Why Stocks Outperformed All Other Gold Investments

Commodities / Gold & Silver Stocks Jun 23, 2012 - 08:36 AM GMTBy: The_Gold_Report

Ian Gordon of Longwave Analytics and Longwave Strategies believes we're on the precipice of very difficult and frightening times and predicts complete financial collapse. But it's in those periods of darkness that gold really shines. Gordon, who recently published a special edition of his Investment Insights entitled "The Gold Rush of the 1930s Will Rise Again," believes that companies with gold in the ground now will be the ones to prosper. In this exclusive Gold Report interview, Gordon discusses where he thinks the Dow will bottom and what companies will come out on top.

Ian Gordon of Longwave Analytics and Longwave Strategies believes we're on the precipice of very difficult and frightening times and predicts complete financial collapse. But it's in those periods of darkness that gold really shines. Gordon, who recently published a special edition of his Investment Insights entitled "The Gold Rush of the 1930s Will Rise Again," believes that companies with gold in the ground now will be the ones to prosper. In this exclusive Gold Report interview, Gordon discusses where he thinks the Dow will bottom and what companies will come out on top.

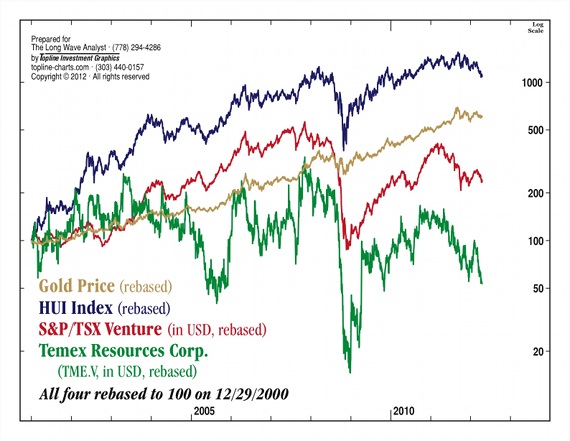

The Gold Report: In a recent edition of Investment Insights, you charted the NYSE Arca Gold BUGS (Basket of Unhedged Gold Stocks) Index (HUI) of senior gold stocks, gold itself, the TSX Venture Exchange as a proxy for junior mining stocks and a specific company, Temex Resources Corp. (TME:TSX.V; TQ1:FSE), from Dec. 29, 2000. All four were equalized to $100 to make the comparison accurate. What did they show?

Ian Gordon: I wanted to look at relative performance since 2000, when gold bottomed out at around $250/ounce (oz)—that was the beginning of the big bull market. The chart shows that the HUI has outperformed all the other benchmarks since 2000. Since then the value of the HUI has increased about 10 times. The second best performer has been gold itself, which has increased about six times. The Venture Exchange has increased just over two times.

I used Temex because it happens to be one of my favorite junior mining stocks, but the performance of Temex as a junior miner has been pretty miserable. That's generally true of any junior mining stock, at least since 2006. In 2008, the price of Temex was destroyed in the panic sell-off. It was down to one-tenth of where it had been in 2000. The price of Temex has recovered since that disaster, but it is still down at about half the price in 2000.

TGR: The chart seems to make a case for the senior gold miners versus the juniors.

IG: It certainly does. That's something that I've noticed in my own portfolio performance. My portfolio performance to about 2006 was outstanding. Thereafter, the junior stocks' performance has been pretty abysmal, which correlates to the performance of my portfolio.

TGR: You've been monitoring the trading volumes of junior precious metal equities, which are down significantly from levels established in the previous decade.

IG: They're at about 20% of the volumes in 2008 when the Venture Exchange began to perform very well. That performance was enhanced by rising volume. Since its peak, which was in about April 2011 on the Venture Exchange, the volume has been falling quite dramatically, along with price.

I maintain that is actually bullish rather than bearish because normally volume should follow price. What we have here is volume that is not going anywhere near where price is going. Volume has been decreasing in a downward market. People have been moving their money out because they are scared of the risk associated with investing in the junior stocks, but there has been essentially no buying coming into the Venture Exchange to offset the selling.

TGR: You believe we're now in the winter of the Kondratieff Cycle and that it started in 2000 (http://www.longwavegroup.com/kondratieff-cycle).

IG: It's not that I believe—I'm convinced. We're in the winter, the deflationary depression stage of the cycle when debt is essentially washed out of the economy. That process is always a very difficult period. This is only the fourth winter in the long wave cycle. The same process of debt deleveraging occurred in all of the previous winters. In 1837, the stock market peaked followed by a crash, which ushered in the winter depression. The same happened after 1873 and 1929. We are enduring the same process again, going through debt elimination, concurrent with the winter of the cycle.

