It’s Time to Leave the Stock Market Party

Stock-Markets / Stock Market 2017 Mar 06, 2017 - 03:03 PM GMTBy: John_Mauldin

BY JARED DILLIAN : I’m a sentiment jockey. It’s good to get a feel for the room. That applies to all kinds of situations. When sentiment gets a little one-sided, I pay attention.

BY JARED DILLIAN : I’m a sentiment jockey. It’s good to get a feel for the room. That applies to all kinds of situations. When sentiment gets a little one-sided, I pay attention.

My good friend Michael Martin, author of The Inner Voice of Trading, once told me his surefire recipe for staying out of trouble in college.

He would leave a party the first time a beer bottle was thrown against the wall. He would be halfway down the street by the time the cops showed up, lights flashing.

Now, if you are a subscriber of my free investment newsletter, The 10th Man, you’ve probably noticed that I am not one of these harebrained idiots trying to short the market on every uptick. I haven’t really been cheerleading it either. I simply acknowledge that the trend is higher.

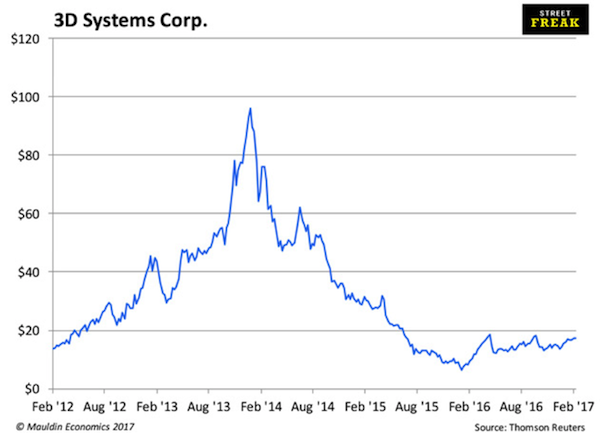

Not that I have anything against CNBC. Or Jay Z. CNBC has been dumb and right before. And Jay Z could be a genius for all I know. But usually when musicians and celebrities start getting involved in markets, all hell breaks loose. Like the time when will.i.am was named Chief Creative Officer of 3D Systems.

Yup, you guessed it.

For a sentiment jockey like me, this is gold. Some people might take that to mean to run out and short a bunch of stocks, or buy a bunch of S&P puts, or short Emini futures, or something drastic.

No, no, no.

All I’m saying is that the first beer bottle has been thrown against the wall. It is probably time to consider leaving the party. Which probably means the market has at least another 10% upside.

So what could make the market go down?

Beats the hell out of me.

Sentiment doesn’t tell you why the stock market will turn. What it tells you is when it's close to turning.

Now, what does “close” mean?

Timing the Market

A general rule of thumb is that investment booms go on much longer than you think they do. I thought sentiment in Canada was frothy three years ago. Since then, people have gone stark raving mad.

People thought tech stocks were overvalued in 1996. That was a painful four years. And by the way, if you “left the party” in 1996, missing the bear market was small consolation. You still underperformed.

One of the realities of investing is that it’s hard to be uninvested or underinvested. The latest fad is to be max invested all the time, but that’s a philosophical issue we won’t discuss here. We’re filthy market-timers, remember.

Market-timing gets a bad name. It sort of implies that you’re constantly trading, but the reality is, if you can catch one or two big returns in your investing lifetime, it makes a world of difference.

Stocks were generationally overpriced in 2000 and generationally underpriced in 2009. If you tweaked your allocation to equities even just slightly in either case, cutting exposure in 2000 or increasing it in 2009, you’re a hero. You didn’t even have to get it exactly right. Anything within a year is good.

But it is the nature of human beings to be excited by higher prices and turned off by lower prices.

I do have one very good friend from a previous life, one of the most successful retail investors I have ever known. He is wired the opposite way—he gets excited by lower prices and turned off by higher prices. He saw GE at 6 bucks in 2009 and shoved all-in.

Some Actionable Advice

Whatever big decisions you make with your portfolio, it is usually a good idea to make them gradually and average into positions over time.

Let’s say you have a 70% allocation to stocks. At this point, it might be wise to go to a 60% allocation in stocks. If the market continues higher, take the allocation down a little further.

People tend to do things all at once. “I’m out!” they say, yanking their money out of the market with the push of a button. Then they watch helplessly as Dow 20,000 turns into Dow 30,000. If you are going to make a mistake, it is best to keep it small.

The other advantage to doing things gradually is that you get feedback over time. If you cut your allocation by 10%, and the market drops suddenly, and volatility spikes, and there is a whiff of crisis, chances are you were right, and you should accelerate your selling program.

Here’s the thing, though: I’m not even all that sure this is one of those moments where stocks are generationally overpriced.

I don’t think this is going to be one of those awful 1932/1974/2002/2009 bear markets, absent any exogenous events. Let’s say the market drops 20%—which, granted, is a big move, and it would cause panic. It’s probably not worth trying to trade around it. Just keep your powder dry and buy on the way down.

These are the things you think about as an individual investor. And at the end of the day, I am an individual investor.

I have a better understanding of different asset classes and correlation and such, but ultimately, I’m just trying to save for my retirement… just like you.

You could sit around and think about these things, and be a portfolio manager, and struggle with these issues, or you could just naively put it in an index fund and not worry about it.

Unless 2009 happened all over again. Then you would worry about it.

Former Lehman Brothers Trader Reveals a Big Investment Opportunity in His Exclusive Special Report, The Return of Inflation

Don’t miss out on this opportunity to cash in. Jared Dillian, the former head of Lehman Brothers’ ETF trading desk, reveals how to make money from the falling bond market in his exclusive special report, The Return of Inflation: How to Play the Bond Bear Market. Download the special report now.

John Mauldin Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.