EURODOLLAR futures above 2016 highs: FED to cut over 100 bps quickly

Interest-Rates / US Bonds Aug 10, 2019 - 02:02 PM GMTBy: QUANTO

The sceptre of recesion is growing worldwide. German industrial production registered its biggest annual decline in almost a decade when it reported numbers in June. We covered it here The result was country’s flattest yield curve since the financial crisis.

The sceptre of recesion is growing worldwide. German industrial production registered its biggest annual decline in almost a decade when it reported numbers in June. We covered it here The result was country’s flattest yield curve since the financial crisis.

EURDOLLAR futures contract

The backbone of financial industry and forex world is the eurdollar futures contract. We take a look at the 3 month 2012 dec contract. It has broken above the 2016 highs. The rise in contract price suggest a lower US yield. Current yield on the 10 year is near 1.725% while the 2016 lows were below 1.4%. There is a lot more fall inyield that we expect as FED cutes rates from here on at teh fastest pace in the last decade. There may be a 50 bps cut in sept and 100 by end of dec.

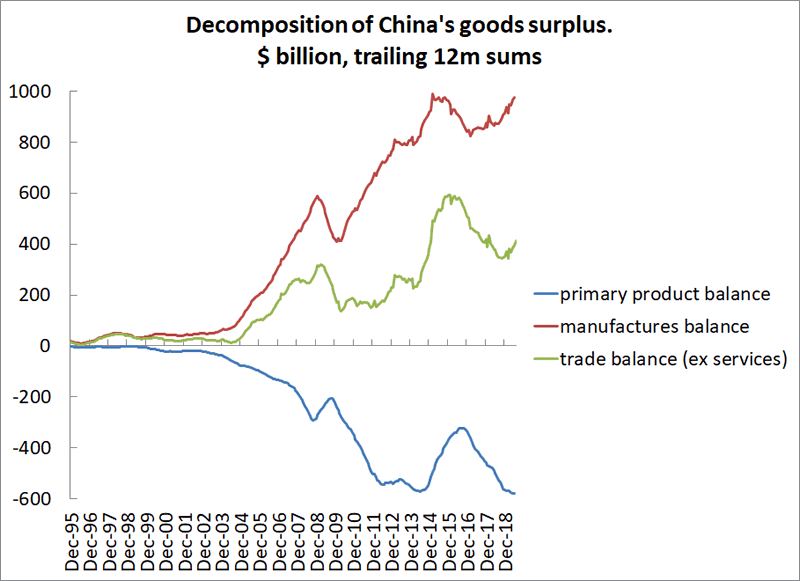

China surplus

China trade surplus is still growing led by manufacturing balance.

