U.S. Homeowners Become Renters - Welcome to the Third World America

Housing-Market / US Housing May 17, 2014 - 04:24 PM GMTBy: John_Rubino

This morning’s housing report was huge. As one representative headline put it: “Housing starts up sharply; permits highest since 2008″.

This morning’s housing report was huge. As one representative headline put it: “Housing starts up sharply; permits highest since 2008″.

Dig just a little deeper and it’s still huge, though in a different way. Turns out that all the increase was in apartment building, while single family homes — the linchpin of what used to be thought of as the American Dream — actually fell yet again. Here’s a brief but on-point analysis from the New York Times:

Housing Is Recovering. Single-Family Homes Aren’t

The headlines in the new report on home building activity — which is being closely watched, after many other kinds of data point to a softening in housing — are pretty terrific.The number of permits for new housing units soared 8 percent in April, the Census Bureau said on Friday, to an annualized 1.08 million. And the number of homes on which builders began construction rose a whopping 13 percent, to an annualized 1.07 million. If nothing else, the numbers help assuage fears that the housing industry is losing momentum. It now looks like the rough winter was indeed a major factor holding back home building activity so far this year, and there is now a spring thaw underway.

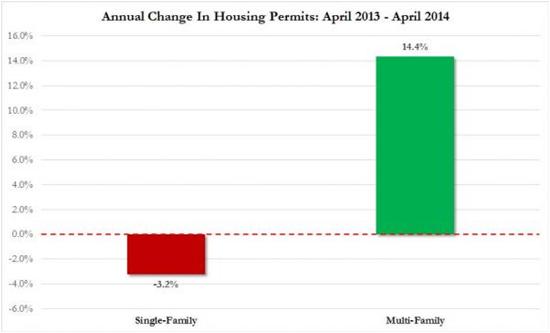

But even in the good new numbers, there is a clear trend evident: The entirety of the improvement is coming from more building of housing in structures with five or more units, most commonly rental apartment buildings.

The number of permits issued for single-family homes rose by a mere 2,000 annualized rate in April, where the number for units in these so-called multifamily structures rose by 81,000. The same story applies for housing starts, where the number of single-family homes rose a measly 5,000, versus 124,000 for multifamily units.

In other words, if you think that this housing recovery involves any meaningful increase in the number of traditional, suburban single-family homes with a yard and picket fence, you have it wrong. The number of single-family homes started is well below its level of late last year and still at February 2013 levels. Multifamily construction, meanwhile, has been soaring throughout the last five years.

Parsing more detailed data available for the first quarter, Jed Kolko, chief economist of real estate firm Trulia, notes on Twitter that 93 percent of the multifamily construction was intended to be rentals, and 89 percent of the units were in buildings with 20 or more units.

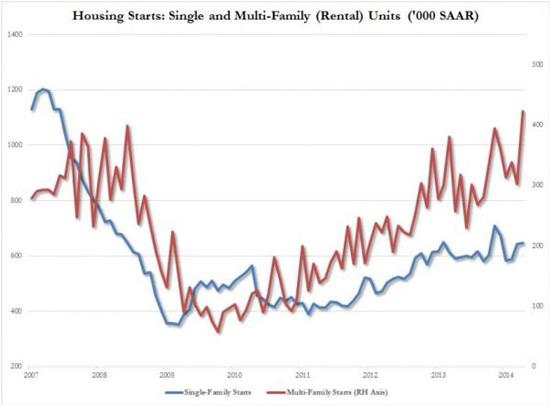

And here are some supporting charts from Zero Hedge:

United Renter States Of America: Spot What’s Wrong With These Housing Charts

The blue line is conventional, single-family housing starts. The red line is “New Normal”, “Blackstone is America’s landlord“:

Some thoughts There are two ways of looking at this:

1) It’s a return to a more rational way of organizing a society in which people who shouldn’t buy houses don’t. Rather than borrowing huge amounts of money against modest incomes and inadequate assets, the typical American family will henceforth rent an apartment or small house until they’ve saved a hefty down payment, say 40%, and proved to themselves and a local bank that their income stream is highly predictable. This kind of world is better for all involved because it avoids the massive, family-disrupting upheavals that now occur with every “housing recession.”

2) It’s yet another signpost on the middle class descent into what used to be thought of as poverty, but is now the new normal. Owning a lot of stuff — house, new SUV, major toys like boats and sports cars — is beyond the reach of more and more families, and in place of this financial freedom-to-act-stupid is something akin to serfdom: dependence on one or several crappy service industry jobs that pay barely enough to cover rent and health insurance; college financed with student loans rather than savings; an inability to save enough to prevent a growing dependency on government and loan-sharky lenders.

In this scenario the US comes to resemble one of those old-style company towns where workers work to survive while their needs are met by dominant, paternalistic entities (government and hedge funds in this case) that charge exorbitant prices and high rates of interest, guaranteeing that most families fall deeper into debt over time.

Where a typical middle class American once had a realistic prospect of paying off their mortgage and thus owning a big, valuable asset free and clear while also saving other money to give themselves a reasonable retirement, both sides of that equation — homeownership and excess income that enables savings — are a thing of the past for a growing number of people.

Unfortunately, explanation number two looks more likely, which means in the absence of a surge of high-paying jobs, this Road to Serfdom will be very busy in the years ahead.

By John Rubino

Copyright 2014 © John Rubino - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.