U.S. Housing Market One Chart Says it All

Housing-Market / US Housing Mar 22, 2014 - 05:53 PM GMTBy: Mike_Whitney

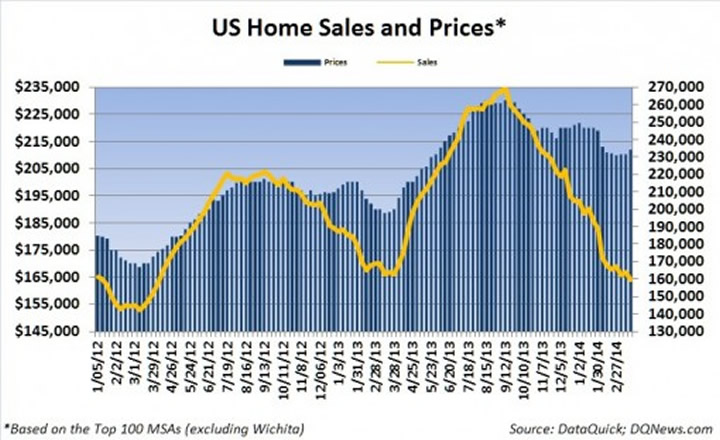

Get a load of this chart from DataQuick’s National Home Sales Snapshot. It’ll tell you everything need to know about housing.

Get a load of this chart from DataQuick’s National Home Sales Snapshot. It’ll tell you everything need to know about housing.

(Note: MSA=metropolitan statistical area)

As you can see, prices are flatlining or drifting lower while sales are sinking like a stone. That’s the whole ball of wax, isn’t it?

Sure, sales will increase in the spring (as they always do), but judging by the sharp dropoff in last year’s hottest markets, this could be the crappiest spring selling season since the crash.

Why?

Because prices are too high, rates are too high, “organic” demand is too weak, credit is too tight, and the pool of potential buyers has shrunk to the size of a walnut, that’s why.

The banks have reduced the percentage of distressed homes (foreclosures and short sales) on the market to roughly 11 percent from 59 percent in 2009. Fewer distressed homes mean higher prices, but higher prices mean fewer sales. It’s a trade-off. The banks get their money, but the market goes to hell. That’s how it works. According to most estimates, there are roughly 4.5 million homes in some stage of foreclosure. That means that –at the present pace–we should get through this Housing Depression a few weeks before Judgment Day. But don’t hold me to that.

Did you catch this gem on Bloomberg last week? It’s about the big private equity guys exiting the market. Take a look:

“Blackstone Group LP is slowing its purchases of houses to rent amid soaring prices after a buying binge made it the biggest U.S. single-family home landlord. Blackstone’s acquisition pace has declined 70 percent from its peak last year, when the private equity firm was spending more than $100 million a week on properties, said Jonathan Gray, global head of real estate for the New York-based firm…

“The institutional wave has passed,” Gray, who oversees almost $80 billion in property investments, said in a telephone interview. ‘It’s at a much lower level than it was 12 or 24 months ago.’

Private-equity firms, hedge funds, real estate investment trusts and other institutional investors have spent more than $20 billion to buy as many as 200,000 rental homes in the last two years. They snapped up properties after prices fell as much as 35 percent from the 2006 peak…

American Homes 4 Rent and Colony American Homes, the second- and third-largest single-family landlords, also have been scaling back as bargains dry up…

“We’re going to have to probably slow down a little bit on our acquisition pace until we have a better view or actual certainty of the capital being available,” (Chief Executive Officer David ) Singelyn said.

Colony Financial Inc. (CLNY), a REIT that invests in Colony American Homes, slowed its funding for acquisitions last year to focus on improving operations, CEO Richard Saltzman said in a November conference call…

American Residential Properties Inc. (ARPI), a landlord with 6,000 homes, slowed acquisitions by almost half in its latest quarter ending Dec. 31. It invested $104 million in 633 homes compared with $204 million on 1,251 homes in the previous quarter, the Scottsdale, Arizona-based company said in a statement.” (Blackstone’s Home Buying Binge Ends as Prices Surge, Bloomberg)

Okay, so the speculators are getting out of housing. How’s that going to effect the market?

No one really knows yet, but it can’t be good, after all, all-cash deals amounted to nearly 50 percent of all homes sales in many of the hotter markets last year. That’s why prices went up even though the economy was still in the shitter, because the fatcats were loading up on cheap real estate. Now it looks like they’re headed for the hills. That’s NOT going to be good for sales.

Did you know that existing home sales have dropped for six months straight, dipping below trend to the same level they were at in 1998?

