Fed Rate Cuts Fail to Halt US House Price Crash

Housing-Market / US Housing Aug 31, 2008 - 01:58 PM GMT Feldstein says low Fed rates may not stimulate growth

Feldstein says low Fed rates may not stimulate growth

“Harvard University economist Martin Feldstein, a member of the committee that charts American business cycles, said the Federal Reserve cannot count on low interest rates to buoy economic growth.

“‘Lower interest rates are not going to get us anything more,' said Feldstein, who retired in June as president of the National Bureau of Economic Research. ‘The economy has really shown one sign after another of weakening.'”

Source: Bloomberg , August 21, 2008.

Sheryl King (Merrill Lynch): Economic domino effect

“Did we really need a 0.7% MoM decline in the index of leading indicators for July to tell us that the US economy is in recession? The unemployment queue is now the longest since December 2001, according to the weekly claims data. Housing starts look to be closing in on 900,000 in the next couple of months, and even that is so far above demand that there is no dent in month's supply on the horizon. Any wonder that the 10-year note now has a firm grip on the 3-handle and the equity market has not boasted four straight up-days since last May?”

Click here for the full report.

Source: Sheryl King, Merrill Lynch , August 27, 2008.

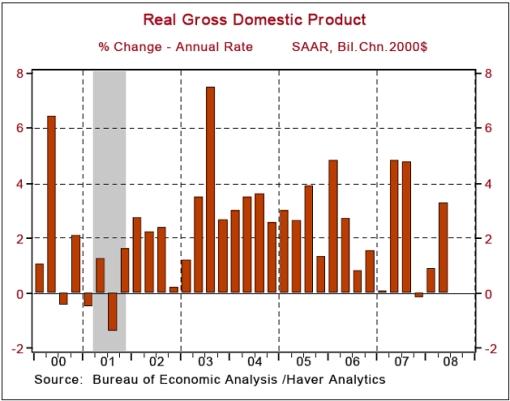

Asha Bangalore (Northern Trust): Q2 GDP is history, focus should be on the future

“The US economy grew at an annual rate of 3.3% in the second quarter compared with the advance estimate of a 1.9% increase. This large discrepancy in the headline estimate came about due a significant upward revision of net exports and inventories. Net exports in the second quarter are now estimated as -$376.7 billion vs. -$395.2 billion in the advance estimate. In addition, firms decreased inventories by $49.4 billion compared with the earlier estimate of a $62.2 billion reduction.

“The upward revision of government expenditures (3.9% vs. 3.4%) was another category accounting for the upward revision of GDP growth in second quarter. Other minor upward revisions included a 1.7% gain in consumer spending vs. a 1.5% increase and a 3.2% drop in capital spending vs. a 3.4% drop in the advance estimate. Offsetting these upward revisions were downward revisions of expenditures on structures and residential investment expenditures.”

Source: Asha Bangalore, Northern Trust – Daily Global Commentary , August 28, 2008.

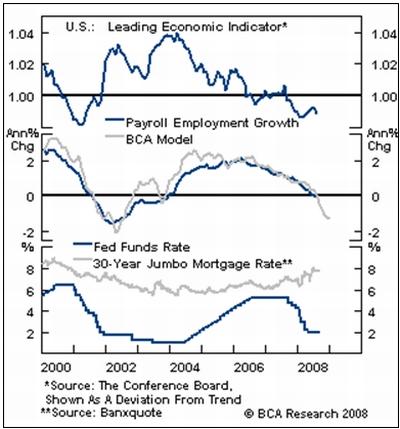

BCA Research: US leading economic indicator – still no recovery in sight

“Massive policy easing and fiscal stimulus have not been sufficient to offset the drags from a housing bust and squeeze on consumption.

“The Conference Board's US leading economic indicator (LEI) fell again in July, providing a fresh reminder that the slowdown is far from over. A domestic recession is underway and policy efforts to stimulate growth have been short-circuited by a collapse of risk-taking in the financial markets.

“Mortgage rates rose as policy rates declined, underscoring that the housing slump will persist. Rumors that the Treasury Department may have to absorb the two large GSEs are proliferating, underscoring the seriousness of the banking and financial crisis (please see the next Insight).

“Bottom line: The economy will remain weak for the foreseeable future, implying persistently low Treasury yields and further struggles for the equity market.”

Source: BCA Research , August 25, 2008.

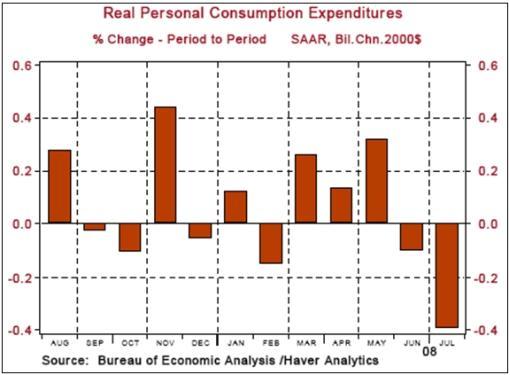

Asha Bangalore (Northern Trust): Consumer spending – strong likelihood of decline in Q3

“Nominal consumer spending increased 0.2% in July, following a 0.6% gain in June. However, inflation adjusted consumer spending fell 0.4% in July after a 0.1% decline in June. Consumer spending will have to advance in leaps and bounds in August and September for a flat reading in the third quarter. In other words, a decline in third quarter consumer spending is nearly certain. Assuming our forecast is accurate, this would be the first quarterly decline in consumer spending since fourth quarter of 1991.”

