Oscars Debacle – Movies More Costly As US Dollar Devalued

Currencies / Fiat Currency Feb 27, 2017 - 02:31 PM GMTBy: GoldCore

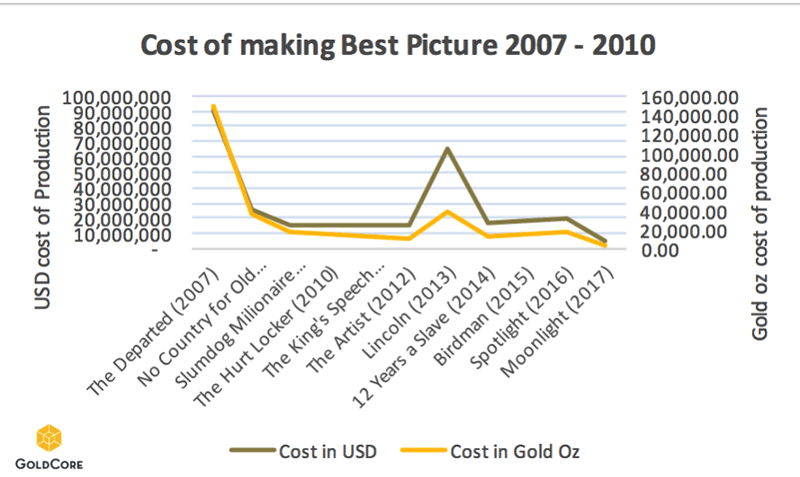

Cost of Best Picture winners show very significant devaluation of the dollar

Cost of Best Picture winners show very significant devaluation of the dollar- Average cost to make an Oscar winning film is over $43 million – in gold terms, this is over 106,000 ounces

- Four $15 million films show nearly 100% difference when priced in gold ounces

- Oscar fiasco was courtesy of error by accountants PWC

- Whilst the price of the films remained the same, the cost in gold ounces fell from 11.53% of the cost to make the Departed, in 2009 to just 6.4% in 2012

- In an error prone, irrational and volatile world, gold retains value over time …

The Oscars – the drama of the dollar

Oscars night seemingly sent Warren Beatty and Faye Dunaway a bit La La as they declared the wrong film the winner of the Best Picture Award at the Oscars, last night.

Instead of announcing ‘Moonlight’ as the winner of the industry’s highest accolade, they read out ‘La La Land’. Cue a few awkward moments, no doubt some heads rolling behind the scenes of the Dolby Theatre and a Daily Mail headline of ‘FAKE OSCARS FIASCO.’

Which it wasn’t really, just a bit odd after a very slick night.

Moonlight was the story of a man who grows up unsure and occasionally uncomfortable about who he is. La La Land is a musical love story about a couple trying to make it in LA – a city known for destroying hopes and throwing many hopefuls to the wayside. Both narratives are not unfamiliar to the world in which we find ourselves. Unfortunately our world is not a fantasy and will certainly not be done with our attentions in just over two hours.

When we wrote about the Oscars last week, we asked if they were Worth Their Weight in Gold and concluded that whilst we might dream in gold just like the glitterati, perhaps gold bullion would be a better investment for most of us. We showed that the price of gold has climbed 60 times ever since the first ceremony in 1929, a sobering example of the devaluation of fiat currencies in the last 88 years.

Whilst we think the devaluation of the dollar, and the maintained value of gold is the lesson to take away, there are a number of different lessons actors, directors and studios would like the critics and viewers to believe they can draw from their masterpieces. For some this is about the big bucks and box office numbers, and how they can make or break a film.

We agree, today there a few examples around that really show how little value the dollar carries.

Now that we are on the other side of the most 89th Academy Awards we take a look at what we can learn from last night’s behemoth that was the Oscars and the films that they work to honour.

Cost of making Best Picture

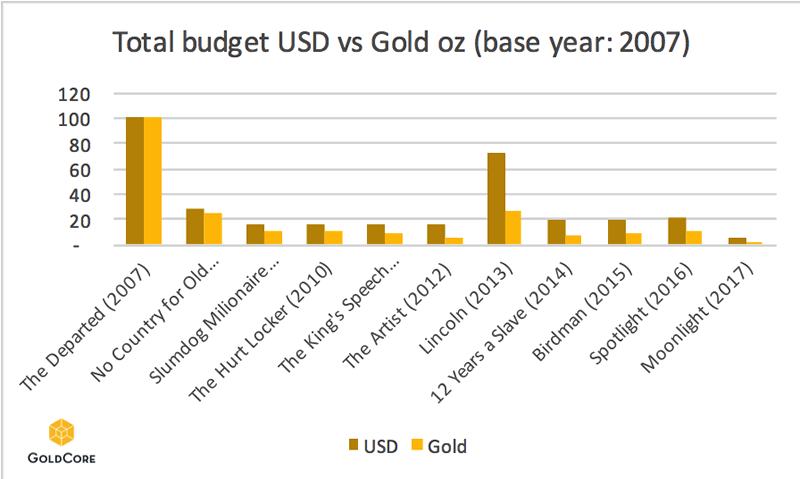

In the last twenty years, the average cost to make an Oscar winning film is over $43 million. In gold terms it is over 106,000 ounces.

