U.S. Housing Market Flipped, Warped Distorted and Manipulated

Housing-Market / US Housing Feb 03, 2014 - 11:49 AM GMTBy: James_Quinn

The report from RealtyTrac last week proves beyond the shadow of a doubt the supposed housing market recovery is a complete and utter fraud. The corporate mainstream media did their usual spin job on the report by focusing on the fact foreclosure starts in 2013 were the lowest since 2007. Focusing on this meaningless fact (because the Too Big To Trust Wall Street Criminal Banks have delayed foreclosure starts as part of their conspiracy to keep prices rising) is supposed to convince the willfully ignorant masses the housing market is back to normal. It’s always the best time to buy!!!

The report from RealtyTrac last week proves beyond the shadow of a doubt the supposed housing market recovery is a complete and utter fraud. The corporate mainstream media did their usual spin job on the report by focusing on the fact foreclosure starts in 2013 were the lowest since 2007. Focusing on this meaningless fact (because the Too Big To Trust Wall Street Criminal Banks have delayed foreclosure starts as part of their conspiracy to keep prices rising) is supposed to convince the willfully ignorant masses the housing market is back to normal. It’s always the best time to buy!!!

The talking heads reading their teleprompter propaganda machines failed to mention that distressed sales (short sales & foreclosure sales) rose to a three year high of 16.2% of all U.S. residential sales, up from 14.5% in 2012. The economy has been supposedly advancing for over four years and sales of distressed homes are at 16.2% and rising. The bubble headed bimbos on CNBC don’t find it worthwhile to mention that prior to 2007 the normal percentage of distressed home sales was less than 3%. Yeah, we’re back to normal alright. We are five years into a supposed economic recovery and distressed home sales account for 1 out of 6 all home sales and is still 500% higher than normal.

The talking heads reading their teleprompter propaganda machines failed to mention that distressed sales (short sales & foreclosure sales) rose to a three year high of 16.2% of all U.S. residential sales, up from 14.5% in 2012. The economy has been supposedly advancing for over four years and sales of distressed homes are at 16.2% and rising. The bubble headed bimbos on CNBC don’t find it worthwhile to mention that prior to 2007 the normal percentage of distressed home sales was less than 3%. Yeah, we’re back to normal alright. We are five years into a supposed economic recovery and distressed home sales account for 1 out of 6 all home sales and is still 500% higher than normal.

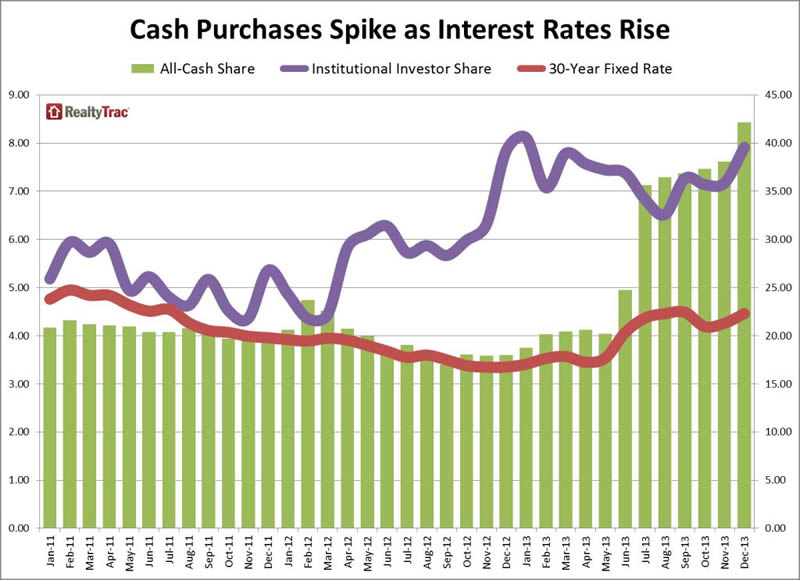

The distressed sales aren’t even close to the biggest distortion of this housing market. The RealtyTrac report reveals that all-cash purchases accounted for 42% of all U.S. residential sales in December, up from 38% in November, and up from 18% in December 2012. Does that sound like a trend of normalization? There were five states where all-cash transactions accounted for more than 50% of sales in December – Florida (62.5%), Wisconsin (59.8%), Alabama (55.7%), South Carolina (51.3%), and Georgia (51.3%). In the pre-crisis days before 2008, all-cash sales NEVER accounted for more than 10% of all home sales. NEVER. This is all being driven by hot Wall Street money, aided and abetted by Bernanke, Yellen and the rest of the Fed fiat heroine dealers.

