A Second Look at U.S. Savings Bonds

Interest-Rates / US Bonds Feb 13, 2014 - 03:26 PM GMTBy: Don_Miller

If you remember bond drives in school, please raise your hand. There are still a lot of us out there. I recall my teacher holding up a US Savings Bond, encouraging us to tell our parents to buy them. She went to great lengths emphasizing that they were the "the safest investment on earth."

If you remember bond drives in school, please raise your hand. There are still a lot of us out there. I recall my teacher holding up a US Savings Bond, encouraging us to tell our parents to buy them. She went to great lengths emphasizing that they were the "the safest investment on earth."

That same teacher gave us ten new words each week that we had to spell and define. "Safe" and "risk" both had their day. Here is how Merriam-Webster defines them:

safe

adjective \sāf\

: not able or likely to be hurt or harmed in any way : not in danger

: not able or likely to be lost, taken away, or given away

risk

noun \risk\

: the possibility that something bad or unpleasant (such as an injury or a loss) will happen

Safety is the absence of risk. When we lived in Texas, we had to take our cars in for a safety inspection. The inspector would hook up a computer and out came a checklist of items with a pass or fail mark. It's time to do a safety inspection for those high-quality bonds considered "the safest investments on earth."

Risk #1: Default. The risk that a loan won't be repaid is the primary risk when lending money to anyone. When it comes to bonds, rating agencies judge that risk for you. The safest way to lend—in terms of getting your money back, anyway—is with federal government bonds or certificates of deposit, which are federally insured.

Corporate bonds are rated with a series of letters beginning with AAA. Anything below the B-ratings are generally not considered investment grade and are commonly referred to as junk bonds. If an investor sticks to AAA bonds, they will earn a little higher interest than they would with US Treasuries to make up for the increased default risk; however, that risk is very low, generally less than 0.5%, on average.

A person buying a US government bond or AAA corporate bond has close to a 100% probability of being paid back with interest. Check off the first item on the inspection sheet. PASS!

Risk #2: Inflation protection. The interest rates paid by a bond (net after income taxes), must be higher than the inflation rate throughout its life. If not, when our principal is returned and added to the interest received, our buying power will be less than it was before we bought the bond. How big of a risk can that be?

In a recent article, we looked at the high inflation during the Carter administration. We took a hypothetical investor who bought a $100,000, 5-year, 6% CD on January 1, 1977. He was in the 25% tax bracket. At the end of five years, the balance on the account was $124,600. While it sounds like more money, his buying power had actually dropped by 25.9% because of inflation.

If, on January 1, 1977, a luxury car cost $25,000, he had enough to buy four of them. Assuming the price of that car rose with inflation, it would have cost $37,500 five years later; he would have had enough for just three with a little gas money left over. I realize no one needs three or four luxury cars, but you get the picture.

Inflation feeds the illusion of wealth, but it is just that: an illusion. If your retirement nest egg does not keep up, you are getting poorer by the day. This is called "negative real rates."

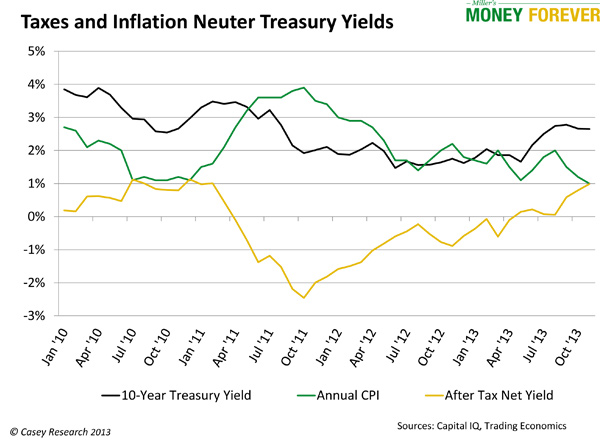

Losing ground to inflation happens with high inflation and/or very low interest rates. The following chart shows the ten-year Treasury rates compared to the inflation rate and the net yield to the investor after taxes (assuming 25% tax rate).

Unlike the days when bonds paid 6% or more, since 2010, low-interest, 10-year Treasuries have not kept up with inflation. Currently, 10-year Treasuries are paying 2.77% and 30-year issues are paying 3.80%.

