for manufacturing output and jobs.

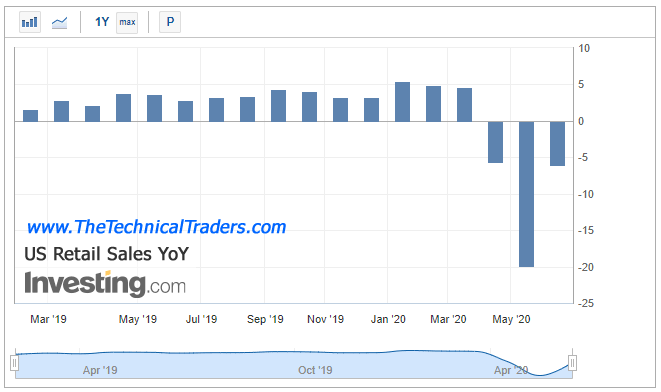

US retail sales have also collapsed over the past 3+ months. Although one could argue that e-commerce sales have made up for these losses, one has to understand that retail sales within the US employs a host of other people that support local and regional stores. Sales clerks, managers, warehouse, delivery and shipping and other positions that would normally be associated with retail or retail services have contracted by as much as 10 to 15% (or more) over the past 3+ months.

Additionally, consumer activity, which includes retail sales and retail services, makes up more than 80% of the US GDP levels. If manufacturing and retail/consumer activity levels have dropped by 10% to 15% or more over the past 3+ months and will continue a slow recovery process lasting many months, we believe the eventual shift and contraction in the real estate market could present a lasting collapse in prices for many urban and outlying areas.

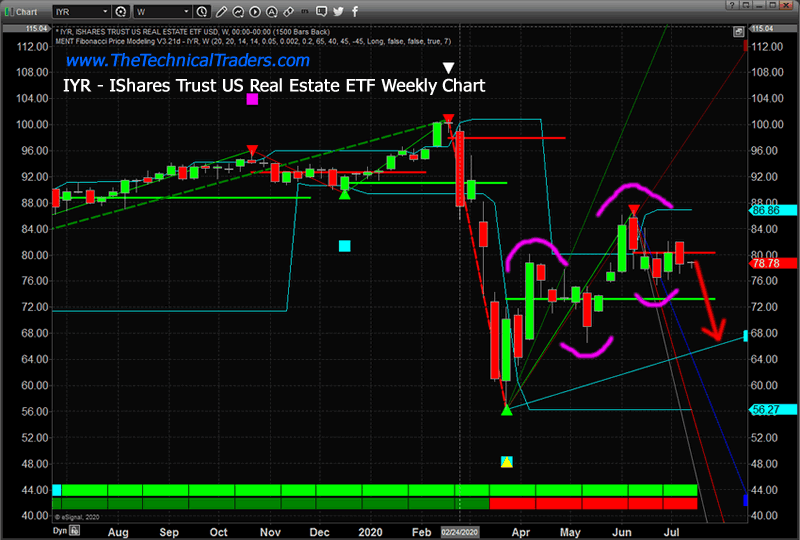

Our researchers believe the Real Estate ETFs may experience a 20% to 40% decline over the next 3+ months as the reality of the urban exodus hits. Cities like Miami, Los Angeles, Chicago, San Francisco, and dozens of others may see a dramatic decrease in demand as buyers focus on more rural areas and the new “work from home” environment. We’re already seen some evidence from discussions with local real estate professionals that a shift in buying interests is taking place. Now, we are watching the middle and upper scale real estate markets in urban areas to confirm our hypothesis.

Once we start to see price decreases in larger urban areas (like Los Angeles, New York, Miami, and other areas), particularly in the condo and apartment sectors, we’ll know the shift in buying is taking place. We believe condos and apartments will be one of the first sectors hit as well as middle and upper scale real estate. We are also watching the foreclosure and auction data to determine if and when new waves of defaults start to hit the marketplace.

After stating what we believe to be a factual interpretation of the current real estate marketplace and the transition that is taking place, we believe the real shock will come to some of the hottest urban markets in the US and abroad. We believe areas like Miami, New York, Los Angeles, Seattle, Portland, and others will experience a sudden lack of demand which will translate into decreasing price levels and sales activity. The COVID-19 virus event has suddenly prompted people to realize the urban lifestyle if fraught with some risks that are partially negated in a rural environment and away from the packed and busy cities.