But how can that be, you ask, when everyone’s blabbing about the recovery? How can that be when the Fed has purchased more than $1.4 trillion in mortgage-backed securities (MBS) and rates are a measly 4.5%? How can that be prices have been climbing higher for more than a year?

Sales are dropping because millions of people are underwater on their mortgages and can’t afford to move. Millions more are stuck in their homes and aren’t paying anything at all. Millions more have student debt up to their eyeballs and will probably never own a home. And millions more still can’t find a job. That’s why home sales are plunging, because the economy stinks. It’s that simple. Sure, the market got a nice little bump from Bernanke’s $4 trillion liquidity-surge. Big whoop. Besides, that was 2012-2013. Today things are different. Today the Fed is winding down QE and there’s even talk of rate-hike. How do you think that’s going to impact sales?

Now get a load of this from Redfin:

“Home sales continued to be sluggish in February, and decreasing affordability is holding back would-be buyers, according to Redfin…. Slow sales have been largely attributed to low inventory for months, but many markets have now seen inventory rise while sales continue to fall. Several markets along the West Coast have seen sharp increases in inventory, yet home sales in the West fell 13.4 percent year over year, hitting their lowest point in five years in the first two months of 2014, while prices rose 19.1 percent year over year…

West Coast Sales Hit Lowest Point in Five Years

– In Redfin’s West Coast markets, sales fell 13.4% from February 2013, and hit a five-year low in the first two months of 2014. Sales fell most dramatically in Las Vegas (-22.7%), Sacramento (-21.8%) and Ventura (-20.8%). Across 19 markets, sales fell 10.3%, with markets east of the Rockies taking a less dramatic hit and a few even seeing modest increases.” (Redfin)

Did you catch that part about “inventory rising while sales continue to fall”?

For months, the media has been using the “low inventory” excuse for the rotten sales figures. Now they’ve moved onto “bad weather” to pull the wool over people’s eyes. Talk about a lame excuse. It’s been in the 70 and 80s in California for most of the winter and sales are down by a whopping 13 percent. Are potential buyers staying at home because they’re afraid of getting skin cancer? Is that it? (That’ll probably be the next excuse.)

So why ARE home sales tanking?

It’s because you can’t buy a house if you’re working graveyard at Freddie’s Burger Bar for $8.50 an hour. It’s because you can’t put together a 20% down-payment if you’re camped out on Mom’s sofa in the attic along with Uncle Murray’s trombone and your Dad’s photo collection of soup cans. It’s because you can’t qualify for a mortgage when 100 percent of your weekly paycheck goes to paying the VISA, filling the gas-tank, and buying a few groceries at Danny’s Discount Foodmart. It can’t be done.

That’s what’s really going on. That’s why the share of firsttime homebuyers is currently at its lowest level ever. That’s why purchase applications are at an 18-year low. That’s why the homeownership rate has slipped to levels not seen since 1995. And that’s why mortgage originations were down almost 60 percent year-over-year. It’s because the economy sucks. Everyone knows it.

Now take a look at one last chart. It’s by Logan Mohtashami at dshort.com. from an article titled, Mortgage Purchase Applications Running Out Of Time.

As you can see, there’s a pretty close connection between incomes (the green line) and the mortgage purchase applications index. (The people who can afford to buy homes.)

Surprised?

Of course not, because most people assume there’s a relationship between ‘what a person earns’ and his ‘ability to buy a home’. After all, we haven’t always lived in this bizarro credit-addled world where anyone who can sit upright in a chair and sign his name on the dotted line can buy a $450,000 rambler in Orchard Hills. That’s a fairly new development.

And that brings us to the point of this article, which is to show that all the monetary hocus pocus has achieved nothing. The Fed’s Koolaid infusions have been a dead-loss. The market is still flat on its back. Kaput. Which shows, that if you want to fix housing, you have to fix the economy. And if you want to fix the economy; you have to put people back to work and pay them a fair wage. It’s that simple.

So why can’t anyone in Washington figure it out?

(Note: As this article was going to press, the latest “existing home sales” data was released.) According to USA Today:

“Existing home sales slowed again in February, falling to the lowest pace in 19 months.”

So February was even slower than the coldest month of the year, January?

Unbelievable.

By Mike Whitney

Email: fergiewhitney@msn.com

Mike Whitney lives in Washington state. He is a contributor to Hopeless: Barack Obama and the Politics of Illusion (AK Press). Hopeless is also available in a Kindle edition. Whitney’s story on declining wages for working class Americans appears in the June issue of CounterPunch magazine. He can be reached at fergiewhitney@msn.com.

© 2014 Copyright Mike Whitney - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Mike Whitney Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.