The above graph doesn’t mean very much though, just that the cost of films go up and down, no matter what currency you decide to price it in.

In the decade of the financial crisis, this has come down somewhat and the average is more like $27 million, or 29,600 ounces. This statistic alone shows you how the dollar is falling in real value. Whilst the average cost in US Dollars to make a winning film is 60% in the last decade, compared to the average in the last 20 years, it is just 27% of the 20 year average when priced in gold ounces.

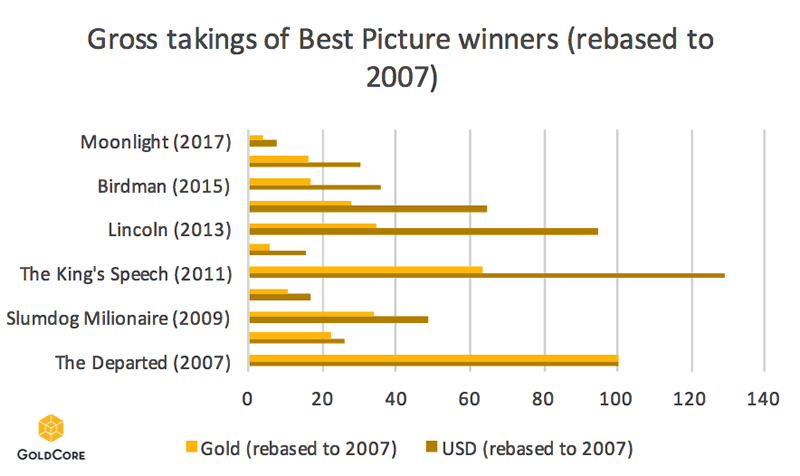

When you rebase to 100, using 2007 as the base year, then you begin to see some interesting results. Conveniently, Martin Scorcese’s 2007 The Departed is the most expensive Best Picture film in the last decade, cost ing $90 million. This was equal to just over 150,000 ounces of gold. No film since then has cost as much. Lincoln was close, costing just 72% of the price of Scorcese’s epic gangster film, but interestingly when priced in gold it cost just 26% percent of the Departed’s gold budget, with 39,000 ounces needed to fund the biopic.

The $15 million question

Perhaps as a sign of the times, Best Picture winners have been getting cheaper in recent years. Moonlight cost just $5 million to make, the lowest price for a winning film in at least two decades. It was also the cheapest in terms of gold ounces, costing just 3,997 ounces.

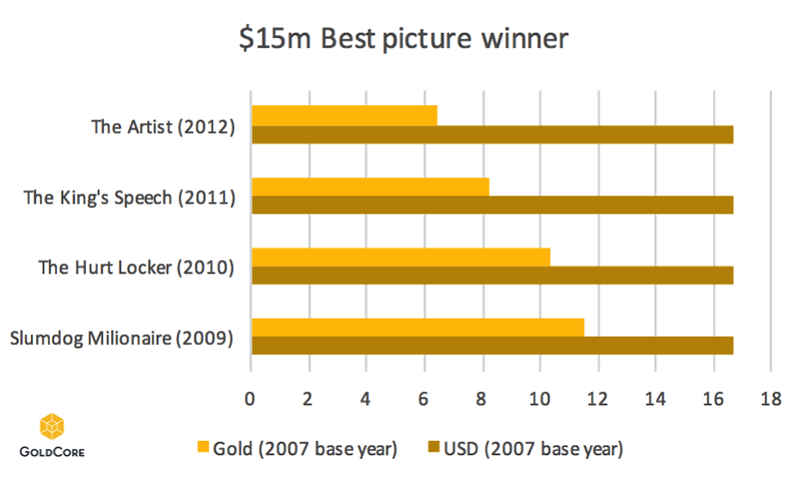

It is when we look at years when films are significantly cheaper that we see real evidence of gold’s purchasing power in the land of stars. Between 2009 and 2012 each Best Picture winner cost $15 million. This is 17% of the cost to make The Departed. One unfamiliar with gold’s ability to hold value would probably think that it costs a similar amount in gold ounces, but unsurprisingly this is not the case.

Whilst the price of the films remained the same, the cost in gold ounces fell from 11.53% of the cost to make the Departed, in 2009 to to just 6.4% in 2012.

One can easily conclude that had film financiers bought gold at the start of the financial crisis then there films would have cost far less to make.

Does more money mean more gold?

One would assume that when we hear phrases such as ‘the highest grossing film of all time’, then it’s something Donald Trump would say and you would wonder if it was true or not…or in this day and age maybe you would believe that it is actually the highest grossing film of all time. But when you look at the box office takings in terms of real money, gold, then it tells a different story and this is a case of FAKE NEWS!