Source: Asha Bangalore, Northern Trust – Daily Global Commentary , August 29, 2008.

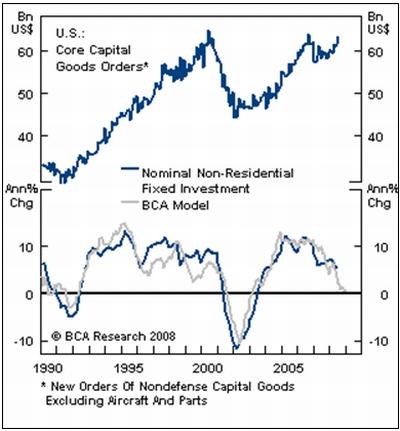

BCA Research: US durable goods orders – expanding, but …

“US core durable goods orders rose further in July, underscoring that business investment has held up well in face of a domestic recession and tight credit conditions. However, risks remain to the downside.

“Investment spending has been a relative ‘bright light' for the US economy, mainly because a weak dollar has allowed US companies to gain global market share, and overseas demand has been resilient. Indeed, core capital goods orders bottomed in 2007 and have been slowly trending higher, in contrast with domestic consumption, which peaked in 2004 and continues to decelerate.

“Nevertheless, our investment spending model forecasts that capex growth will drop to zero by the end of the year. Sticky corporate bond yields, and a further slowing in final demand at home and abroad, will cause companies to defer expansion plans: expect more weakness ahead.”

Source: BCA Research , August 28, 2008.

Bill King (The King Report): Goldman's Jan Hatzius – don't be fooled by durable goods numbers

“Durable goods orders beat expectations with a 1.3% month-on-month increase in July. But the apparent strength is due to higher prices, not stronger activity. In fact, deflating orders by the producer price index for durable manufactured goods shows a 9.4% year-on-year drop in real orders, the worst since early 2002. Even if we adjust for the unfavorable year-on-year comparisons that partly explain this plunge, the recent data look surprisingly similar to those seen in the run-up to the 2001 recession.”

Source: Bill King, The King Report , August 28, 2008.

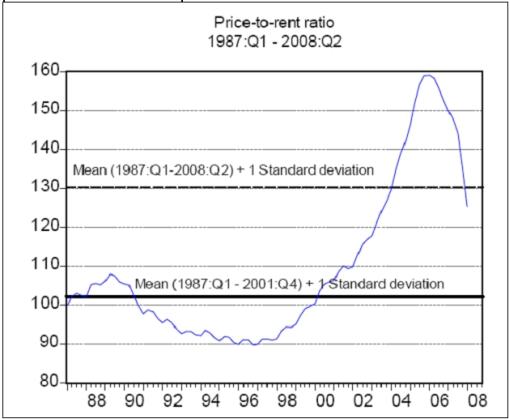

Asha Bangalore (Northern Trust): A perspective on home prices

“The price-to-rent ratio of homes … is a useful measure to put home price trends in a big picture framework.

“The price-to-rent ratio (used here) is computed from the national Case-Shiller Home Price Index and Owners' Equivalent Rent of the Consumer Price Index. The Case-Shiller Price Index goes back to 1987:Q1. (For the convenience of reading a chart, I set the 1987:Q1 price-to-rent ratio = 100.) Excluding the go-go years when home prices climbed rapidly, the median price-to-rent ratio and mean price-to-rent ratio during 1987:Q1 – 2001:Q4 were 94.31 and 96.38, respectively.

“Compared with these numbers, the 125.4 price-to-rent ratio in the second quarter of 2008 is still at an elevated level. It appears that home prices have a long march ahead when compared with the mean (109.6) and median (102.5) price-to-rent ratio for the period 1987-2008:Q2 also.

“If history is any guide, the price-to-rent ratio suggest that the bottom of home prices is not here yet.”

Source: Asha Bangalore, Northern Trust – Daily Global Commentary , August 27, 2008.

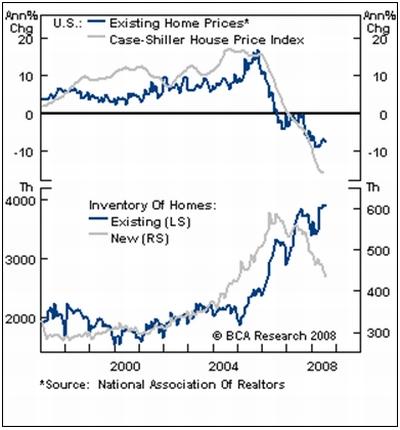

BCA Research: US house prices – no bottom in sight

“Both the National Association of Realtors and the Case Shiller Index confirm that US house prices continue to fall sharply.

“The outlook for US housing is still bleak. Mortgage rates remain elevated, inventories of existing homes are stuck at record highs and prices continue to fall. The only silver lining in this dark cloud is that a nationalization of the GSEs is becoming increasingly likely, which could provide much needed capital to finance housing transactions. However, even such an unprecedented step would not sound the ‘all clear'.

“A domestic recession is underway and a rising unemployment rate means that the uptrend in foreclosure rates will spread beyond the sub-prime market.

