Post FED US Bond Market Yield Spread Falls Further: Risk Aversion is at the Door

Interest-Rates / US Bonds Aug 02, 2019 - 04:41 PM GMTBy: QUANTO

All Powell needed to do was cut rates and to soften the blow on the short end of the curve, he needed to speak of the strong economy and that would have controlled the 1 month and 3 month and 2 year yields. Instead he ended up confusing about recovery and talking of nonsensicall comical terms like insurance cut etc. These are jargons that one should never use.

All Powell needed to do was cut rates and to soften the blow on the short end of the curve, he needed to speak of the strong economy and that would have controlled the 1 month and 3 month and 2 year yields. Instead he ended up confusing about recovery and talking of nonsensicall comical terms like insurance cut etc. These are jargons that one should never use.

The reaction from the bond market was immediate as the 1 month and 3 month yield jumped sharply. Money was flowing out to the long end which is exactly what Powell didnt want to happen when he said "inflation gets baked in to bond yields". Even as he was saying, that is what was happening. We take a look at some of the charts which define and go beyond normal technical and trend lines for forex. We have always suggested: NEVER TRADE FOREX ON TECHNICAL INDICATORS. THEY ARE LAGGING. TO LOOK BACK AND TRADE FORWARD IS FOOLISHNESS.

That is why QUANTO trade copier is the only system available for retail copying which uses bond yield indicators which ledd forex movements by a number of days.

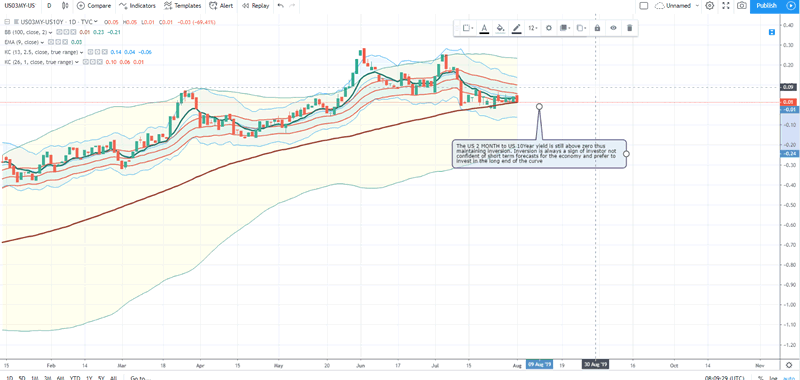

Curve inversion: 3 Month > 10 year yield

The US 2 MONTH to US 10Year yield is still above zero thus maintaining inversion. Inversion is always a sign of investor not confident of short term forecasts for the economy and prefer to invest in the long end of the curve