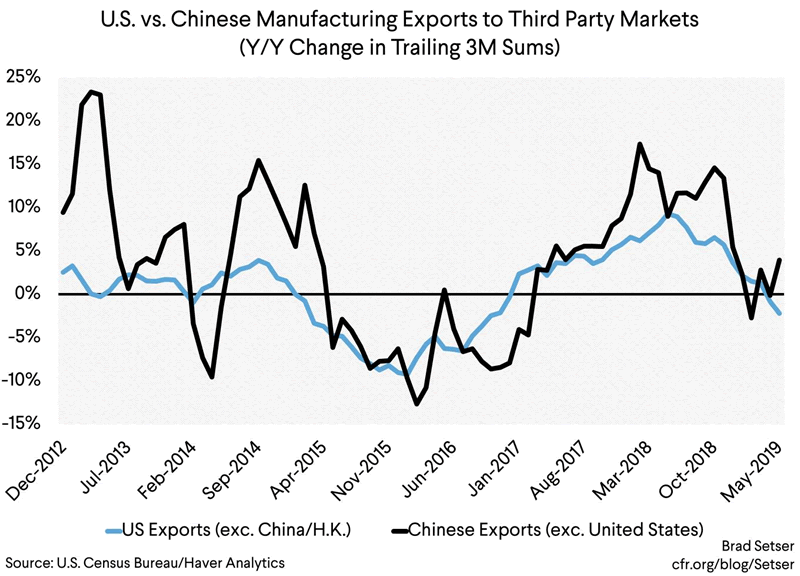

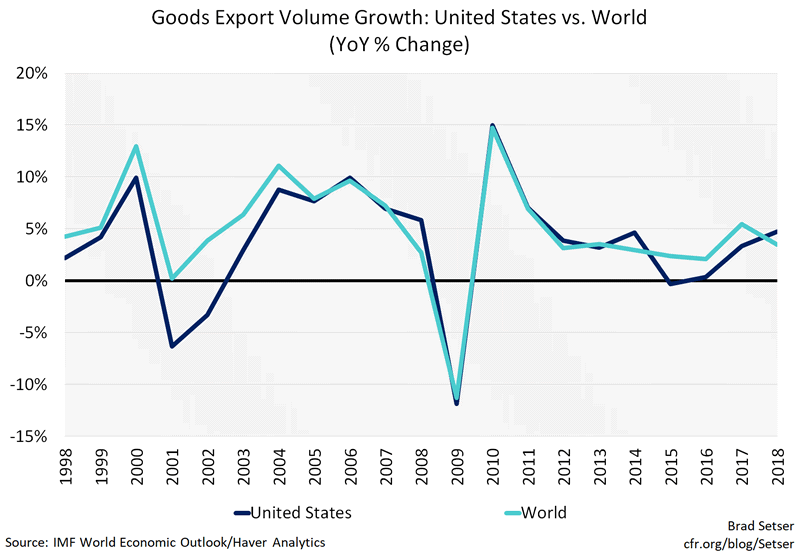

China exports

China’s export growth rebounded in July and imports shrank less than forecast, signaling some recovery in trade just as companies brace for the arrival of new tariffs from the U.S. Yuan has been stable. No runaway deprecitation but this was widely communicated to our clients, that yuan will not depreciate.

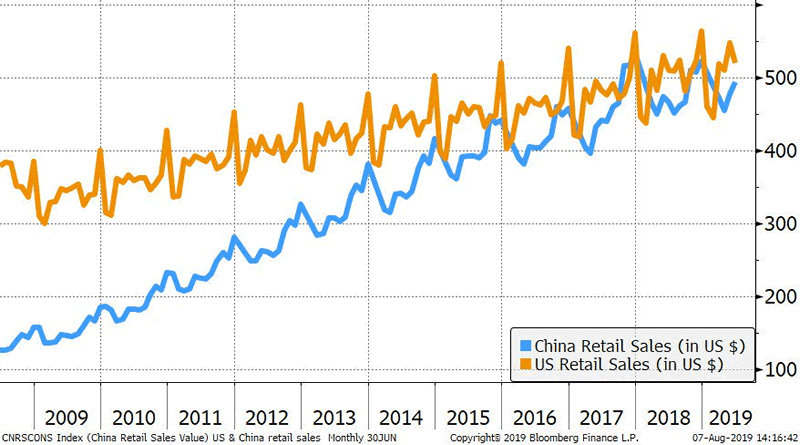

The chinese retail data is rigidly stable showing an economy which is resillient to US tariffs.Now the chinese retail numbers are right up there with US retail thus both the economies are matched on retail sales. China with its vast economy is starting to push the envelope against the 300 mil US retail number. US desperately needs to reflate the prices if they have to match the number else we see china retail economy going far above the US scale.

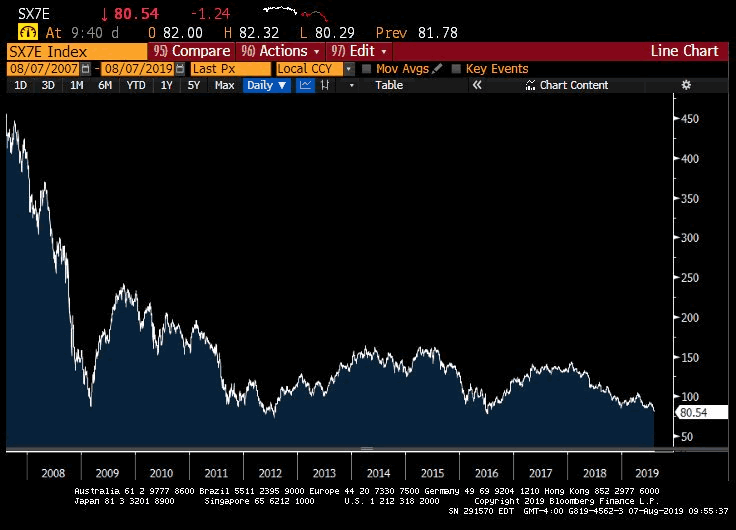

European banks

European banks are the cusp of a all time lows. A break here will almost push a 20 % slide in bank prices.

