Why 2014's Big Investing Winner Is Still Winning in 2015

Interest-Rates / US Bonds Jan 27, 2015 - 04:49 PM GMTBy: DailyWealth

Brett Eversole writes: The BIG winner of 2014 will likely surprise you.

Brett Eversole writes: The BIG winner of 2014 will likely surprise you.

U.S. stocks increased a strong 14% last year. But another, much less interesting, asset crushed stocks. It soared 27%. And still, no one is paying attention.

This same boring asset is up 7% so far this year. And last year's big gains could continue throughout 2015.

Let me explain...

The BIG winner of 2014 was an asset investors universally hated when the year began – long-term U.S. Treasury Bonds.

Market pundits have spent years calling for higher interest rates and lower bond prices in the U.S. But as my colleague Steve Sjuggerud explained last month, these folks could be wrong...

Steve noted that the new Bond King, Jeff Gundlach, is betting on LOWER rates. Jeff sees lower interest rates in places like Spain and France. And that makes U.S. Treasuries a relative value. He expects interest rates to continue falling.

But although Jeff's the new Bond King, he's still in the minority. Investors still uniformly expect higher rates... just like they did a year ago.

At the beginning of 2014, 10-year U.S. Treasuries paid around 3% a year in interest. EVERYONE expected that yield to increase throughout the year. But like most crowded trades, the opposite occurred.

10-year Treasury yields fell from over 3% to just 2.17% at year end. Of course, this happened because everyone bet on higher rates.

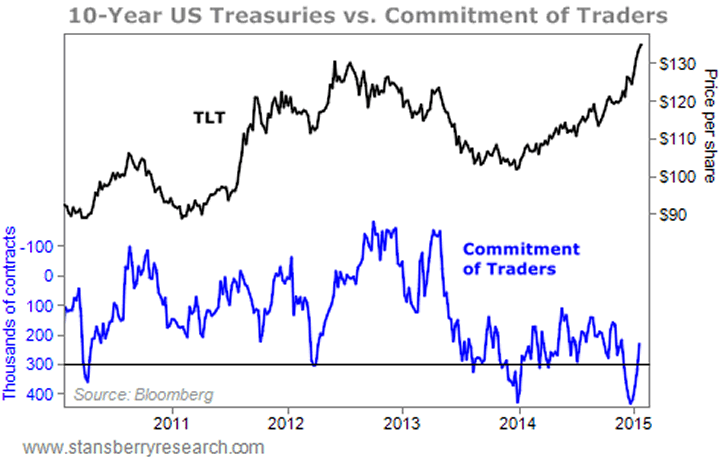

This sentiment showed up in the Commitment of Traders (COT) report for 10-year U.S. Treasuries.

The COT is a report that details the real-money bets of futures traders. When traders all agree – and the COT hits an extreme – it often leads to a reversal in prices.

A year ago, traders' bets on Treasuries were at an extreme... and it led to big gains. The iShares 20+ Year Treasury Bond Fund (TLT) soared 27% throughout the year.

The crazy thing is, even after that enormous return, traders are still uniformly negative on Treasury bonds. Sentiment was just as negative to start 2015 as it was to start 2014. Take a look...

Shares of TLT are already up 7% in 2015... And sentiment is getting less negative, as the chart shows. But that doesn't mean this trade is over...

You see, these trades tend to end when sentiment gets extreme in the other direction... It'll likely end when everyone expects U.S. Treasuries to continue soaring in value. And when everyone expects interest rates to continue falling farther.

We saw that in late 2012. The COT report showed everyone expecting lower rates... And shares of TLT fell 17% over the next nine months. Importantly, we're not there yet...

The COT report shows investors have gotten less negative on Treasuries over the last few weeks. But we're still nowhere near a positive sentiment extreme.

I'm not betting against this trade until investors get "out of whack" in the other direction. Now is NOT the time to bet on higher interest rates... it's time to bet against them.

Good investing,

Brett Eversole

Editor's note: If you'd like more insight and actionable advice from Brett Eversole, consider a free subscription to DailyWealth. Sign up for DailyWealth here and receive a report on the five must-read books on investing. This report wills how you how all of the DailyWealth team's "must read" books, which will help you become a better investor right away. Click here to learn more.

The DailyWealth Investment Philosophy: In a nutshell, my investment philosophy is this: Buy things of extraordinary value at a time when nobody else wants them. Then sell when people are willing to pay any price. You see, at DailyWealth, we believe most investors take way too much risk. Our mission is to show you how to avoid risky investments, and how to avoid what the average investor is doing. I believe that you can make a lot of money – and do it safely – by simply doing the opposite of what is most popular.

Customer Service: 1-888-261-2693 – Copyright 2013 Stansberry & Associates Investment Research. All Rights Reserved. Protected by copyright laws of the United States and international treaties. This e-letter may only be used pursuant to the subscription agreement and any reproduction, copying, or redistribution (electronic or otherwise, including on the world wide web), in whole or in part, is strictly prohibited without the express written permission of Stansberry & Associates Investment Research, LLC. 1217 Saint Paul Street, Baltimore MD 21202

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Daily Wealth Archive

|

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.