US Mortgages, Risky Bisiness "Easy Money"

Housing-Market / US Housing Oct 30, 2014 - 07:53 PM GMTBy: Mike_Whitney

Here we go again.

Here we go again.

Last week, the country’s biggest mortgage lenders scored a couple of key victories that will allow them to ease lending standards, crank out more toxic assets, and inflate another housing bubble. Here’s what’s going on.

On Monday, the head of the Federal Housing Finance Agency (FHFA), Mel Watt, announced that Fannie and Freddie would slash the minimum down-payment requirement on mortgages from 5 percent to 3 percent while making loans more available to people with spotty credit. If this all sounds hauntingly familiar, it should. It was less than 7 years ago that shoddy lending practices blew up the financial system precipitating the deepest slump since the Great Depression. Now Watt wants to repeat that catastrophe by pumping up another credit bubble. Here’s the story from the Washington Post:

“When it comes to taking out a mortgage, two factors can stand in the way: the price of the mortgage,…and the borrower’s credit profile.”

On Monday, the head of the agency that oversees the mortgage giants Fannie Mae and Freddie Mac outlined … how he plans to make it easier for borrowers on both fronts. Mel Watt, director of the Federal Housing Finance Agency, did not give exact timing on the initiatives. But most of them are designed to encourage the industry to extend mortgages to a broader swath of borrowers.

Here’s what Watt said about his plans in a speech at the Mortgage Bankers Association annual convention in Las Vegas:

Saving enough money for a downpayment is often cited as the toughest hurdle for first-time buyers in particular. Watt said that Fannie and Freddie are working to develop “sensible and responsible” guidelines that will allow them to buy mortgages with down payments as low as 3 percent, instead of the 5 percent minimum that both institutions currently require.”

Does Watt really want to “encourage the industry to extend mortgages to a broader swath of borrowers” or is this just another scam to enrich bankers at the expense of the public? It might be worth noting at this point that Watt’s political history casts doubt on his real objectives. According to Open Secrets, among the Top 20 contributors to Watt’s 2009-2010 campaign were Goldman Sachs, Bank of America, Citigroup Inc., Bank of New York Mellon, American bankers Association, US Bancorp, and The National Association of Realtors. (“Top 20 Contributors, 2009-2010“, Open Secrets)

Man oh man, this guy’s got all of Wall Street rooting for him. Why is that, I wonder? Is it because he’s faithfully executing his office and defending the public’s interests or is it because he’s a reliable stooge who brings home the bacon for fatcat bankers and their brood?

This is such a farce, isn’t it? I mean, c’mon, do you really think that the big banks make political contributions out of the kindness of their heart or because they want something in return? And do you really think that a guy who is supported by Goldman Sachs has your “best interests” in mind? Don’t make me laugh.

The reason that Obama picked Watt was because he knew he could be trusted to do whatever Wall Street wanted, and that’s precisely what he’s doing. Smaller down payments and looser underwriting are just the beginning; teaser rates, balloon payments, and liars loans are bound to follow. In fact, there’s a funny story about credit scores in the Washington Post that explains what’s really going on behind the scenes. See if you can figure it out:

“Most housing advocates agree that a bigger bang for the buck would come from having lenders lower the unusually high credit scores that they’re now demanding from borrowers.

After the housing market tanked, Fannie and Freddie forced the industry to buy back billions of dollars in loans. In a bid to protect themselves from further financial penalties, lenders reacted by imposing credit scores that exceed what Fannie and Freddie require. Housing experts say the push to hold lenders accountable for loose lending practices of the past steered the industry toward the highest-quality borrowers, undermining the mission of Fannie and Freddie to serve the broader population, including low- to moderate- income borrowers.

Today, the average credit score on a loan backed by Fannie and Freddie is close to 745, versus about 710 in the early 2000s, according to Moody’s Analytics. And lenders say they won’t ease up until the government clarifies rules that dictate when Fannie and Freddie can take action against them.” (Washington Post)

Can you see what’s going on? The banks have been requiring higher credit scores than Fannie or Freddie.

But why? After all, the banks are in the lending business, so the more loans they issue the more money they make, right?

Right. But the banks don’t care about the short-term dough. They’d rather withhold credit and slow the economy in order to blackmail the government into doing what they want.

And what do they want?

They want looser regulations and they want to know that Fannie and Freddie aren’t going to demand their money back (“put backs”) when they sell them crappy mortgages that won’t get repaid. You see, the banks figure that once they’ve off-loaded a loan to Fannie and Freddie, their job is done. So, if the mortgage blows up two months later, they don’t think they should have to pay for it. They want the taxpayer to pay for it. That’s what they’ve been whining about for the last 5 years. And that’s what Watt is trying to fix for them. Here’s the story from Dave Dayen:

“Watt signaled to mortgage bankers that they can loosen their underwriting standards, and that Fannie and Freddie will purchase the loans anyway, without much recourse if they turn sour. The lending industry welcomed the announcement as a way to ease uncertainty and boost home purchases, a key indicator for the economy. But it’s actually a surrender to the incorrect idea that expanding risky lending can create economic growth.