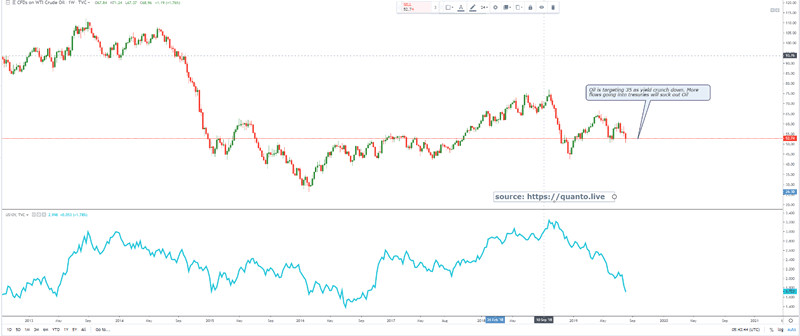

Oil policy

Saudi Arabia has phoned other oil producers to discuss possible policy responses as oil prices slide to a seven-month low, an official told Bloomberg, adding that the kingdom won’t tolerate a continued decline in prices and is considering all options. It comes after Brent crude futures sank almost 5% on Wednesday following a surprise increase in U.S. stockpiles and amid concern over how the U.S.-China trade war could affect demand. Oil futures recovered somewhat overnight. However our resarch shows that Oil has fallen with yield falling so we see a lot more downside in Oil into the year end targetting $35.

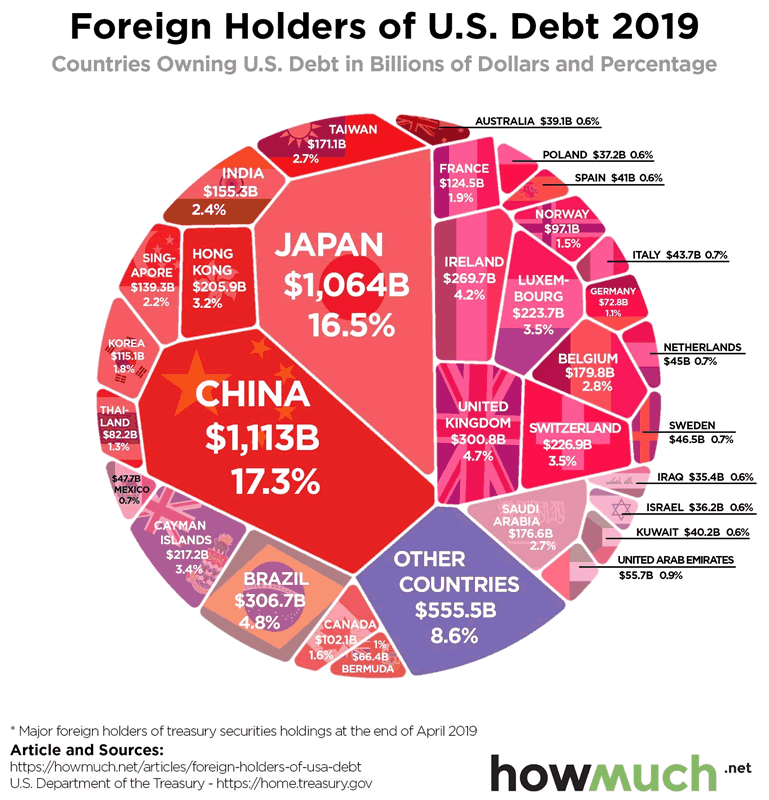

US Debt ownership

China holds 17.3% of US debt which is 1.113trn. That number was higher in 2016 at 1.3 trillion. The US-China spat is because of China reduced holding of US debt. Japan has been taking US debt but will have its limit. It is already 16% of US debt ownershop.

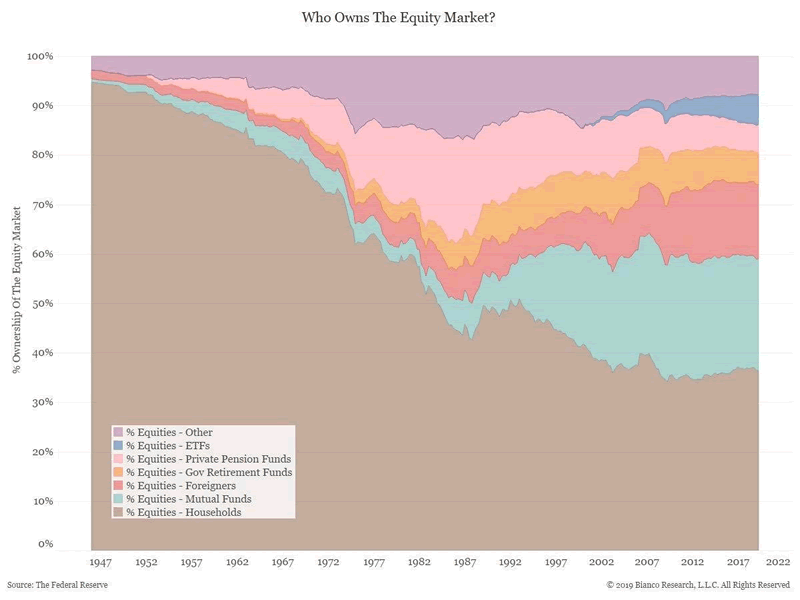

US stocks ownership shows the increasing effects of overseas purchase. This is a marked difference from above 50 years back.

