US Housing Market Real Estate Crash The Next Shoe To Drop – Part II

Housing-Market / US Housing Apr 25, 2020 - 05:25 PM GMTBy: Chris_Vermeulen

As we continue to delve into the looming Real Estate crisis that will likely hit the US and globe over the next 12 to 24+ months, we want to focus on the human psychological process of dealing with a crisis event and how that relates to economic engagement. In the first part of this research article, we discussed how the time-line and events that have unfolded over the past 120+ days have setup a continuing global crisis event. The best of our knowledge, there has been nothing like this, other than massive wars like WWII, that have taken place on the planet over the past 75+ years.

This presents a very real possibility that human psychological processes have engaged throughout the planet that may disrupt how effective the recovery efforts are in the near future. If humans engage in a traditional psychological crisis-cycle process, then there is little chance that the economic recovery will reach 2018-2019 levels very quickly. Let’s review the psychological process of a crisis event.

The normal Psychological reactions to a crisis event are:

Vicarious Rehearsal: People that are distanced from the crisis event (location or expectations) tend to react in a way that reflects their belief that “it won’t result in any dramatic changes to their lives”. Thus, they continue behaving and acting as they would without the crisis.

Denial: The process of denial takes on many forms. Some people simply ignore the warnings or information related to the crisis. Others become agitated or confused. Some simply chose to believe the threat is not real and others may believe the threat does not relate to themselves.

Stigmatization: Sometimes, segments of society may become stigmatized by their community as anger or blame drives people to believe infected people or segments of society that may promote the crisis event are identified. We’ve already seen some of this type of activity throughout the globe take place.

Fear and Avoidance: Fear becomes a central psychological element that may drive certain people to act in extreme, and sometimes irrational, ways to avoid the perceived or real threat. Fear, much like Greed, is to primary element of all human activity and we must understand these components and how they transition throughout this virus event.

Withdrawal, Hopelessness, and Helplessness: When people realize the threat is real and feel there is nothing they can do or change in their lives to avoid the consequences of the threat – a feeling of Hopelessness and Helplessness begins to set in. When this happens, people tend to withdraw from normal activities and isolate themselves from the threat and society as a whole. (Source: https://www.orau.gov)

We believe these components of how society reacts to a crisis event are more like a “transitional process” than a series of separate events or actions. We believe, initially, Vicarious Rehearsal and Denial are the initial reactions to a crisis event. Then, these transition into Stigmatization and Fear when society realizes the threat of the crisis is very real and tangible. Lastly, society moves into a balance between the last three elements where Stigmatization, Fear, and Hopelessness permeate as the crisis event continues to unfold.

Can we find any evidence that consumers were acting in a manner consistent with this psychological process within the data? What would we look for in the data and how would we identify key characteristics of this psychological process?

Before we continue, be sure to opt-in to our free market trend signals before closing this page, so you don’t miss our next special report!

First, we would look for Vicarious Rehearsal and Denial in the form of “opportunity and greed” in the data. The US Fed lowered interest rates to near ZERO on March 15, 2020. This may have prompted a surge in refinancing and purchase commitments from qualified buyers. We would look for a surge in mortgage applications in March 2020 as the expansion and severity of the virus crisis was surging. Additionally, we would also look for a surge in home prices and sales levels as qualified buyers attempted to profit from lower rates.

