A Broken US Bond Market Bounce Beckons!

Interest-Rates / US Bonds Dec 24, 2016 - 10:11 AM GMTBy: Gordon_T_Long

Historical Correlations Give Us a Clue to What May Be Ahead!

Historical Correlations Give Us a Clue to What May Be Ahead!

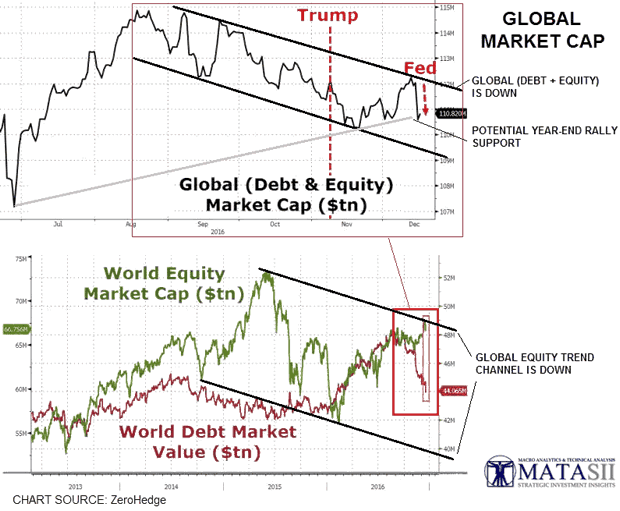

A Falling Global Market Cap Trend Channel

The old adage that the "Trend is Your Friend" has proven to be the one that separates the winners from the losers. The key however is whether you recognize the right trend!

We are being possibly lulled into a false perception and belief of how good things appear if we solely look at the US equity rally. Yes it is temporarily rising but the 600# Gorilla is the Global Bond market and major problems are still lurking.

The trend to focus on GLOBAL MARKET CAP:

- While US bank stockholders are ebullient at The Trump presidency-to-be, the rest of the world has lost a combined $1.5 trillion in market value across its bonds and stocks,

- Global equity and debt markets lost over $1 trillion in value last week (the week of the US FOMC meeting) - the biggest weekly loss since early May (weak China data and huge surge in dollar).

- Global bonds lost over $430 billion in market value last week (Yellen hawkishness and China bond carnage),

- Stocks lost even more ($525 billion) last week as China financial turmoil added to the world's woes (and "three rate hikes next year" and fiscal stimulus efficacy questions did not help).

The divergence between the Global Equity Markets and the Debt Market is significant and tells us there are major differing views on what the future has in-store. Divergences like this are always resolved - and usually quite dramatically.

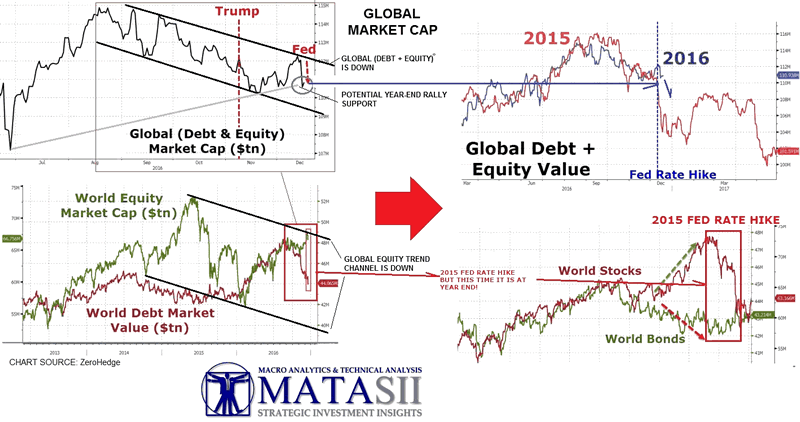

We Have Been Here Before!

The last time we saw such a divergence was in 2015 prior to the last Fed hike! We can see what happened on the right side of the graphic below. Stocks fell hard and bonds rose marginally.