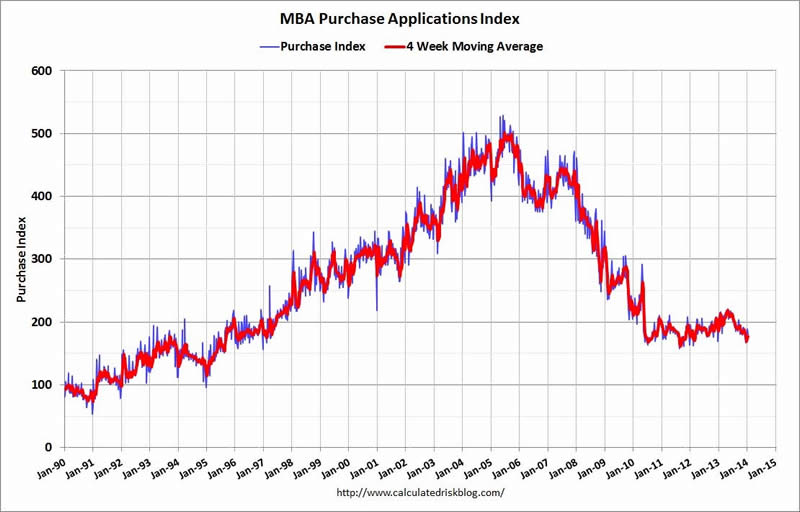

The fact that Wall Street is running this housing show is borne out by mortgage applications languishing at 1997 levels, down 65% from the 2005 highs. Real people in the real world need a mortgage to buy a house. If mortgage applications are near 16 year lows, how could home prices be ascending as if there is a frenzy of demand? Besides enriching the financial class, the contrived elevation of home prices and the QE induced mortgage rate increase has driven housing affordability into the ground. First time home buyers account for a record low percentage of 27%. In a normal non-manipulated market, first time home buyers account for 40% of home purchases.

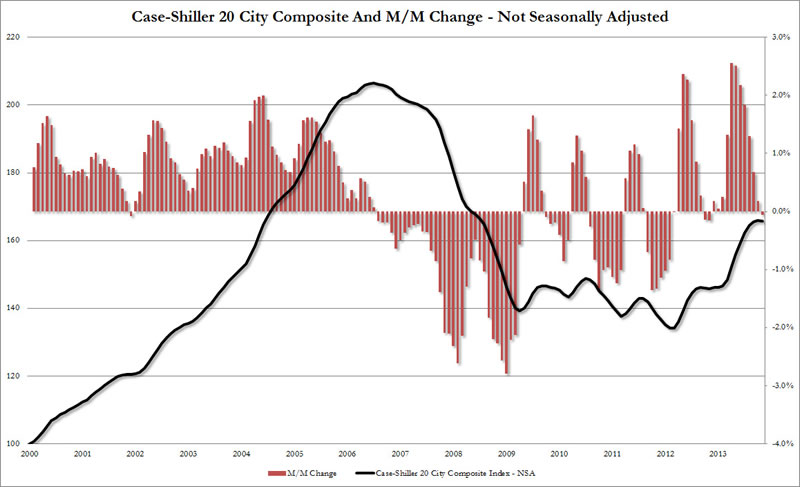

Price increases that rival the peak insanity of 2005 have been manufactured by Wall Street shysters and the Federal Reserve commissars. Doctor Housing Bubble sums up the absurdity of this housing market quite well.

The all-cash segment of buyers has typically been a tiny portion of the overall sales pool. The fact that so many sales are occurring off the typical radar suggests that the Fed’s easy money eco-system has created a ravenous hunger with investors to buy up real estate. Why? The rentier class is chasing yields in every nook and cranny of the economy. This helps to explain why we have such a twisted system where home ownership is declining yet prices are soaring. What do we expect when nearly half of sales are going to investors? The all-cash locusts flood is still ravaging the housing market.

The Case-Shiller Index has shown price surges over the last two years that exceed the Fed induced bubble years of 2001 through 2006. Does that make sense, when new homes sales are at levels seen during recessions over the last 50 years, and down 70% from the 2005 highs? Even with this Fed/Wall Street induced levitation, existing home sales are at 1999 levels and down 30% from the 2005 highs. So how and why have national home prices skyrocketed by 14% in 2013 after a 9% rise in 2012? Why are the former bubble markets of Las Vegas, Los Angeles, San Diego, San Francisco and Phoenix seeing 17% to 27% one year price increases? How could the bankrupt paradise of Detroit see a 17.3% increase in prices in one year? In a normal free market where individuals buy houses from other individuals, this does not happen. Over the long term, home prices rise at the rate of inflation. According to the government drones at the BLS, inflation has risen by 3.6% over the last two years. Looks like we have a slight disconnect.

