Are US Stocks in a Bubble

Stock-Markets / Stock Market 2017 Jul 24, 2017 - 07:51 AM GMTBy: The_Gold_Report

Rudi Fronk and Jim Anthony, the cofounders of Seabridge Gold, examine the role of risk when trying to differentiate between a bull market and a bubble.

Rudi Fronk and Jim Anthony, the cofounders of Seabridge Gold, examine the role of risk when trying to differentiate between a bull market and a bubble.

As we have noted, there is a very important difference between a bull market and a bubble. Valuations are certainly one means of distinguishing them. In retrospect, we can recognize previous historic bubbles such as 1929 and 2000. When basic ratios such as Price-to-Sales and Tobins' Q have reached the levels that marked these bubbles, as they have, we can make a reasonable inference that another bubble has formed.

But there are other measures besides valuation. The most characteristic indicator of a bubble vs. a bull market is that bubbles ignore risk. Bubbles don't discount risk, they don't sniff out the next recession, they ignore or even fight the Fed, they don't fall when earnings do and they do not herd into the long end of the Treasury curve for safety.

Aleksandar Kocic, an analyst at Deutsche Bank, has developed some insightful charts on market response to risk. He uses the Economic Policy Uncertainty (EPU) index as an objective measure of risk. The EPU quantifies three underlying indicators: newspaper coverage of economic policy uncertainty; the number of federal tax code provisions set to expire in future years; and disagreement among economic forecasters. Kocic then compares the EPU to the VIX, which measures the market's perception of risk for the S&P 500.

The chart below shows the EPU in blue and the VIX in black going back to 1996. Note that the two indices track each other well until 2012 and then they diverge.

The divergence above is confirmed in the chart below, where the S&P 500 is in red and the VIX is in black. Note that risk and the S&P tend once again to track each other. . .major spikes in risk correlate with a drop in stocks and vice versa. . .until 2012 when we had the last major spike in volatility.

What these charts tell us is that the equity market essentially stopped discounting risk in late 2012. That's our primary definition of a bubble. What happened in 2012 to nullify investor risk perception? QE3, the last and most aggressive Fed Quantitative Easing program.

Following weeks of advance signalling, QE3 was announced on September 13, 2012. In an 11–1 vote, the Federal Reserve decided to launch a new $40 billion per month, open-ended bond purchasing program, which quickly became known as "QE-Infinity." Additionally, the Fed announced that it would maintain the Federal Funds Rate near zero "at least through 2015." On December 12, 2012, the Fed announced an increase in the amount of open-ended purchases from $40 billion to $85 billion per month.

The markets understood this policy as a massive risk-on signal and the bubble began to inflate. The first casualty was the premier haven during periods of enhanced risk, gold. Even though gold hit a new record high of $1,900 in September 2011, its average annual price was higher in 2012 at $1,669 than it was the prior year at $1,571. But gold was hammered at the end of 2012 and into the beginning of 2013. This conforms exactly to the historical record for bubbles. In the expansion phase, gold underperforms, first commodities and then financial assets. In our view, the collapse of the bubble will bring the reverse (see our post of July 13, 2017).

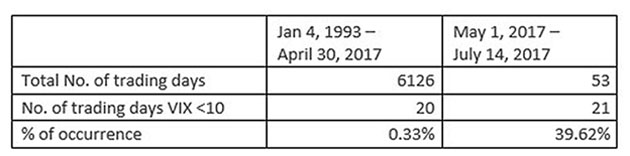

Kyle Beard of Bloomsbury Advisory notes that, as of July 14, 2017 the VIX had only traded below 10 a total of 41 times since the beginning of 1993. An amazing 21 of those occurrences took place since May 1, 2017. When you consider there have been 6,179 trading days since 1993, you can see how incredibly complacent (pro risk) the equity market is.

Here are the numbers:

It's not just the VIX: as Bank of America's David Woo points out, volatility across all financial markets has collapsed in recent months. To us, this is the most salient fact about today's markets.

The Fed has inflated a new bubble, as it intended to do. Chairman Bernanke explained it in terms of creating a "wealth effect" that would stimulate economic demand. This aim has proved elusive. What QE3 did stimulate was a speculation-induced financial asset inflation that anesthetized the perception of risk. Those who threw caution to the wind profited; those who were cautious lost. This is what a bubble looks like.

This article is the collaboration of Rudi Fronk and Jim Anthony, cofounders of Seabridge Gold, and reflects the thinking that has helped make them successful gold investors. Rudi is the current Chairman and CEO of Seabridge and Jim is one of its largest shareholders. The authors are not registered or accredited as investment advisors. Information contained herein has been obtained from sources believed reliable but is not necessarily complete and accuracy is not guaranteed. Any securities mentioned on this site are not to be construed as investment or trading recommendations specifically for you. You must consult your own advisor for investment or trading advice. This article is for informational purposes only.

Want to read more Gold Report articles like this? Sign up for our free e-newsletter, and you'll learn when new articles have been published. To see a list of recent articles and interviews with industry analysts and commentators, visit our Streetwise Interviews page.

Disclosures:

1) Statements and opinions expressed are the opinions of Rudi Fronk and Jim Anthony and not of Streetwise Reports or its officers. The authors are wholly responsible for the validity of the statements. Streetwise Reports was not involved in any aspect of the content preparation. The authors were not paid by Streetwise Reports LLC for this article. Streetwise Reports was not paid by the authors to publish or syndicate this article.

2) Seabridge Gold is a billboard sponsor of Streetwise Reports. Streetwise Reports does not accept stock in exchange for its services. Click here for important disclosures about sponsor fees. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

3) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

Charts provided by the authors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.