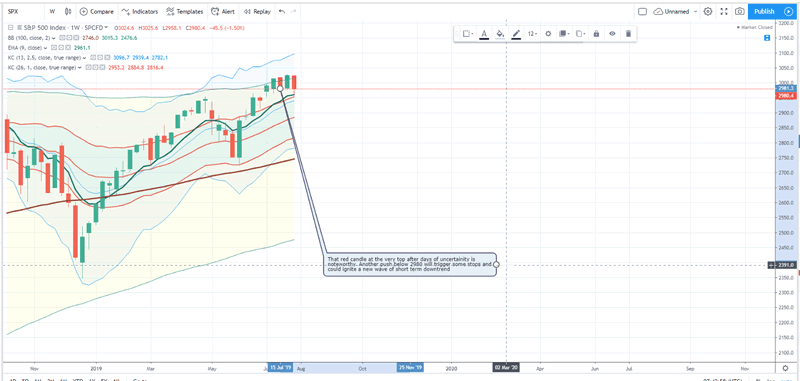

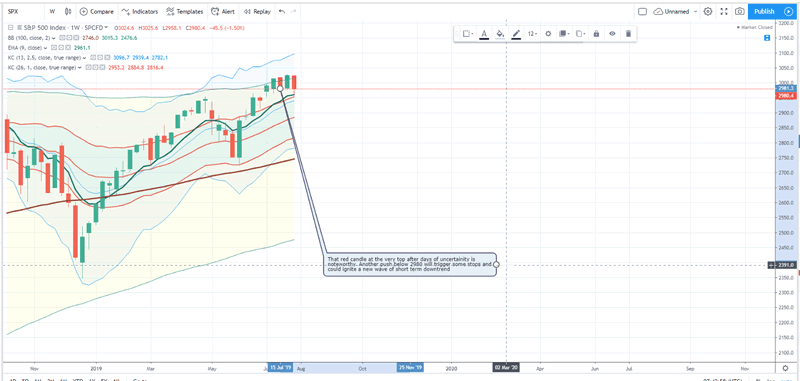

S&P500

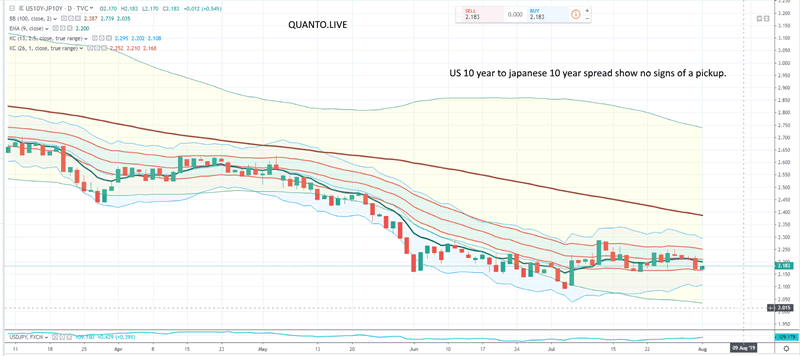

US10Y to Japanese 10year yield: Shrinkage continues

Despite probablity of future hikes falling to 40% post Powell press conference, the bond traders turn a blind to those numbers. They are in a long term trend pushing the yield lower and lower. Foreign buying os US treasury and cash outflow from equity markets is worsening the situation. A major spanking is in order for equity markets.

S&P500

That red candle at the very top after days of uncertainity is noteworthy. Another push below 2980 will trigger some stops and could ignite a new wave of short term downtrend

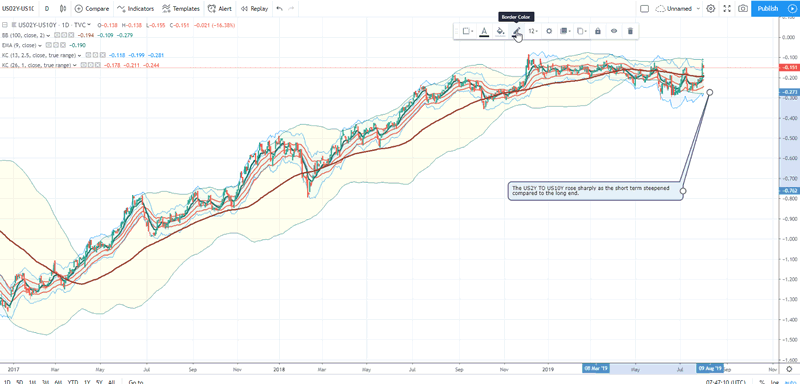

US2YEAR YIELD STEEPENS

The US2Y TO US10Y rose sharply as the short term steepened compared to the long end.

