A Bullish Bond Argument That Hides in Plain Sight

Interest-Rates / US Bonds Aug 15, 2018 - 01:06 PM GMTBy: F_F_Wiley

It’s been awhile since I advised anyone to load up on long Treasuries. The bearish bond narrative has been too strong for that, thanks largely to fiscal policy but also to near-4% unemployment rates, quantitative tightening and—maybe most threatening of all—tit-for-tat tariffs.

It’s been awhile since I advised anyone to load up on long Treasuries. The bearish bond narrative has been too strong for that, thanks largely to fiscal policy but also to near-4% unemployment rates, quantitative tightening and—maybe most threatening of all—tit-for-tat tariffs.

In fact, I challenge anyone to think of a time during the past two decades when bond bears (read: most mainstream commentators) have possessed a more compelling Powerpoint pack.

But maybe the powerful bear story has become overplayed, maybe it was fully or almost fully priced in by mid-May, when the 10-year Treasury yield reached a six-year high of 3.11%. If so, it might be a good time to revisit the argument that the secular bull is still intact, a time for contrarians to speak up.

If that’s what you’re expecting, though, this article might disappoint you. Yes, I’ll make a bullish argument, but it won’t be contrarian. Instead, we’ll consider how you might become a bond bull by embracing the financial mainstream. We’ll explore the inner bull that’s infecting the mainstream bear with a viral case of bond optimism.

To deliver on that promise, I’ll rely on three branches of consensus thinking: the first looks at the yield curve, the second at consensus business cycle forecasts, and the third ties in consensus policy forecasts.

Inverting the Yield Curve Inversion Story

You may have already heard this shock news bulletin: Some analysts connect a flattening yield curve to recession risks. (Gasp!)

In my own reading this year, I’ve seen a few (hundred) articles on this topic. As of late April, I felt the commotion was too loud for the amount of curve flattening to date, and I said as much here. I showed that the yield curve at that time was mid-cycle or even early cycle by historical standards, not late cycle.

Of course, I timed the article perfectly (if the goal is to jinx the economy)—the flattening pace accelerated a couple of weeks later. As of this writing, the curve still isn’t clearly late cycle, but we’re much closer than we were in April. So instead of tempering the mainstream view, let’s do something different—let’s embrace the view but invert it.

It’ll take a minute to explain what I mean by that. We start with the argument that inverted curves foretell recessions, but the historical support for that argument is just “okay” in my opinion. It isn’t perfect. Here are three reasons to be cautious:

- Lags from curve inversions to recessions tend be long, typically between one and two years. In several cases, unrelated events that came after the inversions but before the business cycle peaks were the more obvious recession triggers, casting doubt on the importance of the inversions.

- Before each of the last three recessions, the curve steepened back into a positive position after a brief inversion. At a minimum, pre-recession steepenings raise questions about the strength of any fundamentals at work.

- The curve occasionally inverted as much as three or four years before a business cycle peak, as in 1965 and 1998. These are false recession signals—basically, failures.

So the yield curve might not be a slam-dunk recession predictor, after all. More realistically, it’s one of many clues that we do our best to put together in a sensible way.

But we shouldn’t limit ourselves to the traditional argument that runs from inversions to recessions, because we can draw other conclusions that fit history more precisely. For example, we can say that every time we experience a recession, we should expect to see that the yield curve inverted at an earlier point in time. That slightly different claim (basically, inverted from the traditional claim) accurately describes every business cycle from 1954 to the present, without any failures. So if you believe that inversions predict recessions, you should certainly believe that recessions imply prior inversions. And if you believe that recessions imply prior inversions, your somewhat distant business cycle forecast should be a major input to your immediate bond outlook, as I’ll demonstrate next.

