US Housing Market Is Down For The Count

Housing-Market / US Housing Apr 27, 2014 - 06:55 PM GMTBy: Raul_I_Meijer

Recent news, graphs and data confirm what we have long said would inevitably become clear: the entire global economy appears to have “functioned” through an orgy of refinancing, LBO and M&A lately. That is to say, zombie money has been enthusiastically slushed and re-slushed around to provide commissions, bonuses etc. to bankers and brokers, a process enabled by central bank and government policies in which large amounts of credit were thrown against the wall like so much Jello, hoping – but not demanding – that some would stick. Zero bound interest rates made this process all the more attractive, since it was crucial to lure mom and pop back in. But now, if our eyes don’t receive us, it is reaching its inherent limits. And that’s going to hurt something bad.

Recent news, graphs and data confirm what we have long said would inevitably become clear: the entire global economy appears to have “functioned” through an orgy of refinancing, LBO and M&A lately. That is to say, zombie money has been enthusiastically slushed and re-slushed around to provide commissions, bonuses etc. to bankers and brokers, a process enabled by central bank and government policies in which large amounts of credit were thrown against the wall like so much Jello, hoping – but not demanding – that some would stick. Zero bound interest rates made this process all the more attractive, since it was crucial to lure mom and pop back in. But now, if our eyes don’t receive us, it is reaching its inherent limits. And that’s going to hurt something bad.

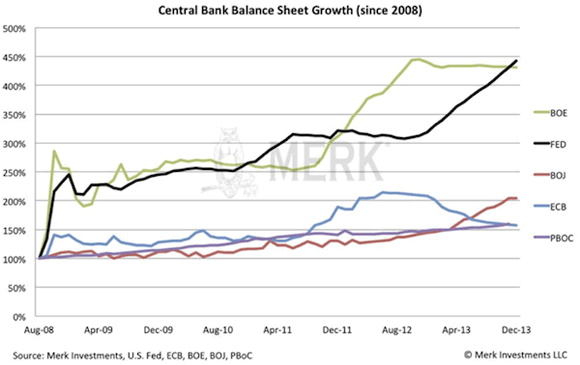

There has been such a flood of numbers in just the past week that it’s hard to choose, and to keep anything I would write on the topic from becoming an entire book. I’ll do my best. Let’s start with a few graphs that John Mauldin posted this weekend, which may seem a bit of a detour when US housing is the subject, but which are vital for understanding just that. First, from Merk, central bank balance sheets growth until January 1 2014. While most of you may be aware of the Fed Balance sheet growth, fewer might know what the Bank of England has been up to: a 200% growth in just one year, from mid-2011 to mid-2012. Note also that the Bank of Japan has been in the QE related game much longer than depicted by the graph’s timeline.

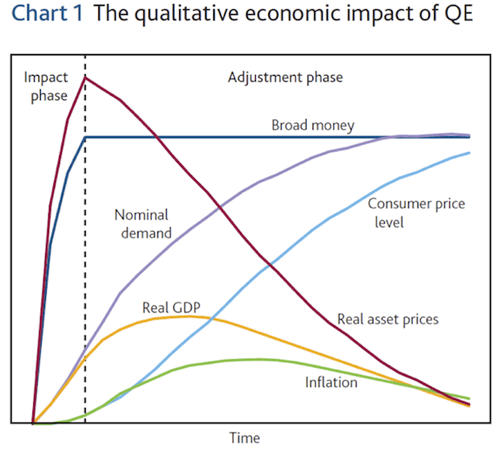

Then, a very interesting graph from the BOE, which dates back to 2011. Take a few real good looks. And realize that the ‘old lady of Threadneedle Street’ knew, as it undertook that 200% growth in its balance sheet, what, let’s put it mildly, the risks were. As an aside, it may be interesting to note how consumer price level and inflation run in opposite directions.

In the article he posted these graphs in, Mauldin says:

In 2011 the Bank of England gave us a paper outlining what they expected to be the consequences of quantitative easing. Note that in the chart below they predict exactly what we have seen. Real (inflation-adjusted) asset prices rise in the initial phase. Nominal demand rises slowly, and there is a lagging effect on real GDP. But note what happens when a central bank begins to flatten out its asset purchases or what is called “broad money” in the graph: real asset prices begin to fall rather precipitously, and consumer price levels rise. I must confess that I look at the graph and scratch my head and go, “I can understand why you might want the first phase, but what in the name of the wide, wide world of sports are you going to do for policy adjustment in the second phase?” Clearly the central bankers thought this QE thing was a good idea, but from my seat in the back of the plane it seems like they are expecting a rather bumpy ride at some point in the future.

I think the key line in that is: “what [..] are you going to do for policy adjustment in the second phase?“, because there doesn’t seem to be any policy available to stop the “second phase”. And that is essential when it comes to US housing (and many other asset classes in the global economy).

Mauldin continues to quote an interview from Finanz und Wirtschaft with William White, the former chief economist of the BIS:

… the fundamental problem we are still facing is excessive debt. Not excessive public debt, mind you, but excessive debt in the private and public sectors. To resolve that, you need restructurings and write-offs. That’s government policy, not central bank policy. Central banks can’t rescue insolvent institutions. All around the western world, and I include Japan, governments have resolutely failed to see that they bear the responsibility to deal with the underlying problems. With the ultraloose monetary policy, governments have no incentive to act. But if we don’t deal with this now, we will be in worse shape than before.

But wouldn’t large-scale debt write-offs hurt the banking sector again? Absolutely. But you see, we have a lot of zombie companies and banks out there. That’s a particular worry in Europe, where the banking sector is just a continuous story of denial, denial and denial. With interest rates so low, banks just keep ever-greening everything, pretending all the money is still there. But the more you do that, the more you keep the zombies alive, they pull down the healthy parts of the economy. When you have made bad investments, and the money is gone, it’s much better to write it off and get 50% than to pretend it’s still there and end up getting nothing.

