Bond Market Investing - Not All Debt Is Created Equal

Interest-Rates / US Bonds Apr 25, 2014 - 04:03 AM GMTBy: Don_Miller

Optimal diversification: We all want it. Diversification is, after all, the holy grail of portfolio management. Our senior research analyst Andrey Dashkov has said that many times before, and he echoes that refrain in his editorial guest spot below.

Optimal diversification: We all want it. Diversification is, after all, the holy grail of portfolio management. Our senior research analyst Andrey Dashkov has said that many times before, and he echoes that refrain in his editorial guest spot below.

A brief note before I hand over the reins to Andrey. The last time the market tanked, many of my friends suffered huge losses. They all thought their portfolios were well diversified. Many held several mutual funds and thought their plans were foolproof. Sad to say, those funds dropped in tandem with the rapidly falling market. Our readers need not suffer a similar fate.

Enter Andrey, who’s here to explain what optimal diversification is and to share concrete tools for implementing it in your own portfolio.

Take it away, Andrey…

Floating-Rate Funds Bolster Diversification

By Andrey Dashkov

Floating-rate funds as an investment class are a good diversifier for a portfolio that includes stocks, bonds, and other types of investments. Here’s a bit of data to back that claim.

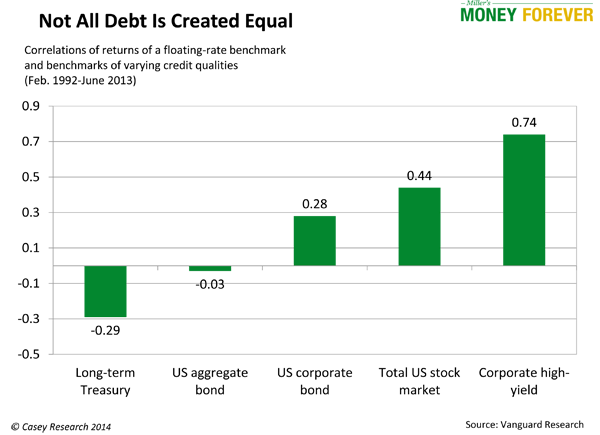

The chart below shows the correlation of floating-rate benchmark to various subsets of the debt universe.

As a reminder, correlation is a measure of how two assets move in relation to each other. This relationship is usually measured by a correlation coefficient that ranges from -1 to +1. A coefficient of +1 says the two securities or asset types move in lockstep. A coefficient of -1 means they move in opposite directions. When one goes up, the other goes down. A correlation coefficient of 0 means they aren’t related at all and move independently.

Why Correlation Matters

Correlation matters because it helps to diversify your portfolio. If all securities in a portfolio are perfectly correlated and move in the same direction, we are, strictly speaking, screwed or elated. They’ll all move up or down together. When they win, they win big; and when they fall, they fall spectacularly. The risk is enormous.

Our goal is to create a portfolio where securities are not totally correlated. If one goes up or down, the others won’t do the same thing. This helps keep the whole portfolio afloat.

As Dennis mentioned, diversification is the holy grail of portfolio management. We based our Bulletproof strategy on it precisely because it provides safety under any economic scenario. If inflation hits, some stocks will go up, while others will go down or not react at all.

You want to hold stocks that behave differently. Our mantra is to avoid catastrophic losses in any investment under any scenario, and the Bulletproof strategy optimizes our odds of doing just that.

When “Weak” is Preferable

Now, a correlation coefficient may be calculated between stocks or whole investment classes. Stocks, various types of bonds, commodities—they all move in some relationship to one another. The relationship may be positive, negative, strong, weak, or nonexistent. To diversify successfully and make our portfolio robust, we need weak relationships. They make it more likely that if one group of investments moves, the others won’t, thereby keeping our whole portfolio afloat.

Now, back to our chart. It shows the correlation between investment types in relation to floating-rate funds of the sort we introduced into the Money Forever portfolio in January. For corporate high-yield debt, for example, the correlation is +0.74. This means that in the past there was a strong likelihood that when the corporate high-yield sector moved up or down, the floating-rate sector moved in the same direction. You have to remember that correlation describes past events and can change over time. However, it’s a useful tool to look at how closely related investment types are.

I want to make three points with this chart:

- Floating-rate loans are closely connected to high-yield bonds. The debt itself is similar in nature: credit ratings of the companies issuing high-yield notes or borrowing at floating rates are close; both are risky (although floating-rate debt is less so, and recoveries in case of a default are higher).

Floating-rate funds as an investment class are not as good a diversifier for a high-yield portfolio. They can, on the other hand, provide protection against rising interest rates. When they go up, the price of floating-rate instruments remains the same, while traditional debt instruments lose value to make up for the increase in yield. - Notice that the correlation to the stock market is +0.44. If history is a guide, a falling market will have less effect on our floating-rate investment fund.

- The chart shows that floating-rate funds serve as an excellent diversifier for a portfolio that’s reasonably mixed and represents the overall US aggregate bond market. The correlation is close to zero: -0.03. This means that movements of the overall US bond market do not coincide with the movements of the floating-rate universe.

Imagine two people walking down a street, when one (the overall debt market) turns left, the other (floating-rate funds) would stop, grab a quick pizza, get a message from his friend, catch a cab, and drive away. No relationship at all… at least, not in the observed time period. This is the diversification we’re looking for.

Floating-rate funds provide a terrific diversification opportunity for our portfolio. This gives us safety, and that is the key takeaway.

Our Bulletproof income portfolio offers a number of options for diversification above and beyond what’s mentioned here. You can learn all about our Bulletproof Income – and the other reasons it’s such an important one for seniors and savers – here.

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Casey Research Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.