Fannie Mae Cumulative Defaults and other Mortgage Market Disasters

Housing-Market / US Housing May 08, 2008 - 01:51 AM GMTBy: Mike_Shedlock

Inquiring minds are checking out the Fannie Mae 2008 Q1 10-Q Investor Summary . There are plenty of charts, graphs and other data to consider.

Inquiring minds are checking out the Fannie Mae 2008 Q1 10-Q Investor Summary . There are plenty of charts, graphs and other data to consider.

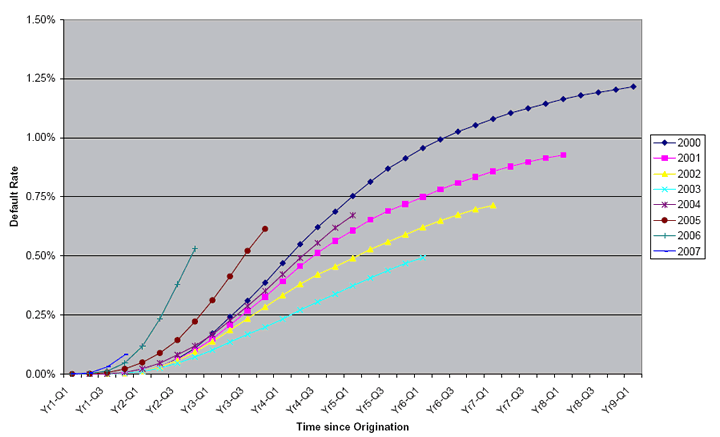

For example, please consider this graph on page 27.

Cumulative Default Rates Overall Originations from 2000 thru 2007

Minyan Peter, former treasurer at a major US bank had this to say:

From experience, vintage data doesn't lie. A group of loans that starts out badly ends badly. And as the chart shows, the most recent vintages are deteriorating faster and to higher levels than older vintages. Further, all of the loss and delinquency data is for a pre-recessionary period.

Professor Kevin Depew was talking about Fannie Mae yesterday in points 1-4 of Tuesday's Five Things . Let's take a look at point number 1.

Fannie Mae Executives Only Ones Surprised by $2.19 Billion Quarterly Loss

Fannie Mae (FNM) this morning reported a wider loss than many analysts estimated, cut its dividend to 25 cents a share and said it will raise $6 billion in capital before it eventually burns to the ground while the Office of Federal Housing Enterprise Oversight plays a fiddle. We're paraphrasing... but only slightly.

Even as Fannie Mae reported a wider-than-expected (for Fannie Mae executives at least, the rest of us seemed to know better) $2.19 billion first quarter loss, the Office of Federal Housing Enterprise Oversight (OFHEO), the regulator that oversees the government-sponsored mortgage giant actually lowered... yes, lowered ... the amount of capital Fannie must hold.

The OFHEO said it will lower requirements for surplus capital to 15% from 20% once the $6 billion in capital is raised, and may reduce it even further to just 10% by September. The move by OFHEO to relax capital surplus requirements for Fannie Mae essentially enables the mortgage-finance company to buy more mortgages and take on even more risk.

"The lowering of the prudential cushion was appropriate in line with the company's progress and with the need to maintain safe and sound operations," OFHEO Director James Lockhart said in a statement , presumably to guard against not being able to maintain a straight face. For if there is one thing we know with absolute certainty, it is this: Fannie Mae is the antithesis of any operation that one could consider "safe and sound." Fannie Mae ignores the effects of foreclosures

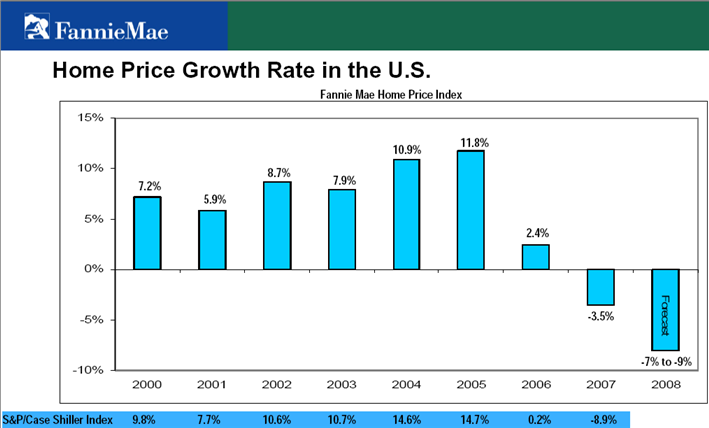

In point number 3 professor Depew pointed out the fine print Fannie Mae's price projections. Here is the chart to consider.

The Fine Print

The S&P/Case-Shiller Index is value-weighted, whereas the Fannie Mae index is unit-weighted; hence the S&P/Case-Shiller index places greater weight on higher cost metropolitan areas.

