U.S. January New Home Sales Moving Sideways But Record Low Number of Homes for Sale Raises Expectations of New Construction

Housing-Market / US Housing Feb 25, 2012 - 12:14 PM GMTBy: Asha_Bangalore

Sales of new homes slipped 0.9% to an annual rate of 321,000 in January. Purchases of new homes have moved around 311,000 to 324,000 for the last four months. Combined sales of new and existing homes have risen in the last three out of four months, largely due to the relatively strong performance of existing home sales.

Sales of new homes slipped 0.9% to an annual rate of 321,000 in January. Purchases of new homes have moved around 311,000 to 324,000 for the last four months. Combined sales of new and existing homes have risen in the last three out of four months, largely due to the relatively strong performance of existing home sales.

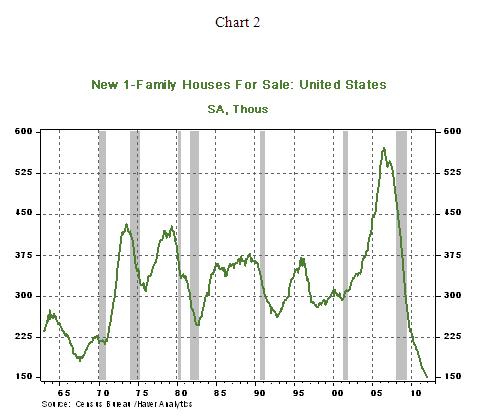

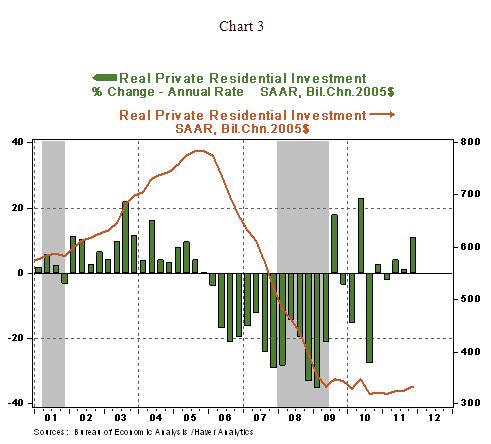

The number of homes for sale at 115,000 in January is a new record. This low mark is indicative that home building activity will stage a strong come back as employment conditions continue to improve. New residential investment expenditures have moved up in the each of the last three quarters, with the fourth quarter showing the strongest reading (see Chart 3).

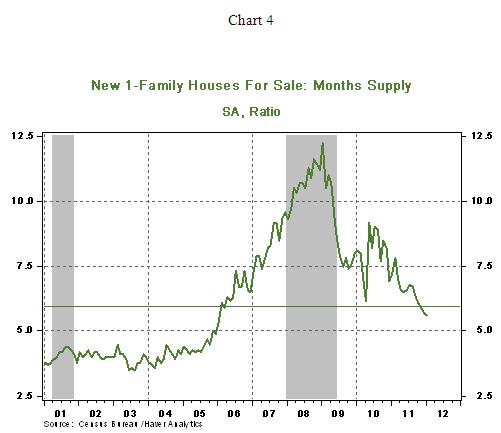

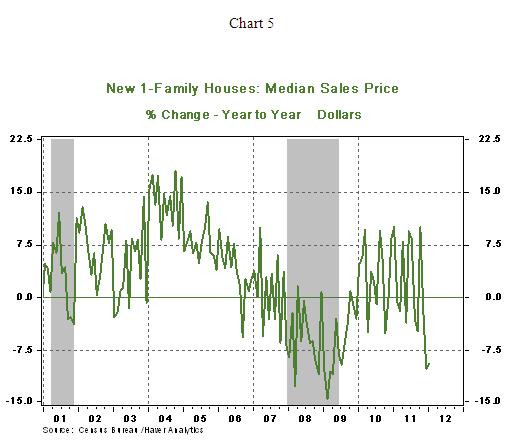

The inventory-sales ratio dropped to 5.6-month supply compared with the historical median of 6.0-months. Despite the low inventory of new homes in the market and historically low mortgage rates, home prices continue to decline. From a year ago, the median price of new single-family home fell 9.6% to $217,000. The recent improvement of labor market conditions, the pickup of the Housing Market Index of the National Association of Home Builders and the favorable interest rate environment are factors supportive of expectations of an increase in residential investment expenditures in 2012.

Asha Bangalore — Senior Vice President and Economist

http://www.northerntrust.com

Asha Bangalore is Vice President and Economist at The Northern Trust Company, Chicago. Prior to joining the bank in 1994, she was Consultant to savings and loan institutions and commercial banks at Financial & Economic Strategies Corporation, Chicago.

Copyright © 2012 Asha Bangalore

The opinions expressed herein are those of the author and do not necessarily represent the views of The Northern Trust Company. The Northern Trust Company does not warrant the accuracy or completeness of information contained herein, such information is subject to change and is not intended to influence your investment decisions.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.