The reason we picked 2000 for the chart is because winters are always signaled by a peak in stock prices concluding the big autumn stock bull market. Some people will say that the Dow Jones Industrial Average actually made a higher high in 2007 and that's true. However, the speculative end of the market never got anywhere near where it had been in 2000. That's what happens in the final stage of the big autumn bull market—there's a massive amount of speculation. In the current cycle, speculation occurred in the NASDAQ. The NASDAQ is absolutely nowhere near where it was at its peak in March 2000.

TGR: Is it typical for junior stocks to perform as well as they did in the winter of the Kondratieff Cycle?

IG: I don't have a record of the actual trading in the junior sector at the beginning of the depression stage following the 1929 stock market peak. All I know is that the money was moving dramatically into the physical metal as well as into the producing gold mining companies' shares. What we do know is during the 1930s, huge amounts of capital were employed to fund exploration and build gold mines throughout Canada and the United States. There were many mines developed here in Canada at that time and, according to the U.S. Bureau of Mines, there were 9,000 gold mines operating in the United States in 1940.

There is the example of Homestake Mining. Homestake enjoyed very dramatic moves in its share price in the '30s even though the gold price was fixed at $20.67/oz until 1934, when it increased to $35/oz. Investors were buying gold stocks regardless of a massive decline in the Dow, which dropped 90% between 1929 and 1932. Homestake's share price fell to $65/share during the stock market crash of 1929, but was up to $83/share in 1930 to $138/share in 1931. By 1933, it reached $373/share. During those years the company paid out significant dividends as well.

TGR: The Dow Jones is around 12,500 now. Are you surprised at all that the Dow continues to do as well as it's doing?

IG: I'm pretty sure that the stock market is manipulated by the authorities. I know that people will say that's just conspiracy nonsense. However, Fed Chairman Ben Bernanke and former Chairman Alan Greenspan both have said they feel that stock prices are extremely important to the confidence of the American people. That confidence leads to confidence in the economy. If stock prices can be held at high levels, people feel wealthy when they look at their mutual fund statements and when they spend money. I don't believe that this kind of manipulation is sustainable. I'm a big believer that markets follow natural law.

TGR: Once the Federal Reserve loses the ability to prop up the stock market, will we see a collapse and a rush into gold, much as we did in the early 1930s?

IG: Yes. I believe that the Dow will bottom at around 1,000 points or less, mirroring the economic depression caused by the debt bubble collapse.

TGR: Allow me for a minute to play devil's advocate. The investors of the 1930s didn't have the options that investors now do. There are now currency markets. Investors can put their money in renminbi, German bonds, Swiss bonds, exchange-traded funds, real estate or other commodities. Why is it going to be gold?

IG: Because gold is money. Unlike paper money, there's no debt attached to gold. The Chinese are buying gold. The central banks are buying gold. They're buying gold because it's the money of last resort.

TGR: Do you expect interest rates to go up dramatically?

IG: Yes. The big debtor nations are having problems with interest rates. Look at Greece. Go to Spain and then Portugal. Interest rates in Spain are over 6%. Italy is getting up over 6%. Imagine what happens to the U.S. if interest rates go to 6%. It's going to be a massive problem. The whole system is collapsing here. It's going to be very traumatic. The move to gold is going to be very dramatic as a result. The move for anybody who has gold assets in the ground is going to be very big, as it was in the 1930s.

TGR: You've helped raise hundreds of millions of dollars in equity financings for juniors that you feel are deserving companies. What are some examples of those?

IG: Let me tell you what I think a deserving company is, first of all. Deserving companies are well managed with good assets in areas without major political risk.

In the early days, I financed Minefinders Corp. at about $1/share. It just got taken over by Pan American Silver Corp. (PAA:TSX; PAAS:NASDAQ) for better than $10/share. I remember financing a little company called Pelangio Exploration Inc. (PX:TSX.V), which is still around and which I like very much. We financed Pelangio at $0.11/share and its share price exceeded $5 a few years after that financing and was then taken over by Detour Gold Corp. (DGC:TSX).

It's been much more difficult lately to find companies that you want to get involved with simply because political risk has increased in many parts of the world, Argentina and El Salvador, for example.

TGR: Do you do site visits?

IG: I do fewer now than I used to. I'm getting to be 70 years old and I just find that a lot of traveling is a little onerous. I spend a lot of time discussing companies. I often make several calls a week to different companies that I have an interest in.

TGR: You wrote in your paper, "What we must do is hold shares in companies with already good gold in the ground assets, properly managed, and with sufficient cash to last at least another 18 months, even if that means cutting back on planned exploration expenditures." Does that mean we can expect at least another 18 months of poor performance from junior precious metal equities?

