Hardest US Housing Market Places to Live - Look Out Middle Class

Housing-Market / US Housing Aug 12, 2018 - 12:57 PM GMTBy: Harry_Dent

In San Francisco, a household now needs an income of $188,000 to afford rent for the average two-bedroom house or apartment with 30% of the household income spent on housing.

In San Francisco, a household now needs an income of $188,000 to afford rent for the average two-bedroom house or apartment with 30% of the household income spent on housing.

The problem is that the median income is only $103,801.

Housing is 81% out of reach!

And this is true across the country as well.

It takes an hourly wage of $22.10 to afford the median two-bedroom apartment versus the actual median wage of $16.88.

That makes it 31% out of reach. And the median cost for a two-bedroom apartment three-times minimum wage.

The most expensive state is Hawaii at $36.16 compared to the $16.16 actual hourly wage earned, making it 123% out of reach.

Meanwhile, the lowest is Arkansas at $13.84 needed, and an actual hourly wage earned of $13.05. That is only 6% out of reach.

Then there’s Puerto Rico at only $9.24 an hour to afford that median two-bedroom versus $9.76 of actual wages.

Finally, an affordable place to live as a U.S. citizen.

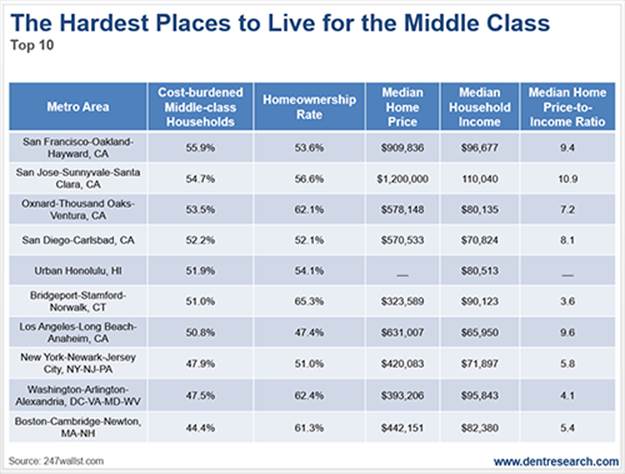

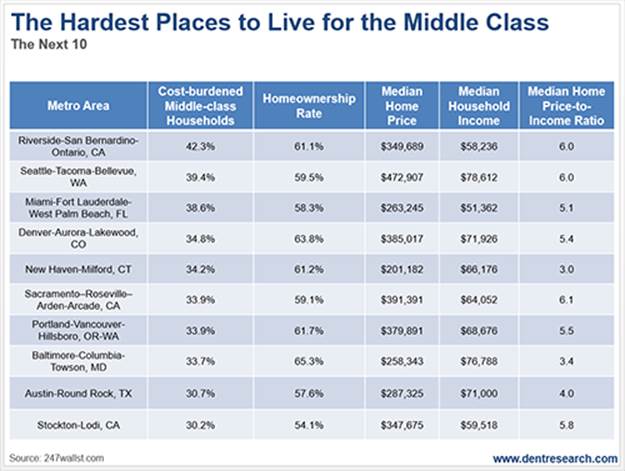

The next two tables summarize a recent survey that ranked cities by the percentage of households that are cost-burdened by renting or owning houses.

This means that they spend over 30% of their income on housing.

They also have some good information on incomes and housing affordability.

The top five for cost burdens are San Francisco (55.9%), San Jose (54.7%), Oxnard/Thousand Oaks/Ventura (53.5%), San Diego (52.2%), and Honolulu (51.9%). Four of these are in California – no surprise.

And Hawaii has always been expensive.

The lowest out of these are Stockton (30.2%), Austin (30.7%), Baltimore (33.7%), Portland (33.9%), New Haven (34.2%), and Denver (34.8%). It jumps to 39%-plus from there.

Austin and Denver are rated high for attractiveness as well.

Housing for ownership is least affordable in San Jose at 10.9-times median income. Los Angeles comes in at 9.6, with San Francisco at 9.4, and San Diego at 8.1.

Honolulu is not quoted here on home prices, but other surveys put its price-to-income ratio at near 10 times, similar to San Francisco.

Conversely, the lowest home ownership rate is in Los Angeles at 47.4%, with both high prices and lower incomes.

Only Miami has lower.

Both of these high-cost rental cities have the lethal combination of expensive housing costs and modest median incomes.

New York is at 51.0%, with San Diego (52.1%), San Francisco (53.0%), and Honolulu (54.1%) all in the same range.

The most affordable price-to-income ratios for home ownership are in New Haven, Connecticut, at a fair 3 times as much, Baltimore at 3.4, and surprisingly, Bridgeport/Stamford at 3.6 times.

A painful housing correction is due to hit.

And it’s precisely the medicine the economy needs to allow the ‘American Dream’ to stay alive for the up-and-coming Millennial generation.

It’s us – the older Baby Boomers – that will feel the brunt of things if we don’t get out of the way.

Harry

Follow me on Twitter @HarryDentjr

Harry studied economics in college in the ’70s, but found it vague and inconclusive. He became so disillusioned by the state of the profession that he turned his back on it. Instead, he threw himself into the burgeoning New Science of Finance, which married economic research and market research and encompassed identifying and studying demographic trends, business cycles, consumers’ purchasing power and many, many other trends that empowered him to forecast economic and market changes.

Copyright © 2018 Harry Dent- All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.