What Happened to the Stock Market Crash Experts Were Predicting

Stock-Markets / Stock Market 2017 Apr 28, 2017 - 02:40 PM GMTBy: Sol_Palha

"Any jackass can kick a barn down, but it takes a carpenter to build it." ~ Sam Rayburn

One jackass (oops we mean expert) after another, has been predicting that this market is ready to crash. The problem is that these brain surgeons have been making this argument for so long it almost sounds like the definition of insanity. Insanity boils down to doing the same thing over and over again and hoping for a new outcome. These predictions are so off the mark that they make a broken clock look fantastic which happens to be right once or twice a day depending on whether you follow military time or not. This market is unlike any other market; it has moved from being the most hated bull market to the most insane bull market of all time. In such an environment technical analysis is technically trash and fundamentals are fundamentally flawed. In fact, for the most part, market technicians have no idea of what they are talking about; they figure that by studying someone else theory or drawing squiggly lines on some chart they can decipher the market.

We have dealt with at least 15 so-called expert technicians who claimed to have found the Holy Grail; in the end, their theory was full of holes and could not account for sudden and rapid trend changes. Technical's do not drive the markets, and neither do fundamentals; emotions drive the market. Understand the emotion, and you can identify the trend. Identify the trend, and you can determine the primary direction of the market. If the trend is up, then you don't need to worry about crashes or correction; the market will not crash when the primary trend is up. It will, however, experience corrections, all of which will prove to be buying opportunities until the trend changes. Simple, prudent money management skills will protect your profits and reduce your losses. Fundamental analysis is even worse; at least technical analysis can be useful when combined with sentiment analysis. Fundamentals boil down to pouring over standard data, and you are usually looking at what happened and not what will happen. We will not spend more time on that topic as in our opinion fundamental analysis is in today's markets is a total waste of time.

Let's look at the NASDAQ as it recently achieved a very important milestone.

What many experts fail to understand is that a bull market starts only after the old high has been taken out. Until that occurs, it's not a real bull market. In that sense, the NASDAQ bull has just started. For over 15 years the NASDAQ struggled to overcome this hurdle. Jack in the box is what comes to mind; so like a coiled spring, it is ready to trade a lot higher before it breaks down. The NASDAQ has already broken past the psychologically significant 6000 level, so the odds are fair to high that it should roughly double from its breakout point; a move to the 9000-10,000 ranges might appear insane now. Experts would have felt the same way if someone told them that the Dow would be trading past 21K after it dropped below 7,000 in 2009.

Don't expect the upward journey to be smooth; the higher the Nasdaq trades, the more volatile the ride will be. In the interim, it would not surprise us if the Nasdaq eventually dropped down to the 5200-5400 ranges with a possible overshoot to 5,0000 before testing 6700.

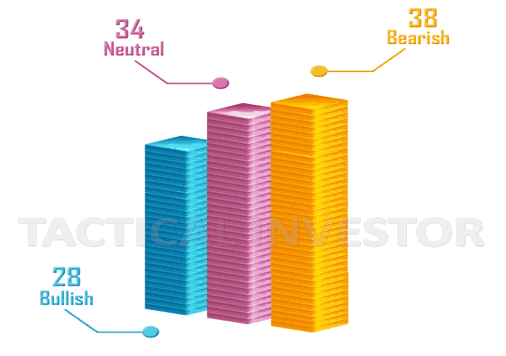

Sentiment data

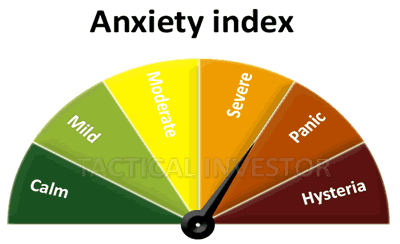

Sentiment continues to paint a fascinating picture as it indicates that for the 1st time in decades the crowd is not driven by panic or euphoria; they are uncertain, and uncertainty is the 1st stage of fear, so that means we are a very long way off from hitting the Euphoric zone. Overall, looking at the situation from a mass psychology perspective what we stated in 2014, 2015 and 2016, continues to hold; this bull market could end up running a lot higher than the most ardent of bulls could ever envision. It has already caught some of the most ardent of bulls by surprise; some of them even turned negative this January.

A back breaking correction needs at least two elements; the masses should be euphoric, and the market needs to be trading in the extremely overbought ranges. At the moment, the market satisfies only one of these conditions. A small wave of selling will propel the masses into the hysteria zone, which will create a mouth-watering opportunity. Markets don't crash when the masses are in disarray; they crash when the crowd is jumping up with Joy. The experts will probably confuse the next correction for a crash, but what can one expect from individuals who have been on the wrong side of this Bull market since its inception.

Conclusion

Uncertainty seems to be the order of the day; experts are uncertain, and so are the masses. Last week two stories were published on the same day; one was arguing for a crash and the other one stating that the markets are going to rise. What's different this time around is that everyone is universally confused. That should be scary right. Everyone does not know what's going on, so something bad is likely to occur. Well, that is what they want you to believe, but as students of Mass psychology, we find this line of thinking to resemble that of those housed up in Ward 12. ~ Market Update April 20, 2017

The stock market is trading in the overbought ranges, but the markets are more likely to experience a correction than crash as the sentiment does not support a crash. Also, the NASDAQ recently broke through a zone of major resistance and in doing, so a new bull market was triggered. This bull market is unlikely to end before the NASDAQ trades to the 8500-9000 ranges. In between, we expect corrections ranging from mild to wild, but they should not be classified as crashes. Given the strength of this market, the odds favour some sort of correction in the summer, and unless something changes dramatically between now and then, the Dow will probably not trade lower than 19,500 on a monthly basis. Until the trend and the sentiment change, strong corrections should be viewed through a bullish lens.

"Sure of their qualities and demanding praise, more go to ruined fortunes than are raised." ~ Alexander Pope

by Sol Palha

Sol Palha is a market analyst and educator who uses Mass Psychology, Technical Analysis and Esoteric Cycles to keep you on the right side of the market. He and his partners are on the web at www.tacticalinvestor.com.

© 2017 Copyright Sol Palha- All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.