“Bottom line: Even if the GSEs are nationalized, there will be no quick fix for the housing market, and it appears that the slump has at least another year to run.”

Source: BCA Research , August 27, 2008.

Financial Times: Merrill losses wipe away long-term profits

“Merrill Lynch's losses in the past 18 months amount to about a quarter of the profits it has made in its 36 years as a listed company, according to Financial Times research that highlights the extent of the global banking crisis.

“Since the onset of the credit crunch last year, Merrill has suffered after-tax losses of more than $14 billion as its balance sheet has been savaged by almost $52 billion in writedowns and credit-related losses.

“Merrill's total inflation-adjusted profits between its 1971 listing and 2006 were about $56 billion, according to figures from Thomson Reuters Fundamentals and an FT analysis of reported earnings.

“The $14 billion in losses for 2007 and the first two quarters of 2008 equal half of Merrill's profits since the beginning of the decade.

“Merrill had the highest ratio of credit crunch losses to historical profits among 10 US and European financial groups analysed by the FT, which included Citigroup, JPMorgan Chase, Bank of America, Morgan Stanley, Goldman Sachs, Lehman Brothers, Bank of America, Credit Suisse and UBS.

“UBS, which has lost more than $15 billion during the crisis, had the second-highest ratio.”

Source: Francesco Guerrera, Financial Times , August 28, 2008.

Financial Times: SEC plans for global accounting standards

“US companies are set to switch to international accounting rules in a move that will, for the first time, see all the world's most important listed groups reporting according to the same set of standards.

“The US Securities and Exchange Commission on Wednesday proposed a ‘roadmap' to manage the migration of US companies from its rules to the international ones. The plans are open to comment for 60 days.

“More than 100 countries use, or are adopting, International Financial Reporting Standards (IFRS), including all 27 European Union members as well as China, Japan, Canada and India. US GAAP, the accounting lingua franca until the sudden rise of IFRS, is the last significant standard to be switched.

“Under the SEC's plans, US groups are likely to adopt IFRS in 2014 providing certain conditions are met, a decision that will be taken in 2011. Some companies may be allowed to adopt IFRS sooner.

“Christopher Cox, SEC chairman, said more groups were reporting under IFRS than US GAAP and the number would rise as other large economies made the switch. He said US GAAP would be marginalised if the US did nothing, making it harder for international investors to consider US companies.

“A single set of globally understood accounting rules is expected to help cut companies' cost of capital and better enable cross-border investment. In countries without strong accounting traditions, the rules are expected to raise the quality of reporting, helping inward investment.”

Source: Jennifer Hughes, Financial Times , August 27, 2008.

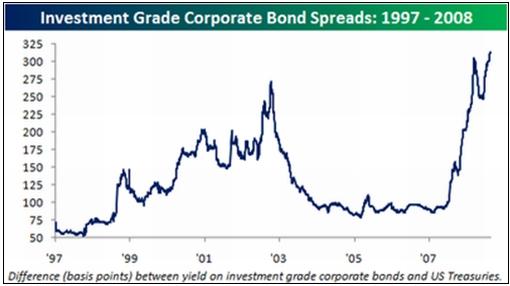

Bespoke: Credit spreads continue to get worse

“FDIC Chairman Sheila Bair commented in a press conference this afternoon that she expects the credit markets to continue to worsen, and judging by the recent action in credit spreads, the market seems to agree. According to Merrill Lynch data, interest rates on investment grade corporate bonds are currently not only at higher levels than they were at the Bear Stearns low, but they are also at their highest levels ever. As of yesterday's close, investment grade corporate bonds were yielding 312 basis points more than Treasuries, which is a 118% increase over year ago levels.”

Source: Bespoke , August 26, 2008.

Financial Times: Government bonds reflect bad tidings

“When it comes to gauging how bad things may get for the global economy, central bankers say they are uncertain. A glance at government bond yields backs that nerve-wracking outlook.

“In the past month, US, German, UK and Japanese bond yields have been falling as investors have dismissed the threat of inflation and priced in a higher risk of global recession led by the big economies.

“The expectation of rate cuts in the UK and eurozone should be vindicated by weaker growth and lower inflation in the coming months. In the US, the sharp cuts earlier this year should suffice unless the economy hits a wall in 2009.

“At the centre of the big freeze, US policymakers still face challenges as home prices keep falling while inventories of unsold properties rise.

“With economic gloom deepening, falling US Treasury yields have been accompanied by rising yields for corporate and mortgage bonds. Until house prices stabilise, banking writedowns will sustain a bid for government debt at the relative expense of other riskier fixed-income securities.

“At some point, however, selling long-dated Treasuries and buying risky mortgage and corporate bonds will become the dominant trade for investors. One barometer to watch will be a sharply steeper yield curve, whereby long-term yields rise much more than those of the two-year note.

“Once banks have plugged all their balance sheet holes, a steeper Treasury curve will facilitate borrowing at low rates and the buying of longer-dated, higher-yielding mortgages and other debt. Call it a carry trade on steroids that slowly helps banks nurse their balance sheets back to health.

“Unfortunately for the Fed, the stars are not yet aligned for banks and investors to play the game of ultimate carry, which suggests that further selling of risky assets beckons.”

