What the U.S. Treasury Bond Market Says About Likelihood of Fed QE Tapering

Interest-Rates / US Bonds Jun 18, 2013 - 04:49 PM GMTBy: Graham_Summers

The big question on every investors’ lips today and tomorrow is: “will the Fed announce or hint at tapering QE?”

The big question on every investors’ lips today and tomorrow is: “will the Fed announce or hint at tapering QE?”

Over the last two years, one of the biggest tools in the Fed’s arsenal has been verbal intervention: the act of saying something in order to push the market up. Time and again 2011-2012 saw various Fed Presidents appear at key points to push the market higher by promising more action or stimulus.

With that in mind, we have to keep our eyes on the bond markets. The Fed is most closely linked to the Primary Dealers. These are the banks that help the Fed and the Treasury with Treasury Auctions (when the US issues debt). These banks, more than any other financial entities on the planet, have access to the Fed’s insights.

Here’s the list of Primary Dealers:

- Bank of America

- Barclays Capital Inc.

- BNP Paribas Securities Corp.

- Cantor Fitzgerald & Co.

- Citigroup Global Markets Inc.

- Credit Suisse Securities (USA) LLC

- Daiwa Securities America Inc.

- Deutsche Bank Securities Inc.

- Goldman, Sachs & Co.

- HSBC Securities (USA) Inc.

- J. P. Morgan Securities Inc.

- Jefferies & Company Inc.

- Mizuho Securities USA Inc.

- Morgan Stanley & Co. Incorporated

- Nomura Securities International Inc.

- RBC Capital Markets

- RBS Securities Inc.

- UBS Securities LLC.

With that in mind, I suggest keeping a close eye on the bond markets. These will be the “tell” of what the Fed is likely to announce.

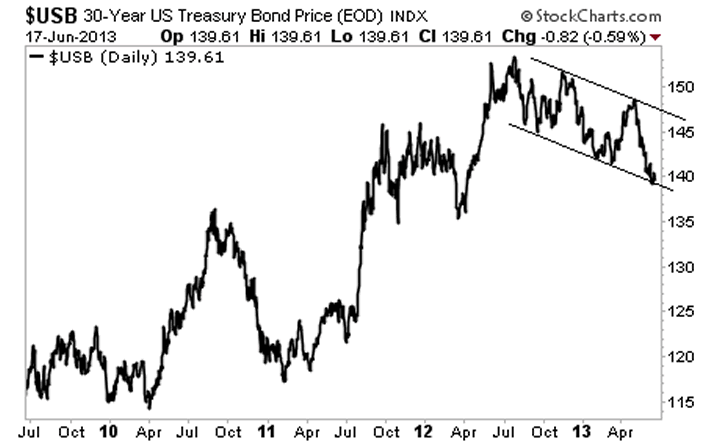

The 30 Year bond is trending lower in a clear downward channel. We’re now coming up on support at which point we see a rally. This would likely indicate that the Fed will not suggest tapering or will at least word things very carefully.

If you’re looking for actionable investment strategies on playing the markets, take a look at my bi-weekly investment newsletter, Private Wealth Advisory.

Published every other Wednesday after the market closes, Private Wealth Advisory, shows individual investors how to beat the market with well-timed unique investments.

To join us…

Graham Summers

Chief Market Strategist

Good Investing!

PS. If you’re getting worried about the future of the stock market and have yet to take steps to prepare for the Second Round of the Financial Crisis… I highly suggest you download my FREE Special Report specifying exactly how to prepare for what’s to come.

I call it The Financial Crisis “Round Two” Survival Kit. And its 17 pages contain a wealth of information about portfolio protection, which investments to own and how to take out Catastrophe Insurance on the stock market (this “insurance” paid out triple digit gains in the Autumn of 2008).

Again, this is all 100% FREE. To pick up your copy today, got to http://www.gainspainscapital.com and click on FREE REPORTS.

Graham also writes Private Wealth Advisory, a monthly investment advisory focusing on the most lucrative investment opportunities the financial markets have to offer. Graham understands the big picture from both a macro-economic and capital in/outflow perspective. He translates his understanding into finding trends and undervalued investment opportunities months before the markets catch on: the Private Wealth Advisory portfolio has outperformed the S&P 500 three of the last five years, including a 7% return in 2008 vs. a 37% loss for the S&P 500.

Previously, Graham worked as a Senior Financial Analyst covering global markets for several investment firms in the Mid-Atlantic region. He’s lived and performed research in Europe, Asia, the Middle East, and the United States.

© 2013 Copyright Graham Summers - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Graham Summers Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.