Watt’s remarks come amid a concerted effort by the mortgage industry to roll back regulations meant to prevent the type of housing market that nearly obliterated the economy in 2008. Bankers have complained to the media that the oppressive hand of government prevents them from lending to anyone with less-than-perfect credit. Average borrower credit scores are historically high, and lenders make even eligible borrowers jump through enough hoops to garner publicity. Why, even Ben Bernanke can’t get a refinance done! (Actually, he could, and fairly easily, but the anecdote serves the industry’s argument.)

(“The Mortgage Industry Is Strangling the Housing Market and Blaming the Government“, Dave Dayen, The New Republic)

Can you see what a fraud this is? 6 years have passed since Lehman crashed and the scum-sucking bankers are still fighting tooth-and-nail to unwind the meager provisions that have been put in place to avoid another system-shattering disaster. It’s crazy. These guys should all be in Gitmo pounding rocks and instead they’re setting the regulatory agenda. Explain that to me? And this whole thing about blackmailing the government because they don’t want to be held responsible for the bad mortgages they sold to the GSE’s is particularly irritating. Here’s more from Dave Dayen:

“After the housing market tanked, Fannie and Freddie forced the industry to buy back billions of dollars in loans. In a bid to protect themselves from further financial penalties, lenders reacted by imposing credit scores that exceed what Fannie and Freddie require. ….And lenders say they won’t ease up until the government clarifies rules that dictate when Fannie and Freddie can take action against them.”

So the industry has engaged in an insidious tactic: tightening lending well beyond required standards, and then claiming the GSEs make it impossible for them to do business. For example, Fannie and Freddie require a minimum 680 credit score to purchase most loans, but lenders are setting their targets at 740. They are rejecting eligible borrowers….so they can profit much more from a regulation-free zone down the line.

So, I ask you, dear reader; is that blackmail or is it blackmail?

And what does Watt mean when he talks about “developing sensible and responsible guidelines’ that will allow them (borrowers) to buy mortgages with down payments as low as 3 percent”?

What a joke. Using traditional underwriting standards, (the likes of which had been used for the entire post-war period until we handed the system over to the banks) a lender would require a 10 or 20 percent down, decent credit scores, and a job. The only reason Watt wants to wave those requirements is so the banks can fire-up the old credit engine and dump more crap-ass mortgages on Uncle Sam. That’s the whole thing in a nutshell. It’s infuriating!

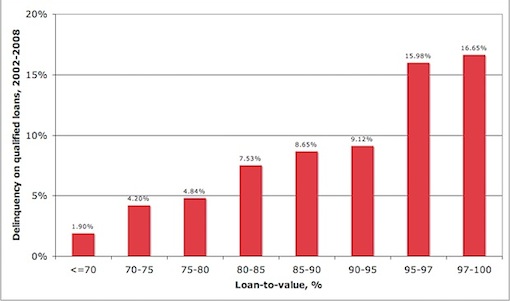

Let me fill you in on a little secret: Down payments matter! In fact, people who put more down on a home (who have “more skin in the game”) are much less likely to default. According to David Battany, executive vice president of PennyMac, “there is a strong correlation between down payments to mortgage default. The risk of default almost doubles with every 1%.”

Economist Dean Baker says the same thing in a recent blog post:

“The delinquency rate, which closely follows the default rate, is several times higher for people who put 5 percent or less down on a house than for people who put 20 percent or more down.

Contrary to what some folks seem to believe, getting moderate income people into a home that they subsequently lose to foreclosure or a distressed sale is not an effective way for them to build wealth, even if it does help build the wealth of the banks.”

(“Low Down Payment Mortgages Have Much Higher Default Rates“, Dean Baker, CEPR)

Now take a look at this chart from Dr. Housing Bubble which helps to illustrate the dangers of low down payments in terms of increased delinquencies:

Data on mortgage delinquencies by downpayment. Source: Felix Salmon

“When the mortgage industry starts complaining about the 14 million people who would be denied the chance to buy a qualified mortgage if they don’t have a 5% downpayment, it’s worth remembering that qualified mortgages for people who don’t have a 5% downpayment have a delinquency rate of 16% over the course of the whole housing cycle.” (“Why a sizable down payment is important“, Dr. Housing Bubble)

So despite what Watt thinks, higher down payments mean fewer defaults, fewer foreclosures, fewer shocks to the market, and greater financial stability.

And here’s something else that Watt should mull over: The housing market isn’t broken and doesn’t need to be fixed. It’s doing just fine, thank you very much. First of all, sales and prices are already above their historic trend. Check it out from economist Dean Baker:

“If we compare total sales (new and existing homes) with sales in the pre-bubble years 1993-1995, they would actually be somewhat higher today, even after adjusting for population growth. While there may be an issue of many people being unable to qualify for mortgages because of their credit history, this does not appear to be having a negative effect on the state of market. Prices are already about 20 percent above their trend levels.” (“Total Home Sales Are At or Above Trend“, Dean Baker, CEPR)

Got it? Sales and prices are ALREADY where they should be, so there’s no need to lower down payments and ease credit to start another orgy of speculation. We don’t need that.

