U.S. Housing Market Setting Up for Another Crash

Housing-Market / US Housing Dec 17, 2013 - 07:46 PM GMTBy: EconMatters

All that Glitters, is not Gold

All that Glitters, is not Gold

The housing market appears to be in better shape than it really is and investors should be wary regarding investing in Housing stocks, investing in property not as a primary residence, and should conduct a thorough analysis of their own financial obligations with regards to their primary residence.

In many parts of the world real estate prices have risen quite substantially due to several factors, one is foreign buyers trying to move money out of their home countries for security purposes. Another is institutional investors hoping to buy low and sell high in an investment strategy, and then there are the small to medium size professional flippers who buy properties, make some cosmetic changes, and hope to sell these properties into an improving market because supply is artificially tighter, and the broader economy is better than when they originally purchased the properties.

Macro Headwinds

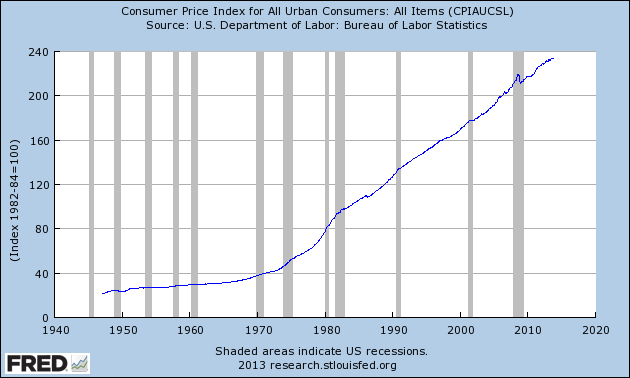

However, there are a couple of macro dynamics that are going to provide significant headwinds for the housing market. One is taxes, and all the financial obligations that are rolled up into property taxes. As governments continue to spend more and more, local as well as state, jurisdictional, and federal the fundamental result is that property taxes continue to rise on real estate.

The property taxes are the real killers in real estate because a homeowner can even diligently pay off their mortgage and owe nothing on their home (which is becoming rarer these days), but still even in these best of circumstances the future property tax obligations are going to catch up to the homeowners as their income shrinks once they retire.

Subsequently these individuals incomes shrink drastically, but the property taxes continue to escalate as these local and state jurisdictions need to get more money to support poor fiscal spending policies, and eventually homeowners have to sell their homes because they cannot afford a decade`s worth of property taxes.

Fortunes Acquired Elsewhere Often Get Lost in Real Estate Market Crashes

The more expensive the real estate the higher the taxes which when the tide goes out in the economy, and people become overextended, then they have to start dumping real estate, and inevitably there is a huge margin call that runs through all financial assets, and hits real estate especially hard.

Many multi-millionaires have lost most of their net worth mainly due to an overextension on real estate when times are good to find that the haircut on these properties when they need to sell via a fire sale just cripples them financially.

The dynamic is as follows: They need to sell, but there are many people in this boat, the few buyers out there get spooked, prices fall sharply, but they still need to sell, so these sellers are forced to take 50 to 60% losses on these properties. There goes all the stored wealth like a vanishing mirage that the investors were trying to protect by investing in hard assets – it is really a vicious, pernicious cycle that repeats itself over and over in the real estate market.

Foreigners Not Exempt

This applies to foreign buyers as well, when they need the money during a reset in other financial areas, they are not going to be able to afford the property taxes on these properties, and local jurisdictions constantly needing more money, and effectively raising these property taxes every year, only makes the problem worse, and sets up the future drivers for the inevitable crash in real estate. Ironically, this results in the local jurisdictions not collecting any taxes at all on the properties for substantial time periods.

Therefore, many foreigners who think that real estate in first world countries are safe and secure wealth storage vehicles when they buy at the top of the market with these offshoring strategies can lose 60% and more of their net worth in a market crash.

This is one of the downfalls of all cash transactions when buying real estate at elevated market levels. Investors can walk away from mortgages like they did in 2007, but with 20 and 30% down payments to secure loans these days from banks; it is still a substantial loss for investors on any market re-set.

Foreigners all hiding money away in these properties are in for a rude surprise when they calculate their future tax obligations over just a ten year period. These people may or may not be able to afford the real estate on a long-term basis, but most of these people will definitely not be able to afford the property taxes on these purchases on a long-term basis without a consistent, perpetual revenue stream.

Likewise, since many of these financial resources were acquired in less than legitimate ways, these revenue streams are not consistently perpetual in nature which is required to meet perpetually consistent tax obligations at elevated levels on expensive real estate.