Do you see outright bubbles in financial markets? Yes, I do. Investors try to attribute the rising stock markets to good fundamentals. But I don’t buy that. People are caught up in the momentum of all the liquidity that is provided by the central banks. This is a liquidity-driven thing, not based on fundamentals.

So are we mostly seeing what the Fed has been doing since 1987 – provide liquidity and pump markets up again? Absolutely. We just saw the last chapter of that long history. This is the last of a whole series of bubbles that have been blown. In the past, monetary policy has always succeeded in pulling up the economy. But each time, the Fed had to act more vigorously to achieve its results. So, logically, at a certain point, it won’t work anymore. Then we’ll be in big trouble. And we will have wasted many years in which we could have been following better policies that would have maintained growth in much more sustainable ways.

The BIS knew, the BOE knew, and there can be no doubt the Fed did too. Obviously, the key line here, “at a certain point, it won’t work anymore”, is essentially the same as Mauldin’s “what [..] are you going to do for policy adjustment in the second phase?“ Any bubble that ever has been blown, or will be, must pop. Or, as Mises put it: ““There is no means of avoiding the final collapse of a boom brought about by credit expansion.”

And at that point we can move on to US housing. First, the withdrawal of LBO funds like Blackrock from the housing market is a major issue. “The nation’s largest landlord” has slowed its purchases from $100 million to $10 million, as Jeffrey Snider writes for Alhambra:

The Q1 Housing Rollover Is Deep And Wide—And A Stinging Rebuke To Monetary Central Planning

In the middle of last week, the Census Bureau estimated that permits to build new single-family homes declined on a year-over-year basis for the second consecutive month. That s the first time we have seen anything like that since the middle of 2011, just before this latest surge in housing began. This week, the National Association of Realtors (NAR) reported another significant decline in existing home sales. After falling 5.1% Y/Y in January (snow, we are told), home sales decreased 7.1% in February (some snow, we are told) and then 7.5% in March (getting ready for next winter?). If that wasn’t enough, the Census Bureau reported on Wednesday that new home sales dropped by a rather stark 12.2% Y/Y, also in March.

Across the state of housing-related finance, there was little surprise to see quarterly bank reports for the first quarter show heavy, massive declines in mortgage finance. Originations at Wells Fargo (-67%), JP Morgan Chase (-68%) and Bank of America (-63%) were a cumulative $185 billion in the first quarter of 2013, but a mere $61.9 billion in this latest quarter. Most of that conclusive cessation of mortgage lending is attributable to refinancing, but more than a fair amount was once lent on the basis of home purchasing intentions.

Total MBS issuance in June 2013 was $185.5 billion, but the latest figures for March show a 53% decline to only $87.2 billion. Institutional buying of property, as you might surmise from that last sentence, has attained more than whispers of dramatic retrenchment, becoming further and actual anecdotes. In California, the largest REO-to-rent firms, those with direct access to QE’s primary magnanimity , have scaled back purchase activity by as much as 70% in recent months. Blackstone, now the nation’s largest landlord, has condensed its purchase pace in California by as much as 90%; 70% overall from last year’s peak pace of more than $100 million per week.

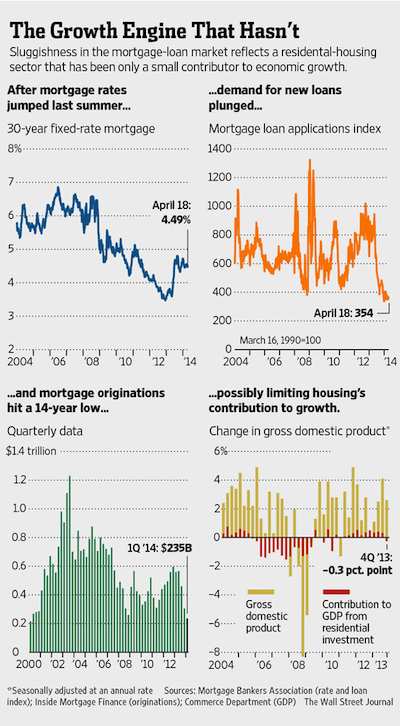

Blackstone is an all-cash buyer, no mortgages involved. So when we see that mortgages, too, are plunging, that’s a double whammy. Moreover, new home sales were reported to have plummeted 14.5% in March (13.3% YoY), to an eight month low, and refinancing is MIA. All in all, US housing looks to be in, say, a bit of a pickle. And with it everyone who’s taken on debt to purchase a house. The Wall Street Journal:

Demand for Home Loans Plunges: Mortgages at 14-Year Low

Mortgage lending declined to the lowest level in 14 years in the first quarter as homeowners pulled back sharply from refinancing and house hunters showed little appetite for new loans, the latest sign of how rising interest rates have dented the housing recovery.

Lenders originated $235 billion in mortgage loans during the January-March quarter, down 58% from the same period a year ago and down 23% from the fourth quarter of 2013, according to industry newsletter Inside Mortgage Finance. The decline shows how the mortgage market is experiencing its largest shift in more than a decade as an era of generally falling interest rates that began in 2000 appears to have run its course. [..] The decline in mortgage lending last quarter stemmed almost entirely from the slide in refinancing. [..] Applications for purchase mortgages last week ran nearly 18% below the level of a year ago, even as the average loan amount on new applications hit a record of $280,500 [..]

By Raul Ilargi Meijer

Website: http://theautomaticearth.com (provides unique analysis of economics, finance, politics and social dynamics in the context of Complexity Theory)

Raul Ilargi Meijer Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.