Why Are The Silver Miners Outperforming?

Commodities / Gold & Silver Stocks Sep 12, 2012 - 02:38 AM GMTBy: GoldSilverWorlds

We have seen major developments in the silver mining sector (SIL) which shows that the majors are hungry for the juniors. Coeur D’Alene (CDE) has made some strategic investments in some juniors silver explorers in British Columbia and Mexico, Hecla (HL) made a bid for U.S. Silver and Silver Wheaton (SLW) has signed its first major royalty deal in years. This signals that the smart money believes we are near a bottom and we may just be at the beginning of a major move in the junior silver miners. The majors are hungry for new deposits in mining friendly jurisdictions.

We have seen major developments in the silver mining sector (SIL) which shows that the majors are hungry for the juniors. Coeur D’Alene (CDE) has made some strategic investments in some juniors silver explorers in British Columbia and Mexico, Hecla (HL) made a bid for U.S. Silver and Silver Wheaton (SLW) has signed its first major royalty deal in years. This signals that the smart money believes we are near a bottom and we may just be at the beginning of a major move in the junior silver miners. The majors are hungry for new deposits in mining friendly jurisdictions.

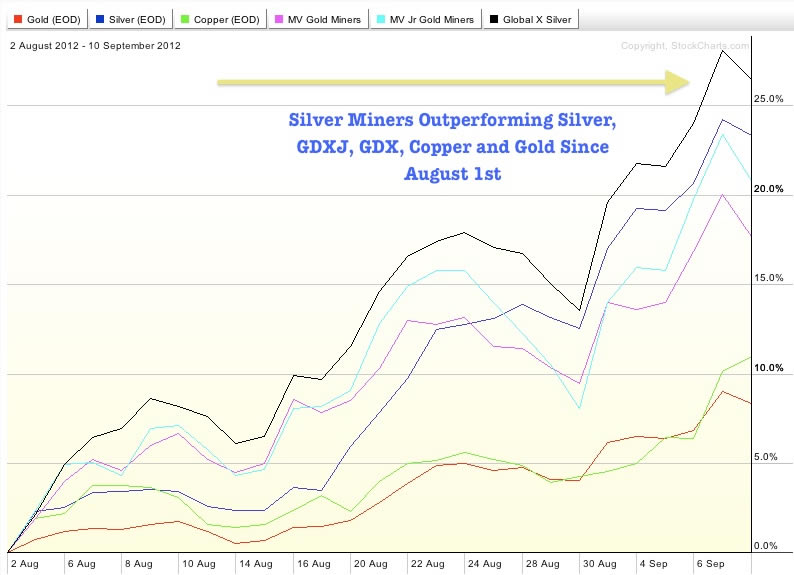

Since Bernanke’s Jackson Hole speech that sparked a risk on rally by indicating that the next round of QE was imminent, the silver miners (SIL) have outperformed gold (GLD), silver (SLV), copper (JJC), the gold miners (GDX) and the junior miners (GDXJ).

We have become interested in a previous silver producing mine right here in Nevada just about to break into all time highs. Libery Silver (LBSV) has recently seen a major increase in accumulation and investment interest. Liberty Silver (LBSV) is permitting and intends to be producing silver at its Trinity Project which was one of the largest silver mines in US history possibly within the next 18-24 months. Trinity produced five million ounces of silver between 1987 and 1989 before Rio Tinto closed id down when silver prices went below $5. Now the ballgame has changed as silver may be on its way to test new highs at $50.

The company is now preparing an updated NI 43-101 Resource Estimate and a Preliminary Economic Assessment (PEA). Liberty is beginning permitting as it believes it could move very quickly into restarting production as it already has an existing open pit mine that was once in production. Now silver is breaking above $30 and could move significantly higher over the near term possibly into new all time highs should QE3 be announced later this month. The higher prices has brought a lot of investment interest into this project and makes this project a potential cash cow with huge leverage to the price of silver.

Liberty’s Trinity Project is located in the same area as Coeur D’alene flagship Rochester silver mine, near Lovelock, Nevada. The Rochester Silver Mine produced over 125 million ounces of silver and still has about 120 million in reserves. This is an area of massive silver deposits and Liberty is sitting on a previously producing silver mine with the potential to expand this resource exponentially. With the addition of the recent Hi Ho Property next door, there could potentially be a large amount of silver on the combined property that is located in a very friendly mining jurisdiction in Pershing County, Nevada.

Order my premium service covering nascent silver stocks and Get a Special Introductory Rate.

Disclosure: Long LBSV

Source - http://goldsilverworlds.com/gold-silver-stocks-news/why-are-the-silver-miners-outperforming/

© 2012 Copyright goldsilverworlds - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.