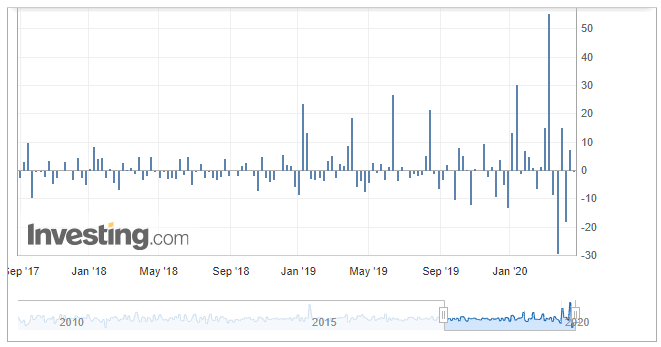

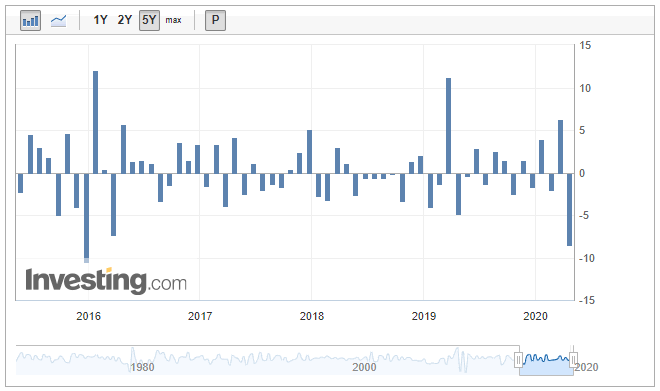

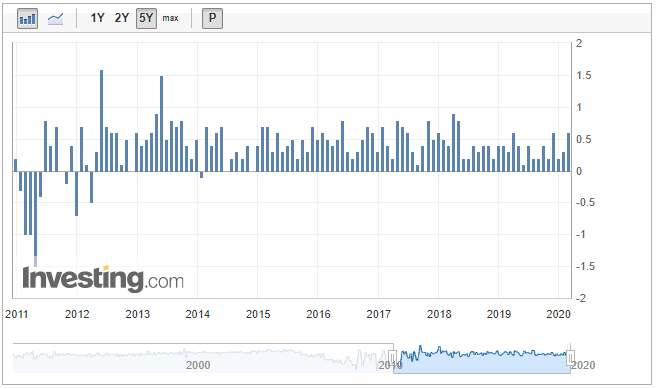

When we look at the charts below, pay attention to the spikes on the charts in March 2020 and how they correlate to the US Fed decreasing interest rates just prior to the shut-down “National Emergency” order from President Trump. The good news in early 2020 related to Q4:2019 earnings and economic data seemed to lull people into believing the risks were minimal. Well, quite a bit has changed since then…

US MBA Mortgage Applications (WoW): Notice the spike on the week of March 11, 2020, above 50? This level was nearly double the previous peak levels going back over 2 years. A flood of buying and refinancing activity took place in early March 2020 near peak price levels.

US Existing Home Sales (MoM): This existing home sales data shows that both January and March 2020 exhibited strong sales numbers of existing homes. Pay special attention to how quickly this data changed in April 2020. Existing home sales levels have collapsed from the previous monthly levels as consumers have moved beyond the Denial stage and into the Fear stage.

US House Price Index (MoM): This chart shows that house price levels are still appreciating while demand has already started to collapse. Again, pay attention to what happened in March 2020 and what is happening in April 2020. Mortgage applications have collapsed. Existing home sales have collapsed. Yet, prices remain rather high right now. It would appear that home sellers are reluctant to decrease pricing as aggressively as potential buyers are exiting the market. Eventually, the lack of real demand will prompt price levels to contract to attract interested buyers. As we’ve seen before, though, when prices start to decline – a vicious cycle begins where potential buyers wait out the bottom or “low-ball” offers because they know the dynamics of the markets have changed in their favor.

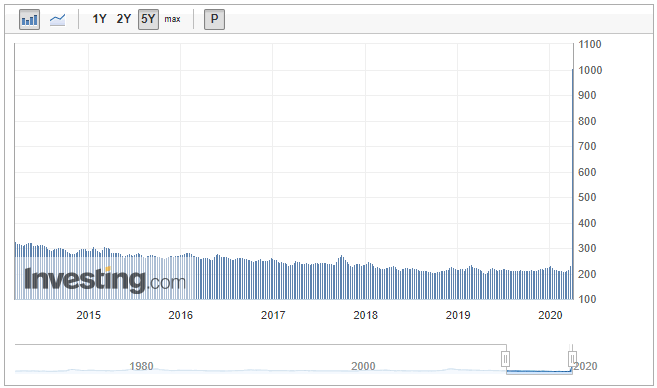

US Jobless Claims 4-Week Average (WoW): The real kicker, in our opinion, is how the shut-down has resulted in a massive segment of new job losses in the US. It is hard to argue with the fact that the “average” 4-week jobless claims number shot up to levels above 1,000,000 recently. This is the highest level we’ve seen in this economic indicator EVER. These levels are nearly 10x the 2008-09 credit crisis levels – trying to put this into perspective.