Affordability Issues

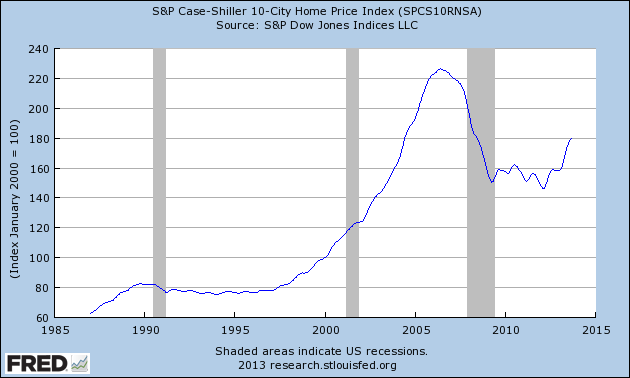

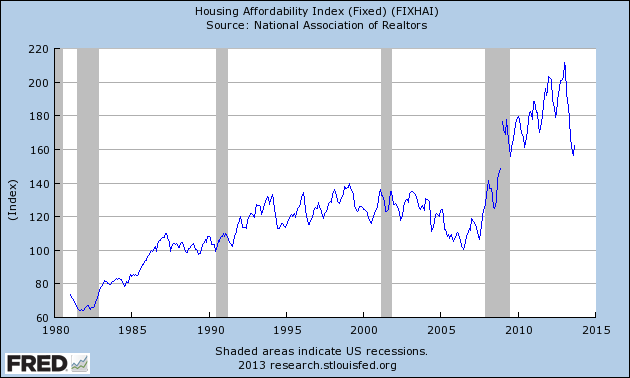

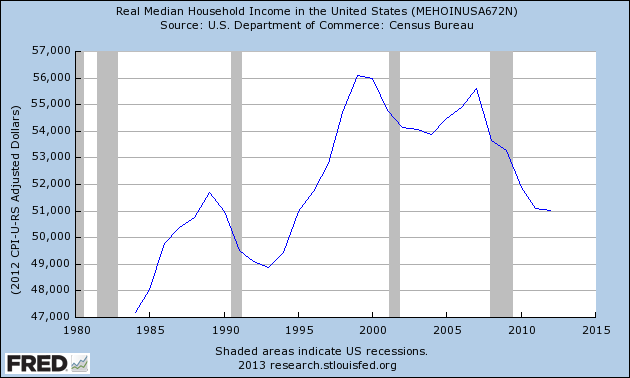

The other problem is that property prices in several parts of the country are too high relative to incomes, think in terms of the two coasts, but there are many other areas as well. This means consumers are paying too high a percentage of their disposable income on housing.

This always means that the market will eventually have to reset, or be forced to reset because any small change in the local labor market causes disproportionate reverberations in the real estate values, and substantially increases the likelihood of add-on contagion which severally makes these markets susceptible to large price drops in value for these expensive real estate markets. In short, you get a market crash in real estate values like we had in 2007.

Demographic Shifts

The final worry is that with the large population of baby boomers now retiring, many of these individuals will soon realize that they don’t have the nest egg they thought they had once their incomes are reduced because they are no longer working full time.

Once they start factoring in property taxes for 15 years on higher appraised values for their homes, and they always go up for tax purposes, and the fact that comps are artificially high because home owners have to make major investments in their homes to market these properties, thereby raising taxable obligations on all homeowners in the process even though most homes haven`t been upgraded. Many of these baby boomers are going to be forced to sell their homes, and turn to the rental market so that they can live off the home equity that they have built up over the years.

This dynamic and macro driver would be very bearish for the real estate market, more supply means market saturation, and this leads to lower prices, which just reinforces the deflationary cycle causing other deflationary outcomes in the overall local economy. The baby boomer demographics are not favorable for the housing market, and this is a negative for the industry as a whole.

Final Thoughts

There are opportunities in the real estate market, but unfortunately most people don`t understand the importance of having cash on the sidelines waiting for these inevitable market crashes to buy at fire sale prices. Most investors get tied up in investments trying to get a return that they get stuck, and when the market crashes and properties are 70% off of their highs; this is the time to buy real estate.

However, the trick is have the cash available, and not tied up in other illiquid investments. And investments can be illiquid for a myriad of reasons, such as usually liquid investments being heavily underwater due to the same market forces that are causing the housing market to crash.

Cash truly on the sidelines is an undervalued investment principle, and one of the hardest long-term investment strategies to learn. Investors are always thinking about returns on an annual basis instead of sitting on cash and being in the position to buy when there are no buyers in markets.

Investors need to factor in the value of market timing in an investment strategy that focuses on long-term returns over a 10-year time period. Investors are so worried about 5% returns on their portfolios and beating inflation that they miss the 70% returns in 16 months type investments because they had no cash on the sidelines available for these market crash opportunities.

By EconMatters

The theory of quantum mechanics and Einstein’s theory of relativity (E=mc2) have taught us that matter (yin) and energy (yang) are inter-related and interdependent. This interconnectness of all things is the essense of the concept “yin-yang”, and Einstein’s fundamental equation: matter equals energy. The same theories may be applied to equities and commodity markets.

All things within the markets and macro-economy undergo constant change and transformation, and everything is interconnected. That’s why here at Economic Forecasts & Opinions, we focus on identifying the fundamental theories of cause and effect in the markets to help you achieve a great continuum of portfolio yin-yang equilibrium.

That's why, with a team of analysts, we at EconMatters focus on identifying the fundamental theories of cause and effect in the financial markets that matters to your portfolio.

© 2013 Copyright EconMatters - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

EconMatters Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.