Stock Market Long-term Elliott Wave View

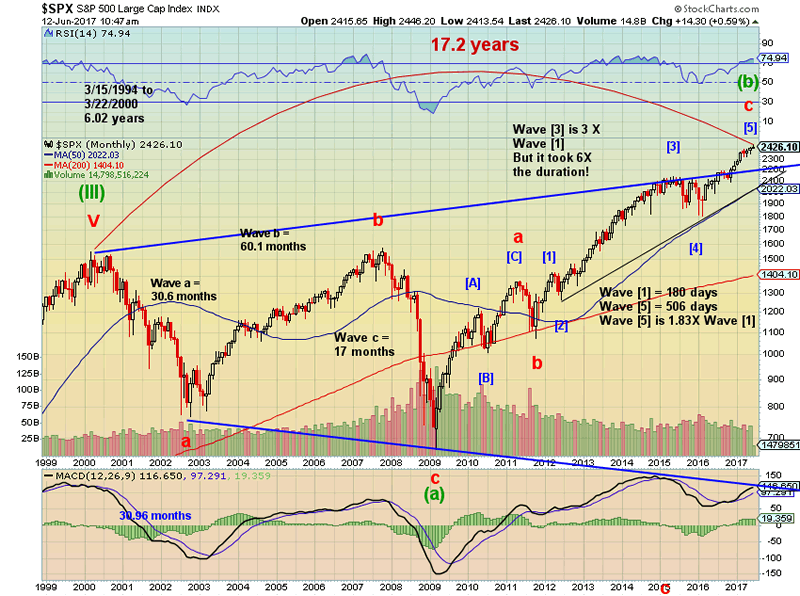

Stock-Markets / Stock Market 2017 Jun 13, 2017 - 08:01 AM GMTI am sending the charts in landscape to capture as much detail as possible. Wave [5] has been a stretch of 506 days, approximately 2.8 times the time of Wave [1]. By stretching, it gave us 17.2 years from high to high in this Super Cycle.

Wave [5] was 636.10 points, while Wave [1] was 347.61 points. Wave [5] was 2.81 times the size of Wave [1] in days.

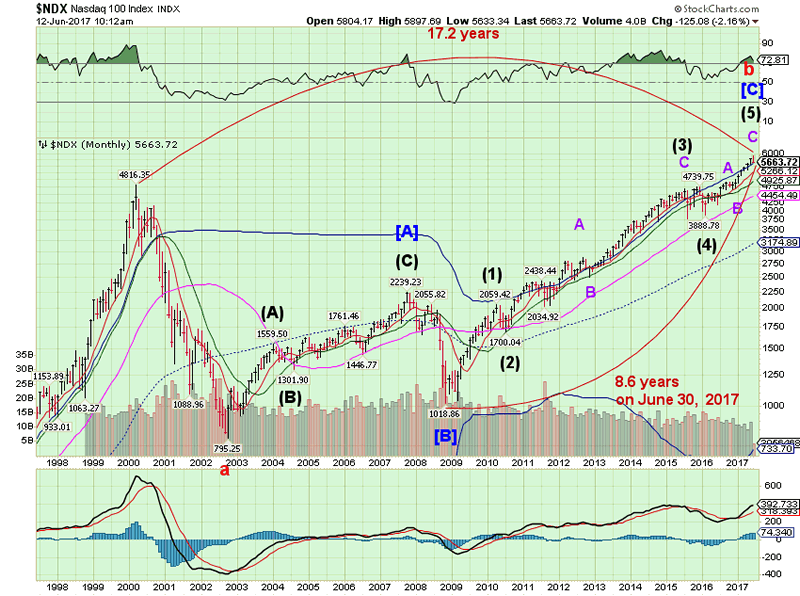

The NDX chart is simpler to chart and understand. There is one major difference, however. NDX did not make its low in March 2009. Instead, it made its low on November 21, 2008. The exact mid-point of this Cycle occurred on October 29, 2008, so I am less concerned about the 8.6 years from the November 21, 2008 low being June 30, 2017. I am more impressed with the fact that 17.2 years have elapsed from the March 24, 2000 high to June 6, 2017. That fact makes this week a good candidate for a major turn in the Cycles.

By the way, crossing the monthly Cycle Top at 5617.00 and the 50-day Moving Average at 5607.04 would be a confirmed sell signal for the NDX.

Regards,

Tony

Our Investment Advisor Registration is on the Web.

We are in the process of updating our website at www.thepracticalinvestor.com to have more information on our services. Log on and click on Advisor Registration to get more details.

If you are a client or wish to become one, please make an appointment to discuss our investment strategies by calling Connie or Tony at (517) 699-1554, ext 10 or 11. Or e-mail us at tpi@thepracticalinve4stor.com .

Anthony M. Cherniawski, President and CIO http://www.thepracticalinvestor.com

As a State Registered Investment Advisor, The Practical Investor (TPI) manages private client investment portfolios using a proprietary investment strategy created by Chief Investment Officer Tony Cherniawski. Throughout 2000-01, when many investors felt the pain of double digit market losses, TPI successfully navigated the choppy investment waters, creating a profit for our private investment clients. With a focus on preserving assets and capitalizing on opportunities, TPI clients benefited greatly from the TPI strategies, allowing them to stay on track with their life goals.

Disclaimer: The content in this article is written for educational and informational purposes only. There is no offer or recommendation to buy or sell any security and no information contained here should be interpreted or construed as investment advice. Do you own due diligence as the information in this article is the opinion of Anthony M. Cherniawski and subject to change without notice.

Anthony M. Cherniawski Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.