This entire contrived episode has been designed to lure dupes back into the market, artificially inflate the insolvent balance sheets of the Too Big To Trust banks, enrich the feudal overlords who have easy preferred access to the Federal Reserve easy money, and provide the propaganda peddling legacy media with a recovery storyline to flog to the willingly ignorant public. The masses desperately want a feel good story they can believe. The ruling class has a thorough understanding of Edward Bernays’ propaganda techniques.

“The conscious and intelligent manipulation of the organized habits and opinions of the masses is an important element in democratic society. Those who manipulate this unseen mechanism of society constitute an invisible government which is the true ruling power of our country. …We are governed, our minds are molded, our tastes formed, our ideas suggested, largely by men we have never heard of.”

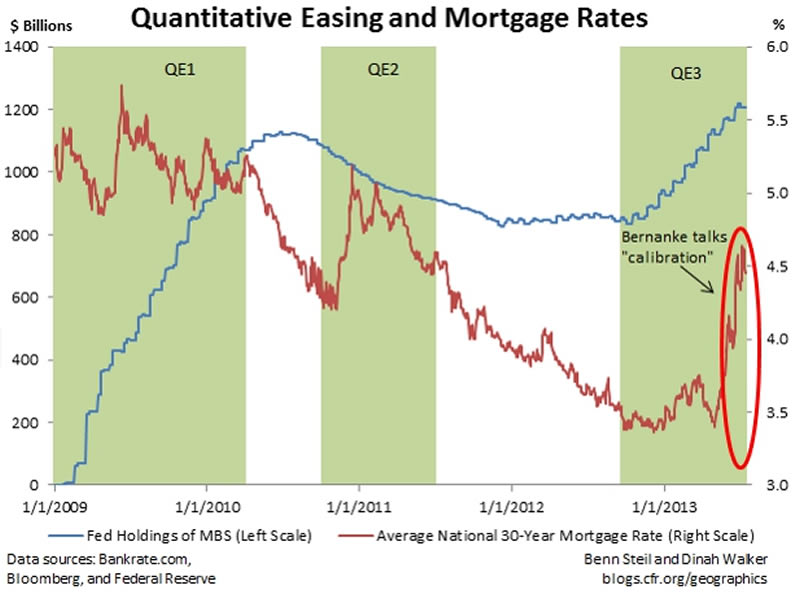

Ben Bernanke increased his balance sheet by $3.2 trillion (450%) since 2008, and it had to go somewhere. We know it didn’t trickle down to the 99%. It was placed in the firm clutches of the .1% billionaire club. Bernanke sold his QE schemes as methods to benefit Main Street Americans, when his true purpose was to benefit Wall Street crooks. 30 year mortgage rates were 4.25% before QE2. 30 year mortgage rates were 3.5% before QE3. Today they stand at 4.5%. QE has not benefited average Americans. They are getting 0% on their savings, mortgage rates are higher, and their real household income has fallen and continues to fall.

But you’ll be happy to know banking profits are at all-time highs, Blackrock and the rest of the Wall Street Fed front running crowd have made a killing in the buy and rent ruse, and record bonuses are being doled out to the men who have wrecked our financial system in their gluttonous plundering of the once prosperous nation. Their felonious machinations have added zero value to society, while impoverishing a wide swath of America. Bernanke, Yellen and their owners have used their control of the currency, interest rates, and regulatory agencies to create the widest wealth disparity between the haves and have-nots in world history. Their depraved actions on behalf of the .1% will mean blood.