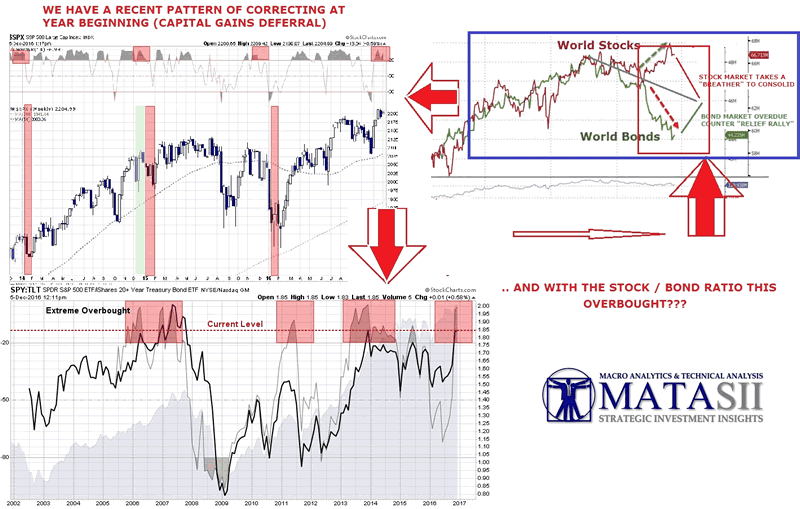

An Overbought Stock / Bond Ratio Needs Correcting

Knowing that the divergence will be resolved, the question is: 1- When and 2- How? Will Bonds rise, Stocks rise, to what degree and is what sequence?

We have an extreme overbought condition in the SPY:TLT ratio as well as a recent market pattern of correcting at year beginning. Both suggest something like the pattern highlighted in the blue box below may occur.

We can take some guess work out of this if we consider a critical correlation that historically normally occurs.

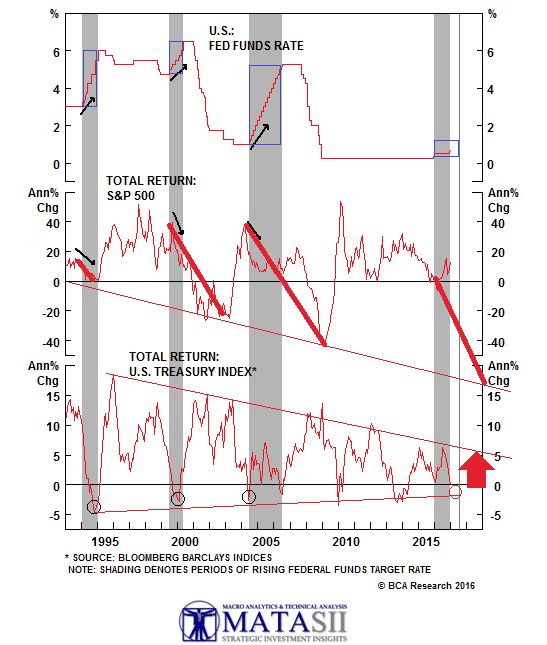

CRITICAL CORRELATION: Fed Funds Rate Change versus S&P 500 Total Return versus US Treasury Total Return

The following graphic shows what normally occurs when the Federal Reserve starts raising rates going back to the early 90's

The conclusion we can draw is that the equity market can be expected to weaken and for money to leave the equity markets for the safety of the bond market. The timing suggests weakness in the equity markets in Q1 2017 and strength in the bond market in Q2 2017. Both could happen earlier and closer together depending on what on known event triggers the correction in the divergence. Whether it is Year Beginning capital gains selling (tax deferral from 2016 gains) and re-positioning, problems in Congress getting fiscally conservative Republicans to accept Trumps fiscal spending plans, Geo-Political problems or China - time will tell.

