UK Base Rate Speculation Causes Fixed Interest Rates to Rise

Interest-Rates / UK Interest Rates Oct 09, 2017 - 03:29 PM GMTBy: MoneyFacts

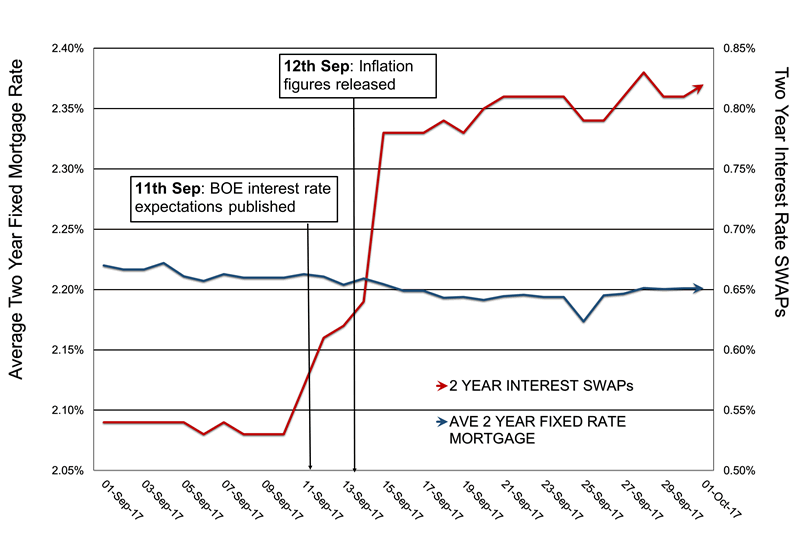

Moneyfacts UK Mortgage Trends Treasury Report data, not yet published, highlights that as SWAP rates have seen a steep increase due to base rate speculation, the average two-year fixed rate mortgage is also starting to rise.

Charlotte Nelson, Finance Expert at Moneyfacts, said:

“While month-on-month figures show that the average two-year fixed mortgage rate has fallen, this doesn’t quite tell the whole story. In fact, the average rate has now increased to 2.24% after a 0.04% rise from 1 October.

“The higher inflation figure announced on 12 September, coupled with the Bank of England stepping up its interest rate warnings, gave a clear indication to markets that a base rate rise is likely in the near future. This acted as a catalyst for SWAP rates to rise, with the two-year SWAP rate increasing from 0.54% to 0.82% in just one month.

“In the past few years, the link between mortgage rates and SWAP rates appeared to be broken, not only due to the volatility of the rates but also the fierce competition among lenders in the mortgage market. However, the substantial increase in SWAP rate seen in the past few weeks has quickly changed this, with 21 providers upping their rates since 12 September.

“Providers are now starting to factor SWAP rate rises into their pricing, causing the average two-year fixed rate to start creeping up, and this new trend is showing no signs of abating yet. With rates having sat at record lows, it is difficult for providers to swallow the increased cost by any means other than increasing the rates on offer. As a result, lenders are now treading a fine line between needing to remain competitive to protect their mortgage book and absorbing the cost of higher SWAP rates.

“The combination of higher SWAPs and an increased LIBOR rate has furthermore given the mortgage market the strongest indication for some time that a base rate rise is likely. This means it is crunch time for borrowers looking to remortgage; it is vital they act fast to ensure they get the best possible deal before their rates increase.”

The Moneyfacts UK Mortgage Trends Treasury Report provides an in-depth monthly review of today’s changing mortgage trends, including all the relevant facts on the UK’s residential and buy-to-let markets.

www.moneyfacts.co.uk - The Money Search Engine

Moneyfacts.co.uk is the UK's leading independent provider of personal finance information. For the last 20 years, Moneyfacts' information has been the key driver behind many personal finance decisions, from the Treasury to the high street.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.