When we have massive amounts of people suddenly losing their jobs (sources of income), this creates a massive disruption in the supply/demand side of the Real Estate market. How massive is this number?? Take a look at the last chart…

Yes, this is a real chart of the jobless situation in the USA. Please remember, if the situation in the USA is as it is being reported, then the situation throughout the rest of the world may be similarly related to job losses. The point we are trying to make is that the job losses recently have been massively higher than anything we saw throughout the 2008-09 credit crisis – nearly 800% to 900% more massive.

I am hoping people can see what I am trying to warn about, which is the next major market crash, much worse than what we saw in March. See this article and video for a super easy to understand the scenario that is playing out as we speak, and real estate will follow.

As a technical analyst and trader since 1997, I have been through a few bull/bear market cycles in stocks and commodities. I believe I have a good pulse on the market and timing key turning points for investing and short-term swing traders. 2020 is going to be an incredible year for skilled traders. Don’t miss all the incredible moves and trade setups.

Subscribers of my ETF trading newsletter had our trading accounts close at a new high watermark. We not only exited the equities market as it started to roll over in February, but we profited from the sell-off in a very controlled way with TLT bonds for a 20% gain. Yesterday we closed out SPY ETF trade taking advantage of this bounce and our account is at another all-time high value. Exciting times for us technical traders!

I hope you found this informative, and if you would like to get a pre-market video every day before the opening bell, along with my trade alerts visit my Active ETF Trading Newsletter.

We all have trading accounts, and while our trading accounts are important, what is even more important are our long-term investment and retirement accounts. Why? Because they are, in most cases, our largest store of wealth other than our homes, and if they are not protected during a time like this, you could lose 25-50% or more of your entire net worth. The good news is we can preserve and even grow our long term capital when things get ugly like they are now and ill show you how and one of the best trades is one your financial advisor will never let you do because they do not make money from the trade/position.

If you have any type of retirement account and are looking for signals when to own equities, bonds, or cash, be sure to become a member of my Long-Term Investing Signals which we issued a new signal for subscribers.

Ride my coattails as I navigate these financial markets and build wealth while others lose nearly everything they own during the next financial crisis.

Chris Vermeulen

www.TheTechnicalTraders.com

Chris Vermeulen has been involved in the markets since 1997 and is the founder of Technical Traders Ltd. He is an internationally recognized technical analyst, trader, and is the author of the book: 7 Steps to Win With Logic

Through years of research, trading and helping individual traders around the world. He learned that many traders have great trading ideas, but they lack one thing, they struggle to execute trades in a systematic way for consistent results. Chris helps educate traders with a three-hour video course that can change your trading results for the better.

His mission is to help his clients boost their trading performance while reducing market exposure and portfolio volatility.

He is a regular speaker on HoweStreet.com, and the FinancialSurvivorNetwork radio shows. Chris was also featured on the cover of AmalgaTrader Magazine, and contributes articles to several leading financial hubs like MarketOracle.co.uk

Disclaimer: Nothing in this report should be construed as a solicitation to buy or sell any securities mentioned. Technical Traders Ltd., its owners and the author of this report are not registered broker-dealers or financial advisors. Before investing in any securities, you should consult with your financial advisor and a registered broker-dealer. Never make an investment based solely on what you read in an online or printed report, including this report, especially if the investment involves a small, thinly-traded company that isn’t well known. Technical Traders Ltd. and the author of this report has been paid by Cardiff Energy Corp. In addition, the author owns shares of Cardiff Energy Corp. and would also benefit from volume and price appreciation of its stock. The information provided here within should not be construed as a financial analysis but rather as an advertisement. The author’s views and opinions regarding the companies featured in reports are his own views and are based on information that he has researched independently and has received, which the author assumes to be reliable. Technical Traders Ltd. and the author of this report do not guarantee the accuracy, completeness, or usefulness of any content of this report, nor its fitness for any particular purpose. Lastly, the author does not guarantee that any of the companies mentioned in the reports will perform as expected, and any comparisons made to other companies may not be valid or come into effect.

Chris Vermeulen Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.