IG: I don't expect that's going to happen, but I want to be prepared because it might be a difficult period for companies to obtain financing. Things in Europe are going to unravel pretty quickly. I don't think it's going to take 18 months for this thing to completely collapse, but it might.

TGR: What are some companies that you're following and are invested in?

IG: I like PC Gold Inc. (PKL:TSX). PC Gold owns the past producing Pickle Crow mine, which incidentally was placed into production in the previous long wave winter in the 1930s. I've been up to Pickle Lake. It's easily accessible by a six-hour drive from Thunder Bay. The company has been achieving good drill results. It has an NI 43-101 resource of about 1.2 million ounces (Moz). Investors can buy PC Gold for about $8/oz of gold in the ground.

I continue to like Temex. It's got 1.8 Moz gold in the ground on its Juby property, half of which are in the Indicated category. I see little to no political risk in being in Ontario. Investors can buy Temex today for about $8/oz gold in the ground. I think that's pretty cheap when gold's at $1,600/oz.

Temex owns 60% of another property, the Whitney project, in the Timmins camps, which it has been drilling near the past-producing Hallnor mine and getting some really good results. Goldcorp Inc. (G:TSX; GG:NYSE) has a 40% ownership in the property. There are five past-producing mines on that property, of which three, including the Whitney, were put into production during the 1930s.

Temex has recently added two new prominent members to the Board of Directors.

I also have a significant investment in Barkerville Gold Mines Ltd. (BGM:TSX.V). Its property is situated in the Cariboo Gold Belt in British Columbia. The property is easily accessible by road. Barkerville the town and Barkerville the company are named after Billy Barker, credited with the gold discovery in the 1860s. Barkerville Gold Mines is now finding the source of that placer gold, which was the gold that Billy Barker and his contemporaries discovered 150 years ago.

TGR: And it's already in production, Ian.

IG: It's been in production, but production ground to a halt. It didn't have the ore to continue production, but it does have a mill. The company anticipates bringing Bonanza Ledge into production, which will produce about 25,000 oz (25 Koz).

The thing about Barkerville is the huge potential that the property could host multimillion ounces of gold. We haven't seen an NI 43-101 on the property since 2006 and there's been a massive amount of drilling since that time. The next NI 43-101, which should be published this month, should substantially increase the 840 Koz that we saw in 2006.

There have been some management issues. I am an adviser to the board. There have been promises that just haven't been met, because management anticipated and published that certain things would happen much faster than they actually have. But I really believe that the property, which is 60 kilometers (km) by about 20km and has seven past producing mines on it, is going to host multimillion ounces. I know mining people who have looked at it believe that's a distinct possibility as well.

TGR: Do you know Frank Callaghan, the president and CEO, personally?

IG: I know him very well. I just got off the phone with him.

TGR: Knowing him as you do, do you think the company has the issues that you referred to sorted out?

IG: I'd like to see the board strengthened. Actually, the company has just added Norman Anderson to the board and this is definitely a step in the right direction. Mr. Anderson is a registered Professional Engineer. He was at Cominco as CEO and chairman and left there after the Teck Resources Ltd. (TCK:NYSE; TCK.A:TSX) takeover. Then he went to Hudbay Minerals Inc. (HBM:TSX; HBM:NYSE) as chairman. He is also a former director of TD Bank. Another board member of Mr. Anderson's caliber would make me very happy.

TGR: But you believe it's a good bet because of the gold potential in that property?

IG: Yes, I do.

TGR: The last time we spoke, we discussed Northern Freegold Resources Ltd. (NFR:TSX.V; NFRGF:OTCQX) and Terraco Gold Corp. (TEN:TSX.V). What's happening with those companies now?

IG: Northern Freegold is one of the few companies in the Yukon with a property that is road accessible. It's been developing a very large gold porphyry system, which typically has other metals associated with the gold that might add value. However, I don't give the base metals that much value because I'm a deflationist.

The grade is low, which is typical of a porphyry, but it's developing into a massive tonnage system. It's pretty close to 5 Moz gold right now, but the potential is something significantly larger than that. The fact that the gold price is going significantly higher makes this a very valuable resource. Investors are paying about $7/oz gold in the ground for the current gold resource.

The company has had to issue a lot of stock. It changed management. President and CEO John Burges seems to be very effective. I own the stock and continue to like owning the stock.

TGR: In May, the company raised about $750,000. Is that, combined with the money it already had, enough to ride out this economic storm that we're experiencing?

IG: Hopefully. Someone like John Burges has a lot of credibility. He has the ability to go and get the money if he needs to. But, at these prices, shareholders are being diluted.

TGR: Terraco has a couple of significant projects: the Almaden project, which has about 1 Moz in Idaho, and the Moonlight project in Nevada, which is on trend from Barrick Gold Corp. (ABX:TSX; ABX:NYSE) and Midway Gold Corp.'s (MDW:NYSE.A) Spring Valley gold project.