Source: Michael Mackenzie, Financial Times , August 25, 2008.

Richard Russell (Dow Theory Letters): Lowry's Index shows worst lies ahead

“On August 26, Lowry's Selling Pressure Index reached its highest level ever – 756, while Lowry's Buying Power Index dropped to a multi-year low of 210. On that day, the spread between the two indices reached a record 546 points. And I wonder whether the August 26 negative spread (with Selling Pressure dominating) might be the ultimate extreme spread between the two indices. I was thinking that at some point the Selling Pressure Index was simply going to head down while at the same time the Buying Power Index was going to turn up. And someplace in the future, the two indices would re-cross as Buying Power finally assumed the dominant position (above Selling Pressure).

“I just talked to Paul Desmond, who runs Lowry's. I asked him why he was so sure that we were heading for 90% down-days. His answer was that this rally is so weak. Overall volume was only 3.7 billion today and today upside volume was only 62.8% of up + down volume. Furthermore, Paul noted that breadth is very weak – breadth should be exploding on the upside here, but that's not happening. In all, this is a weak rally, suggesting that worse action lies ahead!”

Source: Richard Russell, Dow Theory Letters , August 28, 2008.

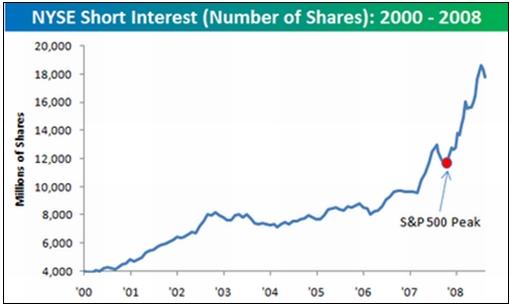

Bespoke: NYSE short interest declines again

“For the second consecutive two-week period, short interest on the New York Stock exchange declined. During the first two weeks of August, short positions in NYSE listed stocks fell by 2.8% to 17.8 billion shares. While the late July figures showing a mere 1.5% decline in short interest seemed to show that the SEC's crackdown partial enforcement of existing laws on short selling had little impact, the larger decline in the most recent figures suggest that the SEC's actions might be affecting investors.

“So what has the SEC done to continue enforcement of short selling rules? They let the temporary order expire, and said a new set of rules would be coming in the ‘next few weeks'.”

Source: Bespoke , August 27, 2008.

David Fuller (Fullermoney): The upside is for the bulls to prove

“The oversold rally commencing in mid-July has certainly stalled. Here is what it would take to revive it:

“Sustained breaks above the August rally highs to date for major indices, preferably with financials participating.

“This is a big ask without a catalyst such as a change in the emphasis of monetary policy from fighting inflation to boosting economic growth. Whether this Rubicon is crossed in the next few weeks or sometime next year remains to be seen and probably depends on events.

“Meanwhile, valuations are much improved, albeit still well above record attractive levels. The west's credit crisis has not gone away but some other concerns have diminished. For instance, most people no longer expect another spike in the price of crude oil anytime soon, and rightly so give demand destruction. A commodity related spike in long-dated government bond yields has not only been avoided for the time being, but yields are actually falling in line with recession fears. Concern over an additional collapse of the US dollar has been replaced by a reassuring rebound.

“In other words, some of the year-long concerns are either abating or at least priced into markets to a not insignificant degree. As practically every financial journalist has talked about the worst financial crisis since the USA's Great Depression, this is not a new story, right or wrong. The only new worry of consequence is some unnecessary and hopefully temporary Cold War style provocation between the Russian Federation and the USA. Potentially more significant for stock markets is the mountain of cash sitting in money market mutual funds.

“Nevertheless investors are understandably cautious given all the financial concerns, whether largely discounted or not, and everyone knows that most stock markets are still in overall downtrends. Therefore the upside is, as we say, for the bulls to prove. Judging from the sluggish chart action, the fear of further losses is still greater than the fear of being of being left behind in the next good rally.”

Source: David Fuller, Fullermoney , August 27, 2008.

Bespoke: Stock market seasonality – September could present rough sledding

“As the unofficial end of Summer draws near, market activity is likely to pick up in the coming weeks as traders set themselves up for the end of the year. If history is any indication, the last four months should provide some improvement to this year's double-digit percentage losses. History shows, however, that September could present some rough sledding before any rally occurs.

“In the chart below, we show the average historical trading pattern of the S&P 500 during the last four months of the year. The blue line shows the S&P 500's trading pattern from 1960 – 2007, while the red line shows the average of the last ten years. As shown, over both time frames, the S&P 500 typically declines during most of September before staging a year-end rally beginning in late September/early October.”

Source: Bespoke , August 26, 2008.

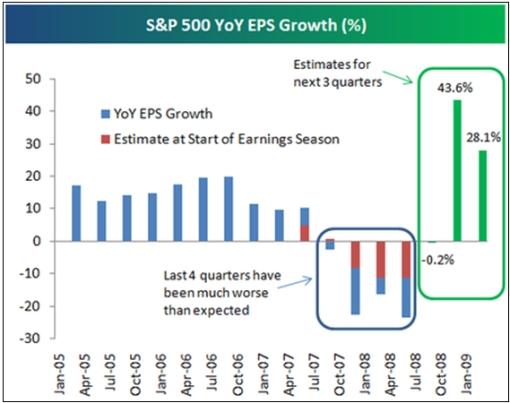

Bespoke: High earnings growth expectations?

