3 Sigma Extremes In the U.S. Treasury Bond Market

Interest-Rates / US Bonds Apr 06, 2015 - 03:54 PM GMTBy: DeviantInvestor

US T-Bond futures closed Friday, March 27 up nearly 12% from the February close. That was the 3rd largest monthly percent move since 1977 when my data begins and created a 3.61 standard deviation change. This is a huge move. What does it mean?

US T-Bond futures closed Friday, March 27 up nearly 12% from the February close. That was the 3rd largest monthly percent move since 1977 when my data begins and created a 3.61 standard deviation change. This is a huge move. What does it mean?

The US T-Bond market peaked on March 25 at an all-time high over 165, up from about 75 in 1990. Bonds move inversely with yields, so yields have dropped to their lowest level ever. This is not surprising because central banks have been monetizing sovereign debt, buying bonds, and supporting the bond and stock markets. Several $Trillion in European sovereign debt currently “pays” negative interest – an extreme condition. The Bank of Japan has aggressively purchased Japanese government bonds as well as Japanese stocks – another extreme example of a bond bubble.

Bonds are priced less on their return and risk of default and more on the current and expected purchases of central banks, which seems crazy. However, central banks are “managing” most markets and have both the means and need to do so. Expect more “management” in coming months.

Examine the log scale chart of the monthly US T-Bonds since 1990.

Note the parallel trend channel since 1990, the over-bought peaks in bonds about every 5 – 6 years, and that current prices have reached the upper trend line. Conclusion: Bonds are over-bought, too expensive, and due to correct. But will they correct? Ask the High Frequency Traders and the central banks – they are insiders and have the motive, means, and opportunity to levitate them further or allow them to crash.

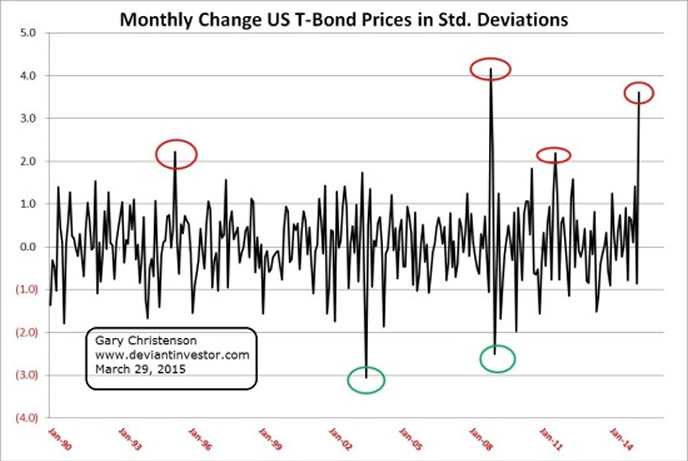

How unusual and extreme was the monthly rise in March 2015? To find out, I took over 450 monthly data points (since 1977), calculated the monthly change as a percentage of price, and divided by the standard deviation of that 450+ database.

Note that monthly price percent changes have exceeded 2 standard deviations only 6 times (4 positive, 2 negative) in the past 25 years. The positive changes were May 1995, November 2008, August 2011, and March 2015. The 2 negative changes were July 2003 and January 2009. What is special about those time periods of extreme bond volatility?

- May 1995 (positive) was the approximate beginning of the NASDAQ bubble when the index broke above 450 on its way to nearly 5,000.

- July 2003 (negative) was the month following a major high in Bonds in June 2003, and a few months after an important low in the S&P in March of 2003.

- November 2008 (positive) was near the end of the 2008 market crash when the S&P plummeted under 750 after reaching over 1,500 the year before. Money left stocks and flooded into bonds causing the huge rise in the bond market.

- January 2009 (negative) was a correction to the bond rally of November and December 2008.

- August 2011 (positive) was the peak in the gold market – an all-time high – and a month in which the S&P dropped 70 points.

- March 2015 (positive) was the all-time peak in the bond market and an important peak in a parabolic rally in the dollar. The S&P hit an all-time high in February, and gold and silver had recently hit important lows in November of 2014.

Conclusion: Bond market extremes often mark important turning points in the S&P and other markets.

WHAT ABOUT CRUDE OIL?

Compare the crude oil bottoms to bond market peaks. The important bond peaks and crude oil bottoms are:

T-Bond Peaks Crude Oil Bottoms

October 1993 December 1993

October 1998 December 1998

December 2008 December 2008 Bonds moved > 3 std. dev.

March 2015 January 2015 (?) Bonds moved > 3 std. dev.

The 3 most important bottoms in crude oil in the last 20 years occurred in December 1998, December 2008, and January 2015. Those crude oil bottoms coincided with T-Bond peaks at the top of the trend channel. Further, the monthly change in T-Bond prices exceeded 3 standard deviations in the last two T-Bond peaks – November 2008 and March 2015. Crude oil strongly rallied after the December 2008 bottom, and the charts suggest it will rally in 2015.

Conclusion: The March 2015 peak in T-Bonds is consistent with the crash in crude oil prices, the peak in the US dollar index, and the peak in the S&P 500. March may be an important turning point in all four markets, in addition to increased trauma relating to Greek debt, war in the Ukraine, war in Yemen, the AIIB (Asian Infrastructure Investment Bank), US credibility, and an acceleration in the use of other (non-dollar) currencies in global trade.

The March 2015 change in T-Bond prices was a (huge) 3.6 standard deviation move – slightly more rare than a golfing “hole-in-one” and slightly more likely than a “perfect” game (27 batters, no walks etc.) in professional baseball. The last 3+ standard deviation move in monthly T-Bond prices occurred in November 2008, during the 2008 stock market crash. Caution is warranted. The global financial system is increasingly leveraged, risky, and appears to be a bubble approaching a “Middle-East or European pin.”

THIS T-BOND MANIA BEGS THE FOLLOWING QUESTIONS:

- After a 3.6 standard deviation spike higher in T-Bonds, would you rather purchase T-bonds or gold?

- After a parabolic rise in the US dollar, commensurate with a 3.6 standard deviation rise in T-bonds, would you rather own fiat dollars or silver?

- After crude oil prices have crashed from $106 last year to about $45 in January, would you want to be short crude oil?

- Do you worry when Janet Yellen says, “cash is not a very convenient store of value.”

- Greenspan recently said, “Gold is a currency. It is still, by all evidence, a premier currency. No fiat currency, including the dollar, can match it.” Do you think this indicates much higher gold prices in 2015 – 2020?

- Do you believe that over $200 Trillion in global debt will ever be repaid? If it can’t be repaid, can it be “rolled over” and increased forever? If not, then what?

- Does a massive default of $Trillions in sovereign debt more closely resemble a refreshing summer breeze or a devastating 9.5 earthquake?

- Are you prepared or are you reaching for yield?

My empirical model shows that an equilibrium price for gold in 2015 is approximately $1,527. Large bank SocGen says gold should average $1,050 in Q4 of 2015 and $925 in 2016. Which is more credible given the global bubbles in debt, currencies, bonds, stocks, and belief in fiat currencies?

GE Christenson aka Deviant Investor If you would like to be updated on new blog posts, please subscribe to my RSS Feed or e-mail

© 2015 Copyright Deviant Investor - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Deviant Investor Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.