Are You Still Trying To “Fade” The Bond Market Rally?

Interest-Rates / US Bonds Aug 07, 2019 - 10:47 AM GMTBy: Avi_Gilburt

For weeks, if not months, I have been reading one bearish bond article after another. In fact, many of these same writers have been arguing with me for months about the bond rally I expected back in November of 2018. One suggests that this rally is really a “fake,” whereas another has been strongly suggesting that investors fade this rally, with many more supporting their opinions. The problem is that these analysts have been trying to “fade” this rally for the last 10-15% up. Yet, I will gladly bank my “fake” 20% profits on this trade.

For weeks, if not months, I have been reading one bearish bond article after another. In fact, many of these same writers have been arguing with me for months about the bond rally I expected back in November of 2018. One suggests that this rally is really a “fake,” whereas another has been strongly suggesting that investors fade this rally, with many more supporting their opinions. The problem is that these analysts have been trying to “fade” this rally for the last 10-15% up. Yet, I will gladly bank my “fake” 20% profits on this trade.

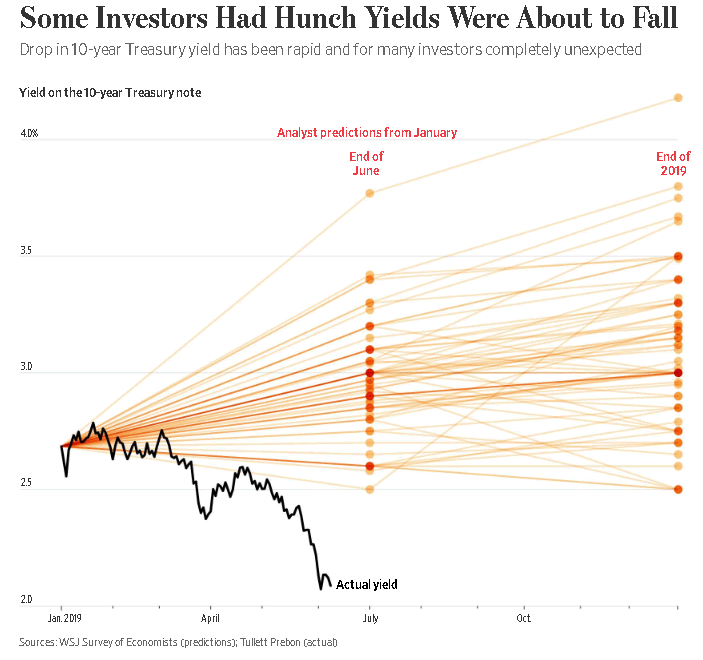

As each week goes by, I continue to chuckle about how many people do not understand the context of the markets upon which they opine. Remember how certain analysts and investors were that rates were only headed higher back in November of 2018?

And, all these same analysts and investors that did not see this rally coming have been fighting it all the way up.

But, those that followed our work and got into bonds when TLT was in the 112-113 region have now made 20% on that trade since November of 2018. In fact, at each stage of the rally, and especially since I first told my subscribers that I was going long TLT, many of my own subscribers fought me along the way.

Going long bonds during the last 10 months has been one of the most hated trades, yet one of the most profitable. Unfortunately, the mantra “you cannot fight the Fed” kept many out of this trade. Isn’t it now funny how the Fed was the one to recently capitulate as it recognized it could not fight the market?

Let me take a moment to recap our history and perspective on bonds. For those that followed our work over the years, you would know that we called for a top to the bond market on June 27, 2016, with the market striking its multi-year highs within a week of our call. Right after that top call, TLT dropped 22%, until we saw the bottoming structure develop in late 2018.

So, in November of 2018, I noted to my subscribers that I was going long TLT just as it broke below the 113 level. At the time, many were telling me that I was crazy to go long bonds, as the Fed was still raising rates. The main reason many thought I was crazy was that “you cannot fight the Fed.”

Well, in my case, I recognized that the Fed cannot fight the market. And, the market was suggesting to me that it was bottoming out and about to turn up quite strongly. In fact, back in the fall of 2018, we set our ideal target for this rally at the 135/136 region. Yes, we not only identified where we think we bottom, but we even set ideal targets before the rally began.

Since that time, TLT has moved from just below 113, when we went long, to just over 136. While I had wanted to see more of a pullback before we began this last segment of the rally, the market had other intentions.

At this point in time, we have almost completed the segment of the rally I was expecting from November of 2018, but we still have a few “squiggles” left. Most specifically, as long as the next smaller degree pullback holds over the 134 support, then my ideal target zone for this rally is in the 137.50-138.50 region, with the outside potential to rally as high as the 140 region.

While the market may choose to go even higher in the coming months, I will be personally divesting of the rest of my TLT holdings into that zone, or on a break down below 134. In fact, as we rallied up through 136 on Friday, I sold more of my holdings. So, I see this as a time to ring the cash register, and cash in for a nice 20% return since our entry in November.

The question I have been asked many times of late is whether one should consider shorting the TLT now that the rally I have been expecting has just about completed?

To be honest, I am not certain at this point in time. While I think the market will likely top out once we complete this segment of the rally, much will depend on whether the TLT can find support in the 129-131 region on the next pullback. If it pulls back correctively to that support, then we can still see one more rally in the coming months which can even make a higher all-time high in TLT. I may even consider one more trade on it at that time, but in a much less aggressive fashion. Clearly, this will be a “game-time” decision for me, based upon the structure of the market on the next pullback.

However, should the market be unable to hold support in the 129-131 region, that is an initial signal that an all-time high was likely struck back in 2016, and that rates are heading higher from here on, and potentially for many years to come.

In the meantime, as I noted above, I have begun to ring the cash register, and have been reaping the 20% profits we have earned since our entry in November. While I still have positions left which I will sell in the 137.50-138.50 region, or on a strong break of 134, I intend to be divesting myself of the rest of my TLT positions over the coming several weeks, at least until I see how the market handles a pullback to the 129-131 region.

Who knows . . . maybe we will see all those who have been bearish bonds, and have missed this 20% rally, begin to turn bullish up here. In fact, I have seen things like this happen more times than I can even count. But, as one of my more astute members have noted, “the goal of Elliott Wave analysis is to analyze market sentiment and not to participate in it.” For now, I think we are getting a bit too frothy for my risk appetite.

See chart illustrating the wave counts on the TLT.

Avi Gilburt is a widely followed Elliott Wave analyst and founder of ElliottWaveTrader.net, a live trading room featuring his analysis on the S&P 500, precious metals, oil & USD, plus a team of analysts covering a range of other markets. He recently founded FATRADER.com, a live forum featuring some of the top fundamental analysts online today to showcase research and elevate discussion for traders & investors interested in fundamental rather than technical analysis.

© 2019 Copyright Avi Gilburt - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.