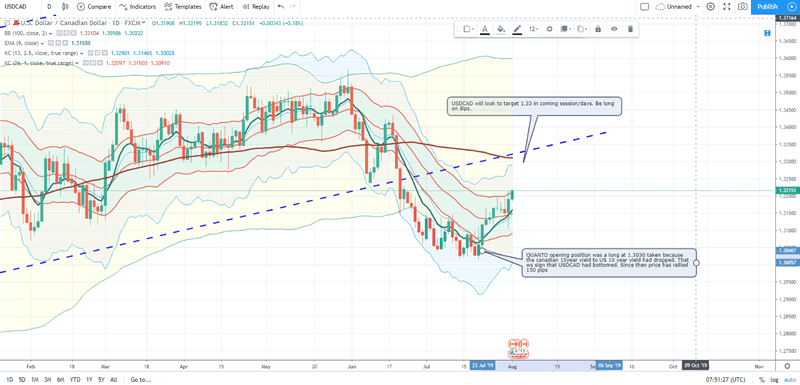

USD/CAD

QUANTO took the long trade at 1.3030 and 1.3050 and 1.3080 and 1.3140. Current pricesa at 1.3210 are in green. Part profits taken and new trades entered. Some hedging positins in place as well. QUANTO is actively trading USD/CAD and made big money in July with a return of +31% overall. QUANTO opening position was a long at 1.3030 taken because the canadian 10year yield to US 10 year yield had dropped. That ws sign that USDCAD had bottomed. Since then price has rallied 150 pips

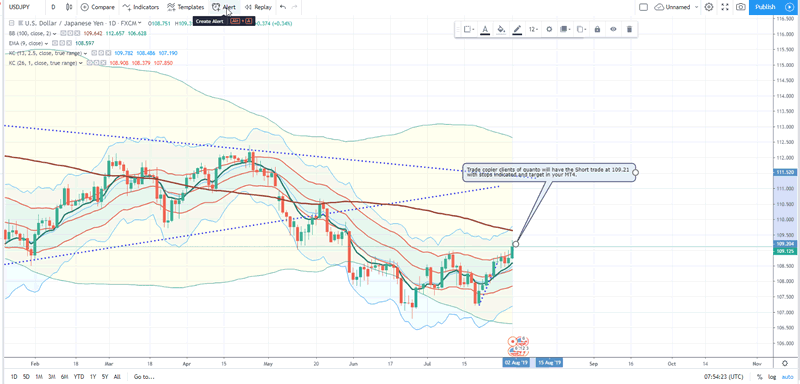

USD/JPY

Trade copier clients of quanto will have the Short trade at 109.21 with stops indicated and target in your MT4.

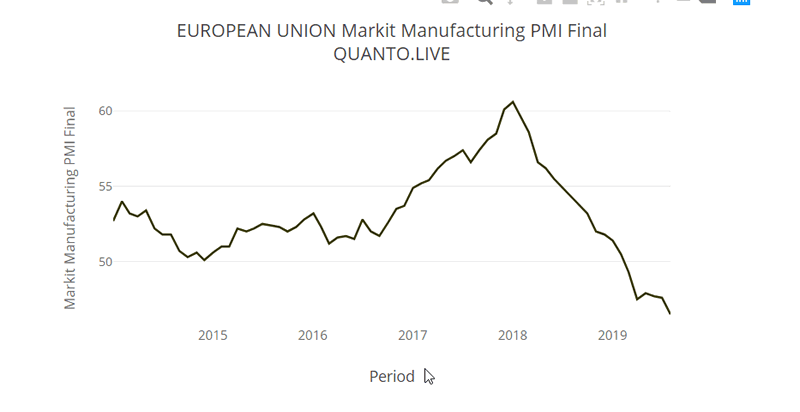

EU data has arrested the fall

No major improvement in EU manufacturing PMI which came at 46.5 slightly better than expected 46.4. This is still below the mean of 53 seen for last 16 quarters.

Trade copier

The QUANTO system is powering higher with monthly returns for August now at 2.99%. The returns for July was +31%.

The Equity returns are rising at fast clip now nearing +80%. Started in May, the system equity has risen without a maor dd event.

If you are interested in runnig the QUANTO and bank some coin, then please contact us here

You can follow us on Twitter: QUANTO Twitter feed

By Quanto

Quanto.live is a Investment Management firm with active Trading for clients including Forex, Crypto. We send our trades via trade copiers which are copied to clients trading terminals. Top notch fundamental analysis and trading analysis help our clients to generate superior returns. Reach out to us: http://quanto.live/reach-us/

© 2019 Copyright Quanto - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.