“Year over year earnings for the S&P 500 declined by a little more than 23% in Q2 ‘08 versus Q2 ‘07. Expectations at the start of earnings season based on cumulative analyst estimates were -11%, so actual numbers were more than twice as bad. This brings us to earnings expectations for the next few quarters. Currently, bottoms up estimates are looking for S&P 500 earnings to decline by 0.2% from Q3 ‘07 to Q3 ‘08. Q4 ‘08 estimates are looking for growth of 43.6%, and Q1 ‘09 estimates are at 28.1%. These high numbers are due to the extremely weak readings we got in Q4 ‘07 and Q1 of this year. Only time will tell if these estimates are too lofty, but based on the last few quarters, they most likely are.”

Source: Bespoke , August 26, 2008.

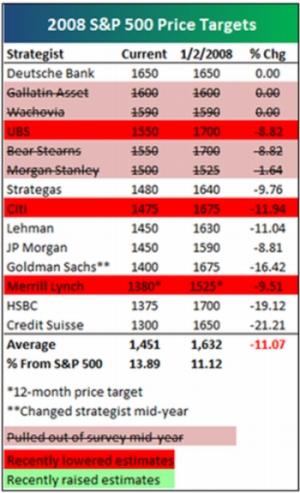

Bespoke: Strategist price targets down the home stretch

“Below we have updated S&P 500 year-end price targets for strategists surveyed by Bloomberg. For each strategist, we provide their 2008 price target at the start of the year as well. As shown, for various reasons, four strategists are no longer giving price targets. Currently, Deutsche Bank is the only firm that has not lowered its price target this year, and it is also the highest at 1,650. For their target to be on the mark, the S&P 500 will need to rise 30% from now to the end of the year. Credit Suisse currently has the lowest price target at 1,300, which is down from their 1,650 target to start the year. Even with the lowest target of 1,300, Credit Suisse is still forecasting the S&P 500 to be up from current levels by the end of 2008. The average price target of all strategists is currently 1,451, which is 13.89% above the S&P 500's current price. At the start of the year, analysts were expecting a gain of 11%.”

Source: Bespoke , August 26, 2008.

Charles Kirk (The Kirk Report): ETF leaders and laggards

“With Jim Cramer having proclaimed that we've hit bottom and we will not take out the July 15th low, I'm curious to see which ETFs have been the raw performance leaders and laggards since that specific point. The top ten for both are below.”

Source: Charles Kirk, The Kirk Report , August 26, 2008.

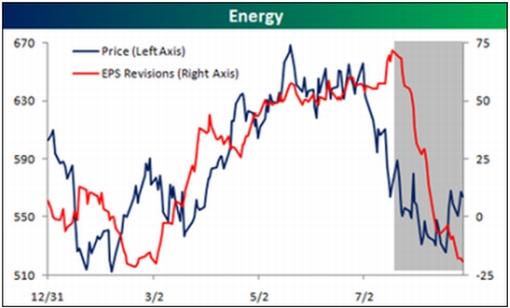

Bespoke: Energy's loss is the financials' gain

“Just as the stocks in the financial sector have stabilized while energy stocks have been weak, analyst sentiment on the sectors seem to be following a similar trend. In the charts below, we track the percentage of stocks in each sector that have seen positive or negative estimate revisions over a rolling one-month period.

“As shown in the shaded areas, estimate revisions for both the energy and financial sectors have had sharp reversals. In mid-July, nearly 55% of stocks in the financial sector had seen their numbers cut in the prior month. Today, the percentage has decreased to only 25%. In the energy sector, in mid-July analysts had raised estimates on nearly 75% of the stocks in the index over the prior four weeks. Currently, nearly 25% of the stocks in the sector have seen their numbers cut over the last four weeks.”

Source: Bespoke , August 29, 2008.

GaveKal: Japanese stocks set to outperform bonds

Source: GaveKal – Checking the Boxes , August 29, 2008.

US Global Investors: Plenty of sidelined liquidity in China

“Growth in China's household savings has accelerated with the stock market meltdown, and cash now represents about 45% of household assets in China versus 10% in the US. Should the market reverse, plenty of sidelined liquidity may participate given limited investment channels in domestic China.”

Source: US Global Investors – Weekly Investor Alert , August 29, 2008.

David Fuller (Fullermoney): Russia offers medium-term value

“The Russian stock market is arguably cheap with a trailing PER of 8, although the Russia RTS $ Index yields only 2.2%. However, a considerable amount of technical damage has occurred since the May high, most notably a plunge down through the long progression of higher reaction lows which marked the previous uptrend. This is a Type-2 top (extreme reaction against the prevailing trend).

“Most of this break occurred as capitulation selling hit resources stocks everywhere, making it the last sector to fall. The invasion of Georgia just gave the Index an extra push on the downside. Even after allowing for global tensions, the decline is becoming quite overextended. However this pattern cannot support more than a technical rally at present and the May high is very unlikely to be retested anytime soon.

“Taking a longer-term view, Fullermoney continues to favour a policy of acquiring resources shares with substantial assets in the ground, in politically stable regions. I would describe Russia as a politically stable region, albeit authoritarian. There are also governance issues, not least concerning the rights of minority shareholders. Nevertheless, resources-rich Russia is also likely to remain one of the world's faster growing economies.