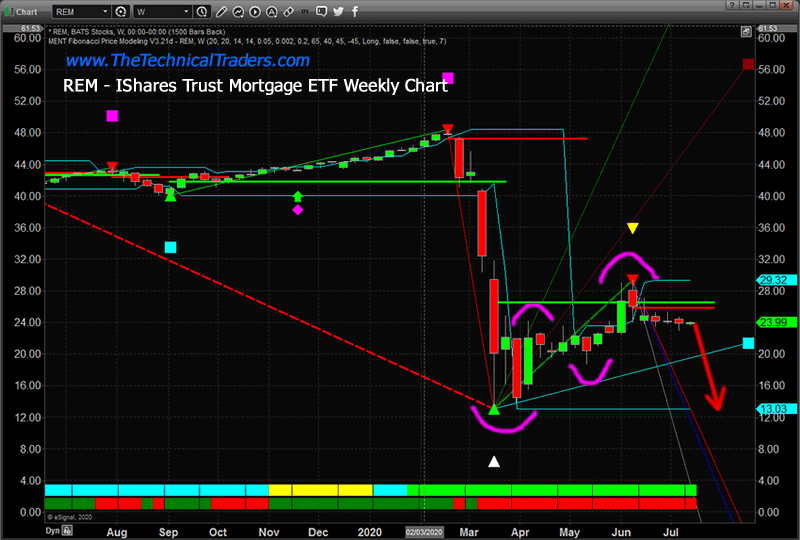

If our research is correct, there is a very real opportunity for skilled technical traders to take advantage of the next downside price wave in IYR and REM. We believe a 20% to 40% price contraction will take place over the next 3+ months prompting a new momentum base to set up near November or December of 2020. This base level may become a temporary base level as we find out how the COVID-19 virus is affecting the US economy and how quickly or aggressively people are exiting the urban environment. Overall, we believe this is an excellent opportunity for skilled technical traders to profit from a new downside price wave.

IYR may target $65 to $68 before finding any real support. Extended downside selling may push IYR to levels near $55 to $60 over the next 6+ months.

REM price levels may collapse to $13 to $15 over the next 4+ months as we believe the shift towards selling the urban areas and the tightening bank standards may result in a more constricted buying phase. Inventory in rural areas is limited – very limited. This may prompt a wave of current sellers to attempt to “get out now” and then wait for/hunt for the best rural opportunities.

Attempting to read this shifting market is like trying to predict the weather 3 months out. There are many various aspects of the real estate market that could subtly change how the market dynamics shift. The one thing we are certain of at this point is that the COVID-19 virus as well as the social and political turmoil will not end until sometime after November/December 2020. Therefore, we are certain to have another 6+ months of shifting markets which may peak shortly after the US Presidential election (although we doubt it).

We strongly believe the remainder of 2020 and most of 2021 may continue to prove very challenging for homeowners and people attempting to make transitions away from urban areas. We are alerting you to these opportunities because we believe a very good opportunity exists in these trades and we believe the real estate market will continue to be one of the biggest transitional price rotations we’ve seen in the past 8+ years. Trillions of dollars reside in both the residential and commercial real estate marketplaces and we believe a huge shift in these markets is about to unload on consumers/banks.

This could be one very big component of a fantastic trading opportunity for skilled technical traders.

Get our Active ETF Swing Trade Signals or if you have any type of retirement account and are looking for signals when to own equities, bonds, or cash, be sure to become a member of my Passive Long-Term ETF Investing Signals which we are about to issue a new signal for subscribers.

Chris Vermeulen

www.TheTechnicalTraders.com

Chris Vermeulen has been involved in the markets since 1997 and is the founder of Technical Traders Ltd. He is an internationally recognized technical analyst, trader, and is the author of the book: 7 Steps to Win With Logic

Through years of research, trading and helping individual traders around the world. He learned that many traders have great trading ideas, but they lack one thing, they struggle to execute trades in a systematic way for consistent results. Chris helps educate traders with a three-hour video course that can change your trading results for the better.

His mission is to help his clients boost their trading performance while reducing market exposure and portfolio volatility.

He is a regular speaker on HoweStreet.com, and the FinancialSurvivorNetwork radio shows. Chris was also featured on the cover of AmalgaTrader Magazine, and contributes articles to several leading financial hubs like MarketOracle.co.uk

Disclaimer: Nothing in this report should be construed as a solicitation to buy or sell any securities mentioned. Technical Traders Ltd., its owners and the author of this report are not registered broker-dealers or financial advisors. Before investing in any securities, you should consult with your financial advisor and a registered broker-dealer. Never make an investment based solely on what you read in an online or printed report, including this report, especially if the investment involves a small, thinly-traded company that isn’t well known. Technical Traders Ltd. and the author of this report has been paid by Cardiff Energy Corp. In addition, the author owns shares of Cardiff Energy Corp. and would also benefit from volume and price appreciation of its stock. The information provided here within should not be construed as a financial analysis but rather as an advertisement. The author’s views and opinions regarding the companies featured in reports are his own views and are based on information that he has researched independently and has received, which the author assumes to be reliable. Technical Traders Ltd. and the author of this report do not guarantee the accuracy, completeness, or usefulness of any content of this report, nor its fitness for any particular purpose. Lastly, the author does not guarantee that any of the companies mentioned in the reports will perform as expected, and any comparisons made to other companies may not be valid or come into effect.

Chris Vermeulen Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.