My Six Favorite Growing Dividend Paying Stocks

Companies / Dividends Oct 29, 2013 - 08:57 AM GMT Mitchell Clark, B.Comm writes: The stock market typically reacts quite positively when a company beats Wall Street consensus. But in a considerable number of cases, a company’s share price after-earnings bounce isn’t really warranted, considering the run-up in anticipation.

Mitchell Clark, B.Comm writes: The stock market typically reacts quite positively when a company beats Wall Street consensus. But in a considerable number of cases, a company’s share price after-earnings bounce isn’t really warranted, considering the run-up in anticipation.

Many stocks go up in value after beating expectations, but many numbers this quarter actually reveal a contraction in business conditions.

Western Digital Corporation (WDC) is the Irvine, California-based maker of hard drives and solid-state hybrid drives for desktops and personal computers (PCs). The company beat the Street on earnings, but the company’s numbers actually represented a decline from the comparable quarter last year.

The company said that in its most recent quarter (fiscal 2014 first quarter), sales dropped six percent to $3.8 billion; earnings fell to $495 million, or $2.05 per share, compared to $519 million, or $2.06 per share, in the same period a year ago; and adjusted earnings came in at $2.12, while Wall Street was looking for a consensus of $2.05.

Naturally, the position moved higher on the stock market. The company did experience an improved gross margin, but it wasn’t a good quarter. The stock is up about 70% so far this year to an all-time record high.

There are countless other stories similar to Western’s, and investors have to be very careful with this so-called outperformance by Wall Street standards. Business conditions are not improving for a lot of companies. Earnings are slightly improving, but only through continued pressure on costs and a slight improvement in pricing.

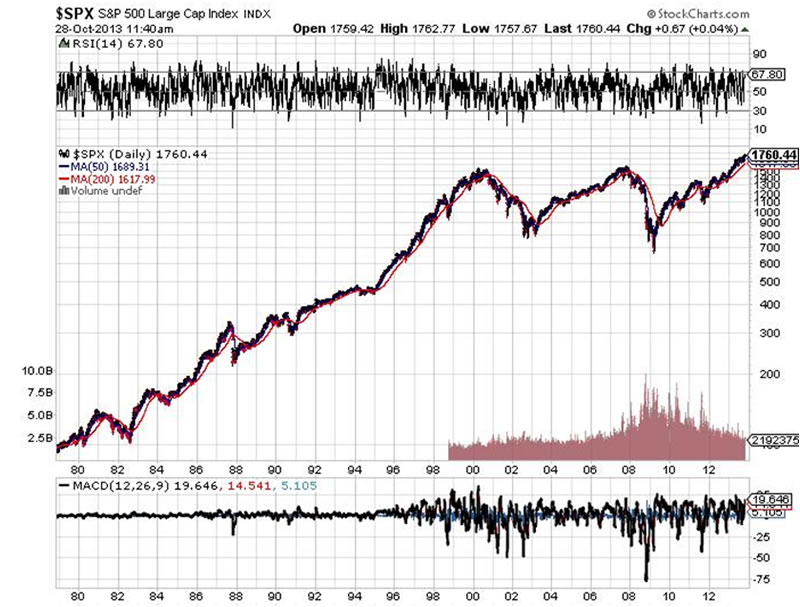

Of course, the monetary backdrop continues to be very supportive for stocks as we know. The S&P 500 Index has broken out of what looked like the perfect head-and-shoulders pattern. It’s still an ominous-looking chart, but the breakout pattern is significant. It’s as if the index is returning to its modern era mean. The S&P 500’s 35-year chart is featured below:

Chart courtesy of www.StockCharts.com

Investment risk is always high with equities, but there are very few alternative investment classes with interest rates sitting so low, especially for those investors who rely on dividend income.

Given the monetary situation and the expectation that the Federal Reserve will continue to be highly supportive to equities, this is very much a market that can still tick higher. But there is absolutely no need to chase stocks, or play the momentum gain, especially with companies that aren’t actually growing.

Wall Street’s expectations for a company are both useful and irrelevant at the same time. Stocks didn’t advance this year on the expectation of better growth rates of revenues and earnings; the marketplace just went all-in with the Federal Reserve’s grand attempt at reflation.

For investors, I like existing winners that pay growing dividends in an era of very slow real corporate growth. Companies like NIKE, Inc. (NKE), Johnson & Johnson (JNJ), PepsiCo, Inc. (PEP), Canadian National Railway Company (CNI), E. I. du Pont de Nemours and Company (DD), and Colgate-Palmolive Company (CL) are just a few examples of growing dividend payers with excellent long-term track records of wealth creation. (See “Equity Market Super Stock Adding Up to Solid Returns.”)

And energy is not to be excluded as a great income provider. It’s one of the economic bright spots with staying power for the rest of this decade.

If a company beats the Street, that’s great. But when it beats the Street without actually growing comparatively, it’s not worth chasing.

This article My Six Favorite Growing Dividend Payers is originally publish at Profitconfidential

Mitchell Clark, B.Comm. for Profit Confidential

http://www.profitconfidential.com

We publish Profit Confidential daily for our Lombardi Financial customers because we believe many of those reporting today’s financial news simply don’t know what they are telling you! Reporters are trained to tell you the news—not what it can mean for you! What you read in the popular news services, be it the daily newspapers, on the internet or TV, is the news from a “reporter’s opinion.” And there’s the big difference.

With Profit Confidential you are receiving the news with the opinions, commentaries and interpretations of seasoned financial analysts and economists. We analyze the actions of the stock market, precious metals, interest rates, real estate and other investments so we can tell you what we believe today’s financial news will mean for you tomorrow!

© 2013 Copyright Profit Confidential - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.