“Could Russia's stock market index fall further before it next experiences a sustained advance? Easily, not least as there is no conclusive evidence that any stock market has bottomed. Is Russia's market likely to be higher in a year or two? I think so.”

Source: David Fuller, Fullermoney , August 26, 2008.

Bloomberg: Vietnam's stock market attractive for investors, says Mobius

“Vietnam's stock market offers investment opportunities after a 45% slump this year, said Mark Mobius, executive chairman of Templeton Asset Management.

“‘Vietnam's stock market now is down, so there are more opportunities,' Mobius said in an interview in Ho Chi Minh City, where Templeton opened its Vietnam representative office today. ‘The market will go up and will be much more valuable in about three years.'

“Mobius, who oversees about $40 billion in emerging-market equities, is increasing Templeton's investments in Vietnam after it bought a 49% stake in the fund management unit of Joint-Stock Commercial Bank for Foreign Trade of Vietnam, known as Vietcombank Fund Management, earlier this year.

“Templeton is turning to emerging markets as it said earlier this month stocks tumbled more than justified because demand for raw materials continues to boost economic growth in those nations. The MSCI Emerging Markets Index has plunged 29% since reaching a record in October.

“Vietnam's central bank has raised interest rates three times this year to ease inflation.

“‘Inflation is high, but we are happy to see the government is acting rapidly and very strongly to beat inflation,' Mobius said. ‘But that's also why the stock market looks attractive.'”

Source: Van Nguyen, Bloomberg , August 22, 2008.

David Fuller (Fullermoney): US dollar – waiting for clearer evidence

“The USD's impressive rally has lost some momentum, but that was inevitable following its upside breakout. If we ask: what was the last really important chart development? USD strength is the only answer. Therefore we may only be seeing a consolidation prior to renewed gains.

“However, that is what most people are predicting and hoping for, because they are long. Sentiment is so often a contrary indicator, as you know. For this reason, I maintain that the USD has to sustain its breakout from prior trading ranges, during this pause, if we are to see renewed strength in the weeks and months ahead. Meanwhile, if the USD continues to move sideways, interest rate differentials will erode more of leveraged traders' recent gains, increasing the possibility of declines back into the prior ranges.

“I remain sceptical of the USD's alleged medium to longer-term recovery scope, for reasons previously discussed at length. However, psychology and technical action are the key short-term drivers, so I am waiting for clearer evidence of the next significant move, either way.”

Source: David Fuller, Fullermoney , August 29, 2008.

Richard Russell (Dow Theory Letters): Dash for cash is good for gold

“The world is now going through the deleveraging of the greatest credit mountain in human history (the credit build-up started right after World War II). What are the implications?

“The first – there's a dash for cash throughout the world. Big, sophisticated money sees what's going on, and they want cash, all the cash they can accumulate.

“Second – Today, all cash is fiat junk currency. When this realization hits, the next big move will be into the only reliable cash outside the central bank system. That move will be to – gold. There will be a rush for gold somewhere ahead. Even now, I suspect gold is in a bottoming process (but not the gold shares).”

Source: Richard Russell, Dow Theory Letters , August 26, 2008.

Guardian: Gold reserves more important than before, says Bundesbank

“Germany's Bundesbank on Friday rejected calls that it should sell some of its gold reserves to help boost the slowing German economy, telling Reuters financial and political uncertainty make the reserves even more important than before.

“‘Gold sales are not a suitable way to sustainably consolidate the public accounts,' the Bundesbank said after a query about trade union proposals that it sell gold to fund some of a $37 billion economic stimulus package.

“‘National gold reserves have a confidence and stability-building function for the single currency in a monetary union. This function has become even more important given the geopolitical situation and the risks present in financial market developments.'

“The Bundesbank is the world's second-largest holder of gold after the US Federal Reserve, and has sold just 20 tonnes out of total reserves of over 3,000 tonnes in the past five years.

“These sales were to allow the German finance ministry to mint gold coins, unlike the much more active sales programmes of other central banks which wanted to shift their portfolios from gold to a more diverse array of assets.”

Source: Guardian , August 22, 2008.

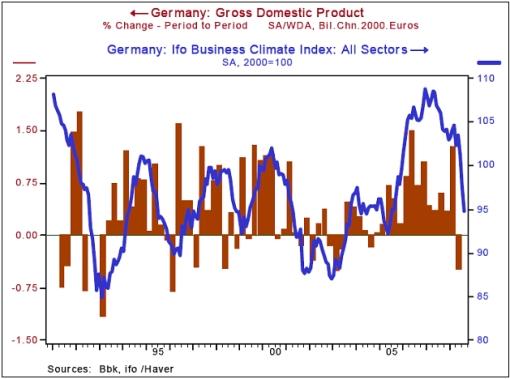

Victoria Marklew (Northern Trust): German data suggest Euro-zone is headed for recession

“So much for hope that Euro-zone growth will improve in Q3. Data releases from Germany today underline the fact that the ‘zone's powerhouse economy is flirting with a technical recession, and the details of those releases point to negative developments for the Euro-zone as a whole.