IG: I really like this company. One of the most interesting things is that Todd Hilditch, the CEO, has developed a very good relationship with a fund manager out of New York. The relationship seems to be very fair to Terraco. Through this fund manager, Terraco has bought royalties on the Barrick/Midway property. Those royalties are going to be worth a substantial amount of money. It has five years to pay for them. You know that the Barrick/Midway property is going to grow considerably in ounces simply because of the amount of money that Barrick has to spend in the next couple of years to earn its percentage.

TGR: It added another rig at Almaden to continue infill drilling there. Do you expect it to significantly boost that resource once the new NI 43-101 is out?

IG: I don't think it will be a huge boost. It will give us more confidence in the resource.

TGR: What are your thoughts on Todd Hilditch, the president and chief executive?

IG: I like him a lot. The fact that he's been able to build this relationship with the fund manager in New York and get these royalties means he's got a very good way with people. He's very effective. This is a good little company.

TGR: Do you have some parting thoughts for our readers, Ian, before I let you go?

IG: What we face here is something that is actually quite frightening: the breakup of the world monetary system, which is a credit-based system. I don't know how the economy functions without credit. It's very difficult and we are facing frightening times. But it's in these periods of darkness that gold really shines. Gold companies are going to come to the fore, just as they did in the 1930s, particularly the ones such as those that we've been discussing today with good gold-in-the-ground assets in politically safe locations.

TGR: Thank you, Ian.

A globally renowned economic forecaster, author and speaker, Ian Gordon is founder and chairman of the Longwave Group, which comprises two companies—Longwave Analytics and Longwave Strategies. The former specializes in Gordon's ongoing study and analysis of the Longwave Principle originally expounded by Nikolai Kondratiev. With Longwave Strategies, Gordon assists select precious metal companies in financings. Educated in England, Gordon graduated from the Royal Military Academy, Sandhurst. After a few years serving as a platoon commander in a Scottish regiment, he moved to Canada in 1967 and entered the University of Manitoba's History Department. Taking that step has had a profound impact because during this period he began to study the historical trends that ultimately provided the foundation for his Long Wave theory. Gordon has been publishing his Long Wave Analyst website since 1998. Eric Sprott, chairman, CEO and portfolio manager at Sprott Asset Management, describes Gordon as "a rare breed in the investment-adviser arena." He notes that Gordon's forecasts "have taken on a life force of their own and if you care to listen, Gordon will tell you how it will all end." Readers can subscribe to Gordon's Long Wave Analyst newsletter here.

Want to read more exclusive Gold Report interviews like this? Sign up for our free e-newsletter, and you'll learn when new articles have been published. To see a list of recent interviews with industry analysts and commentators, visit our Exclusive Interviews page.

Disclosure:

1) Brian Sylvester of The Gold Report conducted this interview. He personally and/or his family own shares of the following companies mentioned in this interview: None.

2) The following companies mentioned in the interview are sponsors of The Gold Report: Detour Gold Corp., Goldcorp Inc., Barkerville Gold Mines Ltd., Northern Freegold Resources Ltd. and Terraco Gold Corp. Streetwise Reports does not accept stock in exchange for services. This interview was edited for clarity.

3) Ian Gordon: I personally and/or my family own shares of the following companies mentioned in this interview: Temex Resources Corp., PC Gold Inc., Northern Freegold Resources Ltd., Barkerville Gold Mines Ltd. and Terraco Gold Corp. I personally and/or my family am paid by the following companies mentioned in this interview: PC Gold Inc., Temex Resources Corp., Northern Freegold Resources Ltd. and Terraco Gold Corp. I was not paid by Streetwise Reports for participating in this story.

Streetwise - The Gold Report is Copyright © 2012 by Streetwise Reports LLC. All rights are reserved. Streetwise Reports LLC hereby grants an unrestricted license to use or disseminate this copyrighted material (i) only in whole (and always including this disclaimer), but (ii) never in part.

The Gold Report does not render general or specific investment advice and does not endorse or recommend the business, products, services or securities of any industry or company mentioned in this report.

From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles on the site, may have a long or short position in securities mentioned and may make purchases and/or sales of those securities in the open market or otherwise.

Streetwise Reports LLC does not guarantee the accuracy or thoroughness of the information reported.

Streetwise Reports LLC receives a fee from companies that are listed on the home page in the In This Issue section. Their sponsor pages may be considered advertising for the purposes of 18 U.S.C. 1734.

Participating companies provide the logos used in The Gold Report. These logos are trademarks and are the property of the individual companies.

101 Second St., Suite 110

Petaluma, CA 94952

Tel.: (707) 981-8999

Fax: (707) 981-8998

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.