U.S. Housing Market: Share of Underwater Homes Trending Down

Housing-Market / US Housing Jul 13, 2012 - 03:03 AM GMTBy: Asha_Bangalore

The recovery of the housing market is another major concern of the Fed in addition to the labor market. Three years of economic recovery is yet to result in a meaningful turnaround of the housing sector. One of the pressing issues is the prevalence of home mortgages with negative equity. Negative equity (often referred to as homes with underwater mortgages) means that homes are worth less than what borrowers owe on their mortgages.

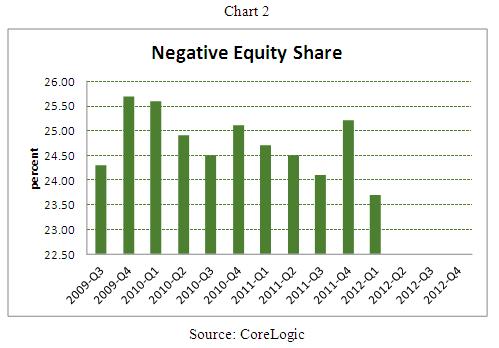

CoreLogic reported today that 23.7% (or 11.4 million) of all residential properties with a mortgage were in negative equity at the end of first quarter of 2012. The magnitude of underwater homes itself is worrisome but the good news is that it is trending down (see Chart 2). A reduction of underwater mortgages implies fewer mortgage defaults in the quarters ahead. Improving home price numbers, fewer foreclosures and short sales, and growth in employment in the first quarter have been factors contributing to the reduction of underwater mortgages.

Asha Bangalore — Senior Vice President and Economist

http://www.northerntrust.com

Asha Bangalore is Vice President and Economist at The Northern Trust Company, Chicago. Prior to joining the bank in 1994, she was Consultant to savings and loan institutions and commercial banks at Financial & Economic Strategies Corporation, Chicago.

Copyright © 2012 Asha Bangalore

The opinions expressed herein are those of the author and do not necessarily represent the views of The Northern Trust Company. The Northern Trust Company does not warrant the accuracy or completeness of information contained herein, such information is subject to change and is not intended to influence your investment decisions.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.

Comments

|

Thomas

13 Jul 12, 10:13 |

Mortgage stats

I think your mortgage stats are wrong. |