“So, the bad news is that the Euro-zone will almost certainly see a second quarter of contraction in Q3, with Germany, France, and Italy headed that way and Spain almost certain to drop into negative territory too. The good news is that, for now at least, it looks as if the ‘zone will stall rather than fall right off a cliff, implying signs of recovery could crop up by the end of this year. But watch those leading indicators.”

Source: Victoria Marklew, Northern Trust – Daily Global Commentary y, August 26, 2008.

Financial Times: Moscow's plan is to redraw the map of Europe

“Any doubts about why Russia invaded Georgia have now been erased. By illegally recognising the Georgian territories of Abkhazia and South Ossetia, Dmitry Medvedev, Russia's president, made clear that Moscow's goal is to redraw the map of Europe using force.

“This war was never about South Ossetia or Georgia. Moscow is using its invasion, prepared over years, to rebuild its empire, seize greater control of Europe's energy supplies and punish those who believed democracy could flourish on its borders. Europe has reason to worry. Thankfully, most of the international community has condemned the invasion and confirmed their unwavering support for Georgia's territorial integrity and sovereignty.

“I believe the most potent western response to Russia is to stay united and firm by providing immediate material and political support. If Moscow is trying to overthrow our government using its lethal tools, let us resist with democratic tools that have sustained more than 60 years of Euro-Atlantic peace. Backing Georgia with Europe's political and financial institutions is a powerful response. Regrettably, this story is no longer about my small country, but the west's ability to stand its ground to defend a principled approach to international security and keep the map of Europe intact.”

Source: Henny Sender, Financial Times , August 27, 2008.

Bloomberg: Gazprom leads surge in Russian debt risk

“OAO Gazprom led a jump in the cost of protecting Russian companies from default to the highest in almost five months on investor concern the country's military incursion in Georgia will trigger a rise in borrowing costs.

“Credit-default swaps on the world's largest natural-gas producer increased 36 basis points to 260 this month, and Moscow-based oil-pipeline operator OAO Transneft rose 33.5 to 265, according to at CMA Datavision. Contracts on Russia's government debt climbed 32 to 134, the highest since April 2.

“The credit crisis has already prompted a jump in Russian corporate funding costs, with the nation's largest lender, OAO Sberbank, increasing rates on outstanding loans by an average of 2 percentage points last month. International investor concern over the Georgia military action may add at least a further 0.5 percentage points to annual interest payments, according to Mikhail Galkin, a fixed-income analyst at MDM Bank in Moscow.

“‘Access to capital for Russian corporations, already severely damaged by the global credit crunch, has further deteriorated on the back of increased political risks,' Galkin said in an interview today.”

Source: Abigail Moses and Denis Maternovsky, Bloomberg , August 27, 2008.

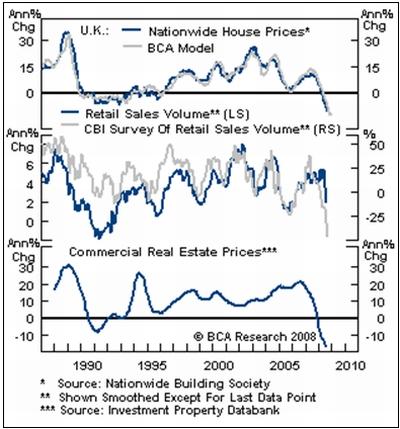

BCA Research: UK economy – look out below!

“The fallout in the UK housing market is gaining momentum and will deliver dramatic knock-on effects for the aggregate economy. The BoE will be forced to respond aggressively.

“Our UK housing model has been predicting double-digit price declines for some time. Alarmingly, the housing market appears to be slipping even faster than the model predicted. Yesterday's release showed that nationwide house prices plunged in August to -10.5% YoY (from -8.1% in July). Still, UK housing remains extremely overvalued and none of the leading real estate indicators suggest that the market is likely to find support in the coming months.

“In turn, the negative wealth effects will continue to mount, keeping the consumer depressed and hesitant to spend. The poor consumer outlook is highlighted by the dismal CBI retail survey for September. The financial sector will also remain under pressure as banks face a second bust in the commercial real estate market.

“Bottom line: The BoE will need to respond by aggressively lowering interest rates (beginning before yearend) in order to limit the fallout in the overall economy. Stay bearish the pound and overweight gilts within a global hedged fixed income portfolio.”

Source: BCA Research , August 29, 2008.

Bloomberg: UK economic growth stagnated in second quarter

“The UK economy stagnated unexpectedly in the second quarter, ending the nation's longest stretch of economic growth in more than a century.

“Gross domestic product was unchanged from the previous quarter, the Office for National Statistics said, compared with a previous estimate for growth of 0.2%. Economists had expected a 0.1% expansion, according to the median estimate of 34 economists. Growth was 1.4% from a year earlier, the weakest since 1992.

“The report, which showed the biggest drop in investment in 23 years, adds pressure on the Bank of England to set aside inflation concerns and cut interest rates. It also worsens Prime Minister Gordon Brown's struggle to salvage his reputation for economic competence.

“‘There is still worse to come,' Ross Walker, an economist at Royal Bank of Scotland, said in a Bloomberg Television interview. ‘We may have to wait until early 2009 before we get the first rate cut because the inflation situation still looks pretty forbidding.'

