The Top of the Wealth Effect

Stock-Markets / Stock Market 2017 Aug 12, 2017 - 03:52 PM GMTBy: Doug_Wakefield

Week two of August. Schools start back soon. Last chance for summer vacations. Football and fall return. The Dow reaches 22,000 this month, proving the “wealth effect” has worked…right?

Yet, cognitive dissonance abounds as we watch global markets and world news.

North Korea Says Guam Strike Plan Ready Within Days, CNN, Aug 10 ‘17

Chinese Daily Turns Outright Hostile, Says Countdown to India-China War Has Begun, The Economic Times, Aug 9 ‘17

Will these headlines turn into events that impact financial markets across the world? Will computers continue their game of “everyone follow the crowd”?

One of the many signs that continue to warn everyone is Newton’s third law of thermodynamics; for every action there is an equal and opposite reaction.

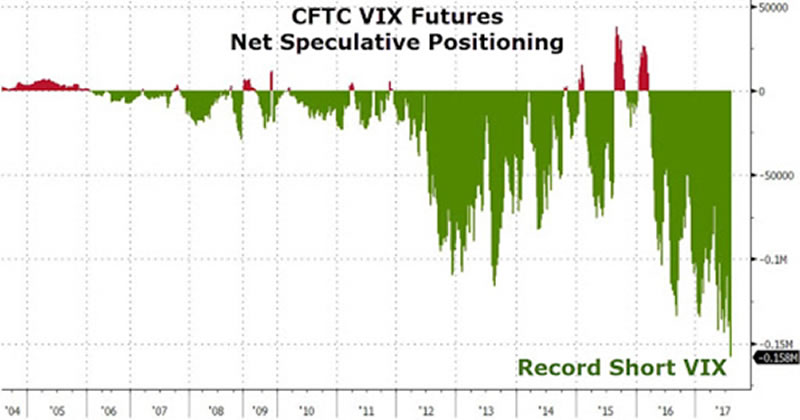

[Source – There Has Never, Ever Been This Many Trades Betting on VIX, Zero Hedge, Aug 9 ‘17]

Without HFT computer programs playing millisecond day trading games, the public’s view of “peaceful rising stock market” would have never developed this strongly. Without trillions in new debt (QE) pouring into global markets for 9 years, the public’s faith in the actions of central banks would not be so tenacious.

The problem with focusing on how individuals FEEL from investing in a calm rising market, is that our senses continue to disconnect from what science teaches about compression.

What if August 2017 turns out to be the final top in the current global stock bubble that began in 2009? What tools should we all consider? How will the individual “investing” with the money flood into ETFs this year at record highs FEEL when the boom becomes a bust?

Click here to join the readers of the Investor’s Mind? Start reading my longest newsletter since starting it in January 2006, “Ten ‘Little’ Dominoes”. Every reader also receives my ongoing view of global markets as I watch for pressure points and patterns rarely seen by most.

On a personal note, may we pray for peace when war seems so inevitable.

Time To Consider a Change from Calm Markets?

This article is the most recent post to the Best Minds Inc blog. Come join us.

The latest post to my personal blog, www.living2024.com, is Who Needs Bankers, We Need God. In 2013, a public article was released asking, Who Needs God, We Have Bankers. Is it time to consider other questions?

Doug Wakefield

President

Best Minds Inc. a Registered Investment Advisor

1104 Indian Ridge

Denton, Texas 76205

http://www.bestmindsinc.com/

doug@bestmindsinc.com

Phone - (940) 591 - 3000

Best Minds, Inc is a registered investment advisor that looks to the best minds in the world of finance and economics to seek a direction for our clients. To be a true advocate to our clients, we have found it necessary to go well beyond the norms in financial planning today. We are avid readers. In our study of the markets, we research general history, financial and economic history, fundamental and technical analysis, and mass and individual psychology

Doug Wakefield Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.