A Weakening Global Expansion Amid Growing Risks. Will Gold Benefit?

Commodities / Gold and Silver Stocks 2019 Jan 22, 2019 - 02:37 PM GMTBy: Arkadiusz_Sieron

Thousands of political, business and cultural leaders are heading now towards Davos, Switzerland, to attend the World Economic Forum. On the eve of the world’s biggest annual gathering of the rich and powerful, the International Monetary Fund released its newest world economic outlook. What are the forecasts – and their implications for the gold market?

Thousands of political, business and cultural leaders are heading now towards Davos, Switzerland, to attend the World Economic Forum. On the eve of the world’s biggest annual gathering of the rich and powerful, the International Monetary Fund released its newest world economic outlook. What are the forecasts – and their implications for the gold market?

Global Expansion Weakens

Well, the title of the IMF’s update is telling: “A Weakening Global Expansion”. The global economy is projected to grow at 3.5 percent this year, 0.2 percentage point below last October’s projections and estimated performance in 2018. The revisions carry over from softer economic momentum in the second half of 2018, in particular in Germany, due to the problems of the automotive industry, and in Italy, due to the worries about sovereign and financial risks. Moreover, the experts acknowledge now the weakened financial sentiment and project deeper contraction in Turkey than previously anticipated.

What is the most important for the gold market, the US economic growth is expected to decline to 2.5 percent in 2019 (unchanged forecast from October) because of the unwinding of fiscal stimulus and further monetary tightening. The slowdown in America may push some investors into gold’s arms, although, given the sluggish growth in Europe, US dollar-denominated assets still look attractive.

While Risks Grow

The downward revisions may seem to be modest. However, the report does not end here. The problem is that risks to more significant downward corrections are rising. What are these risks? First, a further escalation of trade tensions. Higher trade uncertainty could further dampen investment and disrupt global supply chains. Second, a further deterioration of financial conditions: stock valuations went south, while credit spreads widened. Given a high level of debt, a more serious tightening of financial conditions may be particularly dangerous.

Last but not least, an important risk for the global economy is the possibility that China’s growth slowdown could be faster than expected especially if trade tensions continue. And, of course, Brexit is a big question mark (the US federal government shutdown, if protracted, also poses a downside risk). Gold is a safe haven, so it welcomes rising risks.

Implication for Gold

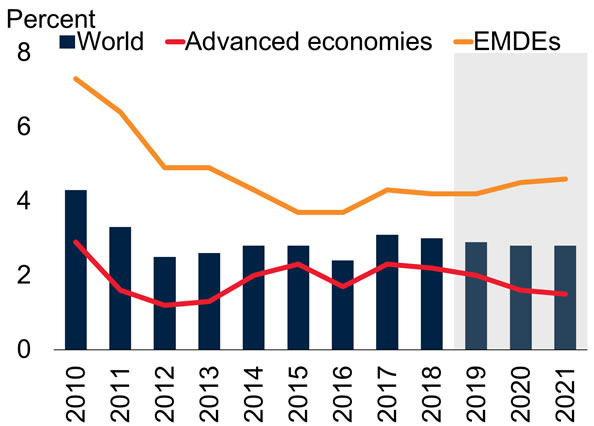

The recent IMF’s world economic outlook projects slower economic growth amid rising risks. The report is in line with the World Bank’s report released earlier in January, which also said that “the outlook for the global economy in 2019 has darkened.” (see the chart below).

Chart 1: Actual and forecasted global growth for the world (bars), advanced economies (red line) and emerging markets and developing countries (orange line) from 2010 to 2021 (source: World Bank).

What do all those gloomy forecasts imply for gold? Well, a lot. You see, we had a solid expansion in the last two years. Now, the world economy is growing more slowly than expected while downside risks are accumulating. It seems to be an excellent combination for gold, which should shine in a sentiment unfriendly toward risky assets.

To be clear, the slowdown is not the end of the world. There is no global recession around the corner. But, as we argued in the January edition of the Market Overview, 2019 may still be better for gold than 2018. The risk of a sharper decline in global growth has increased, after all. In particular, China’s economy may negatively surprise us, as it transforms itself structurally amid trade tensions and high debt burden. According to the official data, the economic growth was 6.6 percent in 2018 – the slowest pace since 1990. And many economists do not trust the official figures, claiming that China’s economy is actually more anemic (we will write more about China in the February edition of the Market Overview). As it was the case in 2015-2016, concerns about the Red Dragon’s health can trigger abrupt sell-offs in financial markets. Gold should shine, then.

Thank you.

If you enjoyed the above analysis and would you like to know more about the gold ETFs and their impact on gold price, we invite you to read the April Market Overview report. If you're interested in the detailed price analysis and price projections with targets, we invite you to sign up for our Gold & Silver Trading Alerts . If you're not ready to subscribe at this time, we invite you to sign up for our gold newsletter and stay up-to-date with our latest free articles. It's free and you can unsubscribe anytime.

Arkadiusz Sieron

Sunshine Profits‘ Market Overview Editor

Disclaimer

All essays, research and information found above represent analyses and opinions of Przemyslaw Radomski, CFA and Sunshine Profits' associates only. As such, it may prove wrong and be a subject to change without notice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are believed to be accurate, Przemyslaw Radomski, CFA and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. Radomski is not a Registered Securities Advisor. By reading Przemyslaw Radomski's, CFA reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Przemyslaw Radomski, CFA, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

Arkadiusz Sieron Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.