“Industrial production, which includes manufacturing as well as utilities and oil and gas extraction, has now contracted for two consecutive quarters. Construction also shrank. Service industries, which range from banks to airlines, grew at the slowest rate since 1995.”

Source: Jennifer Ryan, Bloomberg , August 22, 2008.

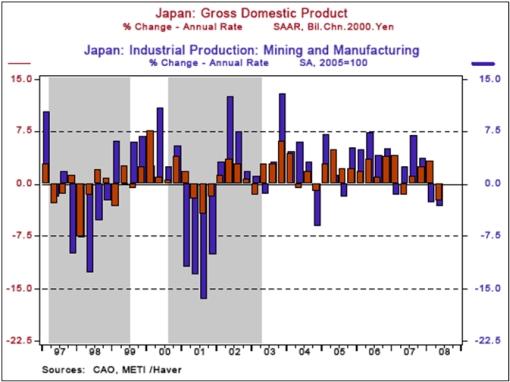

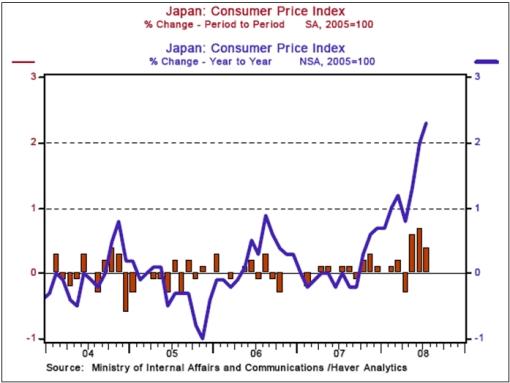

James Pressler (Northern Trust): Japan – response to upcoming recession

“Today, the government announced an ¥11.7 trillion ($107 billion) set of fiscal measures in response to the weakening economy (and likely to the ruling party's low approval ratings).

“Even though GDP has not contracted for the two consecutive quarters required, the world's second-largest economy is showing every sign of recession. A prolonged contraction in industrial production has been the main sign of recent recessions, and that seems to be the case as of today's release. The monthly figure for July production was surprisingly up on the month, but it is very likely that it will show another contraction for Q3 as a whole, and GDP will follow suit. Given this grim scenario, it is no surprise that the government took action. However, it would be hasty to call Tokyo's announced measures a ‘stimulus' package.

After years of stable or declining prices, July inflation rose to a decade-high 2.3% according to today's release. Real interest rates are now decidedly negative, and consumer sentiment has taken a significant hit.”

Source: James Pressler, Northern Trust – Daily Global Commentary , August 29, 2008.

Financial Times: Jing Ulrich and Qing Wang on Chinese reforms

Jing Ulrich, JPMorgan chairman of China equities and Qing Wang, Morgan Stanley chief economist for greater China, discuss the likely policy priorities Beijing will pursue to cope with China's economic downturn and weak stock market.

Source: Financial Times , August 26, 2008.

MarketWatch: Saudi Arabia takes big step toward opening market

“Saudi Arabia's recent decision to allow foreign investors to buy local shares indirectly is a dramatic step toward opening up the biggest stock market in the Middle East.

“The Capital Market Authority (CMA), the Saudi market regulator, announced last Wednesday that it will let foreigners gain exposure to the local market through so-called swap agreements.

“The CMA will allow authorized persons to enter into swap agreements with non-resident foreign investors, whether institutions or individuals, to transfer profits from shares listed on the Saudi Stock Exchange, the Tadawul. The so-called authorized persons will retain legal ownership of the shares.

“‘Up until now, Tadawul has been the least open to foreign investment among the GCC bourses,' said analysts at Kuwait-based Global Investment House in a recent report.

“‘This step is considered a leap in the regulators efforts to diversify the market's investor base and develop the kingdom's financial market,' the analysts said.

“In the past, foreign investors didn't have access to the Saudi stock market, except through mutual funds. Only residents of the GCC countries have been allowed to invest directly in Saudi companies.”

Source: Polya Lesova, MarketWatch , August 28, 2008.

Did you enjoy this post? If so, click here to subscribe to updates to Investment Postcards from Cape Town by e-mail.

By Dr Prieur du Plessis

Dr Prieur du Plessis is an investment professional with 25 years' experience in investment research and portfolio management.

More than 1200 of his articles on investment-related topics have been published in various regular newspaper, journal and Internet columns (including his blog, Investment Postcards from Cape Town : www.investmentpostcards.com ). He has also published a book, Financial Basics: Investment.

Prieur is chairman and principal shareholder of South African-based Plexus Asset Management , which he founded in 1995. The group conducts investment management, investment consulting, private equity and real estate activities in South Africa and other African countries.

Plexus is the South African partner of John Mauldin , Dallas-based author of the popular Thoughts from the Frontline newsletter, and also has an exclusive licensing agreement with California-based Research Affiliates for managing and distributing its enhanced Fundamental Index™ methodology in the Pan-African area.

Prieur is 53 years old and live with his wife, television producer and presenter Isabel Verwey, and two children in Cape Town , South Africa . His leisure activities include long-distance running, traveling, reading and motor-cycling.

Copyright © 2008 by Prieur du Plessis - All rights reserved.

Disclaimer: The above is a matter of opinion and is not intended as investment advice. Information and analysis above are derived from sources and utilizing methods believed reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Do your own due diligence.

Prieur du Plessis Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.