Second, the quality of today’s mortgages ARE BETTER THAN EVER, so why mess with success? Take a look at this from Black Knight Financial Services and you’ll see what I mean:

“Today, the Data and Analytics division of Black Knight Financial Services … released its November Mortgage Monitor Report, which found that loans originated in 2013 are proving to be the best-performing mortgages on record…..

“Looking at the most current mortgage origination data, several points become clear,” said Herb Blecher, senior vice president of Black Knight Financial Services’ Data & Analytics division. “First is that heightened credit standards have resulted in this year being the best-performing vintage on record. Even adjusting for some of these changes, such as credit scores and loan-to-values, we are seeing total delinquencies for 2013 loans at extremely low levels across every product category.”

Okay, so sales and prices are fine and mortgage quality is excellent. So why not leave the bloody system alone? As the saying goes: If it ain’t broke, don’t fix it.

But you know why they’re going to keep tinkering with the housing market. Everyone knows why. It’s because the banks can’t inflate another big-honking credit bubble unless they churn out zillions of shi**y mortgages that they offload onto Fannie and Freddie. That’s just the name of the game: Grind out the product (mortgages), pack it into sausages (securities and bonds), leverage up to your eyeballs (borrow as much as humanly possible), and dump the junk-paper on yield-chasing baboons who think they’re buying triple A “risk free” bonds.

Garbage in, garbage out. Isn’t this how the banks make their money?

You bet it is, and in that regard things have gotten a helluva a lot scarier since last Wednesday’s announcement that the banks are NOT going to be required to hold any capital against the securities they create from bundles of mortgages.

Huh?

You read that right. According to the New York Times: “there will be no risk retention to speak of, at least on residential mortgage loans that are securitized.”

But how can that be, after all, it wasn’t subprime mortgages that blew up the financial system (subprime mortgages only totaled $1.5 at their peak), but the nearly $10 trillion in subprime infected mortgage-backed securities (MBS) that stopped trading in the secondary market after a French Bank stopped taking redemptions in July 2007. (a full year before the crisis brought down Lehman Brothers) . That’s what brought the whole rattling financial system to a grinding halt. Clearly, if the banks had had a stake in those shabby MBS— that is, if they were required to set aside 5 or 10 percent capital as insurance in the event that some of these toxic assets went south– then the whole financial collapse could have been avoided, right?

Right. It could have been avoided. But the banks don’t want to hold any capital against their stockpile of rancid assets, in fact, they don’t want to use their own freaking money at all, which is why 90 percent of all mortgages are financed by Uncle Sugar. It’s because the banks are just as broke as they were in 2008 when the system went off the cliff. Here’s a summary from the New York Times:

“Once upon a time, those who made loans would profit only if the loan were paid back. If the borrower defaulted, the lender would suffer.

That idea must have seemed quaint in 2005, as the mortgage lending boom reached a peak on the back of mushrooming private securitizations of mortgages, which were intended to transfer the risk away from those who made the loans to investors with no real knowledge of what was going on.

Less well remembered is that there was a raft of real estate securitizations once before, in the 1920s. The securities were not as complicated, but they had the same goal — making it possible for lenders to profit without risking capital.

The Dodd-Frank Act of 2010 set out to clean that up. Now, there would be “risk retention.” Lenders would have to have “skin in the game.” Not 100 percent of the risk, as in the old days when banks made mortgage loans and retained them until they were paid back, but enough to make the banks care whether the loans were repaid.

At least that was the idea. The details were left to regulators, and it took more than four years for them to settle on the details, which they did this week.

The result is that there will be no risk retention to speak of, at least on residential mortgage loans that are securitized.

“…..Under Dodd-Frank, the general rule was to be that if a lender wanted to securitize mortgages, that lender had to keep at least 5 percent of the risk…….But when the final rule was adopted this week, that idea was dropped.” (“Banks Again Avoid Having Any Skin in the Game”, New York Times)

No skin in the game, you say?

That means the taxpayer is accepting 100 percent of the risk. How fair is that?

Let’s review: The banks used to lend money to creditworthy borrowers and keep the loans on their books.

They don’t do that anymore, in fact, they’re not really banks at all, they’re just intermediaries who sell their loans to the USG or investors.

This arrangement has changed the incentives structure. Now the goal is quantity not quality. “How many loans can I churn-out and dump on Uncle Sam or mutual funds etc.” That’s how bankers think now. That’s the objective.

Regulations are bad because regulations stipulate that loans must be of a certain quality, which reduces the volume of loans and shrinks profits. (Can’t have that!) Therefore, the banks must use their money to hand-pick their own regulators (“You’re doin’ a heckuva job, Mel”) and ferociously lobby against any rules that limit their ability to issue credit to anyone who can fog a mirror. Now you understand how modern-day banking works.

It would be hard to imagine a more corrupt system.

By Mike Whitney

Email: fergiewhitney@msn.com

Mike Whitney lives in Washington state. He is a contributor to Hopeless: Barack Obama and the Politics of Illusion (AK Press). Hopeless is also available in a Kindle edition. He can be reached at fergiewhitney@msn.com.

© 2014 Copyright Mike Whitney - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Mike Whitney Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.