U.S. House Prices About to Soar... Don't Wait a Moment Longer!

Housing-Market / US Housing Mar 21, 2013 - 09:56 AM GMTBy: DailyWealth

Steve Sjuggerud writes: "We're only one year into this recovery..." Doug Yearley said on Bloomberg TV yesterday morning.

Steve Sjuggerud writes: "We're only one year into this recovery..." Doug Yearley said on Bloomberg TV yesterday morning.

"Remember, we had seven of the worst years in housing that this country has ever seen. This recovery, we believe, should be a lot longer than just one or two years."

Yearley is the CEO of Toll Brothers, a nationwide homebuilder. When asked if he thought the strength in housing could continue, he didn't mince words...

"We feel really good this spring," he said. "Our orders are up 49%."

He explained that there's simply "no inventory." And "no inventory" is one of the key ingredients in seeing higher home prices ahead.

You always have to take a CEO's comments with a grain of salt. It's his job to be optimistic. But I fully agree with his assessment. As you probably know, I have been extremely optimistic on U.S. housing for years now – expecting big gains.

Our True Wealth Systems numbers back me up...

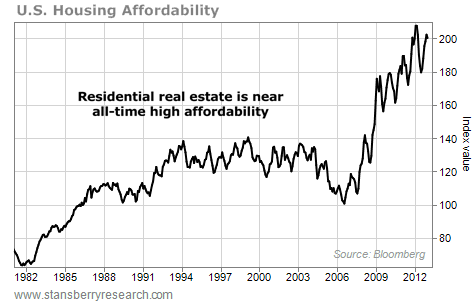

In short, U.S. housing is the greatest value it's ever been in our lifetimes – and probably the greatest value it will ever be.

I objectively define value as "affordability." Affordability is a function of 1) house prices, 2) mortgage rates, and 3) income. The first two crashed to an epic degree, making U.S. housing more affordable than ever.

Even better, house prices are finally going up. We have our uptrend.

So housing is incredibly affordable, and your risk is now reduced because the uptrend has returned.

This is it.

This is as good as it gets. Housing is about to soar. And this moment is your lowest-risk moment to buy. So don't wait a moment longer...

Want to know what to do with your money?

It's simple... Go buy a house.

Good investing,

Steve

The DailyWealth Investment Philosophy: In a nutshell, my investment philosophy is this: Buy things of extraordinary value at a time when nobody else wants them. Then sell when people are willing to pay any price. You see, at DailyWealth, we believe most investors take way too much risk. Our mission is to show you how to avoid risky investments, and how to avoid what the average investor is doing. I believe that you can make a lot of money – and do it safely – by simply doing the opposite of what is most popular.

Customer Service: 1-888-261-2693 – Copyright 2013 Stansberry & Associates Investment Research. All Rights Reserved. Protected by copyright laws of the United States and international treaties. This e-letter may only be used pursuant to the subscription agreement and any reproduction, copying, or redistribution (electronic or otherwise, including on the world wide web), in whole or in part, is strictly prohibited without the express written permission of Stansberry & Associates Investment Research, LLC. 1217 Saint Paul Street, Baltimore MD 21202

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Daily Wealth Archive

|

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.