Smart Traders Are Already Positioning

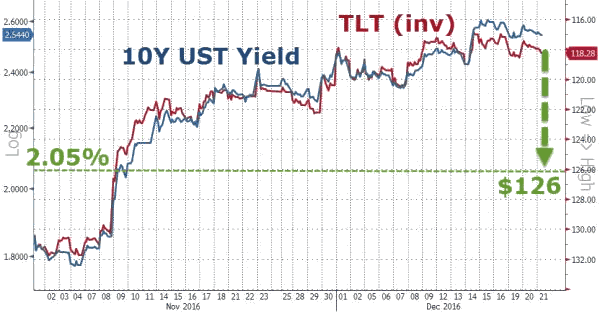

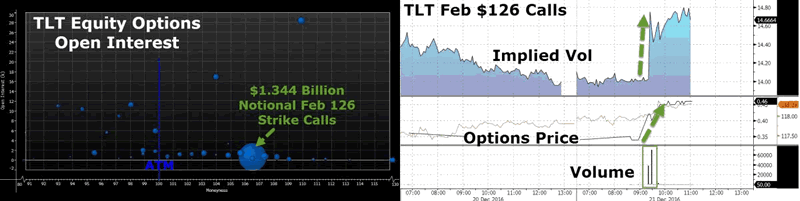

A careful look at options trading shows a massive amount of call positioning now going on in the 10Y UST for February $126 calls. Major bets are being made for the bond market to bounce as 10Y UST yields fall from 2.55% to 2.00 to 2.05% by the third Friday in February. This would be about th time new congress would be debating the initial 100 day plans laid out by the freshly inaugurated Trump Administrations

Conclusion

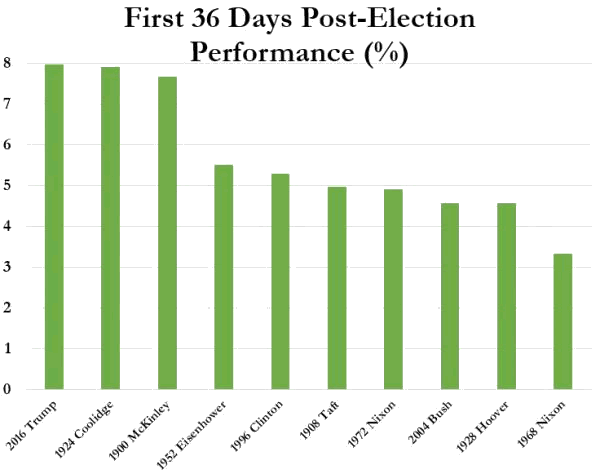

U.S. Economic Confidence has now surged to the highest level that Gallup has ever recorded. Additionally, the degree of Investor euphoria that has occurred since Trump was elected is something never seen in prior Presidential elections.

Like every good party it eventually ends and the hangover is likely to be a dozy!

Minimally we should see the close in our historical divergence.

For more articles signup for GordonTLong.com releases of MATASII Research

Gordon T. Long

Publisher - LONGWave

Signup for notification of the next MACRO INSIGHTS

Request your FREE TWO MONTH TRIAL subscription of the Market Analytics and Technical Analysis (MATA) Report. No Obligations. No Credit Card.

Gordon T Long is not a registered advisor and does not give investment advice. His comments are an expression of opinion only and should not be construed in any manner whatsoever as recommendations to buy or sell a stock, option, future, bond, commodity or any other financial instrument at any time. While he believes his statements to be true, they always depend on the reliability of his own credible sources. Of course, he recommends that you consult with a qualified investment advisor, one licensed by appropriate regulatory agencies in your legal jurisdiction, before making any investment decisions, and barring that you are encouraged to confirm the facts on your own before making important investment commitments. © Copyright 2013 Gordon T Long. The information herein was obtained from sources which Mr. Long believes reliable, but he does not guarantee its accuracy. None of the information, advertisements, website links, or any opinions expressed constitutes a solicitation of the purchase or sale of any securities or commodities. Please note that Mr. Long may already have invested or may from time to time invest in securities that are recommended or otherwise covered on this website. Mr. Long does not intend to disclose the extent of any current holdings or future transactions with respect to any particular security. You should consider this possibility before investing in any security based upon statements and information contained in any report, post, comment or suggestions you receive from him.

Copyright © 2010-2016 Gordon T. Long

Gordon T Long Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.