In addition, the S&P/Case Shiller index includes foreclosure sales; foreclosure sales are excluded from the Fannie Mae index and from this forecast. Foreclosure sales tend to depress the S&P/Case Shiller index relative to the Fannie Mae index.

Fannie Mae does not like the effect foreclosures have on the index so it ignores them.

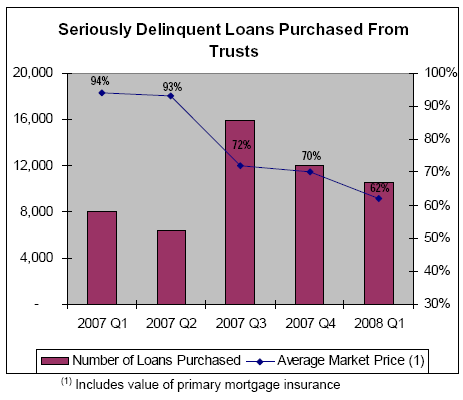

Seriously Delinquent Loan Purchases

Fannie Mae had this to say " Despite a reduction in the number of seriously delinquent loans purchased from MBS trusts, SOP 03-3 losses increased in 2008 Q1 as the average fair value of loans purchased fell from 70% in Q4 2007 to 62% in Q1 2008. "

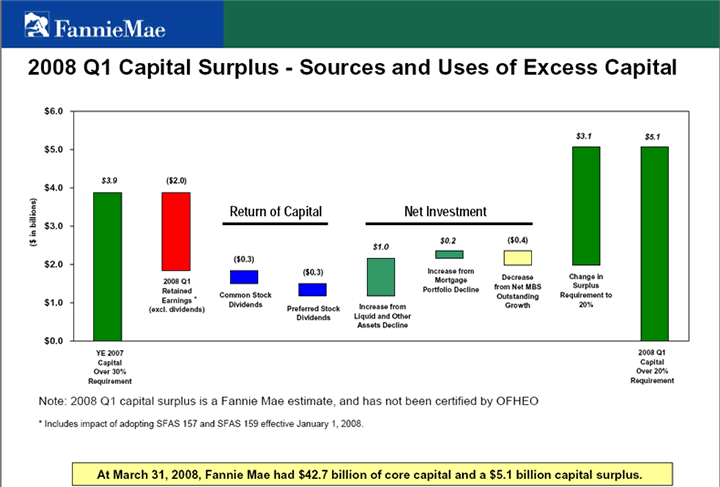

Fannie Mae Capital

Capital Surplus?

Fannie Mae Seems to be bragging about a capital "surplus" of $5.1 billion and $42.7 billion in core capital. Here is another way of looking at things.

- Fannie Mae has $2.7 trillion in loans and only $42.7 billion in capital backing that up.

- Home prices are declining and expected to decline more.

- The US is in a recession and jobs have been lost four consecutive months.

Where did that capital surplus come from?

Fannie Mae had this to say " Capital in excess of the OFHEO mandated 20% surplus increased to$5.1 billion in 2008 Q1 versus $3.9 billion in 2007 Q4 primarily due to the reduction of the surplus requirement from 30% to 20%. "

In other words things are actually getting worse but appear to be getting better because the OFHEO has increased the leverage Fannie Mae is allowed to have. Meanwhile, Fannie Mae, already in an obviously precarious situation on account of leverage and a declining economy is purchasing seriously delinquent loans and thereby compounding its problems.

This is exactly the kind of nonsense that happens when government mandates a solution (GSEs) to a non-problem (home ownership). Government sponsorship of GSEs in conjunction with a Fed micromanaging interest rates created this mess.

The government solution has been to increase the leverage Fannie Mae can take, and propose more power for the Fed. If you have not done so, please consider the Fed Uncertainty Principle and Proposed Fascist Powers For The Fed for an explanation of what is going on.

By Mike "Mish" Shedlock

http://globaleconomicanalysis.blogspot.com

Mike Shedlock / Mish is a registered investment advisor representative for SitkaPacific Capital Management. Sitka Pacific is an asset management firm whose goal is strong performance, low volatility, regardless of market direction. Visit http://www.sitkapacific.com/ to learn more about wealth management for investors seeking strong performance with low volatility. You are currently viewing my global economics blog which has commentary 7-10 times a week. I am a "professor" on Minyanville. My Minyanville Profile can be viewed at: http://www.minyanville.com/gazette/bios.htm?bio=87 I do weekly live radio on KFNX the Charles Goyette show every Wednesday. When not writing about stocks or the economy I spends a great deal of time on photography. I have over 80 magazine and book cover credits. Some of my Wisconsin and gardening images can be seen at www.michaelshedlock.com.

© 2008 Mike Shedlock, All Rights Reserved

Mike Shedlock Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.