Gold Stocks in the Danger Zone

Commodities / Gold and Silver Stocks 2016 May 03, 2016 - 02:29 PM GMTBy: Bob_Kirtley

The bears have been in charge for the last 4 years or so taking both gold and silver into the depths of despair. The associated mining companies also felt the cold with many having to postpone projects, slash dividends and implement a series of cost cutting measures.

The bears have been in charge for the last 4 years or so taking both gold and silver into the depths of despair. The associated mining companies also felt the cold with many having to postpone projects, slash dividends and implement a series of cost cutting measures.

As with most bear markets there were a number of rallies which turned out to be head fakes or bear traps as gold lost its momentum. We can all recall just how well 2015 started as gold bolted in January to higher ground bringing much joy to the perma gold bulls. Alas gold couldn’t maintain it strength and spent the remainder of the year drifting to its lowest level for some time. Fast forward to this year and we can see once again gold has started like an Olympic sprinter taking the price of gold to within touching distance of $1300.00/oz. Silver was a tad slow to start but has now joined the fun by breaching previous resistance levels and confirming golds strength.

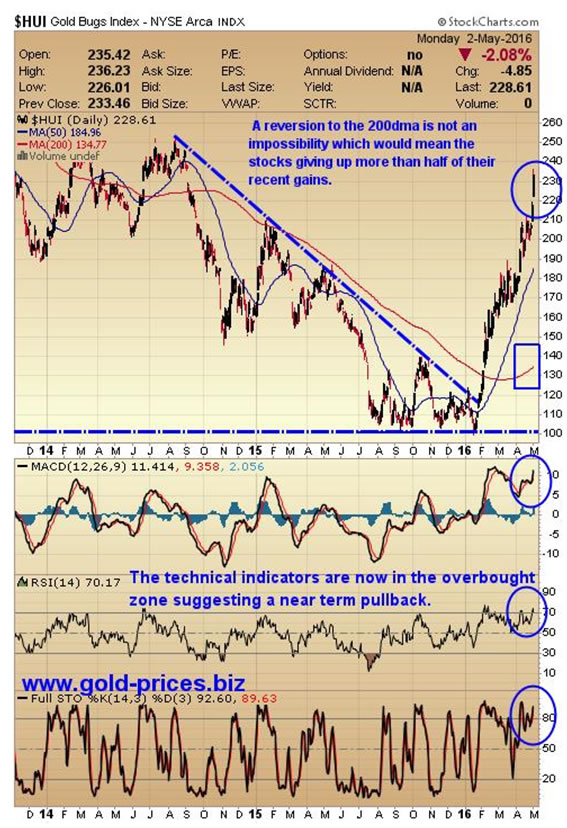

The restructured leaner mining companies really caught the bid and rocketed to higher ground with the Gold Bugs Index (HUI) having bottomed at exactly 100, more than doubling to close at 230. This is by far the best start that precious metals producers have had in a long time.

If you do not have a position then it is an agonizing time for you as you wrestle with the question of ‘should I - shouldn’t I’ purchase stocks right now. Well there two answers to that question. Firstly if you are intending to hold for five years or so then it probably won’t make a lot of difference if you buy now. However, if you intend to trade this market in order to take advantage of the oscillations on the way up and down, then you may be better off waiting for some of the froth to dissipate from this sector.

If we take a quick look at the chart of the HUI we can see that the downtrend has been well and truly broken and the rebound has been more dramatic than most expected.

The technical indicators, the RSI, MACD and the STO are now in the overbought zone suggesting a near term pullback. Also look at the gap that has opened up between the HUI and its 200dma which stands at 134.77. A reversion to the 200dma is not an impossibility, which would mean the stocks giving up more than half of their recent gains. So it wouldn’t be unreasonable to expect a pullback of a lesser extent, to say around 50points, which would take the HUI back to the 180 level.

If such an opportunity were to present itself then it should be taken seriously and an acquisition programme should be implemented by layering into the good quality stocks in preparation of the next leg of this bull market, which isn’t that far away.

Go Gently

Take care.

Bob Kirtley

Email:bob@gold-prices.biz

www.gold-prices.biz

URL: www.skoptionstrading.com

To stay updated on our market commentary, which gold stocks we are buying and why, please subscribe to The Gold Prices Newsletter, completely FREE of charge. Simply click here and enter your email address. Winners of the GoldDrivers Stock Picking Competition 200

DISCLAIMER : Gold Prices makes no guarantee or warranty on the accuracy or completeness of the data provided on this site. Nothing contained herein is intended or shall be deemed to be investment advice, implied or otherwise. This website represents our views and nothing more than that. Always consult your registered advisor to assist you with your investments. We accept no liability for any loss arising from the use of the data contained on this website. We may or may not hold a position in these securities at any given time and reserve the right to buy and sell as we think fit.

Bob Kirtley Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.