Really? Hollywood lied? Yes, we can prove it.

The King’s Speech made the most fiat money at the Box Office in the last ten years, nearly 29% more than the Departed (which comes in second). But it only made 63% of the Departed’s takings, when priced in gold. This means it made less in gold ounces, than the Departed, and yet fiat currencies would have us believe that it was nearly 30% more successful.

This year’s winner, Moonlight, was not only the cheapest film to win in the last decade, but also the lowest in terms of takings. This is true for both dollars and gold ounces. However the percentage difference is drastically different – by over 100%.

Moonlight made 7.4% of the amount the Departed made in 2007 when priced in USD. But when it comes to gold it made just 3.6% of the Departed’s takings.

Conclusion – Never trust the favourite…or an accountant … or fiat currencies …

For all of Reagan’s and now, Donald Trump’s talk about ‘draining the swamp’ it seems that maybe Hollywood needs to perhaps consider doing the same. The fault of the Oscar mishap was courtesy of big accountancy firm Price Waterhouse Coopers.

Just a few days ago Martha Ruiz and Brian Cullina, the two PWC bods responsible for handing the correct envelopes to the presenters were interviewed about their roles as the only individuals who know the results before the winners do.

Cullina told the Art and Science blog, “The producers decide what the order of the awards will be. We each have a full set. I have all 24 envelopes in my briefcase; Martha has all 24 in hers. We stand on opposite sides of the stage, right off-screen, for the entire evening, and we each hand the respective envelope to the presenter. It doesn’t sound very complicated, but you have to make sure you’re giving the presenter the right envelope.”

Turns out that it wasn’t as simple as they were hoping to be, hence three producers thanking wives and families for supporting them in making a film that it turned out didn’t win the most coveted Oscar.

The speeches of the losing side were all about how this shows that dreams really can come true. How ironic. It seems a good analogy for what we see today, false investment hopes and false monetary rewards that can ultimately be ripped away on a moments’ notice thanks to some silly administration error by a firm or bank who isn’t held accountable.

The difference with physical gold bullion bars and coins is that it can’t just be made to disappear. You don’t have to worry about a counter party making a mistake and vanishing your hard earned rewards and wealth into thin air.

But, this can be tough to believe when gold is consistently downplayed by the mainstream.

For the last three years the bookies’ favourite has failed to spark the interest of Academy voters when it comes to the Best Picture Award. Boyhood in 2015, The Revenant in 2016, and now La La Land have each been touted as winners but have been left disappointed on the night.

This is very much reflective of the mainstream’s approach to gold. It is consistently dismissed as something that is a bit too kooky to do well and one shouldn’t focus on it in the long-term, instead we should look at stock markets and big tech companies and definitely save in fiat currencies like the dollar, the pound and the euro.

But, as our analysis shows, gold has been the consistent winner alongside all of those Big Picture winners, underdogs or not.

Billion of dollars are ploughed into these films, whether they are huge A-list casts or made up of Indie newbies. While the dollar cost of movies has been falling in recent years – in real terms – in gold terms the cost is rising.

Movie producers, companies and investors should consider owning physical gold in order to hedge the declining value of the dollar and other fiat currencies.

Whilst the price of gold, like any tradeable asset or currency does fluctuate, analyses such as ours above shows that gold retains value over the long term.

Gold Prices (LBMA AM)

27 Feb: USD 1,256.25, GBP 1,011.16 & EUR 1,187.41 per ounce

24 Feb: USD 1,255.35, GBP 1,000.89 & EUR 1,185.18 per ounce

23 Feb: USD 1,237.35, GBP 992.97 & EUR 1,173.13 per ounce

22 Feb: USD 1,237.50, GBP 994.21 & EUR 1,178.22 per ounce

21 Feb: USD 1,228.70, GBP 988.86 & EUR 1,166.16 per ounce

20 Feb: USD 1,235.35, GBP 991.49 & EUR 1,163.21 per ounce

17 Feb: USD 1,241.40, GBP 1,000.57 & EUR 1,165.55 per ounce

Silver Prices (LBMA)

27 Feb: USD 18.34, GBP 14.77 & EUR 17.33 per ounce

24 Feb: USD 18.27, GBP 14.56 & EUR 17.23 per ounce

23 Feb: USD 18.00, GBP 14.42 & EUR 17.06 per ounce

22 Feb: USD 18.00, GBP 14.47 & EUR 17.14 per ounce

21 Feb: USD 17.89, GBP 14.41 & EUR 16.97 per ounce

20 Feb: USD 17.98, GBP 14.42 & EUR 16.92 per ounce

17 Feb: USD 18.01, GBP 14.50 & EUR 16.91 per ounce

Mark O'Byrne

This update can be found on the GoldCore blog here.

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.