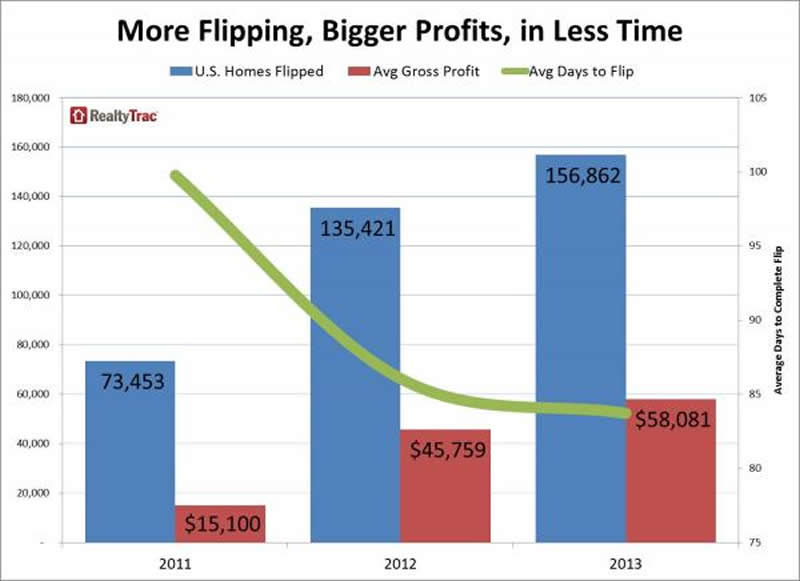

Just as Greenspan’s easy money policies of the early 2000’s created a housing bubble, inspiring low IQ wannabes to play flip that house, Bernanke’s mal-investment inducing QEternity has lured the get rich quick crowd back into the flipping business. The re-propagation of Flip that House shows on cable is like a rerun of the pre-bubble bursting frenzy in 2005. RealtyTrac’s recent report details the disturbing lemming like trend among greedy institutions and dullard brother-in-laws across the land.

- 156,862 single family home flips — where a home is purchased and subsequently sold again within six months — in 2013, up 16% from 2012 and up 114% from 2011.

- Homes flipped in 2013 accounted for 4.6% of all U.S. single family home sales during the year, up from 4.2% in 2012 and up from 2.6% in 2011

The easy profits just keep flowing when the Fed provides the easy money. What could possibly go wrong? Home prices never fall. A brilliant Ivy League economist said so in 2005. The easy profits have been reaped by the early players. Wall Street hedge funds don’t really want to be landlords. Flippers need to make a quick buck or their creditors pull the plug. Home prices peaked in mid-2013. They have begun to fall. The 35% increase in mortgage rates has removed the punchbowl from the party. Anyone who claims housing will improve in 2014 is either talking their book, owns a boatload of vacant rental properties, teaches at Princeton, or gets paid to peddle the Wall Street propaganda on CNBC.

Reality will reassert itself in 2014, with lemmings, flippers, and hedgies getting slaughtered as the housing market comes back to earth with a thud. The continued tapering by the Fed will remove the marginal dollars used by Wall Street to fund this housing Ponzi. The Wall Street lemmings all follow the same MBA created financial models. They will all attempt to exit the market simultaneously when their models all say sell. If the economy improves, interest rates will rise and kill the housing market. If the economy tanks, the stock market will plunge, creating fear and killing the housing market. Once it becomes clear that prices have begun to fall, the flippers will panic and start dumping, exacerbating the price declines. This scenario never grows old.

Real household income continues to fall and nearly 25% of all households with a mortgage are still underwater. Young people are saddled with $1 trillion of government peddled student loan debt and will not be buying homes in the foreseeable future. Dodd-Frank rules will result in fewer people qualifying for mortgages. Mortgage insurance is increasing. Obamacare premium increases are sucking the life out of potential middle class home buyers. Retailers have begun firing thousands. The financial class had a good run. They were able to re-inflate the bubble for two years, but the third year won’t be a charm. In a normal housing market 85% of home sales would be between individuals using a mortgage, 10% would be all cash transactions, less than 5% of sales would be distressed, and 40% would be first time buyers. In this warped market only 40% of home sales are between individuals using a mortgage, 42% are all cash transactions, 16% are distressed sales, 5% are flipped, and only 27% are first time buyers. The return to normalcy will be painful for shysters, gamblers, believers, paid off economists, Larry Yun, and CNBC bimbos.

Join me at www.TheBurningPlatform.com to discuss truth and the future of our country.

By James Quinn

James Quinn is a senior director of strategic planning for a major university. James has held financial positions with a retailer, homebuilder and university in his 22-year career. Those positions included treasurer, controller, and head of strategic planning. He is married with three boys and is writing these articles because he cares about their future. He earned a BS in accounting from Drexel University and an MBA from Villanova University. He is a certified public accountant and a certified cash manager.

These articles reflect the personal views of James Quinn. They do not necessarily represent the views of his employer, and are not sponsored or endorsed by his employer.

© 2014 Copyright James Quinn - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

James Quinn Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.