The Curious Mainstream Position That Three Rights Make a Wrong

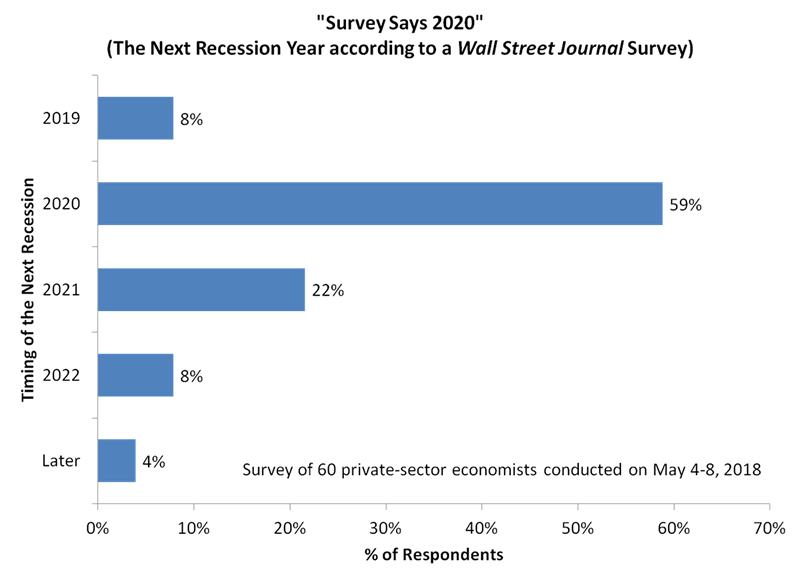

Clear as mud so far? If you haven’t already figured out where I’m going with this, the consensus business cycle outlook should make it clearer. Have a look at this chart that I reproduced from a May 2018 Wall Street Journal article:

The chart shows the consensus expecting a recession in 2020, which shouldn’t be surprising to readers who follow mainstream commentary. I’m proposing that we should combine the consensus recession forecast, as shown in the chart, with the consensus implications of yield curve inversions, as discussed above. With a typical 18-month lag from a curve inversion to a recession, the combination of consensus views tells us to expect an inversion at year-end 2018, prior to the expected recession in mid-2020.

In other words, the curve should invert within the next four and a half months, and if you happen to disagree with that outlook, you’re either

- rejecting the consensus recession forecast, or

- rejecting a yield curve relationship that’s historically perfect and widely endorsed.

But we need one more piece to build a consensus bond outlook—we need to know where we should expect to find short rates at the end of the year. For that, we’ll use the 3-month Treasury bill, which some say gives us the most useful yield curve measure. Market forecasters almost uniformly expect the 3-month bill rate to jump between 30 and 50 basis points by the end of the year, which would lift it from 2.05% (last week’s close) to between 2.35% and 2.55%. We’ll roll with 2.45%, which lines up nicely with other consensus interest rate forecasts compiled by FocusEconomics.

Summarizing all three mainstream views:

- A recession will occur in mid-2020.

- The yield curve will invert roughly 18 months before the recession, which means by the end of 2018.

- The 3-month Treasury bill will yield about 2.45% at the end of 2018.

And then putting the three views together, we should expect the 10-year Treasury to exit 2018 at a yield less than 2.45%—that’s what needs to happen for the curve to invert from the 3-month bill to the 10-year bond. For reference, the 10-year was yielding more than 3% as recently as last week.

In other words, mainstream thinking calls for an impressive bond rally during the second half of the year, and because of that outlook, it also points to a nasty identity crisis within Consensus Town.

Nonconclusions

Judging by either everyday commentary or surveys, most forecasters expect Treasury yields to climb steadily higher. (The most recent survey published by FocusEconomics pegs the year-end 10-year yield at 3.12%.) And the bearish consensus is extremely well-established—it’s been part of the landscape for most of the past two decades.

But closer analysis shows consensus to be a slippery concept. By blending the three views bulleted above, we see Treasury yields falling, not rising. That’s a bullish argument that resembles Gustavo Fring—it hides in plain sight—and it’s the crux of my article. I only need to add conclusions, but I’m honestly unsure how to do that.

On one hand, I’m not fully convinced by the views expressed in the bullets, except for the short rate view. On the other hand, I’m wholly unconvinced by the idea that bonds are on the cusp of a 1970s-style bear market, and even a mid-1990s bear seems a stretch to me—it seems like more of a worst-case trade-war scenario than anything to bet on. What’s more, I’ve been a secular bull for over 15 years now, and it’s worked well for me. Long bonds have provided a maturity premium, an additional return from rolling down the curve, a diversifier, a better match for my investment horizon and a generally downward yield trend. I’m not ready to give up the horns, but I would need to write a different article to fully explain why. (Although I did discuss a few reasons here.)

So instead of segueing into an add-on article, I could go the other direction and sign off with a snappy cliché, but what would that be?

That the consensus is always wrong (one of them has to be), per the clever sayings of Mark Twain?

That the consensus is usually right (again, one of them has to be), per the insightful James Surowiecki?

That you shouldn’t mind the consensus, because you should think independently, per this essential author?

Nah, I’ll settle for this: The next time someone says, “Hey, didn’t you know everyone expects Treasury yields to soar,” answer, “Actually, most commentators expect a whopping Treasury rally before year-end, they just don’t admit it.” And then repeat my analysis and add your own conclusions.

Thank you for reading.

F.F. Wiley

F.F. Wiley is a professional name for an experienced asset manager whose work has been included in the CFA program and featured in academic journals and other industry publications. He has advised and managed money for large institutions, sovereigns, wealthy individuals and financial advisors.

© 2018 Copyright F.F. Wiley - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.