We need to red flag this one. The "safest investment on earth" is a surefire loser for seniors and savers. Do you want to invest your money for 10 to 30 years in Treasuries knowing you will lose buying power to inflation the minute you buy them, and possibly lose even more in the future? Obviously not! FAIL.

Risk #3: Loss of resale value in the aftermarket. Let's take a look at corporate bonds to better understand this concern. Currently 10-year AAA corporate bonds are paying 3.75%. If we invested $10,000, we would receive $375.00 in interest every year. Now suppose the market interest rates change, which they will. Should we want to sell our bond in the aftermarket, we have to adjust our aftermarket selling price to the competition—meaning bonds offering the current market interest rates.

Should interest rates drop, our bond will be worth more because we have a higher-than-market rate and should receive a premium. If interest rates rise, our resale value drops and we are left with two choices: we can sell the bond at a discounted price, or we can hold it to maturity and receive interest at a below-market rate.

How radically could our resale value drop? The term used for calculation is "duration." The duration of a 10-year AAA bond paying 3.75% interest is currently 8.38. In the resale market, it serves as a rule of thumb. If interest rates rise by 1%, you can expect to discount your bond by $838.00 to sell it—that is over two years of interest payments. By comparison, if there were only five years remaining, the duration drops to 4.58, meaning you would have to discount it by $458.00.

Can anyone guarantee interest rates, which are historically low, are going to remain that way for the life of a long-term bond? With the Federal Reserve flooding the banks with money, how much longer before our international creditors are going to demand higher interest rates to hold US dollars? Safety is the absence of potential loss or harm. It's clear that potential for loss or harm is present, not absent, in today's world.

Grade for Risk #3: FAIL.

Combining inflation and interest-rate risk. The real challenge is guessing what might happen to inflation and interest rates during the life of the bond. Here is what happened to inflation during the Carter years:

- 1977—6.5% inflation

- 1978—7.6% inflation

- 1979—11.3% inflation

- 1980—13.5% inflation

- 1981—10.3% inflation

What happened to interest rates? The prime rate reached 21.5% in December 1980, the highest rate in US history. If you held long-term bonds prior to 1977, then you had to choose between large inflation losses or huge losses if you had tried to liquidate your low-interest bonds in the aftermarket. Seniors and savers attempting to protect their nest eggs are trying to avoid those sorts of catastrophic results.

At the time, investors buying higher-than-inflation interest rate bonds did very well. The current 3.75% rate is well below the interest rates that were available during that time frame. When interest rates rise well above the inflation rate, the safety scales will once again tilt in our favor.

Don't let the high rating or federally insured label fool you. If a broker or fund salesperson is trying to sell you safe investments, ask them to clearly define the word "safe." Does it include all three factors mentioned above?

Don't judge a bond on the credit rating alone. While you may have an almost 100% probability of return of your money, the potential for inflation loss or early liquidation losses must be factored into your investment decisions.

Why have bonds changed so radically? A decade ago, bonds were a central part of any retirement nest egg. A retirement portfolio would not be complete without a balance of top-quality Treasuries and corporate bonds paying 6% or more. They did much of the heavy lifting and were considered the epitome of safety—particularly when compared to the volatile stock market.

Negative interest rates, however, have significantly elevated the risk on low-rate, fixed-income investments. As a result, investors are forced into the stock market in order to protect their nest eggs. Swinging the pendulum too far in the other direction is just transferring our capital from one high-risk investment to another. At the end of the day, we still have too much risk. There is a better way.

What is our winning strategy? Just because high-rated, low-yielding, long-term bonds are surefire losers in today's market does not mean we should avoid bonds all together. Quite the contrary, we just have to use the right criteria to evaluate and pick them. There are literally thousands of types of bonds available in the market today, and many of them can fit nicely into your retirement portfolio.

Our team of analysts has done their homework and found excellent opportunities that meet all three checkpoints with excellent passing grades. How? By following Doug Casey's rule to look where no one else is looking.

You can learn more about our "winning approach" by downloading your free copy of our timely special report, Bond Basics. Click here to begin reading your copy now.

© 2014 Copyright Casey Research - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Casey Research Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.