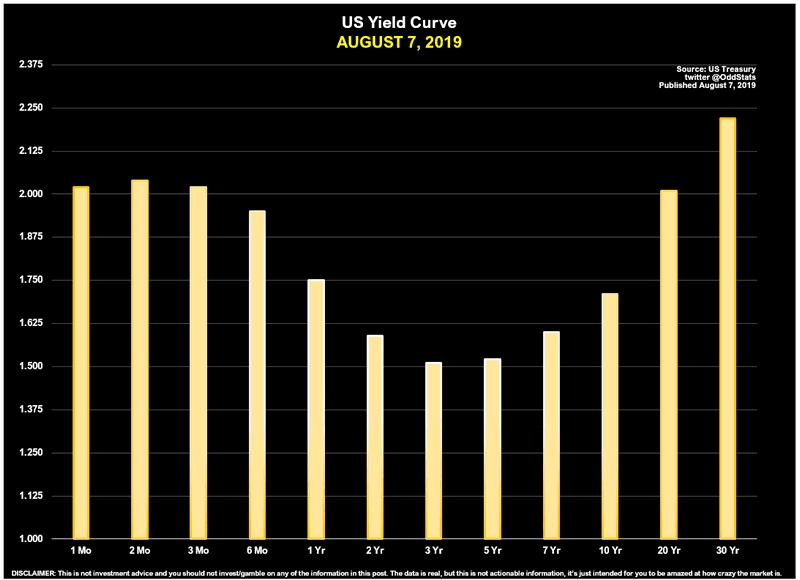

US Yield curve

The US yield curve shows the high short end of curve which is a risk for risk assets. The curve is inverted which suggests that money is flowing into the long end of the curve instead of the real economy. This happens when investors lose confidence with the economy.

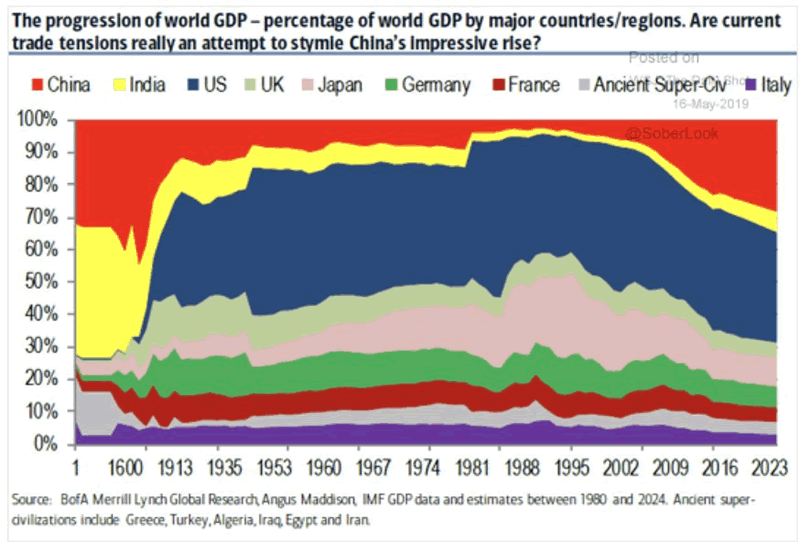

The chart above is a clear representation of the increasing influence of China growth story. They are becoming more and more dominant on the growth front with an ever larger pie of the world economy.

QUANTO trade copier

We run a high performance all market trading system in the forex world. Its available to invest and you can contact us

Overall returns are scrapping above the 100% mark starting in May 2019.

The latest August returns shown it is up +16%.

Weekly returns : This week has made +7%

Monthly returns

Monthly returns show that August is at +16%. The returns are coming in at high profitability.

If you wish to connect your MT4 broker account or FIX account, please get in touch here: Contact Us

Source : https://quanto.live/dailysetups/eurodollar-futures-above-2016-highs-fed-to-cut-over-100-bps-quickly/

By Quanto

Quanto.live is a Investment Management firm with active Trading for clients including Forex, Crypto. We send our trades via trade copiers which are copied to clients trading terminals. Top notch fundamental analysis and trading analysis help our clients to generate superior returns. Reach out to us: http://quanto.live/reach-us/

© 2019 Copyright Quanto - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.